Abstract

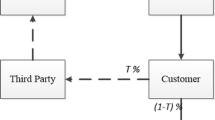

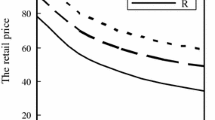

This paper studies the retailer’s optimal corporate social responsibility (CSR) investment decisions in manufacturer-collecting closed-loop supply chains (CLSCs). We establish a centralized and two decentralized models with and without considering the retailer’s CSR investment. The impacts of the supply chain structure and channel power structure on the retailer’s CSR investment decisions are analyzed. We find that (i) the retailer increases CSR investment as the remanufacturing cost savings increase or the collection cost reduces; (ii) the retailer is more willing to make a CSR investment in the centralized model than in the decentralized models; (iii) the CSR effort level in the manufacturer-led model is higher than that in the retailer-led model; and (iv) when the unit cost of CSR investment is moderate, retailer’s CSR investment benefits the retailer while harming the manufacturer; however, CSR investment always leads to a “win–win” situation when the retailer is the channel leader. Finally, we carry out numerical studies to investigate the effects of model parameters on supply chain equilibrium.

Similar content being viewed by others

Availability of data and materials

Not applicable.

Notes

Notice that under manufacturer-led and retailer-led models given in Sects. 4.2.1 and 4.2.2, (i) product remanufacturing always leads to a higher CSR effort; (ii) there also exists thresholds on \(f\) below which retailer CSR investment could result in higher return rates, otherwise CSR investment reduces the return rates. Hence, we will no longer analyze the effects of product remanufacturing on retailer’s CSR effort decisions and retailer CSR investment on manufacturer’s return decisions under manufacturer-led or retailer-led CLSC models.

In the retailer-Stackelberg model, the retailer first determines the optimal retail margin \(s^{*}\). Once the manufacturer determines the optimal wholesale price \(w^{*}\), then the retailer’s optimal retail price \(p^{*}\) is derived with \(p^{*} = s^{*} + w^{*}\).

References

Alev I, Agrawal VV, Atasu A (2020) Extended producer responsibility for durable products. Manuf Serv Oper Manag 22(2):364–382

Atasu A, Van Wassenhove LN, Sarvary M (2009) Efficient take-back legislation. Prod Oper Manag 18(3):243–258

Atasu A, Toktay LB, Van Wassenhove LN (2013) How collection cost structure drives a manufacturer’s reverse channel choice. Prod Oper Manag 22(5):1089–1102

Bian J, Li KW, Guo X (2016) A strategic analysis of incorporating CSR into managerial incentive design. Transp Res Part e: Logist Transp Rev 86:83–93

Chen S, Zhang Q, Hausman WH (2016) Motivating suppliers’ sustainability performance via investments in pollution abatement innovations, working paper

Chen X, Wang X, Chan HK (2017) Manufacturer and retailer coordination for environmental and economic competitiveness: a power perspective. Transp Res Part e: Logist Transp Rev 97:268–281

Choi TM, Li Y, Xu L (2013) Channel leadership, performance and coordination in closed-loop supply chains. Int J Prod Econ 146(1):371–380

Ernst CG, Young (2002) Online availability of public services: how does Europe progress? Web based survey on electronic Public Services

Gao J, Han H, Hou L, Wang H (2016) Pricing and effort decisions in a CLSC under different channel power structures. J Clean Prod 112:2043–2057

Genc TS, De Giovanni P (2018) Optimal return and rebate mechanism in a CLSC game. Eur J Oper Res 269(2):661–681

Guo R, Lee HL, Swinney R (2016) Responsible sourcing in supply chains. Manage Sci 62(9):2722–2744

He P, He Y, Xu H (2019) Channel structure and pricing in a dual-channel closed-loop supply chain with government subsidy. Int J Prod Econ 213:108–123

Hosseini-Motlagh SM, Nouri-Harzvili M, Choi TM, Ebrahimi S (2019) Reverse supply chain systems ptimization with dual channel and demand disruptions: sustainability, CSR investment and pricing coordination. Inf Sci 503:606–634

Hsueh CF (2014) Improving corporate social responsibility in a supply chain through a new revenue sharing contract. Int J Prod Econ 151:214–222

Huang X, Atasu A, Toktay LB (2019) Design implications of extended producer responsibility for durable products. Manage Sci 65(6):2573–2590

Jacobs BW, Subramanian R (2012) Sharing responsibility for product recovery across the supply chain. Prod Oper Manag 21(1):85–100

Kraft T, Raz G (2017) Collaborate or compete: Examining manufacturers’ replacement strategies for a substance of concern. Prod Oper Manag 26(9):1646–1662

Liu Y, Quan BT, Xu Q, Forrest JYL (2019a) Corporate social responsibility and decision analysis in a supply chain through government subsidy. J Clean Prod 208:436–447

Liu Y, Xiao T, Fan ZP, Zhao X (2019b) Pricing, environmental governance efficiency, and channel coordination in a socially responsible tourism supply chain. Int Trans Oper Res 26(3):1025–1051

Ma P, Shang J, Wang H (2017) Enhancing corporate social responsibility: contract design under information asymmetry. Omega 67:19–30

Modak NM, Panda S, Sana SS (2016) Pricing policy and coordination for a two-layer supply chain of duopolistic retailers and socially responsible manufacturer. Int J Log Res Appl 19(6):487–508

Modak NM, Kazemi N, Cárdenas-Barrón LE (2019) Investigating structure of a two-echelon CLSC using social work donation as a corporate social responsibility practice. Int J Prod Econ 207:19–33

Ni D, Li KW (2012) A game-theoretic analysis of social responsibility conduct in two-echelon supply chains. Int J Prod Econ 138(2):303–313

Ni D, Li KW, Tang X (2010) Social responsibility allocation in two-echelon supply chains: insights from wholesale price contracts. Eur J Oper Res 207(3):1269–1279

Panda S, Modak NM, Basu M, Goyal SK (2015) Channel coordination and profit distribution in a social responsible three-layer supply chain. Int J Prod Econ 168:224–233

Panda S, Modak NM, Cárdenas-Barrón LE (2017) Coordinating a socially responsible CLSC with product recycling. Int J Prod Econ 188:11–21

Raza SA (2018) Supply chain coordination under a revenue-sharing contract with corporate social responsibility and partial demand information. Int J Prod Econ 205:1–14

Savaskan RC, Van Wassenhove LN (2006) Reverse channel design: the case of competing retailers. Manage Sci 52(1):1–14

Savaskan RC, Bhattacharya S, Van Wassenhove LN (2004) Closed-loop supply chain models with product remanufacturing. Manage Sci 50(2):239–252

Seyedhosseini SM, Hosseini-Motlagh SM, Johari M, Jazinaninejad M (2019) Social price-sensitivity of demand for competitive supply chain coordination. Comput Ind Eng 135:1103–1126

Shi R, Zhang J, Ru J (2013) Impacts of power structure on supply chains with uncertain demand. Prod Oper Manag 22(5):1232–1249

Sim J, El Ouardighi F, Kim B (2019) Economic and environmental impacts of vertical and horizontal competition and integration. Nav Res Logist 66(2):133–153

Van Wassenhove LN (2019) Sustainable innovation: pushing the boundaries of traditional operations management. Prod Oper Manag 28(12):2930–2945

Wang Z, Wang M, Liu W (2020) To introduce competition or not to introduce competition: an analysis of corporate social responsibility investment collaboration in a two-echelon supply chain. Transp Res Part e: Logist Transp Rev 133:101812

Wu CH (2016) Collaboration and sharing mechanisms in improving corporate social responsibility. CEJOR 24(3):681–707

Wu X, Zhou Y (2017) The optimal reverse channel choice under supply chain competition. Eur J Oper Res 259(1):63–66

Yenipazarli A (2016) Managing new and remanufactured products to mitigate environmental damage under emissions regulation. Eur J Oper Res 249(1):117–130

Yu X, Lan Y, Zhao R (2019) Strategic green technology innovation in a two-stage alliance: vertical collaboration or co-development? Omega 98:102116

Zheng B, Yang C, Yang J, Zhang M (2017) Dual-channel closed-loop supply chains: forward channel competition, power structures and coordination. Int J Prod Res 55(12):3510–3527

Zhu W, He Y (2017) Green product design in supply chains under competition. Eur J Oper Res 258(1):165–180

Acknowledgements

The authors thank the Editors and the two anonymous reviewers for their valuable comments, which significantly improve the quality of this paper. This study is supported in part by the National Natural Science Foundation of China [No. 72102084, 71902079, 72101208], the Social Science Foundation of Education Ministry of China [No. 19YJC630229], and the Fundamental Research Funds for the Central Universities [No. 2662020JGPYG14].

Author information

Authors and Affiliations

Contributions

BZ and GH involved in drafting the manuscript, formulating the models, and performing equilibrium analysis and language polishing. LJ conceived of the study, formulated its design, coordinated the conduct of the study including model formulation, model solving and numerical analysis. JC contributed to the justification of model assumptions and the derivation of mathematical models and proofs.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

This paper does not contain any studies with human participants or animals performed by any of the authors.

Consent to participate

Not applicable.

Consent to publish

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

-

The Derivation of Centralized Models.

When the retailer makes a CSR investment (Model CY), the optimization for the entire supply chain system is:

The corresponding Hessian Matrix is given as below:

It can be readily verified that when the condition \(C_{L} \ge \frac{{m\beta \Delta \left( {\phi - \beta \left( {c_{m} + f - \Delta } \right)} \right)}}{{4m\beta - \gamma^{2} }}\) is satisfied, \(\pi_{T}\) is jointly concave in \(p\), \(e\) and \(\tau\).

Jointly solving \(\frac{{\partial \pi_{T} }}{\partial p} = 0\), \(\frac{{\partial \pi_{T} }}{\partial e} = 0\) and \(\frac{{\partial \pi_{T} }}{\partial \tau } = 0\) yields the optimal solutions for the CLSC, which are given by:

Then, the equilibrium demand and supply chain profits could be obtained.

If the retailer does not make a CSR investment, we can obtain equilibrium outcomes for Model CN by setting \(e = 0\) and \(f = 0\). All equilibrium solutions for Model CN and Model CY are shown in Table 3.

-

The Derivation of Manufacturer-Led Models.

We also consider the case where the retailer makes a CSR investment. Backward induction is used to solve the manufacturer Stackelberg game. The retailer’s optimization problem is:

The Hessian Matrix is as follows:

When \(4\beta m - \gamma^{2} > 0\), the Hessian Matrix is negative-defined. The retailer’s best response functions are:

Then, the manufacturer’s optimization problem is determined by:

The Hessian Matrix is:

It can be verified that only when \(m\beta^{2} \Delta^{2} + 2\left( { - 4m\beta + \gamma^{2} } \right)C_{L} < 0\) (or equivalently, \(C_{L} > \frac{{m\beta^{2} \Delta^{2} }}{{2\left( {4m\beta - \gamma^{2} } \right)}}\)), \(\pi_{M}^{DMY}\) is jointly concave in \(w\) and \(\tau\). According to Lemma 1, the condition \(C_{L} > \frac{{m\beta^{2} \Delta^{2} }}{{2\left( {4m\beta - \gamma^{2} } \right)}}\) can be verified. Then, jointly solving equations \(\frac{{\partial \pi_{M}^{DMY} }}{\partial w} = 0\) and \(\frac{{\partial \pi_{M}^{DMY} }}{\partial \tau } = 0\) yields the manufacturer’s optimal decisions.

Then, the equilibrium profits for channel players and entire supply chain system can be derived. By setting \(e = 0\) and \(f = 0\), the equilibrium solutions for Model DMN are obtained. All equilibrium solutions for Model DMN and Model DMY are shown in Table 3.

-

The Derivation of Retailer-Led Models.

Let \(p = w + s\), where \(s\) denotes the retail margin of the retailer. We first analyze the manufacturer’s optimization problem.

The Hessian Matrix of the manufacturer is:

According to Lemma 1, it can be judged that \(4\beta C_{L} - \beta^{2} {\Delta }^{2} > 0\), the Hessian Matrix is negative-defined. Then, the first-order conditions of the manufacturers lead to:

Then, the retailer’s optimization problem is determined by:

The Hessian Matrix of the retailer is:

According to Lemma 1, we can verify that the second-order determinant of the Hessian Matrix \(8m\beta - \gamma^{2} - \frac{{2m\beta^{2} \Delta^{2} }}{{C_{L} }} > 0\) is satisfied, and \(\pi_{R}^{DRY}\) is jointly concave in \(p\) and \(e\). Jointly solving equations \(\frac{{\partial \pi_{R}^{DRY} }}{\partial p} = 0\) and \(\frac{{\partial \pi_{R}^{DRY} }}{\partial e} = 0\) yields the retailer’s optimal decisions:

Then, the equilibrium profits for channel members and entire supply chain in Model DRY can be obtained. Similarly, the equilibrium solutions for Model DRN can be obtained by setting \(e = 0\) and \(f = 0\). All equilibrium outcomes for Model DRY and Model DRN are shown in Table 4.

Appendix B

Proof of Lemma 1

According to the derivation of the centralized models, we know that there exist unique optimal solutions for the Model CY when \(C_{L} \ge \frac{{m\beta \Delta \left( {\phi - \beta \left( {c_{m} + f - \Delta } \right)} \right)}}{{4m\beta - \gamma^{2} }}\). Similarly, in Model CN, we can obtain the condition \(C_{L} \ge \frac{{\Delta \left( {\beta \Delta + \phi - \beta c_{m} } \right)}}{4}\). Then, combining the boundaries of \(C_{L}\) in Model CY and CY, we have \(C_{L} \ge max\left\{ {\frac{{\Delta \left( {\beta \Delta + \phi - \beta c_{m} } \right)}}{4},\frac{{m\beta \Delta \left( {\phi - \beta \left( {c_{m} + f - \Delta } \right)} \right)}}{{4m\beta - \gamma^{2} }} } \right\}\).

Then, Lemma 1 is proved. □

Proof of Proposition 1

(1) According to the optimal solutions for Model CN and Model CY, we obtain

it can be verified that when \(f \le f^{C}\), \(\pi_{T}^{{CY{*}}} - \pi_{T}^{{CN{*}}} \ge 0\); otherwise, \(\pi_{T}^{{CY{*}}} - \pi_{T}^{{CN{*}}} < 0\), where \(f^{C} = \frac{\phi }{\beta } - c_{m} - \frac{{\left( {\phi - \beta c_{m} } \right)\sqrt {\beta m\left( {4C_{L} - \beta \Delta^{2} } \right)\left( {C_{L} \left( {4\beta m - \gamma^{2} } \right) - \beta^{2} \Delta^{2} m} \right)} }}{{\beta^{2} m\left( {4C_{L} - \beta \Delta^{2} } \right)}}\).

(2) Based on \(f^{C}\) in Proposition 1(1), we obtain that

Then, Proposition 1 is proved. □

Proof of Proposition 2

According to Lemma 2, we can obtain

It can be verified that when \(f \le f^{\tau c}\), \(\tau^{CY*} \ge \tau^{CN*}\); otherwise, \(\tau^{CY*} < \tau^{CN*}\), where \(f^{C} = \frac{{\gamma^{2} \left( {\phi - \beta c_{m} } \right)C_{L} }}{{m\beta^{2} \left( {4C_{L} - \beta \Delta^{2} } \right)}}\).

Then, Proposition 2 is proved. □

Proof of Proposition 3

Similar to the proof of Proposition 1, this proposition can be easily proved. □

Proof of Observation 1

Based on the retailer's optimal profits in Model DMN and Model DMY, we have

because \(\frac{{\partial \pi_{R}^{DMY*} }}{\partial f} = \frac{{2m\beta \left( {4m\beta - \gamma^{2} } \right)\left( {f\beta - \phi + \beta c_{m} } \right)C_{L}^{2} }}{{\left( {m\beta^{2} \Delta^{2} + 2\left( { - 4m\beta + \gamma^{2} } \right)C_{L} } \right)^{2} }} < 0\), \({\uppi }_{R}^{DMY*}\) decreases with \(f\), the minimum value of \({\uppi }_{R}^{DMY*}\) is obtained at the point \(f^{MD}\) when \(f \in \left( {0,f^{MD} } \right]\).

Moreover, based on the optimal profits for the manufacturer in Model DMN and Model DMY, we have

when \(f \in \left( {0,f^{MD1} } \right]\), \(\pi_{M}^{DMY*} \ge \pi_{M}^{DMN*}\), where \(f^{MD1} = \frac{\phi }{\beta } - c_{m} + \frac{{\sqrt {m\beta^{3} \left( {\phi - \beta c_{m} } \right)^{2} \left( {\beta \Delta^{2} - 8C_{L} } \right)\left( {m\beta^{2} \Delta^{2} + 2\left( { - 4m\beta + \gamma^{2} } \right)C_{L} } \right)} }}{{m\beta^{3} \left( {8C_{L} - \beta \Delta^{2} } \right)}}\).

Then, compared with \(f^{MD}\) and \(f^{MD1}\), we obtain

let \(f_{1} = 2\left( {\phi - \beta c_{m} } \right)^{2} \left( {2\left( {4m\beta - \gamma^{2} } \right)C_{L} - m\beta^{2} \Delta^{2} } \right)^{2} m\beta \left( {4m\beta - \gamma^{2} } \right)\), \(f_{2} =\break m\beta \left( {\phi - \beta c_{m} } \right)^{2} \left( {8C_{L} - \beta \Delta^{2} } \right)\left( {2\left( {4m\beta - \gamma^{2} } \right)C_{L} - m\beta^{2} \Delta^{2} } \right)\left( {4m\beta - \gamma^{2} } \right)^{2}\), because \(f_{1} - f_{2} = \beta \left( { - m} \right)\left( {4\beta m - \gamma^{2} } \right)\left( {\phi - \beta c_{m} } \right)^{2} \left( {2C_{L} \left( {\gamma^{2} - 4\beta m} \right) + \beta^{2} \Delta^{2} m} \right)\) \(\left( {4C_{L} \left( {\gamma^{2} - 4\beta m} \right) + \beta \Delta^{2} \left( {2\beta m - \gamma^{2} } \right)} \right) < 0\), we obtain \(f^{MD} > f^{MD1}\). Then, Observation 1 is proved. □

Proof of Proposition 4

Similar to the proof of Proposition 3, this proposition is easily proved. □

Proof of Observation 2

we obtain that \(\pi_{R}^{DRY*} \ge \pi_{R}^{DRN*}\) when \(f \in \left( {0,f^{RD} } \right]\); otherwise, \(\pi_{R}^{DRY*} < \pi_{R}^{DRN*}\), where \(f^{RD} = \frac{1}{2}\left( {\frac{2\phi }{\beta } - 2c_{m} - \frac{{\sqrt 2 \sqrt {m\beta \left( {\phi - \beta c_{m} } \right)^{2} \left( {4C_{L} - \beta \Delta^{2} } \right)\left( {\left( {8m\beta - \gamma^{2} } \right)C_{L} - 2m\beta^{2} \Delta^{2} } \right)} }}{{m\beta^{2} \left( {4C_{L} - \beta \Delta^{2} } \right)}}} \right)\).

we obtain that \(\pi_{M}^{DRY*} \ge \pi_{M}^{DRN*}\) when \(f \in \left( {0,f^{RD1} } \right]\); otherwise, \(\pi_{M}^{DRY*} < \pi_{M}^{DRN*}\), where \(f^{RD1} = \frac{{\gamma^{2} \left( {\phi - \beta c_{m} } \right)C_{L} }}{{2m\beta^{2} \left( {4C_{L} - \beta \Delta^{2} } \right)}}\).

We can easily prove that \(f^{RD1} > f^{RD}\). Hence, when \(f \in \left( {0,f^{RD} } \right]\), \(\pi_{M}^{DRY*} > \pi_{M}^{DRN*}\) and \(\pi_{R}^{DRY*} \ge \pi_{R}^{DRN*}\) are always satisfied. Then, Observation 2 is proved. □

Proof of Proposition 5

(1)

hence, we can obtain that \(e^{CY*} > e^{DRY*} \ge e^{DMY*}\) when \(0 < \gamma \le \frac{\beta \Delta \sqrt m }{{\sqrt {C_{L} } }}\); otherwise, \(e^{CY*} > e^{DMY*} > e^{DRY*}\).

(2) When the retailer does not make CSR investment,

When the retailer makes CSR investment,

hence, we can obtain that \(\tau^{CY*} > \tau^{DRY*} \ge \tau^{DMY*}\) if \(0 < \gamma \le \frac{\beta \Delta \sqrt m }{{\sqrt {C_{L} } }}\); otherwise, \(\tau^{CY*} > \tau^{DMY*} > \tau^{DRY*}\).

Then, Proposition 5 is proved. □

Proof of Proposition 6

Similar to the proof of Proposition 5, we can readily prove Proposition 6. □

Proof of Proposition 7

We can observe that \(f^{C} > f^{RD}\). Then, let \(f_{3} \left( {C_{L} } \right) = m\beta ( 4C_{L} - \beta \Delta^{2} )((4m\beta - \gamma^{2})C_{L} - m\beta^{2} \Delta^{2})(8C_{L} - \beta \Delta^{2})^{2} (4m\beta - \gamma^{2})^{2}\), \(f_{4} \left( {C_{L} } \right) = 4\left( {2\left( {4m\beta - \gamma^{2} } \right)C_{L} - m\beta^{2} \Delta^{2} } \right)m\beta \left( {4m\beta - \gamma^{2} } \right)\left( {4C_{L} - \beta \Delta^{2} } \right)^{2}\). \(f_{3} \left( {C_{L} } \right) - f_{4} \left( {C_{L} } \right) = - m\beta \left( {4m\beta - \gamma^{2} } \right)( 4C_{L} - \beta \Delta^{2})(4(4C_{L} - \beta \Delta^{2})(2(4m\beta - \gamma^{2})C_{L} - m\beta^{2} \Delta^{2}) - ( (4m\beta - \gamma^{2})C_{L} - m\beta^{2} \Delta^{2}) \times(4m\beta - \gamma^{2})(\beta \Delta^{2} - 8C_{L})^{2})\).

Further, let \(f_{5} \left( {C_{L} } \right) = 4\left( {4C_{L} - \beta \Delta^{2} } \right)\left( {2\left( {4m\beta - \gamma^{2} } \right)C_{L} - m\beta^{2} \Delta^{2} } \right.\), \(\left. {f_{6} \left( {C_{L} } \right) = \left( {4m\beta - \gamma^{2} } \right)\left( {\beta \Delta^{2} - 8C_{L} } \right)^{2} \left( {\left( {4m\beta - \gamma^{2} } \right)C_{L} - m\beta^{2} \Delta^{2} } \right)} \right)\). Because

\(f_{5} \left( {C_{L} } \right)\) and \(f_{6} \left( {C_{L} } \right)\) increase with \(C_{L}\). We calculate that \(f_{5} \left( {\frac{{\beta \Delta^{2} }}{8}} \right) = \frac{1}{2}\beta^{2} \gamma^{2} \Delta^{4} > 0\), \(f_{6} \left( {\frac{{\beta \Delta^{2} }}{8}} \right) = 0\); \(f_{5} \left( {\frac{{\beta \Delta^{2} }}{4}} \right) = 0\), \(f_{6} \left( {\frac{{\beta \Delta^{2} }}{4}} \right) = - \frac{1}{4}\beta^{3} \gamma^{2} \left( {4m\beta - \gamma^{2} } \right)\Delta^{6} < 0\). Hence, \(f_{5} \left( {C_{L} } \right) > f_{6} \left( {C_{L} } \right)\); further, we have \(f_{3} \left( {C_{L} } \right) < f_{4} \left( {C_{L} } \right)\) and \(f^{C} > f^{MD}\).

The proposition is proved. □

Proof of Proposition 8

Similar to the proof of Proposition 6, this proposition is easily proved. □

Rights and permissions

About this article

Cite this article

Zheng, B., Jin, L., Huang, G. et al. Retailer’s optimal CSR investment in closed-loop supply chains: the impacts of supply chain structure and channel power structure. 4OR-Q J Oper Res 21, 301–327 (2023). https://doi.org/10.1007/s10288-022-00512-6

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10288-022-00512-6

Keywords

- Manufacturer-collecting

- Closed-loop supply chain

- CSR investment

- Supply chain structure

- Channel power structure