Abstract

Although asset return distributions are known to be conditionally leptokurtic, this fact has rarely been addressed in the recent GARCH model literature. For this reason, we introduce the class of smoothly truncated stable distributions (STS distributions) and derive a generalized GARCH option pricing framework based on non-Gaussian innovations. Our empirical results show that (1) the model’s performance in the objective as well as the risk-neutral world is substantially improved by allowing for non-Gaussian innovations and (2) the model’s best option pricing performance is achieved with a new estimation approach where all model parameters are obtained from time-series information whereas the market price of risk and the spot variance are inverted from market prices of options.

Similar content being viewed by others

References

Bakshi G, Cao C, Chen Z (1997) Empirical performance of alternative option pricing models. J Financ 52: 2003–2049

Barone-Adesi G, Engle RF, Mancini L (2004) GARCH options in incomplete markets, NCCR-FinRisk Paper, University of Zürich, Paper No. 155

Bates D (1996) Testing option pricing models. In: Maddala GS, Rao CR (eds) North-Holland Handbooks of Statistics, vol 9. Elsevier, Amsterdam, New York, pp 567–611

Black F (1976) Studies of stock price volatility changes. In: Proceedings of the 1976 meetings of the American statistical association, business and economic statistics section, pp 177–181

Bougerol P, Picard N (1992) Stationarity of GARCH processes and of some nonnegative time series. J Econom 52: 115–127

Brennan MJ (1979) The pricing of contingent claims in discrete time models. J Financ 34: 53–68

Chernov M, Ghysels E (2000) A study towards a unified approach to the joint estimation of objective and risk neutral measures for the purpose of option valuation. J Financ Econ 56: 407–458

Christie AA (1982) The stochastic behaviour of common stock variances: value, leverage and interest rate effects. J Financ Econ 10: 407–432

Christofferson P, Heston SL, Jacobs K (2004) Option valuation with conditional skewness, working paper, EFA 2004 Maastricht Meetings Paper No. 2964, J Econom (forthcoming)

Christofferson P, Jacobs K (2004a) The importance of the loss function in option valuation. J Financ Econ 72: 291–318

Christofferson P, Jacobs K (2004b) Which GARCH model for option valuation. Manage Sci 50: 1204–1221

Duan J-C (1995) The GARCH option pricing model. Math Financ 5: 13–32

Duan J-C (1997) Augmented GARCH(p, q) processes and its diffusion limit. J Econom 79: 97–127

Duan J-C, Gauthier G, Simonato J-G (2001) Asymptotic distribution of the EMS option price estimator. Manage Sci 47: 1122–1132

Duan J-C, Ritchken P, Sun Z (2004) Jump starting GARCH: pricing and hedging options with jumps in returns and volatilities, working paper, University of Toronto and Case Western Reserve University

Duan J-C, Simonato J-G (1998) Empirical martingale simulation for asset prices. Manage Sci 44: 1218–1233

Duan J-C, Wei J (1999) Pricing foreign currency and cross-currency options under GARCH. J Deriv 7: 51–63

Dumas B, Fleming J, Whaley RE (1998) Implied volatility functions: empirical tests. J Financ 53: 2059–2106

Engle RF, Ng VK (1993) Measuring and testing the impact of news on volatility. J Financ 48: 1749–1778

Heston SL, Nandi S (2000) A closed-form GARCH option valuation model. Rev Financ Stud 13: 585–625

Menn C (2004) Optionspreistheorie: Ein ökonometrischer Ansatz. Dr. Kovač Verlag, Hamburg, Doctoral Thesis at the University of Karlsruhe, Germany

Menn C, Rachev ST (2005) A GARCH option pricing model with α-stable innovations. Eur J Oper Res 163: 201–209

Merton RC (1973) The theory of rational option pricing. Bell J Econ Manage Sci 4: 141–183

Nelson DB (1990) Stationarity and persistence in the GARCH(1,1) model. Econom Theory 6: 318–334

Ritchken P, Hsieh KC (2000) An empirical comparison of GARCH option pricing models, Technical Memorandum 734, Case Western Reserve University

Rubinstein M (1976) The valuation of uncertain income streams and the pricing of options. Bell J Econ Manage Sci 7: 407–425

Samorodnitsky G, Taqqu MS (1994) Stable non-Gaussian random processes. Chapmann & Hall/CRC, Boca Raton

Zolotarev VM (1986) One-dimensional stable distributions. American Mathematical Society, Providence

Author information

Authors and Affiliations

Corresponding author

Additional information

The paper subsumes a previous one under the title “A New Class of Probability Distributions and Its Application to Finance”. The authors gratefully acknowledge comments made by seminar participants at University of California, Santa Barbara, University of Washington, Seattle, Hochschule für Banken, Frankfurt, Cornell University, Princeton University, American University, Washington DC, and the Risk Management and Financial Engineering Conference held in Gainesville, FL in April 2005.

All views and opinions expressed in this article are strictly those of the author and do not necessarily represent the views of Sal. Oppenheim.

Rights and permissions

About this article

Cite this article

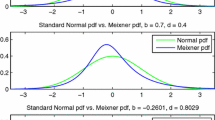

Menn, C., Rachev, S.T. Smoothly truncated stable distributions, GARCH-models, and option pricing. Math Meth Oper Res 69, 411–438 (2009). https://doi.org/10.1007/s00186-008-0245-6

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00186-008-0245-6