Abstract

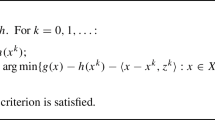

We present a new algorithm, iterative estimation maximization (IEM), for stochastic linear programs with conditional value-at-risk constraints. IEM iteratively constructs a sequence of linear optimization problems, and solves them sequentially to find the optimal solution. The size of the problem that IEM solves in each iteration is unaffected by the size of random sample points, which makes it extremely efficient for real-world, large-scale problems. We prove the convergence of IEM, and give a lower bound on the number of sample points required to probabilistically bound the solution error. We also present computational performance on large problem instances and a financial portfolio optimization example using an S&P 500 data set.

Similar content being viewed by others

References

Acerbi C, Tasche D (2002) On the coherence of expected shortfall. J Bank Financ 26: 1487–1503

Alexander GJ, Baptista AM (2004) A comparison of VaR and CVaR constraints on portfolio selection with the mean-variance model. Manag Sci 50(9): 1261–1273

Artzner P, Delbaen F, Eber J, Heath D (1999) Coherent measures of risk. Math Financ 9: 203–228

Kall P, Mayer J (2005) Stochastic linear programming: models, theory, and computation. Springer, Berlin

Krokhmal P, Palmquist J, Uryasev S (2002) Portfolio optimization with conditional value-at-risk objective and constraints. J Risk 4(2): 11–27

Künzi-Bay A, Mayer J (2006) Computational aspects of minimizing conditional value-at-risk. Comput Manag Sci 3: 3–27

Lübbecke ME, Desrosiers J (2005) Selected topics in column generation. Oper Res 53: 1007–1023

Manistre BJ, Hancock GH (2005) Variance of the CTE estimator. North Am Actuar J 9: 129–156

Nagaraja HN (1982) Some nondegenerate limit laws for the selection differential. Ann Stat 10: 1306–1310

Nemirovski A, Shapiro A (2006) Convex approximations of chance constrained programs. SIAM J Optim 17: 969–996

Rockafellar RT, Uryasev S (2000) Optimization of conditional value-at-risk. J Risk 2: 21–41

Rockafellar RT, Uryasev S (2002) Conditional value-at-risk for general loss distributions. J Bank Financ 26: 1443–1471

Shapiro A (2003) Monte carlo sampling methods. In: Ruszczynski A, Shapiro A (eds) Handbooks in Operations Research and Management Science vol 10. Elsevier, Amsterdam, pp 353–425

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Huang, P., Subramanian, D. Iterative estimation maximization for stochastic linear programs with conditional value-at-risk constraints. Comput Manag Sci 9, 441–458 (2012). https://doi.org/10.1007/s10287-011-0135-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10287-011-0135-x