Abstract

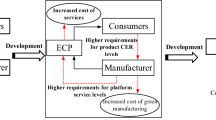

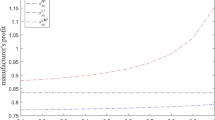

In response to the cap-and-trade policy, many manufacturers begin to reduce emissions by various measures, such as investing in technologies and using clean materials, which will affect their operation strategies and further affect the whole supply chain. Based on this, we explore how the cap-and-trade policy affects firms’ operation decisions under different retailing formats. We study a supply chain with an e-commerce platform and one manufacturer, in which they can cooperate via reseller or marketplace formats. Meanwhile, we employ a new cost function of emission reduction by incorporating the manufacturer’s emission reduction efficiency (ERE). We find that in the absence of low-carbon preference, the manufacturer’s and the platform’s profits both increase as the manufacturer’s ERE improves in reseller format; but in marketplace format, the platform is worse off as the manufacturer’s ERE improves if the efficiency is larger than a threshold. Besides, under which format the platform or the manufacturer is better off is related to the product category. For some product categories, low-carbon preference could alter the retailing format under which the platform or the manufacturer gains a higher profit. Moreover, the platform and the manufacturer are both better off in the presence of low-carbon preference, regardless of retailing formats.

Similar content being viewed by others

References

Abhishek V, Jerath K, Zhang ZJ (2016) Agency selling or reselling? Channel structures in electronic retailing. Manag Sci 62(8):2259–2280

Bai Q, Xu J, Zhang Y (2018) Emission reduction decision and coordination of a make-to-order supply chain with two products under cap-and-trade regulation. Comput Ind Eng 119:131–145

Cao K, Xu X, Wu Q, Zhang Q (2017) Optimal production and carbon emission reduction level under cap-and-trade and low carbon subsidy policies. J Clean Prod 167:505–513

Choi SC (1991) Price competition in a channel structure with a common retailer. Mark Sci 10(4):271–296

Choi SC (1996) Price competition in a duopoly common retailer channel. J Retail 72(2):117–134

Hagiu A, Wright J (2015) Marketplace or reseller? Manag Sci 61(1):184–203

He P, Dou G, Zhang W (2017) Optimal production planning and cap setting under cap-and-trade regulation. J Oper Res Soc 68(9):1094–1105

Ji J, Zhang Z, Yang L (2017a) Carbon emission reduction decisions in the retail-/dual-channel supply chain with consumers’ preference. J Clean Prod 141:852–867

Ji J, Zhang Z, Yang L (2017b) Comparisons of initial carbon allowance allocation rules in an O2O retail supply chain with the cap-and-trade regulation. Int J Prod Econ 187:68–84

Lee JY (2019) Investing in carbon emissions reduction in the EOQ model. J Oper Res Soc. https://doi.org/10.1080/01605682.2019.1609889

Li F, Emrouznejad A, Yang GL, Li Y (2019) Carbon emission abatement quota allocation in Chinese manufacturing industries: an integrated cooperative game data envelopment analysis approach. J Oper Res Soc 10(1080/01605682):1609892

Lin T, Vakharia AJ, Tan YR, Xu Y (2018) Marketplace, reseller, or hybrid: strategic analysis of an emerging e-commerce model. Prod Oper Manag 27(8):1595–1610

Liu J, Ke H (2020) Firms’ preferences for retailing formats considering one manufacturer’s emission reduction investment. Int J Prod Res 10(1080/00207543):1745314

Liu J, Ke H, Tian G (2020) Impact of emission reduction investments on decisions and profits in a supply chain with two competitive manufacturers. Comput Ind Eng 149:106784

Liu Z, Trisha DA, Jose MC (2012) Consumer environmental awareness and competition in two-stage supply chains. Eur J Oper Res 218(3):602–613

Mantin B, Krishnan H, Dhar T (2015) The strategic role of third-party marketplaces in retailing. Prod Oper Manag 23(11):1937–1949

Meneghetti A, Monti L (2015) Greening the food supply chain: an optimisation model for sustainable design of refrigerated automated warehouses. Int J Prod Res 53(21):6567–6587

Motoshita M, Sakagami M, Kudoh Y, Tahara K, Inaba A (2015) Potential impacts of information disclosure designed to motivate Japanese consumers to reduce carbon dioxide emissions on choice of shopping method for daily foods and drinks. J Clean Prod 101:205–214

Peng H, Pang T, Cong J (2018) Coordination contracts for a supply chain with yield uncertainty and low-carbon preference. J Clean Prod 205:291–302

Ryan JK, Sun D, Zhao X (2012) Competition and coordination in online marketplaces. Prod Oper Manag 21(6):997–1014

Sabzevar N, Enns ST, Bergerson J, Kettunen J (2017) Modeling competitive firms’ performance under price-sensitive demand and cap-and-trade emissions constraints. Int J Prod Econ 184:193–209

Shen Y, Willems SP, Dai Y (2019) Channel selection and contracting in the presence of a retail platform. Prod Oper Manag 28(5):1173–1185

Tang R, Yang L (2020) Impacts of financing mechanism and power structure on supply chains under cap-and-trade regulation. Transp Res Part E Logist Transp Rev 139:101957

Wang C, Wan W, Huang R (2017) Supply chain enterprise operations and government carbon tax decisions considering carbon emissions. J Clean Prod 152:271–280

Wang J, Yan Y, Du H, Zhao R (2019) The optimal sales format for green products considering downstream investment. Int J Prod Res 10(1080/00207543):1612963

Xu X, Ping H, Hao X, Zhang Q (2016) Supply chain coordination with green technology under cap-and-trade regulation. Int J Prod Econ 183:433–442

Yan Y, Zhao R, Chen H (2018a) Prisoner’s dilemma on competing retailers’ investment in green supply chain management. J Clean Prod 184:65–81

Yan Y, Zhao R, Lan Y (2018b) Moving sequence preference in coopetition outsourcing supply chain: consensus or conflict. Int J Prod Econ 208:221–240

Yan Y, Zhao R, Liu Z (2018c) Strategic introduction of the marketplace channel under spillovers from online to offline sales. Eur J Oper Res 267:65–77

Yang L, Qin Z, Jingna J (2017) Pricing and carbon emission reduction decisions in supply chains with vertical and horizontal cooperation. Int J Prod Econ 191:286–297

Yang L, Ji J, Wang M, Wang Z (2018) The manufacturer’s joint decisions of channel selections and carbon emission reductions under the cap-and-trade regulation. J Clean Prod 193:506–523

Yu X, Lan Y, Zhao R (2019) Strategic green technology innovation in a two-stage alliance: vertical collaboration or co-development? Omega. https://doi.org/10.1016/j.omega.2019.102116

Yu Y, Han X, Hu G (2016) Optimal production for manufacturers considering consumer environmental awareness and green subsidies. Int J Prod Econ 182:397–408

Yu Y, Zhou S, Shi Y (2020) Information sharing or not across the supply chain: the role of carbon emission reduction. Transp Res Part E Logist Transp Rev 137:101915

Zhang L, Wang J, You J (2015) Consumer environmental awareness and channel coordination with two substitutable products. Eur J Oper Res 241(1):63–73

Zhou Y, Hu F, Zhou Z (2018) Pricing decisions and social welfare in a supply chain with multiple competing retailers and carbon tax policy. J Clean Prod 190:752–777

Author information

Authors and Affiliations

Contributions

JL contributed to conceptualization, formal analysis, methodology, writing—original draft. HK involved in conceptualization, funding acquisition, methodology, writing—review & editing.

Corresponding author

Ethics declarations

Funding

This study was funded by National Natural Science Foundation of China (No. 41971252) and the Fundamental Research Funds for the Central Universities.

Conflict of Interest

The authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with animals performed by any of the authors.

Informed consent

Informed consent was obtained from all individual participants included in the study.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendices

1.1 A.1 Proof of Theorem 1

In reseller format, the manufacturer’s objective function is \(\pi _m= w(1-p_r)- \left( \left( e_m-\tau \right) (1-p_r)-F_m\right) p_c-\frac{(1-\eta ) \tau ^2}{2}\), and the platform’s profit function is \(\pi _r=\left( p_r-w\right) (1-p_r)- \left( e_r (1-p_r)-F_r\right) p_c\). Here, we solve the models by backward induction. Given w, the platform decides the optimal retail price. Taking the first derivative of \(\pi _r\) with respect to \(p_r\) yields \(\frac{\mathrm{d} \pi _r}{\mathrm{d} p_r}=1+w+p_c e_r-2 p_r\). Then, we can get the second derivative \(\frac{\mathrm{d} \pi _r^2}{\mathrm{d} p_r^2}=-2<0\). Therefore, \(\pi _r\) is concave in \(p_r\).

Solving \(\frac{\mathrm{d} \pi _r}{\mathrm{d} p_r}=1+w+p_c e_r-2 p_r=0\), we get

Substituting \(p_r^*\) into the manufacturer’s objective function, we have \(\pi _m=p_c \left( \frac{1}{2} \left( e_m-\tau \right) \left( 1-w-p_c e_r\right) +F_m\right) -\frac{(1-\eta ) \tau ^2}{2}+\frac{1}{2} w \left( 1-w-p_c e_r\right) \). Taking the first partial derivatives of \(\pi _m\) with respect to w and \(\tau \) yields

Then, the second partial derivatives are obtained: \(\frac{\partial \pi _m^2}{\partial w^2}=-1\), \(\frac{\partial \pi _m^2}{\partial \tau ^2}=-(1-\eta )\), \(\frac{\partial \pi _m^2}{\partial w\partial \tau }=\frac{\partial \pi _m^2}{\partial \tau \partial w}=-\frac{p_c}{2}\). Based on the assumption that \(4 (1-\eta ) -p_c^2>0\), we get the Hessian matrix \(H_1=\left( \begin{array}{cc} -1 &{} -\frac{p_c}{2} \\ -\frac{p_c}{2} &{} -(1-\eta ) \\ \end{array} \right) \) is negative. Therefore, \(\pi _m\) is jointly concave in w and \(\tau \).

Solving \(\frac{\partial \pi _m}{\partial w}=0\) and \(\frac{\partial \pi _m}{\partial \tau }=0\), we get

\(w^{\mathrm{RN}}=\frac{2(1-\eta ) e_m p_c+\left( 2 (1-\eta ) -p_c^2\right) \left( 1-e_r p_c\right) }{4 (1-\eta ) -p_c^2}\), \(\tau ^{\mathrm{RN}}=\frac{p_c \left( 1- \left( e_r+e_m\right) p_c\right) }{4 (1-\eta ) -p_c^2}\). Replacing w and \(\tau \) with \(w^{\mathrm{RN}}\) and \(\tau ^{\mathrm{RN}}\) into \(p_r^*\), we can obtain \(p_r^{\mathrm{RN}}=1-\frac{(1-\eta ) \left( 1- \left( e_r+e_m\right) p_c\right) }{4 (1-\eta ) -p_c^2}\).

1.2 A.2 Proof of Corollary 1

Firstly, we recall the assumptions that \(4 (1-\eta )-p_c^2>0\) and \(1-(e_m+e_r)p_c>0\). Then, we take the first partial derivatives of \(w^{\mathrm{RN}}\), \(\tau ^{\mathrm{RN}}\), \(p_r^{\mathrm{RN}}\), \(\pi _m\) and \(\pi _r\) with respect to some parameters.

-

(i)

\(\frac{\partial w^{\mathrm{RN}}}{\partial e_m}=\frac{2 (1-\eta ) p_c}{4 (1-\eta )-p_c^2}>0\), \(\frac{\partial \tau ^{\mathrm{RN}}}{\partial e_m}=-\frac{p_c^2}{4 (1-\eta )-p_c^2}<0\),

\(\frac{p_r^{\mathrm{RN}}}{\partial e_m}=\frac{(1-\eta ) p_c}{4 (1-\eta )-p_c^2}>0\), \(\frac{\partial \pi _m^{\mathrm{RN}}}{\partial e_m}=-\frac{(1-\eta ) p_c \left( 1- \left( e_r+e_m\right) p_c\right) }{4 (1-\eta )-p_c^2}<0\),

\(\frac{\partial \pi _r^{\mathrm{RN}}}{\partial e_m}=-\frac{2 (1-\eta )^2 p_c \left( 1- \left( e_r+e_m\right) p_c\right) }{\left( 4 (1-\eta )-p_c^2\right) {}^2}<0\).

-

(ii)

From \(\frac{\partial w^{\mathrm{RN}}}{\partial e_r}=-\frac{p_c \left( 2 (1-\eta )-p_c^2\right) }{4 (1-\eta )-p_c^2}\), we get when \(\eta <1-\frac{1}{2}p_c^2\), \(\frac{\partial w^{\mathrm{RN}}}{\partial e_r}<0\); and otherwise, \(\frac{\partial w^{\mathrm{RN}}}{\partial e_r}>0\).

\(\frac{\partial \tau ^{\mathrm{RN}}}{\partial e_r}=-\frac{p_c^2}{4 (1-\eta )-p_c^2}<0\), \(\frac{p_r^{\mathrm{RN}}}{\partial e_r}=\frac{(1-\eta ) p_c}{4 (1-\eta )-p_c^2}>0\),

\(\frac{\partial \pi _m^{\mathrm{RN}}}{\partial e_r}=-\frac{(1-\eta ) p_c \left( 1- \left( e_r+e_m\right) p_c\right) }{4 (1-\eta )-p_c^2}<0\),

\(\frac{\partial \pi _r^{\mathrm{RN}}}{\partial e_r}=-\frac{2 (1-\eta )^2 p_c \left( 1- \left( e_r+e_m\right) p_c\right) }{\left( 4 (1-\eta )-p_c^2\right) {}^2}<0\).

-

(iii)

\(\frac{\partial w^{\mathrm{RN}}}{\partial \eta }=-\frac{2 p_c^2 \left( 1- \left( e_r+e_m\right) p_c\right) }{\left( -p_c^2-4 \eta +4\right) {}^2}<0\),

\(\frac{\partial \tau ^{\mathrm{RN}}}{\partial \eta }=\frac{4 p_c \left( 1- \left( e_r+e_m\right) p_c\right) }{\left( 4 (1-\eta )-p_c^2\right) {}^2}>0\),

\(\frac{p_r^{\mathrm{RN}}}{\partial \eta }=-\frac{p_c^2 \left( 1- \left( e_r+e_m\right) p_c\right) }{\left( -p_c^2-4 \eta +4\right) {}^2}<0\),

\(\frac{\partial \pi _m^{\mathrm{RN}}}{\partial \eta }=\frac{p_c^2 \left( 1- \left( e_r+e_m\right) p_c\right) {}^2}{2 \left( -p_c^2-4 \eta +4\right) {}^2}>0\),

\(\frac{\partial \pi _r^{\mathrm{RN}}}{\partial \eta }=\frac{2 (1-\eta ) p_c^2 \left( 1- \left( e_r+e_m\right) p_c\right) {}^2}{\left( -p_c^2-4 \eta +4\right) {}^3}>0\).

1.3 A.3 Proof of Theorem 2

In marketplace format, we only need to solve the manufacturer’s decisions. The manufacturer’s profit function is \(\pi _m= (1-\phi ) p_r D- \left( \left( e_m+e_r-\tau \right) D-F_m\right) p_c-\frac{(1-\eta ) \tau ^2}{2}\). Here the manufacturer decides the retail price and emission reduction amount simultaneously.

Taking the first partial derivatives of \(\pi _m\) with respect to \(p_r\) and \(\tau \) yields \(\frac{\partial \pi _m}{\partial p_r}=p_c \left( e_r+e_m-\tau \right) +(1-\phi ) \left( 1-2 p_r\right) \), \(\frac{\partial \pi _m}{\partial \tau }=p_c \left( 1-p_r\right) -(1-\eta ) \tau \). Then, the second partial derivatives can be obtained: \(\frac{\partial \pi _m^2}{\partial p_r^2}=2 \phi -2\), \(\frac{\partial \pi _m^2}{\partial \tau ^2}=-(1-\eta )\), \(\frac{\partial \pi _m^2}{\partial \tau \partial p_r}=-p_c\). Based on the assumption that \(2 (1-\eta ) (1-\phi )-p_c^2>0\), we get the Hessian matrix \(H_2=\left( \begin{array}{cc} 2 \phi -2 &{} -p_c \\ -p_c &{} -(1-\eta ) \\ \end{array} \right) \) is negative. Therefore, \(\pi _m\) is jointly concave in w and \(\tau \). Solving \(\frac{\partial \pi _m}{\partial p_r}=0\) and \(\frac{\partial \pi _m}{\partial \tau }=0\), we obtain \(p_r^{\mathrm{MN}}=\frac{(1-\eta ) \left( 1-\phi + \left( e_r+e_m\right) p_c\right) -p_c^2}{2 (1-\eta ) (1-\phi )-p_c^2}\), \(\tau ^{\mathrm{MN}}=\frac{p_c \left( 1-\phi - \left( e_r+e_m\right) p_c\right) }{2 (1-\eta ) (1-\phi )-p_c^2}\).

1.4 A.4 Proof of Corollary 2

Similar to Corollary 1, Corollary 2 can be obtained easily by taking the first partial derivatives of the equilibrium solutions and profits with the parameters \(e_m\), \(e_r\), and \(\eta \), and thus, we here omit the detailed solving process.

1.5 A.6 Proof of Proposition 1

According to equilibrium solutions obtained in Theorems 1 and 2, we can derive the platform’s profits in different retailing formats. Then, we get two thresholds \(E_2\) and \(E_3\) by solving \(\pi ^{\mathrm{MN}}_r-\pi ^{\mathrm{RN}}_r=0\).

First, \(\pi ^{\mathrm{MN}}_r-\pi ^{\mathrm{RN}}_r\)

Then, we use \(E=e_m+e_r\) and \(A=\frac{\left( 2 (1-\eta ) (1-\phi )-p_c^2\right) {}^2}{\left( 4 (1-\eta ) -p_c^2\right) {}^2}\) to simplify the equation and obtain \((1-\eta )\phi \left( 1-\phi -p_c E\right) \left( (1-\eta ) \left( 1-\phi +p_c E\right) -p_c^2\right) -A (1-\eta ) ^2 \left( 1-p_c E\right) {}^2=0.\)

Solving the equation, we can get two solutions \(E^*=\frac{2 A (1-\eta ) +\phi p_c^2 \mp \phi \sqrt{4 (1-\eta ) ^2 \left( (1-\phi )^2-A (2-\phi )\right) -4 (1-\eta ) (1-A-\phi ) p_c^2+p_c^4}}{2 (1-\eta ) (A+\phi ) p_c}\).

1.6 A.7 Proof of Proposition 2

Similar to 1, the threshold \(E_4\) can be obtained by solving \(\pi _m^M-\pi _m^R=0\).

1.7 B.1 Proof of Theorem 3

The proof of this theorem is similar to that of Theorem 1; thus, we omit it.

1.8 B.2 Proof of Corollary 3

-

(i)

According to Theorem 3, we have

\(\frac{\partial w^{\mathrm{RP}}}{\partial e_m}=\frac{p_c \left( 2 (1-\eta )-\beta (\beta +p_c) \right) }{4 (1-\eta ) -\left( \beta +p_c\right) {}^2}\). In addition, based on the assumption \(4 (1-\eta ) -\left( \beta +p_c\right) {}^2>0\), we can derive \(2(1-\eta ) > \frac{1}{2}\left( \beta +p_c\right) {}^2\). If \(\frac{1}{2}\left( \beta +p_c\right) {}^2>\beta (\beta +p_c)\) is satisfied, \(2 (1-\eta )-\beta (\beta +p_c)>0\) always holds. From \(\frac{1}{2}\left( \beta +p_c\right) {}^2>\beta (\beta +p_c)\), we can get \(p_c>\beta \). Hence, when \(p_c>\beta \), \(\frac{\partial w^{\mathrm{RP}}}{\partial e_m}>0\). However, for the situation that \(p_c\le \beta \), the \(e_m\) has a positive or negative effect is related to the value of \(2 (1-\eta )-\beta (\beta +p_c)\). When \(2 (1-\eta )-\beta (\beta +p_c)>0\), namely, \(\eta <1-\frac{1}{2}\beta (\beta +p_c)\), \(\frac{\partial w^{\mathrm{RP}}}{\partial e_m}>0\); otherwise, \(\frac{\partial w^{\mathrm{RP}}}{\partial e_m}<0\). Similarly, we get \(\frac{\partial w^{\mathrm{RP}}}{\partial e_r}=-\frac{p_c \left( 2 (1-\eta ) -p_c \left( \beta +p_c\right) \right) }{4 (1-\eta ) -\left( \beta +p_c\right) {}^2}\). When \(p_c<\beta \), \(\frac{\partial w^{\mathrm{RP}}}{\partial e_r}>0\) always holds. For the condition that \(p_c\ge \beta \), when \(\eta <1-\frac{1}{2}p_c(\beta +p_c)\), \(\frac{\partial w^{\mathrm{RP}}}{\partial e_r}>0\); otherwise, \(\frac{\partial w^{\mathrm{RP}}}{\partial e_r}<0\). Next, we have \(\frac{\partial w^{{\mathrm{RP}}}}{\partial \eta }=\frac{2 \left( \beta ^2-p_c^2\right) \left( 1-p_c \left( e_r+e_m\right) \right) }{\left( 4 (1-\eta )-\left( \beta +p_c\right) {}^2\right) {}^2}\), and thus, only when \(\beta >p_c\), \(\frac{\partial w^{{\mathrm{RP}}}}{\partial \eta }>0\) holds; otherwise, \(\frac{\partial w^{{\mathrm{RP}}}}{\partial \eta }<0\). Then, \(\frac{\partial w^{\mathrm{RP}}}{\partial \beta }=\frac{\left( 1-p_c \left( e_r+e_m\right) \right) \left( 4 \beta (1-\eta ) -p_c \left( \beta +p_c\right) {}^2\right) }{\left( 4 (1-\eta )-\left( \beta +p_c\right) {}^2\right) {}^2}\). According to the assumption \(4(1-\eta )>(\beta +p_c)^2\), we have \(4\beta (1-\eta )>\beta (\beta +p_c)^2\). Hence, we can derive that \(4 \beta (1-\eta ) -p_c \left( \beta +p_c\right) {}^2>0\) if \(p_c<\beta \). For the situation \(p_c\ge \beta \), when \(\eta < 1-\frac{p_c \left( \beta +p_c\right) {}^2}{4 \beta }\), \(\frac{\partial w^{\mathrm{RP}}}{\partial \beta }>0\); otherwise, \(\frac{\partial w^{\mathrm{RP}}}{\partial \beta }<0\).

-

(ii)

Taking the first partial derivatives of \(\tau ^{\mathrm{RP}}\), we get

\(\frac{\partial \tau ^{\mathrm{RP}} }{\partial e_m}=-\frac{p_c \left( \beta +p_c\right) }{4 (1-\eta ) -\left( \beta +p_c\right) {}^2}<0\),

\(\frac{\partial \tau ^{\mathrm{RP}} }{\partial e_r}=-\frac{p_c \left( \beta +p_c\right) }{4 (1-\eta ) -\left( \beta +p_c\right) {}^2}<0\),

\(\frac{\partial \tau ^{\mathrm{RP}}}{\partial \eta }=\frac{4 \left( \beta +p_c\right) \left( 1-p_c \left( e_r+e_m\right) \right) }{\left( 4 (1-\eta )-\left( \beta +p_c\right) {}^2\right) {}^2}>0\),

\(\frac{\partial \tau ^{\mathrm{RP}} }{\partial \beta }=\frac{\left( 1-p_c \left( e_r+e_m\right) \right) \left( \left( \beta +p_c\right) {}^2+4 (1-\eta ) \right) }{\left( 4 (1-\eta ) -\left( \beta +p_c\right) {}^2\right) {}^2}>0\).

-

(iii)

Taking the first partial derivatives of \(p^{\mathrm{RP}}_r\), we obtain \(\frac{\partial p^{\mathrm{RP}}_r}{\partial e_m}=\frac{p_c \left( (1-\eta )-\beta (\beta +p_c)\right) }{4 (1-\eta ) -\left( \beta +p_c\right) {}^2}>0\). From the assumption \(4 (1-\eta ) -\left( \beta +p_c\right) {}^2>0\), we have \((1-\eta )>\frac{1}{4}\left( \beta +p_c\right) {}^2\). Thus, when \(\frac{1}{4}\left( \beta +p_c\right) {}^2>\beta (\beta +p_c)\), namely, \(p_c>3\beta \), \((1-\eta )-\beta (\beta +p_c)>0\), and thus, \(\frac{\partial p^{\mathrm{RP}}_r}{\partial e_m}>0\). For the situation \(p_c\le 3\beta \), letting \((1-\eta )-\beta (\beta +p_c)>0\), we get \(\eta <1-\beta (\beta +p_c)\). Hence, when \(p_c\le 3\beta \), if \(\eta <1-\beta (\beta +p_c)\), \(\frac{\partial p^{\mathrm{RP}}_r}{\partial e_m}>0\); otherwise, \(\frac{\partial p^{\mathrm{RP}}_r}{\partial e_m}<0\). Similarly, we have \(\frac{\partial p^{\mathrm{RP}}_r}{\partial e_r}=\frac{p_c \left( (1-\eta )-\beta (\beta +p_c)\right) }{4 (1-\eta ) -\left( \beta +p_c\right) {}^2}=\frac{\partial p^{\mathrm{RP}}_r}{\partial e_m}\). Hence, the impact of \(e_r\) on the retail price is the same with that of \(e_m\) on it. Here, we omit the detailed process. Then, from \(\frac{\partial p_r^{\mathrm{RP}}}{\partial \eta }=\frac{\left( 3 \beta -p_c\right) \left( \beta +p_c\right) \left( 1-p_c \left( e_r+e_m\right) \right) }{\left( 4 (1-\eta )-\left( \beta +p_c\right) {}^2\right) {}^2}\), we can get \(\frac{\partial p_r^{\mathrm{RP}}}{\partial \eta }>0\) only when \(p_c<3\beta \); otherwise, \(\frac{\partial p_r^{\mathrm{RP}}}{\partial \eta }<0\).

1.9 B.3 Proof of Theorem 4

The proof is omitted because it is similar to that of Theorem 2.

1.10 B.4 Proof of Corollary 4

The proof is similar to that of Corollary 3; thus, we will not repeat the solving process.

1.11 B.5 Proofs of Propositions 3 and 5

The proofs of Propositions 3 and 5 are similar to those of Propositions 1, and 2, respectively. Here, we omit them.

1.12 C.1 Proof of Proposition 6

Based on equilibrium solutions obtained in Theorems 1 and 3, we can get \(\tau ^{\text {RP}}-\tau ^{\mathrm{RN}}=\frac{\left( \beta +p_c\right) \left( 1-p_c \left( e_r+e_m\right) \right) }{4 (1-\eta ) -\left( \beta +p_c\right) {}^2}-\frac{p_c \left( 1-p_c \left( e_r+e_m\right) \right) }{4 (1-\eta ) -p_c^2}\). We can easily get

\(\left( \beta +p_c\right) \left( 1-p_c \left( e_r+e_m\right) \right) >p_c \left( 1-p_c \left( e_r+e_m\right) \right) \) and \(4 (1-\eta ) -\left( \beta +p_c\right) {}^2<4 (1-\eta ) -p_c^2\); thus, \(\tau ^{\text {RP}}-\tau ^{\mathrm{RN}}>0\), namely, \(\tau ^{\text {RP}}>\tau ^{\mathrm{RN}}\). Similarly, we can obtain

\(\pi _r^{\text {RP}}-\pi _r^{\mathrm{RN}}=\frac{(1-\eta ) ^2 \left( 1-p_c \left( e_r+e_m\right) \right) {}^2}{\left( 4 (1-\eta ) -\left( \beta +p_c\right) {}^2\right) {}^2}-\frac{(1-\eta ) ^2 \left( 1-p_c \left( e_r+e_m\right) \right) {}^2}{\left( 4 (1-\eta ) -p_c^2\right) {}^2}>0\),

\(\pi _m^{\text {RP}}-\pi _m^{\mathrm{RN}}=\frac{(1-\eta ) \left( 1-p_c \left( e_r+e_m\right) \right) {}^2}{2 \left( 4 (1-\eta ) -\left( \beta +p_c\right) {}^2\right) }-\frac{(1-\eta ) \left( 1-p_c \left( e_r+e_m\right) \right) {}^2}{2 \left( 4 (1-\eta ) -p_c^2\right) }>0\).

Proposition 6 is proved.

1.13 C.2 Threshold values

See Table 4

Rights and permissions

About this article

Cite this article

Liu, J., Ke, H. Firms’ strategy analysis under different retailing formats considering emission reduction efficiency and low-carbon preference. Soft Comput 25, 6691–6706 (2021). https://doi.org/10.1007/s00500-021-05667-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00500-021-05667-8