Abstract

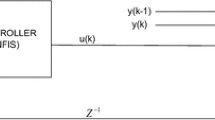

This study aims to examine the fundamental forces driving stock returns and volatility across the international stock markets. Logistic regression analysis is used to investigate possible highly correlated among 9 international stock markets with stock market of Taiwan. Afterward, the highly correlated stock indices with Taiwan would be selected as the input variables of adaptive network-based fuzzy inference system (ANFIS) model to predict stock prices and their direction of Taiwan Stock Exchange Capitalization Weighted Stock Index. The experimental results of the proposed model are contrasted with other models including the first-order model (Chen in Fuzzy Sets Syst 81(3):311–319, 1996), weighted fuzzy time series model (Yu in 349:609–624, 2005), simple neural network model (Huarng and Yu in Phys A 363(2):481–491, 2006), multivariate model (Huarng et al. in J Travel Tour Mark 21(4):15–24, 2007), ANFIS with volatility causality (Cheng et al. in Neurocomputing 72(16–18):3462–3468, 2009), ANFIS with AR model (Chang et al. in Appl Soft Comput 11:1388–1395, 2011), and artificial bee colony-recurrent neural network model (Hsieh et al. in Applied Soft Computing 11:2510–2525, 2011). Finally, the proposed model produces with lower inaccuracy rate and offers higher direction preciseness than above previous models. The benefit of this methodology depended on its application of a hybrid approach to predict the stock prices and direction with higher accuracy.

Similar content being viewed by others

References

Ng A (2000) Volatility spillover effects from Japan and the US to the Pacific–Basin. J Int Money Finance 19:207–233

Eun CS, Shim S (1989) International transmission of stock market movements. J Financ Quant Anal 24(2):241–256

Dickinson DG (2000) Stock market integration and macroeconomic fundamentals: an empirical analysis. Appl Financ Econ 10(3):261–276

Bekaert G, Harvey CR (2000) Foreign speculators and emerging equity markets. J Financ 55:565–613

Kim HW, Stern L, Stern M (2009) Nonlinear mean reversion in the G7 stock markets. Appl Financ Econ 19:347–355

Ahn ES, Kudo FT (2011) Transmission of returns between the US stock market and four other major international stock market indexes. J Econ Int Financ 3(7):468–474

Sakthivel P, Bodkhe N, Kamaiah B (2012) Correlation and volatility transmission across International Stock Markets: a Bivariate GARCH analysis. Int J Econ Financ 4(3):253–264

Cheng CH, Wei LY (2009) Volatility model based on multi-stock index for TAIEX forecasting. Expert Syst Appl 36(3):6187–6191

Chen SM (1996) Forecasting enrollments based on fuzzy time series. Fuzzy Sets Syst 81(3):311–319

Huarng K, Yu HK (2006) The application of neural networks to forecast fuzzy time series. Phys A 363(2):481–491

Constantinou E, Kazandjian A, Kouretas GP, Tahmazian V (2005) Co-integration, causality and domestic portfolio diversification in the cyprus stock exchange. Working paper: University of Crete

Bekaert G, Harvey C (1997) Emerging equity market volatility. J Financ Econ 43:29–77

Worthington A, Higgs H (2004) Transmission of equity returns and volatility in Asian developed and emerging markets: a multivariate GARCH analysis. Int J Financ Econ 9:71–80

Singh P, Kumar B, Pandey A (2010) Price and volatility spillovers across North American, European and Asian stock markets. Int Rev Financ Anal 19:55–64

Ibrahim BM, Brzeszczynski J (2009) Inter-regional and region-specific transmission of international stock market returns: the role of foreign information. J Int Money Financ 28:322–343

Yu THK (2005) Weighted fuzzy time series models for TAIEX forecasting. Phys A 349:609–624

Huarng KH, Moutinho L, Yu THK (2007) An advanced approach to forecasting tourism demand in Taiwan. J Travel Tour Mark 21(4):15–24

Cheng CH, Wei LY, Chen YS (2009) Fusion ANFIS models based on multi-stock volatility causality for TAIEX forecasting. Neurocomputing 72(16–18):3462–3468

Chang JR, Wei LY, Cheng CH (2011) A hybrid ANFIS model based on AR and volatility for TAIEX Forecasting. Appl Soft Comput 11:1388–1395

Hsieh TJ, Hsiao HF, Yeh WC (2011) Forecasting stock markets using wavelet transforms and recurrent neural networks: an integrated system based on artificial bee colony algorithm. Appl Soft Comput 11:2510–2525

Zadeh LA (1965) Fuzzy sets. Inf Control 8:338–353

Chen MY (2013) A Hybrid ANFIS Model for business failure prediction—utilization of particle swarm optimization and subtractive clustering. Inf Sci 220:180–195

Donaldson RG, Kamstra M (1999) Neural network forecast combining with interaction effects. J Franklin Inst 336(2):227–236

Melin P, Castillo O (2004) Intelligent control of a stepping motor drive using a hybrid neuro-fuzzy approach. Soft Comput A Fusion Found Methodol Appl 8(8):546–555

Melin P, Castillo O (2005) Intelligent control of a stepping motor drive using an adaptive neuro-fuzzy inference system. Inf Sci 170(2–4):133–151

Fan MH, Huang HF, Chen MY, Huang TY (2012) The case study of adaptive network-based fuzzy inference system modeling for TAIEX prediction. IEEE the sixth international conference on genetic and evolutionary computing (IEEE ICGEC2012), Kitakyushu, Japan

Song Q, Chissom BS (1993) Forecasting enrollments with fuzzy time series Part I. Fuzzy Set Syst 54:1–10

Keles A, Kolcak M, Keles A (2008) The adaptive neuro-fuzzy model for forecasting the domestic debt. Knowl-Based Syst 21:951–957

Chavarnakul T, Enke D (2009) A hybrid stock trading system for intelligent technical analysis-based equivolume charting. Neurocomputing 72(16–18):3517–3528

Esfahanipour A, Aghamiri W (2010) Adapted Neuro-Fuzzy inference system on indirect approach TSK fuzzy rule base for stock market analysis. Expert Syst Appl 37:4742–4748

Atsalakis GS, Dimitrakakis EM, Zopounidis CD (2011) Elliott Wave Theory and neuro-fuzzy systems, in stock market prediction: the WASP system. Expert Syst Appl 38:9196–9206

Alizadeh M, Jolai F, Aminnayeri M, Rada R (2012) Comparison of different input selection algorithms in neuro-fuzzy modeling. Expert Syst Appl 39:1536–1544

Jilani TA, Burney SMA (2008) A refined fuzzy time series model for stock market forecasting. Phys A 387:2857–2862

Chen MY (2011) Predicting corporate financial distress based on integration of decision tree classification and logistic regression. Expert Syst Appl 38(9):11261–11727

Chen MY (2012) Visualization and dynamic evaluation model of corporate financial structure with self-organizing map and support vector regression. Appl Soft Comput 12(8):2274–2288

Chen MY (2011) Bankruptcy prediction in firms with statistical and intelligent techniques and a comparison of evolutionary computation approaches. Comput Math Appl 62(12):4514–4524

Shie FS, Chen MY, Liu YS (2012) Prediction of corporate financial distress: an application of the America banking industry. Neural Comput Appl 21(7):1687–1696

Jang JS (1993) ANFIS: adaptive-network-based fuzzy inference system. IEEE Tran Syst Man Cybern 23(3):665–685

Jang JS, Sun CT, Mizutani E (1997) Neuro-Fuzzy and soft computing: a computational approach to learning and machine intelligence. Prentice Hall, Englewood Cliffs

Bahrammirzaee A (2010) A comparative survey of artificial intelligence applications in finance: artificial neural networks, expert system and hybrid intelligent systems. Neural Comput Appl 19(8):1165–1195

Abiyev RH (2011) Fuzzy wavelet neural network based on fuzzy clustering and gradient techniques for time series prediction. Neural Comput Appl 20(2):249–259

Cheng CH, Chen TL, Wei LY (2010) A hybrid model based on rough sets theory and genetic algorithms for stock price forecasting. Inf Sci 180(9):1610–1629

Acknowledgments

The authors would like to thank Professor Hui-Feng Huang for her constructive suggestions for ANFIS model implementation. In addition, authors also gratefully acknowledge the editor and anonymous reviewers for their valuable comments.

Author information

Authors and Affiliations

Corresponding author

Appendix

Rights and permissions

About this article

Cite this article

Chen, MY., Chen, DR., Fan, MH. et al. International transmission of stock market movements: an adaptive neuro-fuzzy inference system for analysis of TAIEX forecasting. Neural Comput & Applic 23 (Suppl 1), 369–378 (2013). https://doi.org/10.1007/s00521-013-1461-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00521-013-1461-4