Abstract

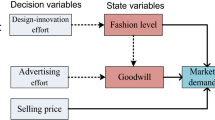

Firms in the fashion industry frequently launch new styles of their products, thereby leading to a ‘two-period’ phenomenon in product sales: the normal selling time and the last salvage time. Researches about cooperative (co-op) advertising, however, seldom concentrate on this phenomenon. This study explores co-op advertising in a two-period fashion supply chain system in which the retailer offers a price discount in the second period. We derive the optimal pricing, product design level and advertising efforts in two scenarios: a decentralised scenario with a co-op advertising program and integrated scenario. Additionally, we propose a bilateral participation-revenue-sharing contract to coordinate this channel. Some insights and management implications are obtained. Firstly, if the consumers are insensitive to the first-period price, the retailer will set a high retail price in this period, while selling the product at a big discount in the second period to stimulate extra consumption. Secondly, if the price elasticity of demand is small, the retailer will spend more on the advertisement, otherwise the condition is opposite. Lastly, this study verifies that the bilateral participation-revenue-sharing contract can achieve a seamless coordination in this supply chain with a transfer payment.

Similar content being viewed by others

References

Ahmadi-Javid A, Hoseinpour P (2018) Cooperative advertising in a capacitated manufacturer–retailer supply chain: a game-theoretic approach. Int Trans Oper Res 25(5):1677–1694

Bergen M, John G (1997) Understanding cooperative advertising participation rates in conventional channels. J Mark Res 34:357–369

Berger PD (1972) Vertical cooperative advertising ventures. J Mark Res 9(3):309–312

Berger PD, Lee J, Weinberg BD (2006) Optimal cooperative advertising integration strategy for organizations adding a direct online channel. J Oper Res Soc 57(8):920–927

Chao GH, Iravani SMR, Savaskan RC (2009) Quality improvement incentives and product recall cost sharing contracts. Manag Sci 55(7):1122–1138

Chen TH (2011) Coordinating the ordering and advertising policies for a single-period commodity in a two-level supply chain. Comput Ind Eng 61(4):1268–1274

Chen TH (2015) Effects of the pricing and cooperative advertising policies in a two-echelon dual-channel supply chain. Comput Ind Eng 87:250–259

Chiang WYK, Chhajed D, Hess JD (2003) Direct marketing, indirect profits: a strategic analysis of dual-channel supply-chain design. Manag Sci 49(1):1–20

Chintagunta PK, Jain D (1992) A dynamic model of channel member strategies for marketing expenditures. Mark Sci 11(2):168–188

Chutani A, Sethi SP (2018) Dynamic cooperative advertising under manufacturer and retailer level competition. Eur J Oper Res 268(2):635–652

Dant RP, Berger PD (1996) Modelling cooperative advertising decisions in franchising. J Oper Res Soc 47(9):1120–1136

De Giovanni P, Karray S, Martín-Herrán G (2019) Vendor Management Inventory with consignment contracts and the benefits of cooperative advertising. Eur J Oper Res 272(2):465–480

Giannoccaro I, Pontrandolfo P (2004) Supply chain coordination by revenue sharing contracts. Int J Prod Econ 89(2):131–139

Gou Q, Zhang J, Liang L, Huang Z, Ashley A (2014) Horizontal cooperative programmes and cooperative advertising. Int J Prod Res 52(3):691–712

Güler MG (2019) Advertising and forecasting investments of a newsvendor. 4OR 17(1):45–73

Guo Z, Ma J (2018) Dynamics and implications on a cooperative advertising model in the supply chain. Commun Nonlinear Sci Numer Simul 64:198–212

He X, Prasad A, Sethi SP (2009) Cooperative advertising and pricing in a dynamic stochastic supply chain: feedback Stackelberg strategies. Prod Oper Manag 18(1):78–94

He X, Krishnamoorthy A, Prasad A, Sethi SP (2011) Retail competition and cooperative advertising. Oper Res Lett 39(1):11–16

He X, Krishnamoorthy A, Prasad A, Sethi SP (2012) Co-op advertising in dynamic retail oligopolies. Decis Sci 43(1):73–106

He Y, Gou Q, Wu C, Yue X (2013) Cooperative advertising in a supply chain with horizontal competition. Math Probl Eng 2013:1–16

He Y, Liu Z, Usman K (2014) Coordination of cooperative advertising in a two-period fashion and textiles supply chain. Math Probl Eng 2014(9):1–10

He Y, Xu Q, Xu B, Wu P (2016) Supply chain coordination in quality improvement with reference effects. J Oper Res Soc 67(9):1158–1168

Huang Z, Li SX (2001) Co-op advertising models in manufacturer–retailer supply chains: a game theory approach. Eur J Oper Res 135(3):527–544

Jørgensen S, Sigué SP, Zaccour G (2000) Dynamic cooperative advertising in a channel. J Retail 76(1):71–92

Jørgensen S, Taboubi S, Zaccour G (2001) Cooperative advertising in a marketing channel. J Optim Theory Appl 110(1):145–158

Jørgensen S, Taboubi S, Zaccour G (2003) Retail promotions with negative brand image effects: Is cooperation possible? Eur J Oper Res 150(2):395–405

Karray S, Amin SH (2015) Cooperative advertising in a supply chain with retail competition. Int J Prod Res 53(1):88–105

Karray S, Zaccour G (2006) Could co-op advertising be a manufacturer’s counterstrategy to store brands? J Bus Res 59(9):1008–1015

Karray S, Martín-Herrán G, Sigué SP (2017) Cooperative advertising for competing manufacturers: the impact of long-term promotional effects. Int J Prod Econ 184:21–32

Leng M, Zhu A (2009) Side-payment contracts in two-person nonzero-sum supply chain games: review, discussion and applications. Eur J Oper Res 196(2):600–618

Leng M, Li Z, Liang L (2016) Implications for the role of retailers in quality assurance. Prod Oper Manag 25(5):779–790

Li SX, Huang Z, Zhu J, Chau PYK (2002) Cooperative advertising, game theory and manufacturer–retailer supply chains. Omega 30(5):347–357

Martín-Herrán G, Sigué SP (2017) An integrative framework of cooperative advertising: Should manufacturers continuously support retailer advertising? J Bus Res 70:67–73

Nagler MG (2006) An exploratory analysis of the determinants of cooperative advertising participation rates. Mark Lett 17(2):91–102

Nash JF Jr (1950) The bargaining problem. Econom J Econom Soc 18(2):155–162

Nerlove M, Arrow KJ (1962) Optimal advertising policy under dynamic conditions. Economica 29(114):129–142

Sethi SP (1983) Deterministic and stochastic optimization of a dynamic advertising model. Opt Control Appl Methods 4(2):179–184

Xie J, Neyret A (2009) Co-op advertising and pricing models in a manufacturer–retailer supply chain. Comput Ind Eng 56(4):1375–1385

Xie J, Wei JC (2009) Coordinating advertising and pricing in a manufacturer–retailer channel. Eur J Oper Res 197(2):785–791

Yan R (2010) Cooperative advertising, pricing strategy and firm performance in the e-marketing age. J Acad Mark Sci 38(4):510–519

Yan R, Cao Z, Pei Z (2016) Manufacturer's cooperative advertising, demand uncertainty, and information sharing. J Bus Res 69(2):709–717

Yang J, Xie J, Deng X, Xiong H (2013) Cooperative advertising in a distribution channel with fairness concerns. Eur J Oper Res 227(2):401–407

Yue J, Austin J, Wang MC, Huang Z (2006) Coordination of cooperative advertising in a two-level supply chain when manufacturer offers discount. Eur J Oper Res 168(1):65–85

Zhang J, Gou Q, Liang L, Huang Z (2013) Supply chain coordination through cooperative advertising with reference price effect. Omega 41(2):345–353

Zhang J, Gou Q, Zhang J, Liang L (2014) Supply chain pricing decisions with price reduction during the selling season. Int J Prod Res 52(1):165–187

Zhou E, Zhang J, Gou Q, Liang L (2015) A two period pricing model for new fashion style launching strategy. Int J Prod Econ 160:144–156

Zhou YW, Li J, Zhong Y (2018) Cooperative advertising and ordering policies in a two-echelon supply chain with risk-averse agents. Omega 75:97–117

Zhu K, Zhang RQ, Tsung F (2007) Pushing quality improvement along supply chains. Manag Sci 53(3):421–436

Acknowledgements

This work was supported by the National Natural Science Foundation of China (Grant Numbers 71502076, 71872075).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

No conflict of interest exits in the submission of this manuscript, and manuscript is approved by all authors for publication. We would like to declare on behalf of my co-author that the work described was original research that has not been published previously.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Proof of the equilibrium solutions in the decentralised scenario

The decision sequences of the supply chain members are: first, the manufacturer determines the product design level and subsidy rate \( \phi_{i} (i = 1,2) \) at the beginning of the first period; second, the retailer decides advertising efforts a1 and retail price p in the first period; third, the retailer decides advertising efforts a2 and price deduction percentage θ at the beginning of the second period.

According to the backward induction, we first solve the price deduction percentage and the advertising efforts in the second period for the retailer; the first-order conditions are as follows:

The second-order conditions are as follows:

We then can obtain the Hessian Matrix

and Δ1 = <0, Δ2 > 0. Therefore, H is negative definite. Therefore, the profit function has a maximum.

Then, we can obtain the expressions of θ and a2 by letting the first-order conditions to be zero. The price deduction percentage and the advertising efforts are as follows:

Then, we solve the optimal advertising efforts and retail price in the first period, a1 and p. Substituting Eqs. (A.3) and (A.4) into Eq. (9), we can obtain the retailer’s profit function \( \pi_{r}^{D} (a_{1} ,p) \). To maximize the profit, we can obtain the first-order conditions of a1 and p

and

The second-order conditions are:

We then can obtain the Hessian Matrix

and Δ1 = <0, Δ2 > 0. Therefore, H is negative definite. Therefore, the profit function has a maximum.

Therefore, we can obtain the expressions of a1 and p by letting the first-order conditions to be zero. The optimal advertising efforts and retail price in the first period are

Finally, substituting Eqs. (A.3), (A.4), (A.8) and (A.9) into Eq. (9), we can obtain the manufacturer’s profit function \( \pi_{m}^{D} (x,\phi_{1} ,\phi_{2} ) \). To maximize the profit, we can obtain the first-order conditions of x, ϕ1 and ϕ2: \( \partial \pi_{m}^{D} (x,\phi_{1} ,\phi_{2} )/\partial x,\partial \pi_{m}^{D} (x,\phi_{1} ,\phi_{2} )/\partial \phi_{1} \) and \( \partial \pi_{m}^{D} (x,\phi_{1} ,\phi_{2} )/\partial \phi_{2} \), respectively. And the Hessian Matrix is negative definite. Therefore, we can obtain the expressions of x, ϕ1 and ϕ2 by letting the first-order conditions to be zero. The optimal product design level and subsidy rates are

where \( A = \beta_{1} \beta_{2}^{2} \gamma w^{2} + \beta_{1}^{2} \beta_{2} w^{2} \), \( B = \beta_{1} \gamma + \beta_{2} \), \( C = \beta_{1} \beta_{2}^{2} c\gamma w + \beta_{1}^{2} \beta_{2} cw - \beta_{1} \beta_{2} c\gamma \) and \( D = \beta_{1} \beta_{2} \gamma w + \beta_{1} \beta_{2} w \).

1.2 Proof of the equilibrium solutions in the integrated scenario

The profit function of the integrated system is

Similarly, according to the backward induction, we first solve the price deduction percentage and the advertising efforts in the second period for the retailer. The first-order conditions are given by

The second-order conditions are as follows:

We then can obtain the Hessian Matrix

and Δ1 = <0, Δ2 > 0. Therefore, H is negative definite. Therefore, the profit function in the integrated scenario has a maximum.

Then, we can obtain the expressions of θ and a2 by letting the first-order conditions to be zero. The price deduction percentage and the advertising efforts in the integrated scenario are as follows:

Similarly, we get the optimal advertising efforts and retail price of the retailer and product design level of the manufacturer, a1, p and x.

Similarly, we can obtain the equilibriums in the scenario with Bilateral participation-revenue-sharing contract.

Rights and permissions

About this article

Cite this article

Yan, G., He, Y. Coordinating pricing and advertising in a two-period fashion supply chain. 4OR-Q J Oper Res 18, 419–438 (2020). https://doi.org/10.1007/s10288-019-00417-x

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10288-019-00417-x