Abstract

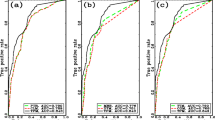

Empirical studies of variations in debt ratios across firms have analyzed important determinants of capital structure using statistical models. Researchers, however, rarely employ nonlinear models to examine the determinants and make little effort to identify a superior prediction model among competing ones. This paper reviews the time-series cross-sectional (TSCS) regression and the predictive abilities of neural network (NN) utilizing panel data concerning debt ratio of high-tech industries in Taiwan. We built models with these two methods using the same set of measurements as determinants of debt ratio and compared the forecasting performance of five models, namely, three TSCS regression models and two NN models. Models built with neural network obtained the lowest mean square error and mean absolute error. These results reveal that the relationships between debt ratio and determinants are nonlinear and that NNs are more competent in modeling and forecasting the test panel data. We conclude that NN models can be used to solve panel data analysis and forecasting problems.

Similar content being viewed by others

References

Judge G, Griffiths W, Hill R, Lee T (1980) The theory and practice of econometrics. John Willey and Sons, New York

Dielman T (1983) Pooled cross-sectional and time-series data: a survey of current statistical methodology. The Am Statistician 37:111–122

Hsiao C (1986) Analysis of panel data. Cambridge University Press, Cambridge

Booth L, Aivazian V, Demirguc-Kunt A, Maksimovic V (2001) Capital structure in developing countries. J Financ 56(1):87–130

Myers SC, Majluf NS (1984) Corporate finance and investment decisions when firms have information that investors do not have. J Financ Econ 13:187–221

Shyam-Sunder L, Myers S (1999) Testing static tradeoff against pecking order models of capital structure. J Financ Econ 51:219–244

Haugen R, Senbet L (1986) Corporate finance and taxes: a review. Financial Manage. 15:5–22

Zimmerman J (1983) Taxes and firm size. J Account Econom 5:119–149

Titman S, Wessels R (1988) The determinants of capital structure choice. J Financ 43:1–20

Myers SC (1984) The capital structure puzzle. J Financ 39:575–592

Myers SC (1977) Determinants of corporate borrowing. J Financ Econ 5:147–175

Miller Merton, Modigliani F (1961) Dividend policy, growth and the valuation of shares. J Bus 34:411–433

Kim WS, Sorensen EH (1986) Evidence on the impact of the agency cost of debt on corporate debt policy. J Financ Quant Anal 21:131–144

Mehran H (1992) Executive incentive plans, corporate control, and capital structure. J Financ Quant Anal 27:539–560

Fuller WA, Battese GE (1974) Estimation of linear models with crossed-error structure. J Econometrics 2:67–78

Parks RW (1967) Efficient estimation of a system of regression equations when disturbances are both serially and contemporaneously correlated. J Am Stat Assoc 62:500–509

Da Silva JGC (1975) The analysis of cross-sectional time series data, PhD dissertation, Department of Statistics, North Carolina State University

Hill T, O’Connor WRM (1996) Neural network models for time series forecasts Manage Sci 42(7):1082–1092

Chiang WC, Urban TL, Baldridge GW (1996) A neural network approach to mutual fund net asset value forecasting, Omega. Int J Manage Sci 24(2):205–215

Liu MC, Kuo W, Sastri T (1995) An exploratory study of a neural network approach for reliability data analysis, Qual Reliab Eng Int 11:107–112

Hwang JN, Choi JJ, Oh S, Marks RJ (1991) Query based learning applied to partially trained multilayer perceptron. IEEE T-NN 2(1):131–136

Yokum JT, Armstrong JS (1995) Beyond accuracy: comparison of criteria used to select forecasting methods. Int J Forecast 11(4):591–597

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Pao, HT., Chih, YY. Comparison of TSCS regression and neural network models for panel data forecasting: debt policy. Neural Comput & Applic 15, 117–123 (2006). https://doi.org/10.1007/s00521-005-0014-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-005-0014-x