Abstract

International investing is the strategy of selecting globally based investment instruments as a part of an investment portfolio. In order to diversify the portfolios and enhance growth opportunities, more and more firms choose to invest on foreign stocks and derivatives that bring not only stock price risk, but also the exchange rate risk. This paper considers foreign derivatives in an uncertain financial market. Under the assumption that both the exchange rate and the stock price follow uncertain differential equations, the domestic prices of foreign European options, American options and Asian options are developed by means of contour process, respectively. Some examples are finally provided to further demonstrate the properties of the pricing formulas.

Similar content being viewed by others

References

Biger N, Hull J (1983) The valuation of currency options. Financ Manag 12:24–28

Black F, Scholes M (1973) The pricing of option and corporate liabilities. J Polit Econ 81:637–654

Chen X (2011) American option pricing formula for uncertain financial market. Int J Oper Res 8(2):32–37

Chen X, Gao J (2013) Uncertain term structure model of interest rate. Soft Comput 17:597–604

Chen X, Liu B (2010) Existence and uniqueness theorem for uncertain differential equations. Fuzzy Optim Decis Mak 9(1):69–81

Chen X, Liu Y, Ralescu D (2013) Uncertain stock model with periodic dividends. Fuzzy Optim Decis Mak 12(1):111–123

Cox J, Ingersoll J, Ross S (1985) A theory of the term structure of interest rates. Econometrica 53:385–408

Delbaen F, Schachermayer W (1999) A general version of the fundamental theorem of asset pricing. Math Ann 300:463–520

Gao J (2013) Uncertain bimatrix game with applications. Fuzzy Optim Decis Mak 12(1):65–78

Harrison M, Kreps D (1979) Martingales and arbitrage in multiperiod securities markets. J Econ Theory 20:381–408

Harrison M, Pliska S (1981) Martingales and stochastic integrals in the theory of continuous trading. Stoch Process Appl 11:215–260

Ji X, Wu H (2017) A currency exchange rate model with jumps in uncertain environment. Soft Comput 21(18):5507–5514

Liu B (2007) Uncertainty theory, 2nd edn. Springer, Berlin

Liu B (2008) Fuzzy process, hybrid process and uncertain process. J Uncertain Syst 2:3–16

Liu B (2009a) Some research problems in uncertainty theory. J Uncertain Syst 3:3–10

Liu (2009b) Theory and practice of uncertain programming. Springer, Berlin

Liu B (2010) Uncertainty theory: a branch of mathematics for modeling human uncertainty. Springer, Berlin

Liu B (2014) Uncertainty distribution and independence of uncertain processes. Fuzzy Optim Decis Mak 13:259–271

Liu Y, Chen X, Ralescu D (2015) Uncertain currency model and currency option pricing. Int J Intell Syst 30:40–51

Merton R (1969) Lifetime portfolio selection under uncertainty: the continuous time case. Rev Econ Stat 51:247–257

Mussa M (1979) Empirical regularities in the behavior of exchange rates and theories of the foreign exchange market. Carnegie Rochester Ser Public Policy 11:9–57

Peng J, Yao K (2011) A new option pricing model for stocks in uncertainty markets. Int J Oper Res 8:18–26

Shen Y, Yao K (2016) A mean-reverting currency model in an uncertain environment. Soft Comput 20:4131–4138

Sun J, Chen X (2015) Asian option pricing formula for uncertain financial market. J Uncertain Anal Appl 3:11

Vasicek O (1977) An equilibrium characterization of the term structure. J Financ Econ 5:177–188

Xiao C, Zhang Y, Fu Z (2016) Valuing interest rate swap contracts in uncertain financial market. Sustainability 8:1186–1196

Yao K (2015) Uncertain contour process and its application in stock model with floating interest rate. Fuzzy Optim Decis Mak 14:399–424

Yao K (2016) Uncertain differential equations. Springer, Berlin

Yao K, Chen X (2013) A numerical method for solving uncertain differential equations. J Intell Fuzzy Syst 25:825–832

Yu X (2012) A stock model with jumps for uncertain markets. Int J Uncertain Fuzziness Knowl Based Syst 20:421–432

Zhang Z, Ralescu D, Liu W (2016) Valuation of interest rate ceiling and floor in uncertain financial market. Fuzzy Optim Decis Mak 15:139–154

Acknowledgements

This work was supported by National Natural Science Foundation of China under Grant No. 61374082, Distinguished Young Scholar Project of Renmin University of China and China Scholarship Council under Grant No. 201606365008.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Communicated by X. Li.

Appendix A

Appendix A

Uncertainty theory, founded by Liu (2007) and refined by Liu (2009a), is a branch of axiomatic mathematics for modeling human uncertainty. Uncertainty theory has been applied in many key areas, for example Gao (2013) studied uncertain game, Liu (2009a) studied uncertain finance, Liu (2009b) studied uncertain programming. Let \(\varGamma \) be a nonempty set, and \(\text{ L }\) be a \(\sigma \)-algebra over \(\varGamma \). Each element \(\varLambda \) in \(\text{ L }\) is called an event. Uncertain measure is defined as a function from \(\text{ L }\) to [0,1]. In detail, Liu (2007) gave the concept of uncertain measure as follows.

Definition A.1

(Liu 2007) The set function \(\text{ M }\) is called an uncertain measure if it satisfies

Axiom 1. \(\text{ M }\{\varGamma \}=1\) for the universal set \(\varGamma \);

Axiom 2. \(\text{ M }\{\varLambda \}+\text{ M }\{\varLambda ^c\}=1 \) for any event \(\varLambda \);

Axiom 3. For any countable sequence of events \(\varLambda _1\), \(\varLambda _2\), \(\cdots \), we have

Besides, in order to provide the operational law, Liu (2009a) defined the product uncertain measure on the product \(\sigma \)-algebre \(\text{ L }\) as follows.

Axiom 4. Let \((\varGamma _k,\text{ L }_k,\text{ M }_k)\) be uncertainty spaces for k = 1, 2, \(\ldots \). The product uncertain measure \(\text{ M }\) is an uncertain measure satisfying

where \(\varLambda _k\) are arbitrarily chosen events from \(\text{ L }_k\) for k = 1, 2 \(\ldots \), respectively. Based on the concept of uncertain measure, we can define an uncertain variable.

Definition A.2

(Liu 2007) An uncertain variable is a function \(\xi \) from an uncertainty space \((\varGamma ,\text{ L },\text{ M })\) to the set of real numbers such that \(\{\xi \in B\}\) is an event for any Borel set B of real numbers.

Definition A.3

(Liu 2007) The uncertainty distribution \(\varPhi \) of an uncertain variable \(\xi \) is defined by

for any real number x.

Moreover, if an uncertainty distribution \(\varPhi (x)\) is continuous and strictly increasing function with respect to x at which \(0<\varPhi (x)<1\), and \(\lim \nolimits _{x \rightarrow - \infty } \varPhi (x) = 0 \), \(\lim \nolimits _{x \rightarrow + \infty } \varPhi (x) = 1 \), then \(\varPhi (x)\) is said to be regular.

Definition A.4

(Liu 2010) Let \(\xi \) be an uncertain variable with regular uncertainty distribution \(\varPhi (x)\). Then, the inverse function \(\varPhi ^{-1}(\alpha )\) is called the inverse uncertainty distribution of \(\xi \).

Definition A.5

(Liu 2007) Let \(\xi \) be an uncertain variable. The expected value of \(\xi \) is defined by

provided that at least one of the above two integrals is finite.

Theorem A.1

(Liu 2010) Let \(\xi \) be an uncertain variable with regular uncertainty distribution \(\varPhi \). If the expected value exists, then

Definition A.6

(Liu 2007) Let \((\varGamma ,\text{ L },\text{ M })\) be an uncertain space, and let T be a totally ordered set (e.g., time). An uncertain process is a function \(X_t(\gamma )\) from \(T \times (\varGamma ,\text{ L },\text{ M }) \) to the set of real numbers such that \(\{X_t \in B \}\) is an event for any Borel set B at each time t.

Definition A.7

(Liu 2014) Uncertain processes \(X_{1t}\), \(X_{2t}\), \(\ldots \), \(X_{nt}\) are said to be independent if for any positive integer k and any times \(t_1, t_2, \ldots ,t_{k}\), to be uncertain vectors

are independent, i.e., for any Borel sets \(B_1, B_2, \ldots , B_n\) of k-dimensional real vectors, we have

Definition A.8

(Liu 2009a) An uncertain process \(C_t\) is said to be a Liu process if

-

(i)

\(C_0\) = 0 and almost all sample path are Lipschitz continuous,

-

(ii)

\(C_t\) has stationary and independent increments,

-

(iii)

every increment \(C_{s+t}-C_s\) is a normal uncertain variable with expected value 0 and variance \(t^2\).

Definition A.9

(Liu 2009a) Let \(X_t\) be an uncertain process, and let \(C_t\) be a Liu process. For any partition of closed interval [a, b] with \(a=t_1< t_2< \cdots < t_{k+1} = b\), the mesh is written as

Then Liu integral of \(X_t\) with respect to \(C_t\) is defined as

provided that the limit exists almost surely and is finite. In this case, the uncertain process \(X_t\) is said to be integrable.

Uncertain differential equation is a type of differential equation driven by Liu process. Chen and Liu (2010) proved the existence and uniqueness theorem of uncertain differential equation. Yao and Chen (2013) found a relationship between an uncertain differential equation and a family of ordinary differential equations, which is called Yao-Chen formula. For more information about uncertain differential equations, the readers can refer to Yao’s book Yao (2016).

Definition A.10

(Liu 2008) Suppose \(C_t\) is a Liu process, and f and g are two functions. Then,

is called an uncertain differential equation. A solution is a general Liu process \(X_t\) that satisfies (A.10) identically in t.

Definition A.11

(Yao and Chen 2013) Let \(\alpha \) be a number with \(0< \alpha < 1\). An uncertain differential equation

is said to have an \(\alpha \)-path \(X_t^{\alpha }\) if it solves the corresponding ordinary differential equation

where \(\varPhi ^{-1}(\alpha )\) is the inverse standard normal uncertainty distribution, i.e.,

Definition A.12

(Yao 2015) Let \(X_t\) be an uncertain process. If for each \(\alpha \) \(\in \) (0,1), there exists a real function \(X_t^{\alpha }\) such that

then \(X_t\) is called a contour process. In this case, \(X_t^{\alpha }\) is called the \(\alpha \)-path of the uncertain process.

For example, a solution of an uncertain differential equation is a contour process.

Theorem A.2

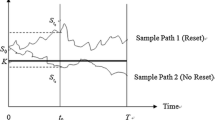

(Yao 2015) Let \(X_t\) be a contour process with an \(\alpha \)-path \(X_t^{\alpha }\). Then, its supremum process

is a contour process with an \(\alpha \)-path

Theorem A.3

(Yao 2015) Let \(X_t\) be a contour process with an \(\alpha \)-path \(X_t^{\alpha }\). Then, its time integral process

is a contour process with an \(\alpha \)-path

Theorem A.4

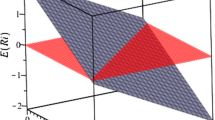

(Yao 2015) Let \(X_{1t}\), \(X_{2t}\), \(\ldots \), \(X_{nt}\) be independent contour processes with \(\alpha \)-paths \(X_{1t}^{\alpha }\), \(X_{2t}^{\alpha }\), \(\ldots \), \(X_{nt}^{\alpha }\), respectively. If \(f(x_1, x_2, \ldots , x_n)\) is strictly increasing with respect to \(x_1\), \(x_2\), \(\ldots \), \(x_m\) and strictly decreasing with respect to \(x_{m+1}\), \(x_{m+2}\), \(\ldots \), \(x_{n}\), then the uncertain process

is a contour process with an \(\alpha \)-path

Rights and permissions

About this article

Cite this article

Zhang, Y., Gao, J. & An, Q. International investing in uncertain financial market. Soft Comput 22, 5335–5346 (2018). https://doi.org/10.1007/s00500-018-3028-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-018-3028-x