Abstract

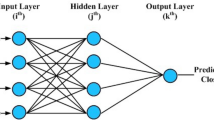

This paper compares a feature transformation method using a genetic algorithm (GA) with two conventional methods for artificial neural networks (ANNs). In this study, the GA is incorporated to improve the learning and generalizability of ANNs for stock market prediction. Daily predictions are conducted and prediction accuracy is measured. In this study, three feature transformation methods for ANNs are compared. Comparison of the results achieved by a feature transformation method using the GA to the other two feature transformation methods shows that the performance of the proposed model is better. Experimental results show that the proposed approach reduces the dimensionality of the feature space and decreases irrelevant factors for stock market prediction.

Similar content being viewed by others

References

Bigus JP (1996) Data mining with neural networks: solving business problems from application development to decision support. McGraw-Hill, New York

Liu H, Motoda H (1998) Feature transformation and subset selection. IEEE Intell Syst Appl 13(2):26–28

Kimoto T, Asakawa K, Yoda M, Takeoka M (1990) Stock market prediction system with modular neural network. In: Proceedings of the international joint conference on neural networks (IJCNN), Washington, DC, June 1990, pp 1–6

Kamijo K, Tanigawa T (1990) Stock price pattern recognition: a recurrent neural network approach. In: Proceedings of the international joint conference on neural networks (IJCNN), Washington, DC, June 1990, pp 215–221

Ahmadi H (1990) Testability of the arbitrage pricing theory by neural networks. In: Proceedings of the international joint conference on neural networks (IJCNN), Washington, DC, June 1990, pp 385–393

Yoon Y, Swales G (1991) Predicting stock price performance: a neural network approach. In: Proceedings of the 24th annual Hawaii international conference on system sciences (HICSS-24), Kauai, Hawaii, January 1991, pp 156–162

Trippi RR, DeSieno D (1992) Trading equity index futures with a neural network. J Portfolio Manag 19:27–33

Choi JH, Lee MK, Rhee MW (1995) Trading S&P 500 stock index futures using a neural network. In: Freedman RS (ed) Proceedings of the 3rd annual international conference on artificial intelligence applications on Wall Street, New York, June 1995, pp 63–72

Tsaih R, Hsu Y, Lai CC (1998) Forecasting S&P 500 stock index futures with a hybrid AI system. Decis Support Syst 23(2):161–174

Kohara K, Ishikawa T, Fukuhara Y, Nakamura Y (1997) Stock price prediction using prior knowledge and neural networks. Int J Intell Syst Accounting Finance Manage 6(1):11–22

Lawrence S, Tsoi AC, Giles CL (1996) Noisy time series prediction using symbolic representation and recurrent neural network grammatical inference. Technical report UMIACS-TR-96–27 and CS-TR-3625, Institute for Advanced Computer Studies, University of Maryland

Sexton RS, Alidaee B, Dorsey RE, Johnson JD (1998) Global optimization for artificial neural networks: a tabu search application. Eur J Operational Res 106(2–3):570–584

Sexton RS, Dorsey RE, Johnson JD (1998) Toward global optimization of neural networks: a comparison of the genetic algorithm and backpropagation. Decis Support Syst 22(2):171–185

Adeli H, Hung S (1995) Machine learning: neural networks, genetic algorithms, and fuzzy systems. Wiley, New York

Bauer RJ (1994) Genetic algorithms and investment strategies. Wiley, New York

Davis L (1994) Genetic algorithms and financial applications. In: Deboeck GJ (ed) Trading on the edge. Wiley, New York, pp 133–147

Hertz A, Kobler D (2000) A framework for the description of evolutionary algorithms. Eur J Operational Res 126(1):1–12

Wong F, Tan C (1994) Hybrid neural, genetic, and fuzzy systems. In: Deboeck GJ (ed) Trading on the edge. Wiley, New York, pp 243–261

Liu H, Setiono R (1996) Dimensionality reduction via discretization. Knowl Based Syst 9(1):67–72

Dash M, Liu H (1997) Feature selection methods for classifications. Intell Data Anal Int J 1(3):131–156

Dougherty J, Kohavi R, Sahami M (1995) Supervised and unsupervised discretization of continuous features. In: Prieditis A, Russell S (eds) Proceedings of the 12th international conference on machine learning (ICML), Tahoe City, California, July 1995. Morgan Kaufmann, San Francisco, pp 194–202

Scott PD, Williams KM, Ho KM (1997) Forming categories in exploratory data analysis and data mining. In: Liu X, Cohen PR, Berthold MR (1997) Proceedings of the 2nd international symposium on advances in intelligent data analysis (IDA’97), London, UK, August 1997. Springer, Berlin Heidelberg New York, pp 235–246

Susmaga R (1997) Analyzing discretizations of continuous attributes given a monotonic discrimination function. Intell Data Anal Int J 1(3):157–179

Raymer ML, Punch WF, Goodman ED, Kuhn LA, Jain AK (2000) Dimensionality reduction using genetic algorithms. IEEE Trans Evol Comput 4(2):164–171

Chou ST, Hsu H, Yang C, Lai F (1997) A stock selection DSS combining AI and technical analysis. Ann Operations Res 75:335–353

Klimasauskas CC (1992) Hybrid fuzzy encodings for improved backpropagation performance. Advanced technology for developers, September 1992, pp 13–16

Liu H, Motoda H (1998) Feature selection for knowledge discovery and data mining. Kluwer, Norwell, Massachusetts

Achelis SB (1995) Technical analysis from A to Z. Probus Publishing, Chicago, Illinois

Murphy JJ (1986) Technical analysis of the futures markets: a comprehensive guide to trading methods and applications. New York Institute of Finance, Prentice-Hall, New York

Choi J (1995) Technical indicator. Jinritamgu Publishing, Seoul, Korea

Chang J, Jung Y, Yeon K, Jun J, Shin D, Kim H (1996) Technical indicators and analysis methods. Jinritamgu Publishing, Seoul, Korea

Edwards RD, Magee J (1997) Technical analysis of stock trends, 7th edn. Amacom, New York

Acknowledgements

This work is supported by the Dongguk University Research Fund.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kim, Kj., Lee, W.B. Stock market prediction using artificial neural networks with optimal feature transformation. Neural Comput & Applic 13, 255–260 (2004). https://doi.org/10.1007/s00521-004-0428-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-004-0428-x