Abstract

In an environment with dynamic arrivals of players who wish to purchase only one of multiple identical objects for which they have a private value, we analyze a sequential auction mechanism with an activity rule. If the players play undominated strategies then we are able to bound the efficiency loss compared to an optimal mechanism that maximizes the total welfare. We have no assumptions on the underlying distribution from which the players’ arrival times and valuations for the object are drawn. Moreover we have no assumption of a common prior on this distribution.

Similar content being viewed by others

Notes

Note that we do not assume that this distribution becomes common knowledge to the players.

It will be convenient, and more interesting, to assume that \(N>>K\), though our results hold for any \(N\).

Obviously if at a given time and price, for a given history, the player’s strategy is to “drop”, and the player was indeed chosen to drop then for the rest of this auction the strategy will continue to be “drop”. The strategy can change to “remain” only when the history continues to the next auction.

A deterministic tie-breaking rule is using the same preference order throughout the auction while a random tie-breaking rule is also allowed and is using a (possibly randomly chosen) different preference order each time the price clock stops. However we assume that the auctioneer makes public the order that was chosen at every step (after the dropper was chosen).

Later on we impose an activity rule which will cause this set to be possibly different than the set of all non-winners with \(r_{i}\le t\).

If the tie-breaking rule is deterministic, then it is part of the description of the mechanism and can be omitted from the detailed description of the histories.

If \(p\) is a price for which no player announced her will to drop out, then the history at \(p\) is given by

$$\begin{aligned} h_{t}(p,0)=(t,X_{t},(p^{\prime },(D_{t}(p^{\prime },k^{\prime }),\succeq _{\left( t,p^{\prime },k^{\prime }\right) })_{k^{\prime }=1,\ldots ,s_{p^{\prime }}^{t}})_{p^{\prime }\in \mathfrak {R}\hbox { s.t. }s_{p^{\prime }}^{t}>0\hbox { and } p^{\prime }<p}\ ,p) \end{aligned}$$Throughout, we use “high bidders” instead of high-value bidders to shorten notation.

Unless no player shows up for some auction and all players that arrived previously are already winners.

An interesting question, that we leave for a later study, is whether a higher cutoff point (with respect to the price) can increase the seller’s revenue.

With a random tie-breaking rule, \(b\) may sometimes yield a negative utility, as it can be that all players will drop before \(i\), forcing her to pay more than her value. A deterministic rule is less effective in this respect.

As explained above, player \(2\) may use such a strategy if she believes that player \(1\) has a high value, while player \(3\) has a low value. Moreover, this might be a weakly undominated strategy for her.

The example uses only two objects but it can be easily adopted to any number \(K\) of objects simply by setting all values of players that arrive before the last two periods to be sufficiently small, and in the last two periods replicate the same example.

There always exists a tuple of undominated strategies such that \(A\)’s value exactly equals \(\tilde{A}\)’s value. Recall that the adversary here may choose the strategy after she knows the values of the bidders. Therefore she can choose the following tuple: each player, other than the player with the \( K-t+1\)’s highest value at auction \(t\), drops when the number of remaining bidders is equal to the number of remaining auctions, or when the price reaches the player’s value, the earliest of the two events. The player with the \(K-t+1\)’s highest value at auction \(t\) drops if and only if the price reaches his value. This ensures that the value of the winner at auction \(t\) is the \(K-t+1\) highest among all bidders who are present at auction \(t\).

Since players are ex-ante symmetric it does not matter which players arrive at time 1 and which arrive at time 2; the only important parameter is the number of arrivals for each auction.

E.g. for a Bernoulli distribution with \(n=7\) and \(p=0.9\), \(r=2\) yields a higher ratio than \(r=3\).

If the distribution is discrete we use an arbitrary deterministic tie-breaking rule to ensure that the events (indexed by \(j\)) “highest player at time 1 has the (j+1)-highest value overall” are mutually exclusive.

Formally, any strategy \(b_{i}^{0}\) is weakly dominated by the strategy \( b_{i}^{*}((r_{i},v_{i}),h_{1}(p,k))=b_{i}^{0}((r_{i},v_{i}),h_{1}(p,k))\) , and \(b_{i}^{*}((r_{i},v_{i}),h_{1}(p_{1}^{*},s_{p_{1}^{*}}^{1}),h_{2}(p,k))=D\) if and only if \(p\ge v_{i}\).

Formally, \(b_{1}^{0}((1,v_{1}),h_{1}(p,k))=D\) for all \(p,k\), and \( b_{1}^{0}((1,v_{1}),h_{1}(p_{1}^{*},s_{p_{1}^{*}}^{1}),h_{2}(p,k))=D\) iff \( p\ge v_{1}\).

Even if one is not free to determine the number of players and their arrival times, one can set the values of all players besides the last three to be zero, by this returning to the limited setting and yielding the impossibility.

References

Athey S, Segal I (2007) An efficient dynamic mechanism. Working paper

Ausubel LM (2004) An efficient ascending-bid auction for multiple objects. Am Econ Rev 94(5):1452–1475

Babaioff M, Lavi R, Pavlov E (2009) Single-value combinatorial auctions and algorithmic implementation in undominated strategies. J ACM 56:1–32

Bergemann D, Välimäki J (2010) The dynamic pivot mechanism. Econometrica 78(2):771–789

Cavallo R, Parkes DC, Singh S (2009) Efficient mechanisms with dynamic populations and dynamic types. Harvard University, Technical report

Cole R, Dobzinski S, Fleischer L (2008) Prompt mechanisms for online auctions. In: Proceeding of the 1st international symposium on algorithmic, game theory (SAGT’08)

Cramton P (2013) Spectrum auction design. Rev Ind Org 42(2):161–190

Gallien J (2006) Dynamic mechanism design for online commerce. Oper Res 54(2):291

Gershkov A, Moldovanu B (2010) Efficient sequential assignment with incomplete information. Games Econ Behav 68(1):144–154

Hajiaghayi M, Kleinberg R, Mahdian M, Parkes D (2005) Online auctions with re-usable goods. In: Proceeding of the 6th ACM conference on electronic commerce (ACM-EC’05)

Lavi R, Nisan N (2004) Competitive analysis of incentive compatible on-line auctions. Theor Comput Sci 310:159–180

Lavi R, Nisan N (2005) Online ascending auctions for gradually expiring items. In: Proceeding of the 16th symposium on discrete algorithms (SODA)

McAfee RP (2002) Coarse matching. Econometrica 70(5):2025–2034

Milgrom P, Weber R (2000) A theory of auctions and competitive bidding, II. In: Klemperer P (ed) The economic theory of auctions. Edward Elgar Publishing, Cheltnam, pp 179–194

Neeman Z (2003) The effectiveness of english auctions. Games Econ Behav 43:214–238

Pai M, Vohra R (2008) Optimal dynamic auctions. Working paper

Parkes DC, Singh S (2003) An MDP-based approach to online mechanism design. In: Proceeding of 17th annual conference on neural information processing systems (NIPS’03)

Said M (2012) Auctions with dynamic populations: efficiency and revenue maximization. J Econ Theory 147(6):2419–2438

Vulcano G, van Ryzin G, Maglaras C (2002) Optimal dynamic auctions for revenue management. Manage Sci 48(11):1388–1407

Ye L (2007) Indicative bidding and a theory of two-stage auctions. Games Econ Behav 58(1):181–207

Acknowledgments

We thank Olivier Compte, Dan Levin, and Benny Moldovanu, for many helpful comments. Ron Lavi supposrted by a Marie-Curie IOF fellowship of the European Commision.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendices

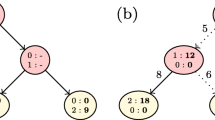

Appendix 1: The need for an activity rule via an example

To exemplify the need to add an activity rule to the auction, consider a setting of two items and three bidders that arrive in time \(1\). In the second auction, it is rather immediate that the strategy of “remaining until price reaches value” weakly dominates all other strategiesFootnote 19. Throughout the paper we have focused on two strategies:

-

1.

In both auctions, remain until price reaches value, i.e. for \(t=1,2\)

$$\begin{aligned} b_{i}^{\text {value}}((r_{i},v_{i}),h(t,p,k))=D,\quad \hbox {iff}\ \ p\ge v_{i}. \end{aligned}$$ -

2.

In the first auction, remain until exactly one other bidder remains, and in the second auction, remain until your value. Formally,

$$\begin{aligned} b_{i}^{EPD}((r_{i},v_{i}),h_{1}(p,k))=D,\quad \hbox {iff}\ \ \{|I_{1}(p,k)|=1\quad \hbox {or}\quad p\ge v_{i}\}, \end{aligned}$$and

$$\begin{aligned} b_{i}^{EPD}((r_{i},v_{i}),h_{1}(p_{1}^{*},s_{p_{1}^{*}}^{1}),h_{2}(p,k))=D,\quad \text { iff }\ p\ge v_{i} \end{aligned}$$(where \(EPD\) stands for Earliest Possible Dropping).

We note that these two strategies do not weakly dominate all other strategies, in the sequential auction without the activity rule. Suppose three bidders \(1,2,3\) arrive at time \(1\), with \(v_{1}>v_{2}>v_{3}\), and let us consider the strategy \(b_{1}^{0}\) for bidder \(1\), in which she drops at price \(0\) in the first auction, and remains until her value in the second auctionFootnote 20. None of the above two strategies dominates \(b_{1}^{0}\) , due to the following reasoning.

Consider first the strategy \(b_{1}^\mathrm{value}\). This strategy performs strictly worse than \(b_{1}^{0}\) in case both \(2\) and \(3\) choose to do the same (remain until their value in both auctions, i.e. play \( b_{2}^\mathrm{value},b_{3}^\mathrm{value}\)), due to the following. By playing \( b_{1}^\mathrm{value}\), bidder \(1\) will win the first auction and will pay \(v_{2}\). By playing \(b_{1}^{0}\), bidder \(1\) will lose the first auction and will win the second auction for a lower price of \(v_{3}\).

Consider next the strategy \(b_{1}^\mathrm{EPD}\). This strategy performs strictly worse than \(b_{1}^{0}\) when bidder \(3\) plays the strategy \(b_{3}^\mathrm{value}\) and \(2\) uses the following strategy (conditional drop): In the first auction, if bidder \(1\) drops at price \(0\) then bidder \(2\) continues until her value, and if bidder \(1\) does not drop at price \(0\) then bidder \(2\) drops at price \(\epsilon \) (for some small fixed \(\epsilon \)). In the second auction, bidder \(2\) remains until her value. In this case, if bidder \(1\) follows \(b_{1}^{0}\) and drops at \(0\) then bidder \(2\) will win the first auction, bidder \(1\) will win the second auction, and will pay \(v_{3}\). If bidder \(1\) follows \(b_{1}^\mathrm{EPD}\) then bidder \(2\) drops, and bidder \(1\) drops immediately after that (since now only bidder \(3\) remains besides \(1\)). Thus, bidder \(3\) wins the first auction, bidder \(1\) again wins the second auction, but this time pays \(v_{2}\) which is larger than \(v_{3}\).

More generally, \(b_1^0\) is not weakly dominated by any other strategy (and is thus an undominated strategy of player 1). To see this, suppose towards a contradiction that \(b_1^0\) is weakly dominated by some strategy \(\bar{b}_i\). Note that \(\bar{b}_i\) cannot drop at zero in the first auction, because this is an unconditional drop making \(\bar{b}_i\) identical to \(b_1^0\). Now, suppose player 1 plays \(\bar{b}_i\), player 2 plays conditional drop, and player 3 bids up to her value in both auctions. Then, player 2 drops at \( \epsilon \) regardless of the values \(v_1, v_2, v_3\) (as long as all values are larger than \(\epsilon \)). Consider the range of values where \(v_1 > \max (v_2,v_3)\). If in the first auction player 1 drops before player 3, the resulting utility of player 1 is \(v_1 - v_2\). For the range of values \(v_2 > v_3\), playing \(b_1^0\) would result in a utility \(v_1 - v_3 > v_1 - v_2\), contradicting the assumption that \(\bar{b}_i\) weakly dominates \(b_1^0\). Thus, in the first auction player 3 must drop before player 1. I.e., player 1 must win the first auction with a resulting utility of \(v_1 - v_3\). For the range of values \(v_2 < v_3\), playing \(b_1^0\) would result in a utility \( v_1 - v_2 < v_1 - v_3\), contradicting once again the assumption that \(\bar{b} _i\) weakly dominates \(b_1^0\).

Appendix 2: Ex-post mechanisms cannot do better

In a “detail-free” /“robust” setting, the literature commonly uses the solution concepts of dominant-strategies (for direct mechanisms) and ex-post equilibria (for indirect mechanisms). A natural question is whether such mechanisms can obtain higher worst-case efficiency than our sequential auction with an activity rule. In this appendix we give a negative answer to this question, and show that every dominant-strategy mechanism for our setting can obtain, in the worst-case, at most half of the optimal welfare. Lavi and Nisan (2005) and subsequently Hajiaghayi et al. (2005) and Cole et al. (2008) prove similar results for slightly different settings. In particular they all rely on the fact that players have a departure time to prove the impossibility. The argument that we devise here does not rely on this assumption and is therefore suitable for our sequential auction setting.

By the direct-revelation principle, we can focus on direct mechanisms in which truthful reporting of the type is a dominant-strategy. We term these “truthful mechanisms”. We additionally assume ex-post Individual Rationality, i.e. that a winner is never required to pay more than her declared value. We show the impossibility for the very restrictive setting of two items and three players, where it is common knowledge that players \(1\) and \(2\) arrive for the first auction and player \(3\) arrives for the second auction. Clearly, this only strengthens the impossibility, since if one can freely determine the number of items and players and their arrival times then one can replicate this limited setting.Footnote 21

Definition 13

(A direct-mechanism for a limited dynamic setting) A direct mechanism is a set of four functions: \(w_{1}(v_{1},v_{2})\) determines the winner (either \(1\) or \(2\)) of the first item, and she pays a price \(p_{1}(v_{1},v_{2})\), where \(p_{1}(v_{1},v_{2}) \le v_{w_{1}(v_{1},v_{2})}\). \(w_{2}(v_{1},v_{2}, v_{3})\) determines the winner of the second item (either \(1\), \(2\), or \(3\), but not \(w_{1}(v_{1},v_{2})\)), and she pays a price \(p_{2}(v_{1},v_{2}, v_{3})\), where \( p_{2}(v_{1},v_{2},v_{3}) \le v_{w_{2}(v_{1},v_{2},v_{3})}\). Such a mechanism is truthful if it is a dominant-strategy of every player to report her true type.

Theorem 14

Every truthful mechanism for the limited dynamic setting obtains in the worst-case at most half of the optimal social welfare.

Proof

Fix any \(\frac{1}{2}\ge \epsilon >0\). Suppose by contradiction that their exists a truthful mechanism \(M=(w_{1}(\cdot ,\cdot ),p_{1}(\cdot ,\cdot ),w_{2}(\cdot ,\cdot ,\cdot ),p_{2}(\cdot ,\cdot ,\cdot ))\) that always obtains at least \(\frac{1}{2}+\epsilon \) of the optimal social welfare. We reach a contradiction via a series of three claims. \(\square \)

Claim 15

If \(v_{2} > \frac{v_{1}}{2\epsilon }\) then \( w_{1}(v_{1},v_{2})=2,\) i.e. player \(2\) must be the winner of the first auction.

Proof

Suppose by contradiction that there exists an instance \((v_{1},v_{2},v_{3})\) such that \(v_{2}>\frac{v_{1}}{2\epsilon }\) and \(w_{1}(v_{1},v_{2})=1\). Consider another instance \((\tilde{v}_{1},\tilde{v}_{2},\tilde{v}_{3})\), where \(\tilde{v}_{1}=v_{1},\tilde{v}_{2}=v_{2}\), and \(\tilde{v}_{3}=v_{2}\). The optimal social welfare in this instance is \(2v_{2}\). We have \(w_{1}( \tilde{v}_{1},\tilde{v}_{2})=w_{1}(v_{1},v_{2})=1\), and therefore the social welfare that the mechanism obtains is \(v_{1}+v_{2}\). But

which contradicts the fact that the mechanism always obtains at least \(\frac{ 1}{2}+\epsilon \) of the optimal social welfare. \(\square \)

Claim 16

In the instance \((v_{1}=1, v_{2} > \frac{1-2\epsilon }{ 1+2\epsilon }, v_{3}=0),\) the winners must be players \(1\) and \(2\).

Proof

Any other set of winners has welfare strictly less than a fraction of \(\frac{ 1}{2}+\epsilon \) of the optimal social welfare of this instance. \(\square \)

Claim 17

If \(v_{1}=1, v_{2} > \frac{1-2\epsilon }{1+2\epsilon },\) and \(w_{1}(v_{1},v_{2})=2,\) then \(p_{1}(v_{1},v_{2}) \le \frac{1-2\epsilon }{ 1+2\epsilon }\) (note that \(\frac{1-2\epsilon }{1+2\epsilon } < 1\) ).

Proof

Suppose a contradicting instance \((v_{1},v_{2},v_{3})\) where \( p_{1}(v_{1},v_{2}) > \frac{1-2\epsilon }{1+2\epsilon } + \delta \) for some \( \delta > 0\). Note that player \(2\) wins item \(1\) and pays the same price in the instance \((v_{1},v_{2},0)\) (call this “instance \(2\)”). Consider a third instance \((\tilde{v}_{1},\tilde{v}_{2},\tilde{v}_{3})\), where \(\tilde{v }_{1} = 1, \tilde{v}_{2} = \frac{1-2\epsilon }{1+2\epsilon } + \delta \), and \( \tilde{v}_{3} = 0\). By claim 16 player \(2\) must be a winner in the third instance, and by individual rationality she pays at most \(\frac{ 1-2\epsilon }{1+2\epsilon } + \delta \). Therefore, in instance \(2\), player \(2\) has a false announcement (\(\frac{1-2\epsilon }{1+2\epsilon } + \delta \) instead of \(v_{2}\)) that strictly increases her utility, a contradiction to truthfulness. \(\square \)

We can now reach a contradiction and conclude the proof of the theorem. Consider the instance \((1,1,5)\). Suppose without loss of generality that \( w_{1}(1,1)=1\). To obtain at least half of the optimal social welfare we must have \(w_{2}(1,1,5)=3\). Thus player \(2\) loses and has zero utility. However if player \(2\) will declare some \(\tilde{v}_{2}>\frac{1}{2\epsilon }\) instead of her true type \(v_{2}=1\) then by claim 15 she will win the first item and by claim 17 she will pay a price of at most \(\frac{1-2\epsilon }{1+2\epsilon }<1\). Thus player \(2\) is able to strictly increase her utility by some false declaration, contradicting truthfulness.

Appendix 3: Proof of Proposition 10

We need to show that, for any \(n,r\), and \(0\le p<1\),

We first differentiate this expression with respect to \(n\), to show that it decreases as \(n\) increases.

We concentrate on the term

and claim that it is nonnegative for every \(2\le r\le n\) and \(p\in [0,1]\). For \(p=0\) we have \(G(0,r)=0\) and for \(p=1\) we have \(G(1,r)=0\). Moreover

and since

for every \(r\ge 2\) we know that \(\frac{d^{2}}{dp^{2}}G\left( p,r\right) \le 0 \) and \(G\left( p,r\right) \) is concave in \(p\). We thus conclude that \( G\left( p,r\right) \ge 0\) for every \(2\le r\le n\) and \(p\in \left[ 0,1 \right] \) and consequently that \(\frac{d}{dn}\left( \frac{\left( 2-p^{r}-p^{n}-r\left( 1-p\right) p^{r-1}\right) }{\left( 2-p^{r}-p^{n}-r\left( 1-p\right) p^{n-1}\right) }\right) \le 0\). We take \(n\) to infinity and get that

We wish to find the minimum of

which will give us a lower bound for (4), for every \(n\), since we obtained that (4) decreases towards the limit as \(n\) increases.

Equivalently, we look for the maximum of

Now

Therefore if there exists a global maximum at \(0<p<1\) and \(2<r\) then we must have

and

but this is not possible since for every \(0<p<1\) we have \(-\ln p>1-p\). We thus conclude that the maximum is achieved on the boundary. Now for \(p=0\), we have \(H\left( 0,r\right) =0\) and for \(p=1\), we have \(H\left( 1,r\right) =0 \); therefore we conclude that the maximum is achieved on the boundary where \(r=2\). We find \(p\) that solves

and the solution is

Finally, for \(r=2,p^{*}=2-\sqrt{2}\) and \(n\rightarrow \infty \) we have

Rights and permissions

About this article

Cite this article

Lavi, R., Segev, E. Efficiency levels in sequential auctions with dynamic arrivals. Int J Game Theory 43, 791–819 (2014). https://doi.org/10.1007/s00182-013-0405-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00182-013-0405-7