Abstract

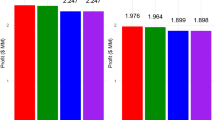

This paper investigates the impact of ENSO-based climate forecasts on optimal planting schedules and financial yield-hedging strategies in a framework focused on downside risk. In our context, insurance and futures contracts are available to hedge against yield and price risks, respectively. Furthermore, we adopt the Conditional-Value-at-Risk (CVaR) measure to assess downside risk, and Gaussian copula to simulate scenarios of correlated non-normal random yields and prices. The resulting optimization problem is a mixed 0–1 integer programming formulation that is solved efficiently through a two-step procedure, first through an equivalent linear form by disjunctive constraints, followed by decomposition into sub-problems identified by hedging strategies. With data for a representative cotton producer in the Southeastern United States, we conduct a study that considers a wide variety of optimal planting schedules and hedging strategies under alternative risk profiles for each of the three ENSO phases (Niña, Niño, and Neutral.) We find that the Neutral phase generates the highest expected profit with the lowest downside risk. In contrast, the Niña phase is associated with the lowest expected profit and the highest downside risk. Additionally, yield-hedging insurance strategies are found to vary significantly, depending critically on the ENSO phase and on the price bias of futures contracts.

Similar content being viewed by others

References

Artzner, P., Delbaen, F., Eber, J.-M., & Heath, D. (1999). Coherent measures of risk. Mathematical Finance, 9, 203–228.

Black, F. (1976). The pricing of commodity contracts. Journal of Financial Economics, 3, 167–179.

Cabrera, V. E., Fraisse, C., Letson, D., Podestá, G., & Novak, J. (2006). Impact of climate information on reducing farm risk by optimizing crop insurance strategy. Transactions of the American Society of Agricultural and Biological Engineers, 49, 1223–1233.

Cabrera, V. E., Letson, D., & Podestá, G. (2007). The value of the climate information when farm programs matter. Agricultural Systems, 93, 25–42.

Cane, M. A., Eshel, G., & Buckland, R. (1994). Forecasting Zimbabwean maize yield using eastern equatorial Pacific sea surface temperature. Nature, 370, 204–205.

Chambers, R. G., & Quiggin, J. (2002). Optimal producer behavior in the presence of area-yield crop insurance. American Journal of Agricultural Economics, 84, 320–334.

Coble, K. H., Miller, J. C., & Zuniga, M. (2004). The joint effect of government crop insurance and loan programmes on the demand for futures hedging. European Review of Agricultural Economics, 31, 309–330.

de Roon, F. A., Nijman, F. T., & Veld, C. (2000). Hedging pressure effects in futures markets. Journal of Finance, 55, 1437–1456.

Dusak, K. (1973). Futures trading and investor returns: an investigation of commodity market risk premiums. Journal of Political Economy, 81, 1387–1406.

Embrechts, P., McNeal, A., & Straumann, D. (2002). Correlation and dependence in risk management: properties and pitfalls. In M. Dempster (Ed.), Risk management: value-at-risk and beyond (pp. 176–223). Cambridge: Cambridge University Press.

Gorton, G., & Rouwenhorst, K. G. (2006). Facts and fantasies about commodity futures. Financial Analysts Journal, 62, 47–68.

Hansen, J. W. (2002). Realizing the potential benefits of climate prediction to agriculture: issues, approaches, challenges. Agricultural Systems, 74, 309–330.

Hansen, J. W., Hodges, A. W., & Jones, J. W. (1998). ENSO influences on agriculture in the Southeastern US. Journal of Climate, 11, 404–411.

Hicks, J. R. (1939). Value and capital. Cambridge: Oxford University Press.

Hirshleifer, D. (1988). Residual risk, trading costs, and commodity futures risk premia. Review of Financial Studies, 1, 173–193.

Hirshleifer, D. (1989). Determinants of hedging and risk premia in commodity futures markets. Journal of Financial and Quantitative Analysis, 24, 313–331.

Jagannathan, R. (1985). An investigation of commodity futures prices using the consumption-based inter-temporal capital asset pricing model. Journal of Finance, 40, 175–191.

Jones, J. W., Hansen, J. W., Royce, F. S., & Messina, C. D. (2000). Potential benefits of climate forecast to agriculture. Agriculture, Ecosystems & Environment, 82, 169–184.

Jones, J. W., Hoogenboom, G., Porter, C. H., Boote, K. J., Batchelor, W. D., Hunt, L. A., Wilkens, P. W., Singh, U., Gijsman, A. J., & Ritchie, J. T. (2003). The DSSAT cropping system model. European Journal of Agronomy, 18, 235–265.

Jorion, P. (2000). Value at risk: the new benchmark for managing financial risk (2nd ed.). New York: McGraw-Hill.

Keynes, J. M. (1930). A treatise on money (Vol. 2). London: Macmillan.

Kruksal, W. H. (1958). Ordinal measures of association. Journal of the American Statistical Association, 53, 814–861.

Mahul, O. (2003). Hedging price risk in the presence of crop yield and revenue insurance. European Review of Agricultural Economics, 30, 217–239.

Markowitz, H. M. (1952). Portfolio selection. Journal of Finance, 7, 77–91.

Messina, C. R., Jones, J. W., & Fraisse, C. W. (2005). Development of cotton CROPGRO crop model. Southeast Climate Consortium Staff Paper Series 05-05, Gainesville, FL.

Nemhauser, G. L., & Wolsey, L. A. (1999). Integer and combinatorial optimization. New York: Wiley.

Poitras, G. (1993). Hedging and crop insurance. The Journal of Futures Markets, 13, 373–389.

Rockafellar, R. T., & Uryasev, S. (2000). Optimization of conditional value-at-risk. The Journal of Risk, 2, 21–41.

Sklar, A. (1959). Fonctions de répartition à n dimensions et leurs marges. Publications de l’Institut de Statistique de L’Université de Paris, 8, 229–231.

Stoll, H. (1979). Commodity futures and spot price determination and hedging in capital market equilibrium. Journal of Financial and Quantitative Analysis, 14, 873–895.

Szegö, G. (2002). Measures of risk. Journal of Banking and Finance, 26, 1253–1272.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

AitSahlia, F., Wang, CJ., Cabrera, V.E. et al. Optimal crop planting schedules and financial hedging strategies under ENSO-based climate forecasts. Ann Oper Res 190, 201–220 (2011). https://doi.org/10.1007/s10479-009-0551-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-009-0551-2