Abstract

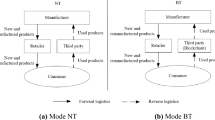

In this paper, we design a supply chain financing (SCF) system with a manufacturer, a retailer and a commercial bank where the retailer is capital constrained under demand uncertainties. We formulate a multi-level Stackelberg game in which the manufacturer acts as the leader and the bank as the sub-leader. Considering the bankruptcy risks of the retailer, we analyze the optimal credit line for the commercial bank, the optimal order for the retailer and the optimal wholesale price for the manufacturer, respectively. Comparing the benchmark scenarios of no capital constraint and constrained capital without financing, interdependencies between the operational and financial decisions are explored, as well as coordination analysis of the wholesale price contract with different credit lines. Finally, by conducting numerical studies, interactions between the operational and financial decisions and the impacts of credit lines on contract coordination are illustrated. The results validate our theoretical analysis. Our analysis suggests that a suitable financing scheme with limited credit would motivate the capital-constrained retailer to order more and the wholesale price contract with finite loans would achieve coordination in the SCF system.

Similar content being viewed by others

References

Arnold J, Minner S (2011) Financial and operational instruments for commodity procurement in quantity competition. Int J Prod Econ 131(1):96–106. doi:10.1016/j.ijpe.2010.02.007

Buzacott JA, Zhang RQ (2004) Inventory management with asset-based financing. Manag Sci 50(1):1274–1292. doi:10.1287/mnsc.1040.0278

Cachon GP (2003) Supply chain coordination with contracts. In: de KoK AG, Graves SC (eds) Handbooks in operations research and management science: supply chain management. Elsvier, Amsterdam, pp 229–339

Cachon GP, Netessine S (2004) Game theory in supply chain analysis. In: Simchi-Levi D, Wu SD, Shen ZM (eds) Handbook of quantitative supply chain analysis: modeling in the e-business era. International series in operations research and management science, vol. 74. Kluwer Academic Publishers, Boston, pp 13–68

Caldentey R, Haugh MB (2009) Supply contracts with financial hedging. Oper Res 57(1):47–65. doi:10.1287/opre.1080.0521

Chen X, Wang A (2012) Trade credit contract with limited liability in the supply chain with budget constraints. Ann Oper Res 196(1):153–165. doi:10.1007/s10479-012-1119-0

Chludek AK (2011) A note on the price of trade credit. Manag Financ 37(6):565–574. doi:10.1108/03074351111134754

Dada M, Hu Q (2008) Financing newsvendor inventory. Oper Res Lett 36(5):569–573. doi:10.1016/j.orl.2008.06.004

Demica (2007) Steady supply: the growing role of supply chain finance in a changing world. Demica report eries, vol 1. http://www.demica.com

Hofmann E, Belin O (2011) Supply chain finance solutions. Springer, Berlin. doi:10.1007/978-3-642-17566-4

Kouvelis P, Zhao W (2012) Financing the newsvendor: supplier vs. bank, and the structure of optimal trade credit contracts. Oper Res 60(3):566–580. doi:10.1287/opre.1120.1040

Lai G, Debo L, Sycara K (2009) Sharing inventory risk in supply chain: the implication of financial constraint. Omega 37(4):811–825. doi:10.1016/j.omega.2008.06.003

Lariviere MA (2006) A note on probability distributions with increasing generalized failure rates. Oper Res 54(3):602–604. doi:10.1287/opre.1060.0282

Lariviere MA, Porteus EL (2001) Selling to the newsvendor: an analysis of price-only contracts. Manuf Serv Oper Manag 3(4):293–305. doi:10.1287/msom.3.4.293.9971

Lee CH, Rhee BD (2010) Coordination contracts in the presence of positive inventory financing costs. Int J Prod Econ 124(2):331–339. doi:10.1016/j.ijpe.2009.11.028

Lee CH, Rhee BD (2011) Trade credit for supply chain coordination. Eur J Oper Res 214(1):136–146. doi:10.1016/j.ejor.2011.04.004

Pfohl HC, Gomm M (2010) Supply chain finance: optimizing financial flows in supply chains. Logist Res 1(3–4):149–161. doi:10.1007/s12159-009-0020-y

Srinivasa Raghavan NR, Mishra VK (2011) Short-term financing in a cash-constrained supply chain. Int J Prod Econ 134(2):407–412. doi:10.1016/j.ijpe.2009.11.014

Zhang G (2010) The multi-product newsboy problem with supplier quantity discounts and a budget constraint. Eur J Oper Res 206(2):350–360. doi:10.1016/j.ejor.2010.02.038

Acknowledgments

This research is supported by the Natural Science Foundation of China (Grant No. 71002021, 71272234), Beijing Natural Science Foundation (Grant No. 9112015) and program for Innovation Research in Central University of Finance and Economics.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 A.1 Proof of Lemma 1

Proof

From Eq. (1), If the retailer’s liquid assets from the sales at the end of the season can cover its loan obligations, i.e., \(p\min (q,x)+(k_r +L(\theta )-wq)\ge L(\theta )(1+R_r ),\) then the retailer has no bankruptcy risk. Hence, when \(x\le q\), the minimal realized demand \(\hat{x}(q)={(wq-K_r )(1+\theta R_r )} / p\) can be easily obtained from the inequality of \(px-(wq-k_r )(1+\theta R_r )\ge 0\). \(\square \)

1.2 A.2 Proof of Proposition 1

Proof

First, we solve the unconstrained optimization problem of Eq. (1). For notational convenience, let \(\Omega =w(1+\theta R_r ) / p\) From Eq. (1), the retailer’s expected profit can be rewritten as \(\pi _r =p \int _{{\hat{x}}}^{q} {\bar{F}(\hat{x})\mathrm{d}x}\). Taking the first-order and second-order derivative of \(\pi _r \) with respect to \(q\), it follows that \({\mathrm{d}\pi _r}/{\mathrm{d}q}=p\bar{F}(q)-p\bar{F}(\hat{x})\cdot {\mathrm{d}\hat{x}}/{\mathrm{d}q}=p({\bar{F}(q)-\Omega \bar{F}(\hat{x})})\) and \({\mathrm{d}^2\pi _{r} }/{\mathrm{d}q^2}=p({-f(q)+\Omega f(\hat{x})\cdot {\mathrm{d}\hat{x}}/{\mathrm{d}q}})=p({-f(q)+\Omega ^2f(\hat{x})})\). As \(p>w(1+R_r)\) and \(0<\theta <1\), it is obvious that \(\Omega <1\) and thus \(\Omega ^2<1\). If the distribution of demand is IFR, the inequality of \(\Omega ^2f(\hat{x})-f(q)<0\) holds for \(\hat{x}<q\), i.e., \(\mathrm{d}^2{\pi _r }/{\mathrm{d}q^2<0}\). Hence, from \(\mathrm{d}\pi _r {(q^*)}/{dq=0}\) we have \(q^*=\bar{F}^{-1}({\Omega \bar{F}(\hat{x})})\).

Next, we consider the constrained optimization problem of Eqs. (1) and (2). Using Lagrangian relaxation method, we reformulate Eqs. (1) and (2) as \(\max \nolimits _q L(q,\lambda )=\pi _r (q)+\lambda (wq-K_r)\). Then the optimal order quantity \(q^{*} \) and Lagrangian multiplier \(\lambda ^{*}\) satisfies the complementary slackness conditions such that \(\mathrm{d}L{(q^*,\lambda ^*)} / {{\mathrm{d}q=0}} ,\,\lambda ^{*} (wq^{*}-K_r )=0,\,\,\lambda ^{*} \ge 0\), and \(wq^*-K_r \ge 0\). Differentiating Lagrangian function \(L(q,\lambda )\) with respect to \(q\), we have \(\mathrm{d}L{(q,\lambda )}/{{\mathrm{d}q=\mathrm{d}\pi _r}} {(q)}/{{\mathrm{d}q}} +w\lambda =p( {\bar{F}(q)-\Omega \bar{F}(\hat{x})})+w\lambda \). If \(\lambda ^*>0\), \(q^*\) satisfies \(wq^*-K_r =0\). Substituting \(q^*={K_r }/w\) into the first-order optimality condition of \(\mathrm{d}L{(q^*,\lambda ^*)} / {\mathrm{d}q=0}\), the optimal \(\lambda ^*=p{[{\Omega \bar{F}(\hat{x})-\bar{F}( {{K_r } / w})} ]} /w\), which implies \(\lambda ^*\le 0\) since \(\Omega \bar{F}(\hat{x})=\bar{F}(q)\le \bar{F}( {{K_r } / w})\). Hence, the optimal solution in this case should be disregarded because of the contradiction of \(\lambda ^*\). Alternatively, in the case of non-binding constraint where \(\lambda ^*=0\), the condition \(\mathrm{d}L{(q^*,\lambda ^*)}/{\mathrm{d}q=0}\) can be transformed as \(\mathrm{d}\pi _r {(q^*)}/{\mathrm{d}q^*=0}\), which is the same with the unconstrained case. Thus, the optimal solution \(q^*=\bar{F}^{-1}( {\Omega \bar{F}(\hat{x})})\) is unique. \(\square \)

1.3 A.3 Proof of Lemma 2

Proof

Applying the Implicit Function Theorem of \(\bar{F}(q^*)=\Omega \bar{F}( {\hat{x}(q^*)})\) from Proposition 1 yields \(-f(q^*)\cdot {\mathrm{d}q^*}/{\mathrm{d}\theta } =\bar{F}( {\hat{x}(q^*)})\cdot {\mathrm{d}\Omega }/{ {\mathrm{d}\theta -\Omega f( {\hat{x}(q^*)})\cdot {\mathrm{d}( {\hat{x}(q^*)})} / }} {\mathrm{d}\theta }\). As \({\mathrm{d}( {\hat{x}(q^*)})}/{\mathrm{d}\theta } \quad {=( {R_r B(q^*)+w(1+\theta R_r )\cdot \mathrm{d}q^*/{\mathrm{d}\theta }})} / p\) and \({\mathrm{d}\Omega }/{\mathrm{d}\theta }={wR_r } / p\), the first-order derivate of \(\pi _b \) with respect to \(\theta \) can be obtained as \({\mathrm{d}q^*}/{\mathrm{d}}\theta \) = \({wR_r {[{\bar{F}(\hat{x})-(\hat{x})f(\hat{x})}]} / p[{\Omega ^{2} f(\hat{x})-f(q^*)}]}.\) If the demand distribution function is IFR, then \(\hat{x}<q^*\) makes it easy to observe \({\hat{x}f(\hat{x})} / {\bar{F}(\hat{x}){<\Omega q{^*}f(q^*)} / {\bar{F}(q^*)\le 1}}\). Therefore, the inequality of \(\bar{F}(\hat{x})-\hat{x}f(\hat{x})>0\) holds. Moreover, the inequality of \(\Omega ^2f(\hat{x})-f(q)<0\) has been proved in Proposition 1, so the inequality of \({\mathrm{d}q^*(\theta )} / {\mathrm{d}\theta <0}\) holds. \(\square \)

1.4 A.4 Proof of Proposition 2

Proof

From Eq. (3), the bank’s expected profit can be expressed as \(\pi _b \!=\!p\int _0^{\hat{x}} {\bar{F}(x)\mathrm{d}x\!-\!p\hat{x}\!+\!\theta ( {wq-k_r })( {R_r -R_f })} \). The first-order condition and the second-order condition of \(\pi _b \) for \(\theta \) can be given as \({\mathrm{d}\pi _b } / \mathrm{d}\theta =( {wq-K_r +\theta w\cdot {\mathrm{d}q} / {\mathrm{d}\theta }}) ( {R_r \bar{F}(\hat{x})-R_f })-wF(\hat{x})\cdot {\mathrm{d}q}/{\mathrm{d}\theta }\) and \({\mathrm{d}^2\pi _b }/\mathrm{d}\theta ^2=2w( {R_r \bar{F}(\hat{x})-R_f })\cdot {\mathrm{d}q}/\mathrm{d}\theta +w[{\theta ({R_r \bar{F}(\hat{x})-R_f })-F(\hat{x})}]\cdot {\mathrm{d}^{2}q}/{\mathrm{d}\theta ^{2}}-pf(\hat{x})\cdot ({{\mathrm{d}\hat{x}}/{\mathrm{d}\theta ^2}})\), respectively. Meanwhile, from Lemma 2, we can deduce that \({\mathrm{d}^2q^*}/{\mathrm{d}\theta ^2}=\,\,-2wR_r f(\hat{x})( {\Omega ^2f(\hat{x})-f(q^*)})\cdot {\mathrm{d}\hat{x}}/\mathrm{d}\theta +\Omega ( {\bar{F}(\hat{x})-\hat{x}f(\hat{x})})\cdot {\mathrm{d}\Omega }/{\mathrm{d}\theta } / {p[{\Omega ^2f(\hat{x})-f(q^*)} ]^2}\). Since \({\mathrm{d}\hat{x}}/{\mathrm{d}\theta }=(wq-K_r ){R_r } / {p+\Omega \cdot {\mathrm{d}q}/{\mathrm{d}\theta }}<0\) and \({\mathrm{d}\Omega }/{\mathrm{d}\theta >0}\), as well as the inequalities of \(\bar{F}(\hat{x})-\hat{x}f(\hat{x})>0\) and \(\Omega ^2f(\hat{x})-f(q)<0\) proved in Lemma 2, the inequality of \({\mathrm{d}^2q^*}/{\mathrm{d}\theta ^2<0}\) holds obviously. Substituting \({\mathrm{d}^2q^*}/{\mathrm{d}\theta ^2<0}\) and \({\mathrm{d}q^*} /{\mathrm{d}\theta }<0\), proved in Lemma 2, into \(\mathrm{d}^2{\pi _b}/{\mathrm{d}\theta ^2}\), the inequality of \({\mathrm{d}^2\pi _b}/{\mathrm{d}\theta ^2}<0\) holds if \({\bar{F}(\hat{x})\ge R_f }/{R_r}\). Therefore, with \({\mathrm{d}\pi _b (\theta ^*)}/{\mathrm{d}\theta =0}\), the optimal \(\theta ^*\) can be obtained. \(\square \)

1.5 A.5 Proof of Proposition 3

Proof

From Eq. (4), taking the first-order derivative of \(\pi _m \) with respect to \(w\), we have \(\mathrm{d}\pi _m /\mathrm{d}w=\partial \pi _m /\partial q^*\cdot \mathrm{d}q^*/\mathrm{d}w+\partial \pi _m /\partial w=({w-c})\cdot \,\mathrm{d}q^*/\mathrm{d}w+q^*\cdot \) Hence, let \(\mathrm{d}\pi _m /\mathrm{d}w=0\), the optimal wholesale price can be obtained as \(w^*=c-\frac{q^*}{\mathrm{d}q^*/\mathrm{d}w}\cdot \)

According to Proposition 1, applying the Implicit Function Theorem on \(\bar{F}( {q^*})\!=\!\Omega \bar{F}( {\hat{x}( {q^*})})\) yields \(\mathrm{d}q^*/\!\mathrm{d}w\!=\!-[{\bar{F}( {\hat{x}( {q^*})})\!\cdot \!\mathrm{d}\Omega \!/\mathrm{d}w\!-\!\Omega f( {\hat{x}( {q^*})})\!\cdot \! \mathrm{d}( {\hat{x}({q^*})})\!/\mathrm{d}w}]/\!f( {q^*})\). Moreover, the first-order derivate of \(\hat{x}( {q^*})\) and \(\Omega \) for \(w\) are \(\mathrm{d}({\hat{x}( {q^*})})/\mathrm{d}w=({1+\theta R_r })( {q^*\,+w\cdot \mathrm{d}q^*/\mathrm{d}w})/p\) and \(\mathrm{d}\Omega /\mathrm{d}w=\Omega /w\), respectively; substitute them into \(\mathrm{d}q^*/\mathrm{d}w\), and thus \(\mathrm{d}q^*/\mathrm{d}w=\Omega [{\bar{F}( {\hat{x}})-\Omega q^*\,f( {\hat{x}})}]/w[{\Omega ^2\,f( {\hat{x}})-f( {q^*})}]\). As \(\bar{F}( {\hat{x}})-\Omega q^*\,f( {\hat{x}})=\bar{F}( {\hat{x}})( {1-\Omega q^*\,f( {\hat{x}})/\bar{F}( {\hat{x}})})\) and \(0<\Omega <1\), the inequality of \(\Omega q^*\,f( {\hat{x}})/\bar{F}( {\hat{x}})<\Omega q^*\,f({q^*})/\bar{F}( {q^*})<1\) holds for the IFR demand distribution and \(\hat{x}<q\). Meanwhile, because \(\Omega ^2f( {\hat{x}})-f( q)<0\) proved in Proposition 1, the inequality of \(\mathrm{d}q^*/\mathrm{d}w<0\) holds.

Next, we aim to show that the second-order derivative is negative, i.e., \(\mathrm{d}^2\pi _m/\mathrm{d}w^2<0\). Taking the second-order derivative of \(\pi _m \)with respect to \(w\) we have \(\mathrm{d}^2\pi _m/\mathrm{d}w^2=2dq^*/\mathrm{d}w+( {w-c})\cdot \,\mathrm{d}^2\,q^*/\mathrm{d}w^2\). Recall that \(\mathrm{d}q^*/\mathrm{d}w<0\) proved above and the assumption of \(w\ge c\). Hence, we only need to prove \(\mathrm{d}^2{q_{i}^{*}}/\mathrm{d}w_{i}^{2} <0\), where \(\mathrm{d}^2q^*/\mathrm{d}w^2=-2\Omega ^2f( {\hat{x}})( {2\bar{F}( {q^*})-\Omega ^2q^*f( {\hat{x}})q^*f( {q^*})})/w^2( {\Omega ^2f( {\hat{x}})-f( {q^*})})^2\). Recall that \(\bar{F}( {q^*})\ge \Omega ^2q^*f( {\hat{x}})\) and \(\bar{F}( {q^*})\ge q^*f( {q^*})\), it is obvious that \(\mathrm{d}^2q^*/\mathrm{d}w^2<0\). Hence, the second-order condition of \(\pi _m \) for \(w\) satisfies \(\mathrm{d}^2\pi _m/\mathrm{d}w^2=2dq/\mathrm{d}w+( {w-c})\cdot \,\mathrm{d}^2q/\mathrm{d}w^2<0\). Therefore, from the first-order condition of \(\mathrm{d}\pi _m ( {w^*})/\mathrm{d}w=q+\Omega ( {w^*-c})[{\bar{F}( {\hat{x}})-\Omega qf( {\hat{x}})}]/w^*[{\Omega ^2f( {\hat{x}})-f( q)}]=0\), the optimal \(w^*\) can be obtained. \(\square \)

1.6 A.6 Proof of Proposition 4

Proof

From Proposition 1, we have \(q^*=\bar{F}^{-1}( {\Omega \bar{F}( {\hat{x}})})\). It is obvious that the inequality of \(q^{N^{*} }\ge q^{NB^{*}} \)holds if \(\bar{F}^{-1}( {\Omega \bar{F}( {\hat{x}})})\ge \bar{F}^{-1}( {\Omega ^N})\), which implies that \(\Omega \bar{F}( {\hat{x}})\le \Omega ^N\) since \(F(x)\) is strictly increasing and follows IFR. Hence, substituting \(\Omega \) and \(\Omega ^N\) into it we transform the inequality of \(\Omega \bar{F}( {\hat{x}})\le \Omega ^N\) into \(\bar{F}( {\hat{x}})\le ( {1+R_f })/( {1+\theta R_r })\), which implies that \(\theta \le \bar{\theta }=( {{F}( {\hat{x}})+R_f })/R_r \bar{F}( {\hat{x}})\).

Moreover, according to the optimality of \(\theta ^*\) given in Proposition 2, we have the inequality of \({\theta ^{*}} \ge \underline{\theta }={F}( {\hat{x}})/( {R_r \bar{F}( {\hat{x}})-R_f })>0\). Therefore, when \(0<\underline{\theta }<\theta \le \bar{\theta }<1\), the inequality of \(q^*\ge q^{N^{*}}\) holds. Moreover, it is obvious that \(q^{N^{*} }\ge q^{\textit{NB}^{*}}\). Hence, the inequality of \(q^*\ge q^{N^{*} }\ge q^{\textit{NB}^{*}}\) could be valid. \(\square \)

1.7 A.7 Proof of Proposition 5

Proof.

According to the above analysis, it is obvious that the coordination condition of \(q^*( {\hat{w},\hat{\theta }})=q_{s}^{*} ( {\hat{w},\hat{\theta }})\) implies that \(\bar{F}( {q^*( {\hat{w},\hat{\theta }})})=\bar{F}( {q_{s}^{*} ( {\hat{w},\hat{\theta }})})\), i.e., \(\hat{w}( {1+\hat{\theta }R_r })\bar{F}( {\hat{x}})=( {\hat{\theta }\hat{w}R_f +c})\bar{F}( {\hat{x}_{s}})\). Therefore, if the credit line in the wholesale price contract with a finite loan satisfies the condition of \(\hat{\theta }={( {\hat{w}\bar{F}(\hat{x})-c\bar{F}(\hat{x}_s )})} / {\hat{w}( {R_f \bar{F}(\hat{x}_s )-R_r \bar{F}(\hat{x})})}\), the SCF system can achieve coordination. Moreover, to guarantee the credit line \(\hat{\theta }\in (0,1)\), the inequality of \(1<{\hat{w}(1+R_r )} / {(\hat{w}R_f +c)}<{\bar{F}(\hat{x}_s )} / {\bar{F}(\hat{x})}\) holds for \(\hat{w}>c\). \(\square \)

1.8 A.8 Proof of Proposition 6

Proof.

Similar to the proof of Proposition 5, if a coordinating wholesale price \(\hat{w}^I\) with infinite loans exists, the necessary condition of \(q_{\theta =1}^{*} ( {\hat{w}^I})=q_S^{I^{*} } ( {\hat{w}^I})\) for coordinating the SCF system should be satisfied. It is also implies that \(\bar{F}( {q_{\theta =1}^{*} ( {\hat{w}^I})})=\bar{F}( {q_S^{I^{*} } ( {\hat{w}^I})})\), i.e.,\(\hat{w}^I=c\bar{F}( {\hat{x}_s })/( {( {1+R_r })\bar{F}( {\hat{x}})-R_f \bar{F}( {\hat{x}_s })})\). However, since \(R_r \ge R_f \) and \(\bar{F}( {\hat{x}_{S}^{I} ( {q_{S}^{I^{*}} })})<\bar{F}( {\hat{x}( {q_{\theta =1}^*})})\) with the IFR demand distribution, the ratio of \(\bar{F}( {\hat{x}_S })/( {( {1+R_r })\bar{F}( {\hat{x}})-R_f \bar{F}( {\hat{x}_S })})\) is less than 1, i.e., \(\hat{w}^I<c\). Hence it’s straightforward to find that \(q_{{\theta = 1}}^{*} (\hat{w}^{I}) = q_{s}^{{I^{*}}} (\hat{w}^{I})\) only if \(\hat{w}^{I} <c.\) \(\square \)

Rights and permissions

About this article

Cite this article

Yan, N., Sun, B. Coordinating loan strategies for supply chain financing with limited credit. OR Spectrum 35, 1039–1058 (2013). https://doi.org/10.1007/s00291-013-0329-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00291-013-0329-4