Abstract

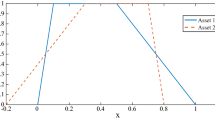

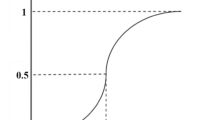

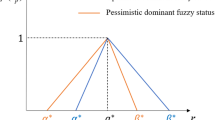

The risk measure plays an important role for portfolio selection problem. The lower partial risk (downside risk) measures have been considered to be more in line with investor’s attitude toward risk. The purpose of this paper is to construct a portfolio selection model in the lower partial risk framework. First, semi-variance and semi-absolute deviation risk measures are used as double-risk measures simultaneously, which can overcome the shortcomings of both semi-variance risk measure and semi-absolute deviation risk measure and can provide additional strengths and flexibility. Second, to address a real portfolio selection problem, by considering the transaction cost and liquidity of portfolio, and regarding the returns of risk assets as LR-type fuzzy variables, we present a fuzzy multi-objective portfolio selection model. Third, in order to limit the proportion of the portfolio invested in assets with common characteristics and to avoid very small holdings, the quantity and class constraints are introduced into the model. Finally, to solve the proposed model efficiently, a new multi-objective evolutionary algorithm is designed. Furthermore, some experiments are conducted by using the data of Shanghai Stock Exchange, and the results indicate the efficiency and effectiveness of the proposed model and algorithm.

Similar content being viewed by others

References

Barak S, Abessi M, Modarres M (2013) Fuzzy turnover rate chance constraints portfolio model. Eur J Oper Res 228(1):141–147

Bass SM, Kwakernaak H (1997) Rating and ranking of multiple-aspect alternatives using fuzzy sets. Automatica 13:47–58

Bermúdez JD, Segura JV, Vercher E (2012) A multi-objective genetic algorithm for cardinality constrained fuzzy portfolio selection. Fuzzy Sets Syst 188:16–26

Bernard C, Rüschendorf L (2015) Value-at-risk bounds with variance constraints. J Risk Insur (supplemental material)

Byrne P, Lee S (2004) Different risk measures: different portfolio compositions? J Prop Invest Finance 22(6):501–511

Calvo C, Ivorra C, Liern V (2016) Fuzzy portfolio selection including cardinality constraints and integer conditions. J Optim Theory Appl 170:343–355

Chiodi L, Mansini R, Speranza MG (2003) Semi-absolute deviation rule for mutual funds portfolio selection. Ann Oper Res 124(1):245–265

Dai C, Wang YP (2015) A new uniform evolutionary algorithm based on decomposition and CDAS for many-objective optimization. Knowl Based Syst 85:131–142

Deb K, Sinha A, Kukkonen S (2006) Multi-objective test problems, linkages, and evolutionary methodologies. In: Proceedings of the 8th annual genetic and evolutionary computation conference (GECCO’06), Seattle, July, pp 1141–1148

Deng X, Li RJ (2014) Gradually tolerant constraint method for fuzzy portfolio based on possibility theory. Inf Sci 259:16–24

Dubio DJ, Prade H (1980) Fuzzy sets and systems: theory and applications. Academic, New York

Eftekharian SE, Shojafar M, Shamshirb S (2017) 2-Phase NSGA II: an optimized reward and risk measurements algorithm in portfolios optimizatio. Algorithms 10(4):1–14

Fono LA, Kamdem JS, Tassak C, Fono LA (2012) Moments and semi-moments for fuzzy portfolio selection. Insur Math Econ 51(3):517–530

Fullér R, Majlender P (2003) On weighted possibilistic mean and variance of fuzzy numbers. Fuzzy Sets Syst 136:363–374

Gaigi M, Vath VL, Mnif M, Toumi S (2016) Numerical approximation for a portfolio optimization problem under liquidity risk and costs. Appl Math Optim 74(1):163–195

Guo S, Yu L, Li X, Kar S (2016) Fuzzy multi-period portfolio selection with different investment horizons. Eur J Oper Res 254:1026–1035

Gupta P, Mukesh KS, Saxena A (2010) A hybrid approach to asset allocation with simultaneous consideration of suitability and optimality. Inf Sci 180:2264–2285

Javanmardi S, Shojafar M, Shariatmadari S, Ahrabi S (2015) FR TRUST: a fuzzy reputation based model for trust management in semantic P2P grids. Int J Grid Util Comput 6(1):57–66

Jean WH (1971) The extension of portfolio analysis to three or more parameters. J Financ Quant Anal 6(1):505–515

Kandasamy H (2008) Portfolio selection under various risk measures. Clemson University, Pro Quest, Ann Arbor

Konno H, Waki H, Yuuki A (2002) Portfolio optimization under lower partial risk measures. Asia Pac Financ Mark 9(2):127–140

Lin CC, Liu YT, Chen AP (2016) Hedging an option portfolio with minimum transaction lots: a fuzzy goal programming problem. Appl Soft Comput 47:295–303

Liu C, Zheng H (2016) Asymptotic analysis for target asset portfolio allocation with small transaction costs. Insur Math Econ 66:59–68

Liu YJ, Zhang WG, Zhang P (2013) A multi-period portfolio selection optimization model by using interval analysis. Econ Model 33:113–119

Mansini R, Speranza MG (2005) An exact approach for portfolio selection with transaction costs and rounds. IIE Trans 37:919–929

Markowitz H (1952) Portfolio selection. J Finance 7(1):77–91

Mei XL, DeMiguel V, Nogales FJ (2016) Multiperiod portfolio optimization with multiple risky assets and general transaction costs. J Bank Finance 69:1058–1120

Nguyen TT, Lee GB, Abbas K (2015) Fuzzy portfolio allocation models through a new risk measure and fuzzy Sharpe ratio. IEEE Trans Fuzzy Syst 23(3):1–2

Pae YT, Sabbaghi N (2014) Log-robust portfolio management after transaction costs. OR Spectr 36:95–112

Roman D, Dowman KD, Mitra G (2007) Mean risk models using two risk measures: a multi-objective approach. Quant Finance 7(4):443–458

Rubio A, Bermudez JD, Vercher E (2016) Forecasting portfolio returns using weighted fuzzy time series methods. Int J Approx Reason 75:1–12

Saborido R, Ruiz AB, Bermúdez JD, Vercher E, Luque M (2016) Evolutionary multi-objective optimization algorithms for fuzzy portfolio selection. Appl Soft Comput 39:48–63

Sefair JA, Méndez CY, Babat O, Medaglia AL (2016) Linear solution schemes for mean-semi variance project portfolio selection problems: an application in the oil and gas industry. Omega, available online 17

Seyedhosseini SM, Esfahani MJ, Ghaffari M (2016) A novel hybrid algorithm based on a harmony search and artificial bee colony for solving a portfolio optimization problem using a mean-semi variance approach. J Central South Univ 23(1):181–188

Speranza MG (1993) Linear programming models for portfolio optimization. Finance 14:107–123

Van Veldhuizen DA, Lamont GB (2014) Multiobjective evolutionary algorithms: analyzing the state-of-the-art. Evol Comput 8(2):125–147

Veldhuizen DA (1999) Multi-objective evolutionary algorithms: classifications, analyses, and new innovations. PhD thesis, Dept. Electr. Comput. Eng. Graduate School Eng, Air Force Institute of Technology, Wright-Patterson AFB, Ohio

Vercher E, Bermúdez JD (2015) Portfolio optimization using a credibility mean-absolute semi-deviation model. Expert Syst Appl 42:7121–7131

Vercher E, Bermúdez DJ, Segura JV (2007) Fuzzy portfolio optimization under downside risk measures. Fuzzy Sets Syst 158:769–782

Yan W, Miao R, Li SR (2007) Multi-period semi-variance portfolio selection: model and numerical solution. Appl Math Comput 194:128–134

Yue W, Wang YP (2017) A new fuzzy multi-objective higher order moment portfolio selection model for diversified portfolios. Physica A 465:124–140

Zadeh LA (1965) Fuzzy sets. Inf Control 8(1):338–353

Zeng ZQ, Nasri E, Chini A, Ries R, Xu JP (2015) A multiple objective decision making model for energy generation portfolio under fuzzy uncertainty: case study of large scale investor-owned utilities in Florida. Renew Energy 75:224–242

Zhang WG, Nie ZK (2003) On possibilistic variance of fuzzy numbers. Lect Notes Artif Intell 263:398–402

Zhang WG, Xiao WL (2009) On weighted lower and upper possibilistic means and variances of fuzzy numbers and its application in decision. Knowl Inf Syst 18:311–330

Zhang P, Zhang WG (2014) Multi-period mean absolute deviation fuzzy portfolio selection model with risk control and cardinality constraints. Fuzzy Sets Syst 255:74–91

Zitzler E, Thiele L, Laumanns M, Fonseca CM, da Fonseca VG (2003) Performance assessment of multi-objective optimizers: an analysis and review. IEEE Trans Evol Comput 7(2):117–132

Acknowledgements

This work was supported by National Natural Science Foundations of China (Nos. 61872281 and 61472297).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have declared that no conflict of interest exists.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Communicated by V. Loia.

Rights and permissions

About this article

Cite this article

Yue, W., Wang, Y. & Xuan, H. Fuzzy multi-objective portfolio model based on semi-variance–semi-absolute deviation risk measures. Soft Comput 23, 8159–8179 (2019). https://doi.org/10.1007/s00500-018-3452-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-018-3452-y