Abstract

A flexible Bayesian periodic autoregressive model is used for the prediction of quarterly and monthly time series data. As the unknown autoregressive lag order, the occurrence of structural breaks and their respective break dates are common sources of uncertainty these are treated as random quantities within the Bayesian framework. Since no analytical expressions for the corresponding marginal posterior predictive distributions exist a Markov Chain Monte Carlo approach based on data augmentation is proposed. Its performance is demonstrated in Monte Carlo experiments. Instead of resorting to a model selection approach by choosing a particular candidate model for prediction, a forecasting approach based on Bayesian model averaging is used in order to account for model uncertainty and to improve forecasting accuracy. For model diagnosis a Bayesian sign test is introduced to compare the predictive accuracy of different forecasting models in terms of statistical significance. In an empirical application, using monthly unemployment rates of Germany, the performance of the model averaging prediction approach is compared to those of model selected Bayesian and classical (non)periodic time series models.

Similar content being viewed by others

Notes

In the empirical analysis below \(c_{1}\) and \(c_{2}\) in (4) are both set equal to 100 in order to express lack of prior knowledge with regard to the variation of the regression coefficients.

In the following the first p observations are used as initial values \(\mathbf {y}_{0}\). The conditioning on \(\mathbf {y}_{0}\) is suppressed subsequently.

In case of the discrete break date \(T_{B}\) the corresponding integration is in fact a summation.

For \(m=0\) this step is omitted.

For a PAR(p) model a stationarity condition can be stated by using a multivariate model representation as in Tiao and Grupe (1980).

Here the variable of interest is simply regressed on a set of S dummy variables \(D_{s,t}\), which equal one if observation t is associated with season s.

Note that the MAPE for a specific horizon k does not depend on the scale or dimension.

Note that the sign test presumes i.i.d. observations, an assumption that needs to be checked in practice.

This is the \(S_{2}\)-test statistic of Diebold and Mariano (1995), p. 255, which follows a Binomial distribution with parameters T and \(\pi _{i,j}=0.5\) under the null hypothesis.

For example, in the MC experiments presented below, 2-years ahead forecasts using quarterly data are conducted and thus \(T=8\), whereas in the empirical application of Sect. 5, 1-year ahead forecasts using monthly data are considered and thus the length of the realized loss-differential sequences is \(T=12\).

Here for all computations \(\alpha =\beta =10^{-10}\) is used.

Here \(\omega _{0}=0.5\) is chosen.

The SARMA specification corresponds to the ‘constant parameter representation’ of a monthly PAR(1) process, cf. Ghysels and Osborn (2001), p. 150 for details.

All initial values are chosen to be fixed and equal to zero.

The MC integration steps to obtain the marginal posterior predictive distributions of the \(y_{T+k},~k=1 \ldots 8,\) are conducted on a grid of 100 points.

For each loss differential series a Runs test for randomness is conducted, where rejection of the null of ‘randomness’ would be problematic with regard to the iid-assumption of the used tests, see Diebold and Mariano (1995). Here no further evidence for nonrandomness of the sequences has been found.

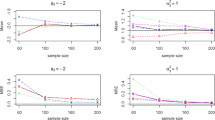

Similar results have been obtained for other parameterizations of the DGP in (18) and also for a periodic moving average process of order one as DGP. The average PMSEs in the latter case are 1.22 for a PAR(1) model, 1.23 for an AR(1) model and 1.26 for a PMEANS model.

The corresponding results under Haldane’s prior are 0.0077 for all three comparisons.

The SARMA model has an averaged PMSE (MAPE) of 1.87 (2.84).

This reform brought together the former unemployment benefits for long term unemployed (‘Arbeitslosenhilfe’) and the former welfare benefits (‘Sozialhilfe’). That is, since January 2005 these two groups have both been considered as ‘unemployed’. This simple change in ‘measurement’ of the unemployment rate induced the instantaneous level shift for most of the series.

In this context, note the following useful approximate relationship between the BIC and the posterior probability mass function of model \(M_i\): \(f(M_{i}| ~data) \approx \exp {(-1/2~ BIC_{i})}/\sum _{j=1}^{I} \exp {(-1/2~ BIC_{j})}\), which can be derived by applying a Laplace approximation (see Tierney and Kadane 1986; Tierney et al. 1989) to the joint posterior density.

Most of these six loss-differences are however not statistically significant.

The results for the 18 series are omitted here.

References

Andel J (1983) Statistical analysis of periodic autoregression. Apl Mat 28(5):364–385

Bauwens L, Lubrano M, Richard JF (1999) Bayesian inference in dynamic econometric models, 1st edn. Oxford University Press, Oxford

Berger JO (1980) Statistical decision theory and bayesian analysis, 2nd edn. Springer, New York

Berger JO, Sellke T (1987) Testing a point null hypothesis: the irreconcilability of P values and evidence. J Am Stat Assoc 82(397):112–122

Berry DA, Hochberg Y (1999) Bayesian perspectives on multiple comparisons. J Stat Plan Inference 82(1):215–227

Boswijk HP, Franses PH (1996) Unit roots in periodic autoregressions. J Time Ser Anal 17(3):221–245

Boswijk HP, Franses PH, Haldrup N (1995) Multiple unit roots in periodic autoregression. J Econom 80:167–193

Box GEP, Jenkins GM, Reinsel GC (2008) Time series analysis forecasting and control, 4th edn. Wiley, Hoboken

Broemeling LD (1985) Bayesian analysis of linear models, 1st edn. Marcel Dekker Inc., New York

Broemeling LD, Land M (1984) On forecasting with univariate autoregressive processes: a Bayesian approach. Commun Stat Theory Methods 13(11):1305–1320

Casella G, Berger RL (2002) Statistical inference, 2nd edn. Duxbury, Pacific Grove

Chen CWS, Liu FC, Gerlach R (2011) Bayesian subset selection for threshold autoregressive moving-average models. Comput Stat 26:1–30

Chib S (1995) Marginal likelihood from the Gibbs output. J Am Stat Assoc 90(432):1313–1321

Clark TE, West KD (2007) Approximately normal tests for equal predictive accuracy in nested models. J Econom 138:291–311

Diebold FX, Mariano RS (1995) Comparing predictive accuracy. J Bus Econ Stat 15(3):253–263

Draper D (1995) Assessment and propagation of model uncertainty. J R Stat Soc Ser B 57(1):45–70

Feldkircher M (2012) Forecast combination and Bayesian model averaging: a prior sensitivity analysis. J Forecast 31(4):361–376

Fernandez C, Ley E, Steel MFJ (2001) Benchmark priors for Bayesian model averaging. J Econom 100:381–427

Franses PH (1994) A multivariate approach to modeling univariate seasoanl time series. J Econom 63:133–151

Franses PH (2003) Periodicity and stochastic trends in economic time series, 2nd edn. Oxford University Press, New York

Franses PH, Koop G (1997) A Bayesian analysis of periodic integration. J Forecast 16:509–532

Franses PH, Paap R (2006) Periodic time series models, 2nd edn. Oxford University Press, New York

George EI, McCulloch RE (1993) Variable selection via Gibbs sampling. J Am Stat Assoc 88(423):881–889

Geweke J, Whiteman CH (2006) Bayesian forecasting. Handb Econ Forecast 1:3–80

Ghysels E, Osborn DR (2001) The econometric analysis of seasonal time series, 1st edn. Cambridge University Press, Cambridge

Ghysels E, Osborn DR, Rodrigues PMM (2006) Forecasting seasonal time series. In: Elliott G, Granger CWJ, Timmermann A (eds) Vol. 1 of Handbook of economic forecasting. Elsevier, Amsterdam

Giacomini R, White H (2006) Tests of conditional predictive ability. Econometrica 74:1545–1578

Gladyshev EG (1961) Periodically correlated random sequences. Sov Math 2:385–388

Hamilton JD (1994) Time series analysis, 1st edn. Cambridge University Press, New York

Hansen BE (2007) Least squares model averaging. Econometrica 75(4):1175–1189

Hibon M, Evgeniou T (2005) To combine or not to combine: selecting among forecasts and their combinations. Int J Forecast 21:15–24

Hjort NL, Claeskens G (2003) Frequentist model average estimators. J Am Stat Assoc 98:879–899

Hoeting JA, Madigan D, Raftery AE, Volinsky CT (1999) Bayesian model averaging: a tutorial. Stat Sci 14:382–417

Hong H, Preston B (2012) Bayesian averaging, prediction and nonnested model selection. J Econom 167:358–369

Inoue A, Kilian L (2006) On the selection of forecasting models. J Econom 130:273–306

Judge GG, Griffiths WE, Hill RC, Lütkepohl H, Lee TC (1985) The theory and practice of econometrics, 2nd edn. Wiley, New York

Klinger S, Weber E (2016) Decomposing Beveridge curve dynamics by correlated unobserved components. Oxf Bull Econ Stat 78:877–894

Koop G, Oseiwalski J, Steel MFJ (1995) Bayesian long-run prediction in time series models. J Econom 69:61–80

Madigan D, Raftery AE (1994) Model selection and accounting for model uncertainty in graphical models using Occam’s window. J Am Stat Assoc 89(428):1535–1546

Meese R, Rogoff K (1983) Empirical exchange rate models of the seventies. Do they fit out of sample? J Int Econ 14:3–24

Monahan JF, Boos D (1992) Proper likelihoods for Bayesian analysis. Biometrika 79(2):271–278

Osborn DR (1991) The implications of periodically varying coefficients for seasonal time-series processes. J Econom 48:373–384

Osborn DR, Chui APL, Smith JP, Birchenhall CR (1988) Seasonality and the order of integration for consumption. Oxf Bull Econ Stat 50:361–377

Osborn DR, Smith JP (1989) The performance of periodic autoregressive models in forecasting seasonal U.K. consumption. J Bus Econ Stat 7(1):117–128

Pagano M (1978) On periodic and multiple autoregressions. Ann Stat 6(6):1310–1317

Pereira C, Stern JM (1999) Evidence and credibility: full Bayesian significance test for precise hypotheses. Entropy 1:69–80

Pereira C, Stern JM, Wechsler S (2008) Can a significance test be genuinely Bayesian? Bayesian Anal 3:79–100

Phillips PCB (1991a) Bayesian routes and unit roots: de rebus prioribus semper est disputandum. J Appl Econom 6(4):435–473

Phillips PCB (1991b) To criticize the critics: an objective Bayesian analysis of stochastic trends. J Appl Econom 6(4):333–364

Raftery A, Madigan D, Volinsky C (1996) Accounting for model uncertainty in survival analysis improves predictive performance (with discussion). In: Berger JO, Bernardo JM, Dawid AP, Lindley DV, Smith AFM (eds) Bayesian statistics, vol 5. Oxford University Press, London, pp 323–349

Raftery AE, Madigan D, Hoeting JA (1997) Bayesian model averaging for linear regression models. J Am Stat Assoc 92:179–191

Raftery AE, Zheng Y (2003) Performance of Bayesian model averaging. J Am Stat Assoc 98:931–938

Robert CP (2007) The Bayesian choice, 1st edn. Springer, New York

Schwarz G (1978) Estimating the dimension of a model. Ann Stat 6(2):461–464

So MKP, Chen CWS, Liu FC (2006) Best subset selection of autoregressive models with exogenous variables and generalized autoregressive conditional heteroscedasticity errors. J R Stat Soc Ser C 55:201–224

Stock JH, Watson MW (1999) Forecasting inflation. J Monet Econ 44(2):293–335

Tanner MA, Wong WH (1987) The calculation of posterior distributions by data augmentation. J Am Stat Assoc 82(398):528–540

Tiao GC, Grupe MR (1980) Hidden periodic autoregressive-moving average models in time series data. Biometrika 67(2):365–373

Tierney L, Kadane JB (1986) Accurate approximations for posterior moments and marginal densities. J Am Stat Assoc 81(393):82–86

Tierney L, Kass RE, Kadane JB (1989) Fully exponential laplace approximations to expectations and variances of nonpositive functions. J Am Stat Assoc 84(407):710–716

Vecchia AV (1985) Maximum likelihood estimation for periodic autoregressive moving average models. Technometrics 27(4):375–384

Vosseler A (2016) Bayesian Model selection for unit root testing with multiple structural breaks. Comput Stat Data Anal 100:616–630

Vosseler A, Weber E (2017) Bayesian analysis of periodic unit roots in the presence of a break. Appl Econ 49(38):3841–3862

Wright JH (2009) Forecasting US inflation by Bayesian model averaging. J Forecast 28(2):131–144

Zellner A (1971) Introduction to Bayesian inference in econometrics, 1st edn. Wiley, New York

Zou H, Yang Y (2004) Combining time series models for forecasting. Int J Forecast 20(1):69–84

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

Appendix A

See Tables 1, 2, 3, 4, 5, 6, 7 and 8.

Appendix B

Rights and permissions

About this article

Cite this article

Vosseler, A., Weber, E. Forecasting seasonal time series data: a Bayesian model averaging approach. Comput Stat 33, 1733–1765 (2018). https://doi.org/10.1007/s00180-018-0801-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00180-018-0801-3