Abstract

How should we rank different income distributions? Should we adopt the Rawlsian criterion that focuses on the minimal income in the distribution? Or should we rather maximize the geometric mean, a criterion advocated by gamblers and welfarists alike? This paper microfounds these two criteria by showing that each of them can be obtained by granting veto rights to the members of society ‘behind a veil of ignorance’, where society is represented by the set of regular utilities (Hart 2011). The Rawlsian maximin criterion is obtained by granting each member of society a right to veto acceptance of any candidate income distribution, while the geometric-mean criterion is obtained by granting instead a right to veto rejection of income distributions. This way, the proposed method circumvents the need to arbitrarily choose a representative agent when ranking income distributions. The Rawlsian maximin criterion is further shown to be robust to extending the set of utilities that constitutes “society” to all risk-averse utilities, while the geometric-mean criterion is not as robust.

Similar content being viewed by others

Notes

I assume throughout that income distributions have finite support in \(\mathbb {\mathfrak {R}}^{+}\), and therefore the maximum and minimum incomes exist and are well defined. For ease of exposition I denote by x (and y) both the distribution itself and the corresponding random variable.

Levy (1992) adds further the third-order stochastic-dominance, which corresponds to the partial ranking agreed upon by all utilities with \(u^{\prime }>0\), \(u^{\prime \prime }<0\) and \(u^{\prime \prime \prime }>0\).

The differentiability assumption (\(U^{*}\subseteq \mathcal {C}^{2}\)) is without consequences for the resulting rankings. My set \(U^{*}\) is very similar to the set of regular utilities of Hart (2011) but is a bit less restrictive because my last requirement (R4) replaces two requirements that Hart sets: decreasing absolute risk aversion and “some rejection”. These two requirements of Hart are, taken together, more demanding than my own substitute requirement.

Whenever I write that u prefers distribution x over distribution y, I mean that \(E[u(x)]\ge E[u(y)]\).

This property, advocated by Arrow (1965, 1971), says that acceptance of risky prospects is weakly decreasing with relative wealth. Informally, this means that the inclination to invest one’s total wealth in a risky prospect whose returns are given in proportional terms (like a stock) weakly declines with the amount of one’s wealth. There exists empirical evidence (albeit being inconclusive) in favor of IRRA, see e.g. Siegel and Hoban (1982), Morin and Suarez (1983), Halek and Eisenhauer (2001), and, more recently, Paravisini et al. (2016).

One may replace the strong inequality with a weak one without changing the results of the model. Note that I do not assume that everybody has the same wealth—below I use uniformity over w. The comparison to an outside option \(w_{0}\) is just a part of the proposed mechanism for judging the attractiveness of various income distributions ‘behind a veil of ignorance’.

Not to be confused with the Nash social welfare function, which is achieved by multiplying the individual (expected) utilities of all members of society from a given income distribution.

Note that the inclusion of R3 on top of R1 and R2 (i.e., using \(U_{3}\) rather than \(U_{2}\)) does not affect the outcome, as stated in part (2) of Proposition 2. The reason for this is that, as mentioned, the least risk averse utility under requirements R1 and R2 is the risk-neutral utility, and this utility has a fixed relative risk aversion coefficient of 0, hence satisfies weak IRRA (R3) too while excluding the existence of a more risk-loving utility in \(U_{3}\).

There are of course also papers that axiomatize the Nash social welfare function, i.e. the product of individual utilities (see e.g. Luce and Raiffa 1957 and Kaneko and Nakamura 1979 for classical treatments and Sprumont 2020 for a recent axoimatization). Like noted in footnote 8, this is not the same as multiplying the payoffs themselves (as done when calculating the geometric mean of the income distribution). In fact, the Nash social welfare relates to the max-geometric-mean criterion that results from applying rejection-based domination to the set \(U^{*}\), just like Utilitarianism (the sum of individual utilities, see Harsanyi 1955) relates to the max-expected-value criterion that results from applying rejection-based domination to the set \(U_{2}\) or \(U_{3}\) (Sect. 3).

The reason why wealth-uniform rejection is not applied here is that when the primitives of the model are distributions over final outcomes rather than over net outcomes (see more below), this notion has no bite, as it refers to rejection at all wealth levels, while its clear that no decision maker will reject an income distribution over strictly positive values at all wealth levels.

Hart (2011) does have a different notion of acceptance domination, which does not produce a complete ranking and is not applied here either.

\(\hat{u}_{\alpha }\left( w\right)\) was originally proposed by Hart (2011).

References

Arrow Kenneth J (1965) Aspects of the theory of risk-bearing. Yrjö Jahnssonin Säätiö, Helsinki

Arrow Kenneth J (1971) Essays in the theory of risk bearing. Markham, Chicago

Atkinson AB (1970) On the measurement of inequality. J Econ Theory 2(3):244–263

Aumann RJ, Serrano R (2008) An economic index of riskiness. J Political Econ 116:810–836

Blanchard O, Fischer S (1989) Lectures on macroeconomics. MIT Press, Cambridge

Ebert U (1987) Size and distribution of incomes as determinants of social welfare. J Econ Theory 41:23–33

Foster DP, Hart S (2009) An operational measure of riskiness. J Political Econ 117:785–814

Gotoh R, Yoshihara N (2003) A class of fair distribution rules a la Rawls and Sen. Econ Theory 22(1):63–88

Hadar J, Russell WR (1969) Rules for ordering uncertain prospects. Am Econ Rev 59(1):25–34

Halek M, Eisenhauer JG (2001) Demography of risk aversion. J Risk Insur 68:1–24

Hanoch Giora, Levy Haim (1969) The efficiency analysis of choices in- volving risk. Rev Econ Stud 36:335–46

Harsanyi JC (1953) Cardinal utility in welfare economics and in the theory of risk-taking. J Political Econ 61(5):434–435

Harsanyi JC (1955) Cardinal welfare, individualistic ethics, and interpersonal comparisons of utility. J Political Econ 63(4):309–321

Hart S (2011) Comparing risks by acceptance and rejection. J Political Econ 119(4):617–638

Kaneko M, Nakamura K (1979) The Nash social welfare function. Econometrica 47:423–435

Levy H (1992) Stochastic dominance and expected utility: survey and analysis. Manag Sci 38(4):555–593

Lombardi M, Miyagishima K, Veneziani R (2016) Liberal egalitarianism and the harm principle. Econ J 126(597):2173–2196

Luce RD, Raiffa H (1957) Games and decisions. Wiley, New York

Mariotti M, Veneziani R (2009) Non-interference implies equality. Soc Choice Welf 32(1):123–128

Mariotti M, Veneziani R (2018) Opportunities as chances: maximising the probability that everybody succeeds. Econ J 128(611):1609–1633

Morin Roger A, Suarez A Fernandez (1983) Risk aversion revisited. J Finance 38(4):1201–1216

Paravisini D, Rappoport V, Ravina E (2016) Risk aversion and wealth: evidence from person-to-person lending portfolios. Manag Sci 63(2):279–297

Rawls J (1971) A theory of justice. Harvard University Press, Cambridge

Rothschild M, Stiglitz JE (1970) Increasing risk: I. A definition. J Econ Theory 2(3):225–243

Safra Z, Segal U (1998) Constant risk aversion. J Econ Theory 83:19–42

Sen AK (1976) Real national income. Rev Econ Stud 43:19–39

Sheshinski E (1972) Relation between a social welfare function and the Gini index of income inequality. J Econ Theory 4(1):98–100

Shorrocks AF (1983) Ranking income distributions. Econometrica 50:3–17

Siegel Frederick W, Hoban James P Jr (1982) Relative risk aversion revisited. Rev Econ Stat 64(3):481–487

Sprumont Y (2013) On relative egalitarianism. Soc Choice Welf 40(4):1015–1032

Sprumont Y (2020) Nash welfarism and the distributive implications of informational constraints. Econ Theory Bull 8:49–64

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I would like to thank Benjamin Bachi, Sergiu Hart, Alan Miller, Ilan Nehama, Shiran Rachmilevitch, Ori Shai, Moses Shayo, Ran Shorrer, Jean Mercier Ythier and the annonymous referees of Social Choice and Welfare for their valuable comments.

Appendix: proofs

Appendix: proofs

Proof of part 1 of Proposition 1

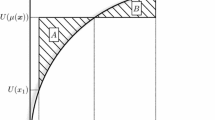

For any income distribution (random variable) z, let \(L(z)\equiv \min z\) and let \(M(z)\equiv \max z\). Notice that for any income distribution z, and every \(u\in U^{*}\), u accepts z at any \(w\le L(z)\). Now let \(w_{0}=L(z)+\epsilon\) for some arbitrary small and positive \(\epsilon\), and let \(p_{L}\) denote the non-zero probability of \(L(z)\in\) supp\(\left( z\right)\). Now let \(\hat{u}_{\alpha }\left( w\right) :=\left( \log \left( \alpha w\right) -1\right) /e\) for \(w\le \frac{1}{\alpha }\) and \(\hat{u}_{\alpha }\left( w\right) :=-\exp \left( -\alpha w\right)\) for \(w\ge \frac{1}{\alpha }\); then \(\gamma _{\hat{u}_{\alpha }}(w)=1\) for \(w\le \frac{1}{\alpha }\) and \(\gamma _{\hat{u}_{\alpha }}(w)=\alpha w\) for \(w\ge \frac{1}{\alpha }\) and so \(\hat{u}_{\alpha }\left( w\right) \in U^{*}\) for each \(\alpha >0\).Footnote 14 For every \(\alpha >\frac{1}{L(z)}\), we get that \(\hat{u}_{\alpha }\left( w\right)\) rejects distribution z at \(w_{0}\) if and only if \(\hat{u}_{\alpha }(w_{0})\ge E[\hat{u}_{\alpha }(z)]\). A sufficient condition for a rejection of z by \(\hat{u}_{\alpha }\left( w\right)\) at \(w_{0}\) is then

Dividing by \(-\exp \left( -\alpha L(z)\right)\) and setting \(\alpha \left( \epsilon \right) =-\frac{\log \left( p_{L}\right) }{\epsilon }\), we get that \(\hat{u}_{\alpha \left( \epsilon \right) }\left( w\right)\) rejects distribution z at \(w_{0}\), because \(p_{L}\le p_{L}+\left( 1-p_{L}\right) p_{L}^{\frac{M(z)-L(z)}{\epsilon }}\). Letting \(\epsilon \rightarrow 0\), we get that \(\forall \epsilon >0\), \(\exists \alpha \left( \epsilon \right)\) such that every \(\hat{u}_{\alpha }\left( w\right) \in U^{*}\) with \(\alpha >\alpha \left( \epsilon \right)\) rejects z at wealth level \(L(z)+\epsilon\). Consequentially, income distribution x is unanimously accepted at w if and only if \(w\le L(x)\), and income distribution y is unanimously accepted at w if and only if \(w\le L(y)\), and so x unanimously-acceptance dominates y if and only if \(L(x)\ge L(y)\). \(\square\)

Lemma 1

Let \(u_{1},u_{2}\in U_{2}\) be two utility functions with absolute risk aversion coefficients \(\rho _{1}\) and \(\rho _{2}\) respectively, where \(\rho _{1}\left( w\right) \ge\) \(\rho _{2}\left( w\right)\) for every \(w>0\). Then for every income distribution z with finite support in \(\mathfrak {R}^{+}\) and every \(w>0\), if \(u_{2}\) rejects z at w then \(u_{1}\) rejects z at w too.Footnote 15

Proof

Let \(\psi\) be such that \(u_{1}=\psi \circ u_{2}\); then \(\psi\) is strictly increasing (since \(u_{1}\) and \(u_{2}\) are such), and concave (since for every \(w>0\) we have \(\psi \prime \left( u_{2}\left( w\right) \right) =u_{1}^{\prime }\left( w\right) /u_{2}^{\prime }\left( w\right)\), hence \(\left( \log \psi \prime \left( u_{2}\left( w\right) \right) \right) ^{\prime }=\left( \log u_{1}^{\prime }\left( w\right) \right) ^{\prime }-\left( \log u_{2}^{\prime }\left( w\right) \right) ^{\prime }=-\rho _{1}\left( w\right) +\) \(\rho _{2}\left( w\right) \le 0\), and so \(\psi ^{\prime \prime }\le 0\)). Therefore \(E[u_{2}(z)]\le u_{2}\left( w\right)\) implies by Jensen inequality and by the monotonicity of \(\psi\) that \(E[u_{1}(z)]=E[\psi \left( u_{2}(z)\right) ]\le \psi \left( E[u_{2}(z)]\right) \le \psi \left( u_{2}\left( w\right) \right) =u_{1}\left( w\right)\). \(\square\)

Proof of part 2 of Proposition 1

For any income distribution z and any wealth level \(w>0\), I will show that z is unanimously rejected at w if and only if \(\log (w)\ge E[\log (z)]\). This means that unanimous rejection by all \(u\in U^{*}\) implies and is implied by rejection by the log utility, hence rejection-based domination boils down to the preferences of the log utility (i.e., x rejection-based dominates y if and only if \(E[\log (x)]>E[\log (y)]\)). The “only if” direction is immediate: if \(\log (w)<E[\log (z)]\), then \(u_{l}\equiv \log (w)\in U^{*}\) accepts z at w, thus z is not unanimously rejected at w. The proof for the “if” direction is less straightforward. Lemma 8 in Hart (2011) implies that if u is increasing and strictly concave, and \(\lim \limits _{w\rightarrow 0^{+}}u(w)=-\infty\) (as implied by property (R4) of \(U^{*}\)), then \(\lim \limits _{w\rightarrow 0^{+}}\gamma _{u}(w)\ge 1\). From property (R3) of \(U^{*}\) (weakly increasing \(\gamma _{u}(w)\)), it follows that \(\forall u\in U^{*},\) \(\gamma _{u}(w)\ge 1\) for all \(w>0\). Thus, Lemma 1 implies that \(\forall u\in U^{*}\subset U_{2}\), if \(u_{2}=u_{l}\) rejects z at w then \(u_{1}=u\) rejects z at w too (because \(\gamma _{u}(w)\ge 1=\gamma _{u_{l}}(w)\Rightarrow \rho _{u}(w)\ge \rho _{u_{l}}(w)\)), i.e., \(\log (w)\ge E[\log (z)]\) implies that z is unanimously rejected at w. \(\square\)

Proof of part 1 of Proposition 2

The proof of part (1) of Proposition 1 applies here too, for both statements (a) and (b), because \(\hat{u}_{\alpha }\left( w\right) \in U^{*}\subset U_{3}\subset U_{2}\), hence the fact that every \(\hat{u}_{\alpha }\left( w\right)\) with \(\alpha >\alpha \left( \epsilon \right)\) rejects z at wealth level \(L(z)+\epsilon\) (see the proof of part (1) of Proposition 1) is relevant here too, implying that income distribution x is not unanimously accepted at w whenever \(w>L(x)\); and at the same time it still holds that for any income distribution z, and every \(u\in U_{2}\) (hence also every \(u\in U_{3}\subset U_{2}\)), u accepts z at any \(w\le L(z)\).\(\square\)

Proof of part 2 of Proposition 2

-

(a)

For any income distribution z and any wealth level \(w>0\), I will show that income distribution z is unanimously rejected at w if and only if \(w\ge E[z]\) (this would then imply that \(x\ge _{RD_{2}}y\) if and only if \(E[x]\ge E[y]\)). Let \(u_{neut}\in U_{2}\) denote the risk-neutral utility function. The “only if” direction: if \(w<E[z]\), then \(u_{neut}\) accepts z at w, thus z is not unanimously rejected at w. The “if” direction: Lemma 1 implies that \(\forall u\in U_{2}\), if \(u_{2}=u_{neut}\) rejects z at w then \(u_{1}=u\) rejects z at w too (because \(\gamma _{u}(w)\ge 0=\gamma _{u_{neut}}(w)\Rightarrow \rho _{u}(w)\ge \rho _{u_{neut}}(w)\)), i.e., \(w\ge E[z]\) implies not only that \(u_{neut}\) rejects z at w, but also that z is unanimously rejected at w.

-

(b)

The same proof of (a) holds, substituting \(U_{2}\) with \(U_{3}\) and \(\ge _{RD_{2}}\) with \(\ge _{RD_{3}}\). \(\square\)

Rights and permissions

About this article

Cite this article

Michaeli, M. On Measuring Welfare ‘Behind a Veil of Ignorance’. Soc Choice Welf 56, 57–66 (2021). https://doi.org/10.1007/s00355-020-01271-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00355-020-01271-1