Abstract

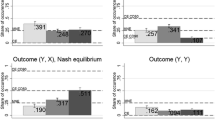

We utilize a laboratory experiment to examine the effect of asymmetric costs in the volunteer’s dilemma, a public goods game where all players receive a benefit if at least one person volunteers and nothing otherwise, which presents a social dilemma where the optimal action for the individual differs from that for the group. Additionally, we introduce uncertainty to explore the role of information and find that individual behavior aligns most closely with the more intuitive Nash equilibrium strategies under full information and to a lesser extent with incomplete information. Although uncertainty about fellow group members’ costs incentivizes greater volunteering and thus has the potential to improve efficiency, we find that the inability to coordinate prevents groups from experiencing welfare gains as a result.

Similar content being viewed by others

Notes

Diekmann applied this reasoning to the case of Kitty Genovese, a New Yorker who was stabbed to death in from of a building block where a significant number of people allegedly witnessed the attack. No one supposedly came to her rescue or even called the police. This situation demonstrates a volunteer’s dilemma; everyone likely would have benefitted if at least one person called the police, yet there was a diffusion of responsibility where everyone apparently believed that someone else would make the call. This resulted in the non-optimal outcome where the public good, in this case the arrival of the police, was not provided.

There is also a coordinated volunteer’s dilemma where, if more than one person volunteers, only one player is randomly selected to serve as the volunteer so there is no redundant volunteering. The coordinated game models scenarios where a maximum of one volunteer may bear the cost, resulting in a different set of strategies and potential outcomes. See Bergstrom et al. (2015) for theory and experimental findings on coordinated volunteer’s dilemma games.

In Darley and Latane (1968), the experiment involved recruiting college students under the ruse that they were taking part in a conversation with another student about college life over an intercom system. Then, one of the students would have a, “very serious nervous seizure similar to epilepsy.” The dependent variable in the experiment was how long each subject took to report the emergency to the experimenter.

Meaning, if N = 6, in individual that draws a $0.60 cost knows that either all six group members have $0.60 or that half of the group (3 other members) face a cost of $0.20, with equal probability. The costs were randomly drawn across rounds in advance and set in the design to ensure consistency in the variation and order of cost draws experienced across experimental sessions.

The goal is not to encourage or support learning across the experiment, but rather to make each round independent from one another in order to test how the likelihood of volunteering may vary across costs and information specifications. Thus, we provided the minimum amount of information between rounds, which is strictly whether or not there was at least one volunteer (which subjects could infer from their earnings in each round).

There are also asymmetric equilibria where one person volunteers and other group member (or members, when N = 6) do not, even when costs are identical. The random re-matching function of the experimental design would make this equilibrium challenging for coordination, but it is worthwhile to note.

There is also a mixed strategy Nash equilibrium that is similarly counter-intuitive. For N = 2, the probability that the low-cost player contributes is 2/5 and the high-cost player contributes with probability 4/5.

There is no purely mixed strategy equilibrium when N = 6 with 3 of each type of player (low cost or high cost), as noted in Diekmann (1993). For N = 6, this means that players may be constrained to an equilibrium where one type (the high-cost player) does not mix, which is supported by the experimental data.

For N = 2, the expected rate of return to volunteering is always positive when the cost draw is low, while the expected return with a high-cost draw is always negative, so there are no mixed-strategy equilibria with N = 2 with incomplete information.

It is straightforward to show that there is an asymmetric pure strategy equilibrium where the low cost players volunteer with probability p = 1 and the high cost players do not volunteer if and only if N ≤ 3. The payoff to the low-cost volunteers is 0.8. If we assume the high-cost players do not volunteer, the expected return to a low-cost player who does not volunteer is 1 − \( (1/2)^{N - 1} . \) There will be a pure strategy of this type only if 1 − c > 1 − \( (1/2)^{N - 1} , \) which is only true for N ≤ 3.

Although we use the more-intuitive predictions to make comparisons to the experimental data, it is worthwhile to note that the many other asymmetric and mixed-strategy Nash equilibria are still possible regardless of whether or not they are intuitive.

Hillenbrand and Winter (2018) find that lower costs to volunteer do not increase a player’s likelihood of volunteering, but there are two critical experimental differences: (1) they use a one-shot version of the game so subjects only experience one cost specification and thus there is no opportunity to observe how an individual subject would change strategies in response to differing costs, and (2) the cost variations in that study were quite small, with a “low” cost of 4€ or a “high” cost of 5€, both with a benefit of 10€, which also likely contributed to the non-finding.

Another unintuitive result may be the lack of a significant gender effect. Vesterlund et al. (2015) find evidence from a coordinated volunteer’s dilemma that people believe that women are more likely to volunteer, but there is no evidence in our data to suggest a gender effect in any of the cost specifications or overall rate of volunteering. We revisit player behavior by gender again in Sect. 5.4.

When costs are high, subjects volunteer approximately 11.1% of the time under incomplete information versus 13.7% with full information, which are not significantly different (p value of two-sided t-test = 0.39).

If we include an individual fixed effect in the regression in column 1 of Table 4, the coefficient for free-riding in the previous period is − 0.072, with a standard error of 0.021. The coefficients for all the variables that vary within-subjects remain essentially equivalent to those in column 1.

We found no significant gender effects in this experiment, either in rates of volunteering (p-value of a two-sided t-test = 0.905) or in preference types. Regarding the latter, is interesting to note that although those with the highest and lowest volunteer rates were men, women were the second and third next-highest volunteers in the sample, and women were also the next two lowest volunteers at the low side, right before the three pure free-riding males.

A successful free-rider with cost c = 0.20 has relative earnings of $1.00 compared to $0.80 if they volunteered (a 20% return on free-riding), while a successful free-rider with cost c = 0.60 has relative earnings of $1.00 compared to $0.40 if they volunteered (a 40% return on free-riding).

References

Andreoni J (1989) Giving with impure altruism: applications to charity and Ricardian equivalence. J Polit Econ 97:1447–1458

Archetti M (2009) The volunteer’s dilemma and the optimal size of a social group. J Theor Biol 261:475–480

Baron J (2008) Social dilemmas: cooperation versus defection in thinking and deciding, 4th edn. Cambridge University Press, Cambridge

Bergstrom T, Garratt R, Leo G (2015) Let me, or let George? Motives of competing altruists. Economics Working Paper Series qt48m9547q, Department of Economics, University of California, Santa Barbara

Bliss C, Nalebuff B (1984) Dragon-slaying and ballroom dancing: the private supply of a public good. J Public Econ 25:1–12

Cason T, Lau S, Mui V (2013) Learning, teaching, and turn taking in the repeated assignment game. Econ Theory 54:335–357

Darley JM, Latane B (1968) Bystander intervention in emergencies: diffusion of responsibility. J Personal Soc Psychol 8:377–383

De Heus P, Hoogervorst N, van Dijk E (2010) Framing prisoners and chickens: valence effects in the prisoner’s dilemma and the chicken game. J Exp Soc Psychol 46:736–742

Diekmann A (1985) Volunteer’s dilemma. J Confl Resolut 29:605–610

Diekmann A (1993) Cooperation in an asymmetric volunteer’s dilemma game: theory and experimental evidence. Int J Game Theory 22:75–85

Goeree JK, Holt C, Smith A (2017) An experimental examination of the volunteer’s dilemma. Games Econ Behav 102:303–315

Hillenbrand A, Winter F (2018) Volunteering under population uncertainty. Games Econ Behav 109:65–81

Johnson JP (2002) Open source software: private provision of a public good. J Econ Manag Strategy 11:637–662

Kuzmics C, Palfrey T, Rogers BW (2014) Symmetric play in repeated allocation games. J Econ Theor 154(c):25–67

Leo G (2017) Taking turns. Game Econ Behav 102(C):525–547

Molina A, Chambers B (2010) Strangers who saved man from burning van ‘angels’. The Orange County Register, February 16, 2010

Murnighan J, Kim J, Metzger A (1993) Volunteer dilemma. Adm Sci Q 38:515–538

Myatt D, Wallace C (2008) An evolutionary analysis of the volunteer’s dilemma. Games Econ Behav 62:67–76

Ochs J (1995) Games with unique, mixed strategy equilibria: an experimental study. Games Econ Behav 10:202–217

Vesterlund L, Babcock L, Recalde MP, Weingart L (2015) Breaking the glass ceiling with ‘no’: gender differences in accepting and receiving requests for non-promotable tasks. Discussion Paper, University of Pittsburgh

Weesie J (1993) Asymmetry and timing in the volunteer’s dilemma. J Confl Resolut 37:569–590

Weesie J (1994) Incomplete information and timing in the volunteer’s dilemma: a comparison of four models. J Confl Resolut 38:557–585

Weesie J, Franzen A (1998) Cost sharing in the volunteer’s dilemma. J Confl Resolut 42:600–618

Author information

Authors and Affiliations

Corresponding author

Additional information

This study was funded by the Russell Sage Foundation (Grant no. 15-2-25115-80715) and a Loyola Marymount University grant and the authors gratefully acknowledge this support. We thank Ted Bergstrom, Greg Leo, Jean-Francois Mercier, the participants at the Western Economic Association meetings in June 2016 and the participants at the University of Virginia Experimental Social Science conference in September 2016. We gratefully acknowledge comments from two anonymous reviewers as well.

Appendix

Appendix

1.1 Instructions [language variations by treatment indicated in brackets]

This is an experiment in decision-making. Various research agencies have provided funds for the conduct of this research. The instructions are simple and if you follow them carefully and make good decisions, you may earn a considerable amount of money that will be paid to you in cash at the end of the experiment. What you earn depends partly on your decisions and partly on the decisions of other participants in this experiment. It is in your best interest to fully understand the instructions, so please feel free to ask any questions at any time. It is important that you do not talk or discuss your information with other participants in the room during the experiment.

In this experiment, you will be interacting with the other participants in a sequence of 24 rounds. In each round, you will be matched with one other person selected at random from the other participants. You will be randomly re-matched with a new person in each round. The decisions that you and the other person make will determine your earnings.

[When N = 2: Both you and the other person will decide whether to pay a cost to undertake an action that benefits both of you.] [When N = 6: Both you and the other people will decide whether to pay a cost to undertake an action that benefits all of you.] You will not be able to see the others’ decision while choosing yours and vice versa. The full benefit from this action is available to all if at least one person undertakes the costly action. No additional benefits are given if more than one person chooses to pay this cost.

In each round, you will decide whether to make a costly decision, which is referred to as an investment. If you decide to invest, you will pay a cost of either $0.20 or $0.60, each with an equal probability. This is the same as saying that, in each round, your cost is decided by a coin flip where heads gives you a cost of $0.20 and tails gives you a cost of $0.60. [Full information treatment: You will be able to see both your cost and the cost of the other person/people in each round before making your investment decision.] [Incomplete information treatment: You will be able to see your cost in each round before making your investment decision, but you will not know the cost of the other person/people.] If your decision is to not invest, your cost is $0.

If at least one person decides to invest, each person will receive $1.00, whether or not he or she invested in that round. For example, if at least one participant invests, then the participant who invests with a cost of $0.20 will earn $1.00–$0.20 = $0.80 and a participant who doesn’t invest earns $1.00. If nobody invests, you both earn $0.

Again, there will be 24 rounds total, and in each round you will be randomly re-matched with another participant. You will need to keep track of your investment decision, cost, and your earnings for every round. If you have a question now, please raise your hand.

Rights and permissions

About this article

Cite this article

Healy, A.J., Pate, J.G. Cost asymmetry and incomplete information in a volunteer’s dilemma experiment. Soc Choice Welf 51, 465–491 (2018). https://doi.org/10.1007/s00355-018-1124-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00355-018-1124-6