Abstract

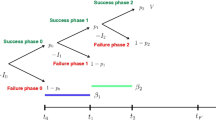

Much previous research has shown that the R&D investments can be evaluated by real growth options approach. But few studies have been done on real abandonment options for R&D projects which may not succeed. The contribution of this paper is not only to derive a more general closed-form solution for evaluating real abandonment options, but to put backup project consideration into our model for reality. We show that both Black-Scholes’s and Stulz’s models are special cases of our model under some specifications of parameters. From the simulation results, we explore that the higher the percentage of recovering salvage value, the more investment projects should be carried out. We hope that the results in this study could provide a useful reference for the manager, to make better decisions regarding backup projects.

Similar content being viewed by others

References

Berger PG, Ofek E, Swary I (1996) Investor valuation of the abandonment option. J Financ Econ 42:257–287

Black F, Scholes M (1973) The pricing of options and corporate liabilities. J Political Econ 81:637–654

Brach MA, Paxson DA (2001) A gene to drug venture: poisson options analysis. R&D Manage 31:203–214

Childs PD, Triantis AJ (1999) Dynamic R&D investment policies. Manage Sci 45:1359–1377

Cox JC, Ross SA (1976) The valuation of options for alternative stochastic processes. J Financ Econ 3:145–166

Curnow RN, Dunnett CW (1961) The numerical evaluation of certain multivariate normal integrals. Ann Math Stat 33:571–579

Harrison JM, Kreps DM (1979) Martingales and arbitrage in multiperiod securities markets. J Econ Theory 20:381–408

Howell SD, Jagle AJ (1997) Laboratory evidence on how managers intuitively value real growth options. J Bus Financ Account 24: 915–935

Jagle AJ (1999) Shareholder value, real options, and innovation in technology-intensive companies. R&D Manage 29:271–287

Johnson H (1987) Options on the maximum or the minimum of several assets. J Financ Quant Anal 22:277–284

Lee J, Paxson DA (2001) Valuation of R&D real american sequential exchange options. R&D Manage 31:191–201

Myers SC, Majd S (1990) Abandonment value and project life. Adv Future Option Res 4:1–21

Ottoo RE (1998) Valuation of internal growth opportunities: the case of a biotechnology company. Q Rev Econ Financ 38:615–633

Pennings E, Lint O (1997) The option value of advanced R&D. Eur J Oper Res 103:83–94

Schwartz ES, Moon M (2000) Evaluating research and development investments. In: Brennan M, Trigeorgis L (eds). Project flexibility, agency and competition. Oxford University Press, Oxford, pp 85–106

Stulz R (1982) Options on the minimum or the maximum of two risky assets: analysis and applications. J Financ Econ 10:161–185

Trigeorgis L (1996) Real Options—managerial flexibility and strategy in resource allocation. MIT, Cambridge

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Wu, MC., Yen, S.H. & Lou, KR. Pricing real abandonment options on several R&D investment projects. Soft Comput 11, 1123–1129 (2007). https://doi.org/10.1007/s00500-007-0162-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-007-0162-2