Abstract

I analyze an auction environment where two units of an object are sold at two simultaneous, sealed-bid, first-price auctions to bidders who have a one-dimensional type space, where a type represents the value a bidder places on each of the two units. All bidders have an identical budget constraint that binds their ability to spend in the auctions. I show that if the valuation distribution is atom-less then there does not exist any equilibrium in behavioral strategies in this auction game.

Similar content being viewed by others

Notes

This bidding function is the pure strategy equilibrium of a single-unit first price auction.

A higher budget level will not be binding for any bidder type, as explained in the next section.

If such a bidder type does not exist, then using a similar argument we can show there will be a profitable deviation for a bidder type bidding in the neighborhood of \(\{b,w-b\}\).

Bidders will prefer to reduce their bid since they will not lose out too much in terms of probability of winning but will gain considerably in terms of ex-post payoffs.

I thank an anonymous referee for providing this example.

First-price auction strategy.

For a survey, see de Castro and Karney (2012)

I thank Vijay Krishna and two anonymous referees who encouraged me to investigate the link between the result of my paper and current existence result in auctions.

I can find \(\hat{v}\) by solving for it in \(\Pi ^i(\hat{v},\{\frac{v}{2},\frac{v}{2}\},x^*_{-i})=\Pi ^i(\hat{v},\{\frac{w}{2},\frac{w}{2}\},x^*_{-i})\). That is,

$$\begin{aligned} 2\left( \hat{v}-\frac{\hat{v}}{2}\right) F(\hat{v})=2\left( \hat{v}-\frac{w}{2}\right) \left( F(\hat{v})+\frac{1-F(\hat{v})}{2}\right) \end{aligned}$$where in the right hand side of the above equation I use the fact that there is are mass points in the bid distributions and that ties are broken with equi-probability.

We can find \(\tilde{v}\) by solving for it in

$$\begin{aligned} 2\left( \tilde{v}-\frac{\tilde{v}}{2}\right) F(\tilde{v})=\left( \tilde{v}-\frac{w}{2}\right) +\left( \tilde{v}-\frac{\tilde{v}}{2}\right) F(\tilde{v}) \end{aligned}$$.

The equation \(w=2\tilde{v}-\tilde{v}^2\) has two roots; 0.1835 and 1.8165. The latter is not a feasible value for \(\tilde{v}\).

I thank an anonymous referee for bringing the latter to my attention.

Araujo et al. (2008) also covers the case of multi-unit auctions with unitary demands.

I conjecture that this must be true independent of tie-breaking rules. It certainly is the case for tie-breakers which use a secondary auction.

Suppose \(H^j_1(\hat{b}_1)=0\). Let \(b=\liminf _{n\rightarrow \infty }\{b^n|H^j_1(b^n)=0\}\). Then there is a positive measure of bidder types with \(v\in [0,b]\subset [0,v]\) who are submitting bids higher than \(b\) in auction 1, winning with positive probability and hence making negative payoffs .

Since \(H^j_2(\cdot )\) is a monotone function, we know the left-hand and right-hand limits at \(w-\hat{b}_1\) exist.

This equilibrium can be found using standard arguments which use ordinary differential equations as in Lebrun (1996). In this case the auction game becomes two single-unit first price auctions, since no bidder is hitting her constraint.

Since \(H^i_1(\frac{w}{2})-H^i_1(\frac{w}{2}-\varepsilon )>0\), Lemma 4.2 implies \(H^j_1(\frac{w}{2})-H^j_1(\frac{w}{2}-\varepsilon )>0\). If there does not exist \(v\) for whom \(\{\frac{w}{2},\frac{w}{2}\}\) belongs in the support of \(\sigma ^j\), then there must exist a positive measure of bidder \(j\) types who bid in the interval \((\frac{w}{2}-\varepsilon ,\frac{w}{2})\). This implies there must exist positive measure of bidder \(i\) types who bid in \((\frac{w}{2}-\varepsilon ,\frac{w}{2})\).

An identical proof applies if \(b_1\le b_2\), since there is also a mass point in \(H^i_2(\cdot )\) at \(\frac{w}{2}\).

Lower bidder types prefer \(b_2\) and higher bidder types prefer \(\hat{b}_2\).

Since \(b_1>\bar{b}_1\) is a contradiction to the definition of \(\bar{b}_1\) and \(b^i_1=\bar{b}_1\) will lead to the conclusion of the previous step.

Suppose, \(b_1+b_2<w\). Since \(\{b_1,b_2\}\in \beta ^i(\bar{v})\), \((\bar{v}-b_1)H^j_1(b_1)\ge (\bar{v}-b'_1)H^j_1(b'_1)\), where \(b'_1\in (b_1,w-b_2)\). This implies, \((v-b_1)H^j_1(b_1)>(v-b'_1)H^j_1(b'_1)\) for all \(v<\bar{v}\). Therefore, \(H^i_1(w-b_2)-H^i_1(b_1)=0\), a contradiction, since \(b_1<\bar{b}_1\).

This is true since, \(\bar{b}_1=\max \{\bar{b}_1,\bar{b}_2\}\ge b_2=w-b_1\).

If \(\{\bar{b}_1,w-\bar{b}_1\}=\beta ^i(v')\),then a similar argument as in (6.1) with strict inequalities, can show that \(\{\bar{b}_1,w-\bar{b}_1\}=\beta ^i(v'')\) for all \(v''\in (v',\bar{v})\).

If \(\bar{b}=b'_1\) then \(H^i_2(w-\bar{b})-H^i_2(b'_2)=0\), also a contradiction.

References

Araujo A, de Castro L, Moreira H (2008) Non-monotonicities and the all-pay auction tie-breaking rule. Economic Theory 35(3):407–440

Barelli P, Govindan S, Wilson R (2014) Competition for a majority. Econometrica 82(1):271–314

Benoit J-P, Krishna V (2001) Multiple-object auctions with budget constrained bidders. Review of Economic Studies 68(1):155–179

Bulow J, Levin J and Milgrom P (2009) Winning play in spectrum auctions, mimeo

Brusco S, Lopomo G (2009) Simultaneous ascending auctions with complementarities and known budget constraints. Economic Theory 38:1

de Castro LI, Karney DH (2012) Equilibria existence and characterization in auctions: Achievements and open questions. Journal of Economic Surveys 26(5):911–932

Ghosh G (2012) Simultaneous First-Price Auctions with Budget Constrained Bidders. mimeo

Jackson MO (2009) Non-Existence of Equilibrium in Vickrey. Second Price and English Auctions, Review of Economic Design 13:137–145

Jackson MO, Simon LK, Swinkels JM, Zame WR (2002) Communication and Equilibrium in Discontinuous Games of Incomplete Information. Econometrica 70(5):1711–1740

Lebrun B (1996) Existence of an equilibrium in first price auctions. Economic Theory 7:421–443

Maskin E, Riley J (2000) Equilibrium in sealed high bid auctions. Review of Economic Studies 67:439–454

Milgrom PR (2004) Putting Auction Theory to Work. Cambridge University Press, Cambridge

Milgrom PR, Weber RJ (1985) Distributional strategies for games with incomplete information. Mathematics of Operation Research 10(4):619–632

Palfrey TR (1980) Multiple-object, discriminatory auctions with bidding constraints: A game-theoretic analysis. Management Science 26(9):935–946

Reny PJ (1999) On the existence of pure and mixed-strategy Nash equilibria in discontinuous games. Econometrica 67(5):1029–1056

Simon LK and Zame WR (1990) Discontinuous Games and endogenous sharing rules. Econometrica 58(4):861–872

Acknowledgments

I am grateful to Srihari Govindan, Ayça Kaya, Vijay Krishna (editor), Heng Liu, Clinton Levitt, the associate editor and two anonymous referees for their comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Proof of Lemma 4.1

-

(i)

Without loss of generality \(\hat{b}_1\ge \hat{b}_2\) as shown in Fig. 1. Note that \(H^j_1(\hat{b}_1)>0\) and \(H^j_2(\hat{b}_2)>0\) if \(\hat{b}_1>0\) and \(\hat{b}_2>0\) respectively.Footnote 16

When playing \(\{\hat{b}_1,\hat{b}_2\}\), bidder type \(\hat{v}\) does not expend her entire budget. Hence, \(\hat{v}\) must weakly prefer \(\hat{b}_2\) to any \(b\in (\hat{b}_2,w-\hat{b}_1]\), since the bid pair \(\{\hat{b}_1,b\}\) is affordable.

Note that if the above inequality is an equality, then \(H^j_2(\hat{b}_2)<H^j_1(b)\). In either case, whether it is a strict inequality or an equality, all bidder types below \(\hat{v}\) strictly prefer \(\hat{b}_2\) to \(b\) in auction 2. A similar argument shows that all bidder types \(v<\hat{v}\) strictly prefer \(\hat{b}_1\) to \(b'\in (\hat{b}_1,w-\hat{b}_2]\) in auction 1.

If either \(\hat{b}_1=0\) or \(\hat{b}_2=0\), then all higher bids would give negative payoffs for bidder type \(\hat{v}\) since \(\{\hat{b}_1,\hat{b}_2\}\in \beta ^i(\hat{v})\). The same would be the case for all bidder types below \(\hat{v}\).

-

(ii)

In order to prove differentiability of \(H^j_2(\cdot )\) at \(w-\hat{b}_1\), I will first show continuity. Suppose to the contrary, \(\lim _{\varepsilon \rightarrow 0}H^j_2(w-\hat{b}_1+\varepsilon )-\lim _{\varepsilon \rightarrow 0}H^j_2(w-\hat{b}_1-\varepsilon )=\Delta >0\).Footnote 17 The payoff to bidder \(i\) of type \(\hat{v}\) is,

$$\begin{aligned} \Pi ^i(\hat{v},\hat{b}_1,w-\hat{b}_1,\sigma ^j)&=(\hat{v}-\hat{b}_1)H^j_1(\hat{b}_1)+(\hat{v}-w+\hat{b}_1)(H^j_2(w-\hat{b}_1)-\frac{1}{2}\Delta ) \end{aligned}$$

Clearly, by changing the bids to \(\{\hat{b}_1-\varepsilon ,w-\hat{b}_2+\varepsilon \}\), where \(\varepsilon >0\) and small, bidder \(i\) would be better off. Her payoff will approximately increase by \(\frac{1}{2}(\hat{v}-w+\hat{b}_1)\Delta \) because she will not lose too much by bidding less in auction 1 due the differentiability of \(H^j_1(\cdot )\) at \(\hat{b}_1\). Hence \(H^j_2(\cdot )\) cannot have a mass point at \(w-\hat{b}_1\). What remains to be shown is differentiability. Since \(\hat{v}\) is playing best responses, for any \(\varepsilon >0\) the following are true,

Expanding the above inequalities, dividing by \(\varepsilon \) and taking limits as \(\varepsilon \rightarrow 0\) we get,

From the above, notice

Therefore \(H^2_k(\cdot )\) is differentiable at \(\hat{b}_2=w-\hat{b}_1\).

-

(iii)

Without loss of generality, let \(\hat{v}<\tilde{v}\). For any \(v\in (\hat{v},\tilde{v})\), there exists \(\alpha <1\), such that \(v=\alpha \hat{v}+(1-\alpha )\tilde{v}\). Then,

$$\begin{aligned} \Pi ^i(v,\hat{b}_1,\hat{b}_2,\sigma ^j)&=\alpha \Pi ^i(\hat{v},\hat{b}_1,\hat{b}_2,\sigma ^j)+(1-\alpha )\Pi ^i(\tilde{v},\hat{b}_1,\hat{b}_2,\sigma ^j \nonumber \\&\ge \alpha \Pi ^i(\hat{v},b_1,b_2,\sigma ^j)+(1-\alpha )\Pi ^i(\tilde{v},b_1,b_2,\sigma ^j)\nonumber \\&=\Pi ^i(v,b_1,b_2,\sigma ^j), \end{aligned}$$(6.1)for any \(\{b_1,b_2\}\in B\). Therefore, \(\{\hat{b}_1,\hat{b}_2\}\in \beta ^i(v)\). \(\square \)

1.2 Proof of Lemma 4.4

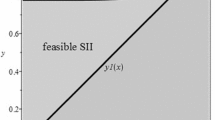

Without loss of generality, let \(\max \{\bar{b}_1,\bar{b}_2\}=\bar{b}_1\). I need to disprove \(\bar{b}_1\le \frac{w}{2}\). First, suppose, \(\bar{b}_1< \frac{w}{2}\). Then, Lemma 4.3 implies \(H^i_k(\cdot )\) is continuous everywhere for all \(i\) and \(k\). Then there exists a unique equilibrium which is symmetric, in pure strategies and differentiable.Footnote 18 This equilibrium should also be an equilibrium of the auction(s) without a budget constraint. However the first-price auction game without a budget constraint has a unique equilibrium, which is not possible in the current environment with a budget constraint \( w<2\int _{0}^{1}{xdF(x)}\).

Now, suppose, \(\bar{b}_1= \frac{w}{2}\). If there is no mass point at \(\frac{w}{2}\), then the argument in the preceding paragraph applies. Suppose there is a mass point, \(\Delta ^i_1(\frac{w}{2})\). Lemma 4.3 shows \(\Delta ^i_1(\frac{w}{2})=\Delta ^i_2(\frac{w}{2})\). The rest of the proof proceeds as follows. I will show that there are bidder types bidding arbitrarily close to \(\frac{w}{2}\), who prefer to bid more than \(\frac{w}{2}\) to beat the probability mass \(\Delta ^i_1(\frac{w}{2})\). This contradicts \(\bar{b}_1= \frac{w}{2}\).

First, let us establish that there are bidder types bidding arbitrarily close to \(\frac{w}{2}\). Suppose, to the contrary, there exists \(\varepsilon >0\) such that \(H^i_1(\frac{w}{2})-\Delta ^i_1(\frac{w}{2})-H^i_1(\frac{w}{2}-\varepsilon )=0\). Consider bidder \(j\) with type \(v\) for whom \(\{\frac{w}{2},\frac{w}{2}\}\) belongs in the support of \(\sigma ^j\).Footnote 19 This bidder’s payoff is given by

Suppose this bidder submits the bid pair \(\{\frac{w}{2}-\varepsilon , \frac{w}{2}+\frac{\varepsilon }{N}\}\), where \(N\) is some large number. With this strategy, the bidder will win auction 2 for sure and the auction 1 with probability \(H^i_1(\frac{w}{2}-\varepsilon )=(1-\Delta ^i_2(\frac{w}{2}))\). The payoff from this deviation is

The strict inequality (true for \(N\) large enough) is a contradiction. Therefore, for all \(\varepsilon >0\), \(H^i_k(\frac{w}{2})-\Delta ^i_k(\frac{w}{2})-H^i_k(\frac{w}{2}-\varepsilon )>0\). Using Lemma 4.2, this implies, \(H^j_k(\frac{w}{2})-\Delta ^j_k(\frac{w}{2})-H^j_k(\frac{w}{2}-\varepsilon )>0\).

Now, I show that a bidder type bidding close to \(\frac{w}{2}\) prefers to deviate. Consider bidder \(j\) type \(v\) for whom \(\{b_1,b_2\}\) belongs to the support of \(\sigma ^j\), where \(b_1\in (\frac{w}{2}-\varepsilon ,\frac{w}{2})\) and \(b_1\ge b_2\).Footnote 20 Therefore \(w-b_1-b_2>\frac{w}{2}-b_1=\varepsilon '\). Even as \(\varepsilon \rightarrow 0\) I can always find such a bidder. Suppose she bids \(\{b_1+\varepsilon '_+,b_2\}\), where \(\varepsilon '_+>\varepsilon '\) but very close to \(\varepsilon '\).

The first inequality is true since \((\frac{w}{2}+\varepsilon '_+-b_1)\approx 2\varepsilon '<(v-b_1)\Delta ^i_1(\frac{w}{2})\) as \(\varepsilon \) gets small enough. The second inequality is true since \(H^i_1(b_1)<1-\Delta ^i_1(\frac{w}{2})\). Since \(w-b_1-b_2>\varepsilon '\), the bid pair \(\{b_1+\varepsilon '_+, b_2\}\) is affordable. Therefore \(\{b_1,b_2\}\notin \beta ^{j}(v)\) which contradicts \(\{b_1,b_2\}\) being in the support of \(\sigma ^j\).

Finally, suppose without loss of generality, \(\bar{b}_1=\max \{\bar{b}_1,\bar{b}_2\}\). Then \(\bar{b}_2=\min \{\bar{b}_1,\bar{b}_2\}\). If \(\bar{b}_2<w-\bar{b}_1\), then the sum of every equilibrium bid-pair is less than the budget. Therefore no bidder type is hitting her constraint. Applying the same reasoning as in the first paragraph of this proof, this can not be case since the single-unit first price auctions have a unique equilibrium. \(\square \)

1.3 Proof of Lemma 4.6

Step 1

Suppose, there exists \(v\) and \(b_2\), such that \(\{\bar{b}_1,b_2\}\in \beta ^i(v)\) where \(b_2<w-\bar{b}_1\). Lemma 4.5 implies there must exist a positive measure of bidder \(i\) types bidding in the interval \((b_2,w-\bar{b}_1)\) in auction 2, since \(\bar{b}_2\ge w-\bar{b}_1\) due to Lemma 4.4. Consider \(\hat{v}\) such that \(\{\hat{b}_1,\hat{b}_2\}\in \beta ^i(\hat{v})\) where \(\hat{b}_2\in (b_2,w-\bar{b}_1)\) as shown in Fig. 2.

First, I will show that \(\hat{v}>v\). To the contrary, suppose \(\hat{v}< v\). Since \(\{\hat{b}_1,\hat{b}_2\}\in \beta ^i(\hat{v})\), it must be the case that \((\hat{v}-\hat{b}_2)H^j_2(\hat{b}_2)\ge (\hat{v}-b^i_2)H^j_2(b_2)\). This implies \((v-\hat{b}_2)H^j_2(\hat{b}_2)>(v-b_2)H^j_2(b_2)\). Since \(\{\bar{b}_1,\hat{b}_2\}\) is affordable, it must be the case that \(\Pi ^i(v,\bar{b}_1,\hat{b}_2,\sigma ^j)>\Pi ^i(v,\bar{b}_1,b_2,\sigma ^j)\). This contradicts \(\{\bar{b}_1,b_2\}\in \beta ^i(v)\).

Suppose \(\hat{v}=v\). We know that \(\{\hat{b}_1,\hat{b}_2\},\{\bar{b}_1,b_2\}\in \beta ^i(v)\). Since both these bid pairs are affordable, this implies no bidder would submit \(b'_2\in (b_2,\hat{b}_2)\), a contradiction to Lemma 4.5.Footnote 21 Therefore, \(\hat{v}>v\).

The final part in this step is to show \(\hat{b}_1>\bar{b}_1\) which is a contradiction. Suppose \(\hat{b}_1<\bar{b}_1\). Since \(\{\bar{b}_1,\hat{b}_2\}\) is affordable and \(\{\hat{b}_1,\hat{b}_2\}\in \beta ^i(\hat{v})\), it must be the case that \((\hat{v}-\hat{b}_1)H^j_1(\hat{b}_1)\ge (\hat{v}-\bar{b}_1)H^j_1(\bar{b}_1)\). Since \(\hat{v}>v\), the above inequality implies \((v-\hat{b}_1)H^j_1(\hat{b}_1)>(v-\bar{b}_1)H^j_1(\bar{b}_1)\). Therefore \(\Pi ^i(v,\hat{b}_1,b_2,\sigma ^j)>\Pi ^i(v,\bar{b}_1,b_2,\sigma ^j)\), which is a contradiction to \(\{\bar{b}_1,b_2\}\in \beta ^i(v)\). The only case remaining is \(\hat{b}_1=\bar{b}_1\). This would apply to all the bidder types for whom \(b_2\in (b_2,w-\bar{b}_1)\) belongs in the support of \(\sigma ^i_2\), of which there is positive measure. Therefore it must be the case that \(H^i_2(w-\bar{b}_1)-H^i_2(b_2)=\Delta ^i_1(\bar{b}_1)>0\). That is there is positive mass at \(\bar{b}_1\) in \(H^i_1(\cdot )\), which is a contradiction, due to Lemmas 4.4 and 4.3. Hence the only remaining possibility is \(\hat{b}_1>\bar{b}_1\), a contradiction in itself. Therefore, \(b_2=w-\bar{b}_1\).

Step 2

Suppose, \(\{\bar{b}_1,w-\bar{b}_1\}\notin \beta ^i(\bar{v})\). Also, \(\{\bar{b}_1,w-\bar{b}_1\}\in \beta ^i(v)\) for some \(v\). Let, \(\{b_1,b_2\}\in \beta ^i(\bar{v})\), where \(b_1<\bar{b}_1\).Footnote 22 Also note, \(b_1+b_2=w\).Footnote 23 Without loss of generality let \(b_1\ge b_2\). Since \(v\) and \(\bar{v}\) are playing best responses and \(\{\bar{b}_1,w-\bar{b}_1\}\notin \beta ^i(\bar{v})\),

Substituting \(b_2=w-b_1\) and then subtracting the first equation from the second we get

Since \(H^j_1(\bar{b}_1)=1\), the above implies \(H^j_1(b_1)> H^j_2(w-\bar{b}_1)\).

Now, again, since \(\{\bar{b}_1,w-\bar{b}_1\}\in \beta ^i(v)\)

The final implication follows from \(H^j_1(b_1)> H^j_2(w-\bar{b}_1)\), \(\bar{b}_1>b_1\) and \(\bar{b}_1\ge w-b_1\).Footnote 24 The final implication is contradictory to (6.2). Therefore \(\{\bar{b}_1,w-\bar{b}_1\}\in \beta ^i(\bar{v})\).

Step 3

Finally, suppose, there exists \(v<\bar{v}\), such that \(\{\bar{b}_1,w-\bar{b}_1\}\in \beta ^i(v)\). Lemma 4.1(iii) implies that for any \(v'\in (v,\bar{v})\), it must be the case that \(\{\bar{b}_1,w-\bar{b}_1\}\in \beta ^i(v')\). However, note that if \(\{\bar{b}_1,w-\bar{b}_1\}=\beta ^i(v')\) for some \(v'\in [v,\bar{v}]\), then for all \(v''\in (v',\bar{v})\), \(\{\bar{b}_1,w-\bar{b}_1\}=\beta ^i(v'')\), leading to mass points in \(H^i_1(\cdot )\) and \(H^i_2(\cdot )\) at \(\bar{b}_1\) and \(w-\bar{b}_1\) respectively.Footnote 25 Therefore, \(\beta ^i(v')-\{\bar{b}_1,w-\bar{b}_1\}\ne \phi \), for all \(v'\in [v,\bar{v}]\).

Now, I will show that \(\beta ^i(v')=\beta ^i(v'')\) for any \(v',v''\in (v,\bar{v})\). I will prove that \(\beta ^i(v')\subseteq \beta ^i(v'')\). Suppose, this is not true for some \(v',v''\), where \(v'<v''\), without loss of generality. Then, there exists \(\{b'_1,b'_2\}\ne \{\bar{b}_1,w-\bar{b}_1\}\), such that \(\{b'_1,b'_2\}\in \beta ^i(v')\) and \(\{b'_1,b'_2\}\notin \beta ^i(v'')\). The latter implies \(\Pi ^i(v'',\bar{b}_1,w-\bar{b}_1,\sigma ^j)>\Pi ^i(v'',b'_1,b'_2,\sigma ^j)\). Since there exists \(\alpha \) such that \(v'=\alpha v+(1-\alpha )v''\), I can use a strict version of the argument in Lemma 4.1(iii), to show \(\Pi ^i(v',\bar{b}_1,w-\bar{b}_1,\sigma ^j)>\Pi ^i(v',b'_1,b'_2,\sigma ^j)\) which will contradict \(\{b'_1,b'_2\}\in \beta ^i(v')\). Therefore \(\beta ^i(v')\subseteq \beta ^i(v'')\). Similarly I can show, \(\beta ^i(v'')\subseteq \beta ^i(v')\).

Recapping, for all \(v',v''\in [v,\bar{v}]\), \(\{\bar{b}_1,w-\bar{b}_1\}\in \beta ^i(v')\), \(\beta (v')-\{\bar{b}_1,w-\bar{b}_1\}\ne \phi \) and \(\beta ^i(v')=\beta ^i(v'')\). Suppose, there exists \(\{b'_1,b'_2\}\in \beta ^i(\bar{v})\), such that \(b'_1+b'_2<w\). Lemma 4.1(i) will imply, that \(H^i_1(\bar{b})-H^i_1(b'_1)=0\) which is a contradiction.Footnote 26 Therefore if \(\{b'_1,b'_2\}\in \beta ^i(v')\) where \(v'\in [v,\bar{v}]\), then \(b'_1+b'_2=w\).

Consider, \(\{b'_1,w-b'_1\}\in \beta ^i(v')\) where \(b'_1<\bar{b}_1\). So, \(\Pi ^i(v',b'_1,w-b'_1,\sigma ^j)=\Pi ^i(v',\bar{b}_1,w-\bar{b}_1,\sigma ^j)\). If \(b'_1>w-\bar{b}_1\), then using a similar argument used in Step 2 of the proof, we can show a contradiction. Formally, \(\Pi (v',b'_1,w-b'_1,\sigma ^j)=\Pi (v',\bar{b}_1,w-\bar{b}_1,\sigma ^j)\) and \(\Pi (\bar{v},b'_1,w-b'_1,\sigma ^j)=\Pi (\bar{v},\bar{b}_1,w-\bar{b}_1,\sigma ^j)\) together imply,

Since \(H^j_1(\bar{b}_1)=1\), the above implies \(H^j_2(w-\bar{b}_1)\le H^j_1(b'_1)\).

Then, similar to the procedure in Step 2 we can show that \(\Pi (v',b'_1,w-b'_1,\sigma ^j)=\Pi (v',\bar{b}_1,w-\bar{b}_1,\sigma ^j)\) implies,

where the final inequality follows from \(\bar{b}_1>b'_1\), \(b'_1>w-\bar{b}\) and \(H^j_2(w-\bar{b}_1)\le H^j_1(b'_1)\). This is contradiction to equation 6.3.

So, the only remaining possibility is \(b'_1=w-\bar{b}\). This would apply to any \(\{b'_1,w-b'_1\}\in \beta ^i(v')\). Therefore for all \(v'\in [v,\bar{v}]\), \(\beta ^i(v')=\{w-\bar{b},\bar{b}\}, \{\bar{b},w-\bar{b}\}\), leading to mass points, which is a contradiction.

Now, I can prove the second part of the lemma. We know that \(\bar{b}_2\ge w-\bar{b}_1\) from Lemma 4.4. If \(\bar{b}_2= w-\bar{b}_1<\frac{w}{2}\), then Lemma 4.3 implies that \(H^i_2(\cdot )\) is continuous for all \(i\). This implies \(H^i_1(\cdot )\) is continuous. Also, \(\bar{b}_2= w-\bar{b}_1\) along with Lemma 4.6 implies that only the highest valued bidder is at the budget constraint. However, since this bidder type is winning both units with probability one, she is not necessarily ‘constrained’. All other bidder types submit bid-pairs which are strictly inside the budget set. Since no bidder type is ‘constrained’ per se, and the bid distributions are continuous, we are led to the conclusion of the first paragraph in the proof of Lemma 4.4. Namely, that these strategies should also form an equilibrium of the auction(s) without a budget constraint, which is not possible. \(\square \)

1.4 Proof of \(u_{i}^{sup}>u_i(x^*)\)

The first term is positive since bidder types \(v\in (\tilde{v},\hat{v})\), strictly prefer bidding \(\{\frac{v}{2},\frac{w}{2}+\delta \} \) to \(\{\frac{v}{2},\frac{v}{2}\}\). That is the payoff from bidding \(\frac{w}{2}+\delta \), which is \((v-\frac{w}{2}-\delta )>(v-\frac{v}{2})F(v)\), where the second term is the payoff from bidding \(\frac{v}{2}\). The second term is positive since \(\hat{v}=\frac{w}{2-w}<w\) \(\square \)

Rights and permissions

About this article

Cite this article

Ghosh, G. Non-existence of equilibria in simultaneous auctions with a common budget-constraint. Int J Game Theory 44, 253–274 (2015). https://doi.org/10.1007/s00182-014-0428-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00182-014-0428-8