Abstract

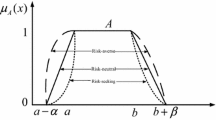

Risk and uncertainties plays a major role in stock market investments. It is a pedagogical practice to deduce probability distributions for analysing stock market returns using theoretical models of investor behaviour. Generally, economists estimate probability distributions for stock market returns that are observed from the history of past returns. Besides this, there are impreciseness involved in various factors affecting market investment and returns. As such, we need to model a more reliable strategy that will quantify the uncertainty with better confidence. Here, we have presented a computational method to solve fuzzy stochastic Volterra–Fredholm integral equation which is based on the block pulse functions (BPFs) using fuzzy stochastic operational matrix (SOM). The concept of fuzziness has been hybridized with BPFs, and the corresponding stochastic integral equation has been modelled. For illustration, the developed model has been used to investigate an example problem of Black–Scholes fuzzy stochastic differential equation (FSDE), and the results are compared in special cases.

Similar content being viewed by others

References

Arqub OA (2017) Adaptation of reproducing kernel algorithm for solving fuzzy Fredholm–Volterra integrodifferential equations. Neural Comput Appl 28:1591–1610

Arqub OA, Al-Smadi M, Momani S, Hayat T (2016) Numerical solutions of fuzzy differential equations using reproducing kernel Hilbert space method. Soft Comput 20:3283–3302

Arqub OA, Al-Smadi M, Momani S, Hayat T (2017) Application of reproducing kernel algorithm for solving second-order, two-point fuzzy boundary value problems. Soft Comput 21:7191–7206

Babolian E, Maleknejad K, Mordad M, Rahimi B (2011) A numerical method to solve Fredholm–Volterra integral equations in two dimensional spaces using block pulse functions and operational matrix. J Comput Appl Math 235(14):3965–3971

Berger MA, Mizel VJ (1980) Volterra equations with Ito integrals I. J Integral Equ 2:187–245

Chakraverty S, Nayak S (2013) Fuzzy finite element method in diffusion problems. In: Chakraverty S (ed) Mathematics of uncertainty modelling in the analysis of engineering and science problems. IGI Global, Hershey, pp 309–328

Cortes JC, Jodar L, Villafuerte L (2007) Numerical solution of random differential equations: a mean square approach. Math Comput Model 45:757–765

Etheridge A (2002) A course in financial calculus. Cambridge University Press, Cambridge

Jankovic S, Ilic D (2010) One linear analytic approximation for stochastic integro-differential equations. Acta Math Sci 30(4):1073–1085

Jiang ZH, Schaufelberger W (1992) Block pulse functions and their applications in control systems. Springer, Berlin

Khodabin M, Maleknejad K, Rostami M, Nouri M (2011) Numerical solution of stochastic differential equations by second order Runge–Kutta methods. Math Comput Model 53:1910–1920

Kloeden PE, Platen E (1999) Numerical solution of stochastic differential equations. In: Applications of mathematics. Springer, Berlin

Knight FH (2006) Risk, uncertainty and profit. Cosimo Classics, New York

Maleknejad K, Mahmoudi Y (2004) Numerical solution of linear Fredholm integral equation by using hybrid Taylor and block pulse functions. Appl Math Comput 149:799–806

Maleknejad K, Shahrezaee M, Khatami H (2005) Numerical solution of integral equations system of the second kind by block pulse functions. Appl Math Comput 166:15–24

Malinowski MT, Michta M (2011) Stochastic fuzzy differential equations with an application. Kybernetika 47(1):123–143

Murge MG, Pachpatte BG (1990) Succesive approximations for solutions of second order stochastic integrodifferential equations of Ito type. Indian J Pure Appl Math 21(3):260–274

Nayak S, Chakraverty S (2016a) Numerical solution of stochastic point kinetic neutron diffusion equation with fuzzy parameters. Nucl Technol 193(3):444–456

Nayak S, Chakraverty S (2016b) Numerical solution of fuzzy stochastic differential equation. J Intell Fuzzy Syst 31:555–563

Oksendal B (2003) Stochastic differential equations: an introduction with applications. Springer, Heidelberg

Prasada Rao G (1983) Piecewise constant orthogonal functions and their application to systems and control. Springer, Berlin

Tudor C, Tudor M (1995) Approximation schemes for Ito–Volterra stochastic equations. Bol Soc Mat Mex 3(1):73–85

Yong J (2006) Backward stochastic Volterra integral equations and some related problems. Stoch Process Appl 116:779–795

Zhang X (2008) Euler schemes and large deviations for stochastic Volterra equations with singular kernels. J Differ Equ 244:2226–2250

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Communicated by V. Loia.

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Nayak, S., Marwala, T. & Chakraverty, S. Stochastic differential equations with imprecisely defined parameters in market analysis. Soft Comput 23, 7715–7724 (2019). https://doi.org/10.1007/s00500-018-3396-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-018-3396-2