Abstract

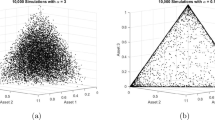

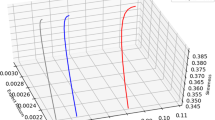

It is assumed in the standard portfolio analysis that an investor is risk averse and that his utility is a function of the mean and variance of the rate of the return of the portfolio or can be approximated as such. It turns out, however, that the third moment (skewness) plays an important role if the distribution of the rate of return of assets is asymmetric around the mean. In particular, an investor would prefer a portfolio with larger third moment if the mean and variance are the same. In this paper, we propose a practical scheme to obtain a portfolio with a large third moment under the constraints on the first and second moment. The problem we need to solve is a linear programming problem, so that a large scale model can be optimized without difficulty. It is demonstrated that this model generates a portfolio with a large third moment very quickly.

Similar content being viewed by others

References

F. Arditti, Risk and required return on equity, J. Fin. 22 (1967) 19–36.

V. Chvátal,Linear Programming (Freeman and Co, 1983).

E.J. Elton, and M.J. Gruber,Modern Portfolio Theory and Investment Analysis, 3rd ed. (Wiley, 1987).

G.A. Hawawini, An analytical examination of the intervaling effect on skewness and other moments, J. Fin. Quantit. Anal. 15 (1980) 1121–1128.

J.E. Ingersoll, Jr.,Theory of Financial Decision Making (Rowman and Littlefield, 1987).

T. Kariya et al.,Distribution of Stock Prices in the Stock Market of Japan (Toyo Keizai, 1989), in Japanese.

H. Konno, Piecewise linear risk functions and portfolio optimization, J. Oper. Res. Soc. Japan 33 (1990) 139–156.

H. Konno, and K. Suzuki, A fast algorithm of solving large scale mean-variance models by compact factorization of covariance matrices, J. Oper. Res. Soc. Japan 35 (1992) 93–104.

H. Konno and H. Yamazaki, Mean-absolute deviation portfolio optimization model and its application to Tokyo Stock Exchange, Manag. Sci. 37 (1991) 519–531.

A. Kraus, and R. Litzenberger, Skewness preference and the valuation of risky assets, J. Fin. 21 (1976) 1085–1094.

Y. Kroll, H. Levy, and H. Markowitz, Mean-variance versus direct utility maximization, J. Fin. 39 (1984) 47–62.

H. Markowitz,Portfolio Selection: Efficient Diversification of Investments (Wiley, 1959).

H. Markowitz et al., Fast computation of mean-variance efficient sets using historical covariance, Daiwa Securities Trust Co., Jersey City, NJ (1991).

R. Merton, Optimum consumption and portfolio rules in continous-time model, J. Econ. Theory 3 (1971) 373–413.

A. Perold, Large scale portfolio optimizations, Manag. Sci. 30 (1984) 1143–1160.

P.A. Samuelson, The fundamental approximation theorem of portfolio analysis in terms of means, variances and higher moments, Rev. Econ. Studies 25 (1958) 65–86.

M. Sarnat, A note on the implications of quadratic utility for portfolio theory, J. Fin. Quantit. Anal. 9 (1974) 687–689.

W.F. Sharpe,Portfolio Theory and Capital Market (McGraw-Hill, 1970).

H. Takehara, An application of the interior point algorithm for large scale optimization in finance,Proc. 3rd RAMP Symp., (Operations Research Society of Japan, 1991) pp. 43–52 (in Japanese).

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Konno, H., Shirakawa, H. & Yamazaki, H. A mean-absolute deviation-skewness portfolio optimization model. Ann Oper Res 45, 205–220 (1993). https://doi.org/10.1007/BF02282050

Issue Date:

DOI: https://doi.org/10.1007/BF02282050