Abstract

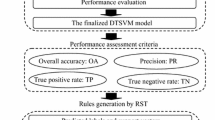

Financial distress prediction is very important to financial institutions who must be able to make critical decisions regarding customer loans. Bankruptcy prediction and credit scoring are the two main aspects considered in financial distress prediction. To assist in this determination, thereby lowering the risk borne by the financial institution, it is necessary to develop effective prediction models for prediction of the likelihood of bankruptcy and estimation of credit risk. A number of financial distress prediction models have been constructed, which utilize various machine learning techniques, such as single classifiers and classifier ensembles, but improving the prediction accuracy is the major research issue. In addition, aside from improving the prediction accuracy, there have been very few studies that specifically consider lowering the Type I error. In practice, Type I errors need to receive careful consideration during model construction because they can affect the cost to the financial institution. In this study, we introduce a classifier ensemble approach designed to reduce the misclassification cost. The outputs produced by multiple classifiers are combined by utilizing the unanimous voting (UV) method to find the final prediction result. Experimental results obtained based on four relevant datasets show that our UV ensemble approach outperforms the baseline single classifiers and classifier ensembles. Specifically, the UV ensemble not only provides relatively good prediction accuracy and minimizes Type I/II errors, but also produces the smallest misclassification cost.

Similar content being viewed by others

References

Altman EI (1968) Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. J Finance 23:589–609

Balcaen S, Ooghe H (2006) 35 years of studies on business failure: an overview of the classic statistical methodologies and their related problems. Br Account Rev 38:63–93

Beaver WH (1966) Financial ratios as predictors of failure. J Account Res 4:71–111

Bishop CM (1995) Neural networks for pattern recognition. Oxford University Press, Oxford

Boritz JE, Kennedy DB (1995) Effectiveness of neural network types for prediction of business failure. Expert Syst Appl 9:503–512

Breiman L (1996) Bagging predictors. Mach Learn 24(2):123–140

Clyde MA, Lee HK (2001) Bagging and the Bayesian bootstrap. In: International conference on artificial intelligence and statistics, pp 169–174

Crook JN, Edelman DB, Thomas LC (2007) Recent developments in consumer credit risk assessment. Eur J Oper Res 183:1447–1465

Demsar J (2006) Statistical comparisons of classifiers over multiple data sets. J Mach Learn Res 7:1–30

Dietterich TG (1997) Machine-learning research. AI Mag 18:97

Ethem A (2004) Introduction to machine learning. MIT Press, Cambridge

Fawcett T (2006) An introduction to ROC analysis. Pattern Recogn Lett 27:861–874

Fitzpartrick PJ (1932) A comparison of the ratios of successful industrial enterprises with those of failed companies. The Accountants Publishing Company.

Freund Y, Schapire RE (July 1996) Experiments with a new boosting algorithm. In: Proceedings of the international conference on machine learning, Bari, Italy, pp 148–156

Geng R, Bose I, Chen X (2015) Prediction of financial distress: an empirical study of listed Chinese companies using data mining. Eur J Oper Res 241:236–247

Heo J, Yang JY (2014) AdaBoost based bankruptcy forecasting of Korean construction companies. Appl Soft Comput 24:494–499

John GH Langley P (1995) Estimating continuous distributions in Bayesian classifiers. In: International conference on uncertainty in artificial intelligence, pp 338–345

Kim H, Kim H, Moon H, Ahn H (2011) A weight-adjusted voting algorithm for ensembles of classifiers. J Korean Stat Soc 40:437–449

Kittler J, Hatef M, Duin RPW, Matas J (1998) On combining classifiers. IEEE Trans Pattern Anal Mach Intell 20(3):226–239

Kohavi R (1995) A study of cross-validation and bootstrap for accuracy estimation and model selection. In: International joint conference on artificial intelligence, pp 1137–1143

Kumar PR, Ravi V (2007) Bankruptcy prediction in banks and firms via statistical and intelligent techniques—a review. Eur J Oper Res 180:1–28

Lei S, Xinming M, Lei X, Xiaohong H (2010) Financial data mining based on support vector machines and ensemble learning. In: International conference on intelligent computation technology and automation, pp 313–314

Li H, Sun J, Wu J (2010) Predicting business failure using classification and regression tree: an empirical comparison with popular classical statistical methods and top classification mining methods. Expert Syst Appl 37:5895–5904

Lin W-Y, Hu Y-H, Tsai C-F (2012) Machine learning in financial crisis prediction: a survey. IEEE Trans Syst Man Cybern Part C Appl Rev 42(4):421–436

Ohlson JA (1980) Financial ratios and the probabilistic prediction of bankruptcy. J Account Res 18:109–131

Ozkan-Gunay EN, Ozkan M (2007) Prediction of bank failures in emerging financial markets: an ANN approach. J Risk Finance 8:465–480

Paleologo G, Elisseeff A, Antonini G (2010) Subagging for credit scoring models. Eur J Oper Res 201:490–499

Sexton RS, Sriram RS, Etheridge H (2003) Improving decision effectiveness of artificial neural networks: a modified genetic algorithm approach. Decis Sci 34:421–442

Shi L, Xi L, Ma X, Hu X (2009) Bagging of artificial neural networks for bankruptcy prediction. In: International conference on information and financial engineering, pp 154–156

Shin K-S, Lee TS, Kim H-J (2005) An application of support vector machines in bankruptcy prediction model. Expert Syst Appl 28:127–135

Tam KY, Kiang MY (1992) Managerial applications of neural networks: the case of bank failure predictions. Manag Sci 38:926–947

Tsai C-F (2009) Feature selection in bankruptcy prediction. Knowl Based Syst 22:120–127

Verikas A, Kalsyte Z, Bacauskiene M, Gelzinis A (2010) Hybrid and ensemble-based soft computing techniques in bankruptcy prediction: a survey. Soft Comput 14:995–1010

Wang G, Hao J, Ma J, Jiang H (2011) A comparative assessment of ensemble learning for credit scoring. Expert Syst Appl 38:223–230

Wang G, Ma J (2012) A hybrid ensemble approach for enterprise credit risk assessment based on support vector machine. Expert Syst Appl 39(5):5325–5331

Wang S-J, Mathew A, Chen Y, Xi L-F, Ma L, Lee J (2009) Empirical analysis of support vector machine ensemble classifiers. Expert Syst Appl 36:6466–6476

West D (2000) Neural network credit scoring models. Comput Oper Res 27:1131–1152

West D, Dellana S, Qian J (2005) Neural network ensemble strategies for financial decision applications. Comput Oper Res 32:2543–2559

Wolpert DH (1992) Stacked generalization. Neural Netw 5(2):241–259

Wu X, Kumar V, Quinlan JR, Ghosh J, Yang Q, Motoda H, McLachlan GJ, Ng A, Liu B, Yu PS, Zhou Z-H, Steinbach M, Hand DJ, Steinberg D (2008) Top 10 algorithms in data mining. Knowl Inf Syst 14:1–37

Xu X Frank E (2004) Logistic regression and boosting for labeled bags of instances. In: Dai H, Srikant R, Zhang C (eds) Proceedings 8th Pacific-Asia Conference, PAKDD 2004, Sydney, Australia, 26–28 May 2004. Springer, Berlin, pp. 272–281

Yao P (2009) Credit scoring using ensemble machine learning. In: International conference on hybrid intelligent systems, pp 244–246

Zhang D, Zhou X, Leung SCH, Zheng J (2010) Vertical bagging decision trees model for credit scoring. Expert Syst Appl 37:7838–7843

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Liang, D., Tsai, CF., Dai, AJ. et al. A novel classifier ensemble approach for financial distress prediction. Knowl Inf Syst 54, 437–462 (2018). https://doi.org/10.1007/s10115-017-1061-1

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10115-017-1061-1