Abstract

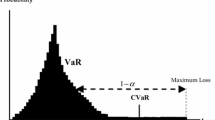

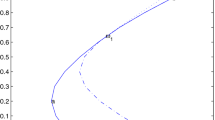

Risk management through marginal rebalancing is important for institutional investors due to the size of their portfolios. We consider the problem of improving marginally portfolio VaR and CVaR through a marginal change in the portfolio return characteristics. We study the relative significance of standard deviation, mean, tail thickness, and skewness in a parametric setting assuming a Student’s t or a stable distribution for portfolio returns. We also carry out an empirical study with the constituents of DAX30, CAC40, and SMI. Our analysis leads to practical implications for institutional investors and regulators.

Similar content being viewed by others

Notes

Skewness and kurtosis are estimated in a robust way since the classical estimator is sensitive to outliers.

References

Artzner, P., Delbaen, F., Eber, J.-M., & Heath, D. (1998). Coherent measures of risk. Mathematical Finance, 6, 203–228.

Bibby, B. M., & Sorensen, M. (2003). Hyperbolic processes in finance. In S. T. Rachev (Ed.), Handbook of heavy-tailed distributions in finance (p. 212–248).

Boudt, K., Peterson, B., & Croux, C. (2008). Estimation and decomposition of downside risk for portfolios with non-normal returns. The Journal of Risk, 11(2), 79–103.

Daníelson, J., Jorgensen, B., Samorodnitsky, G., Sarma, M., & de Vries, C. (2011), Fat tails, VaR and subadditivity (Research paper). London School of Economics.

Dokov, S., Stoyanov, S., & Rachev, S. (2008). Computing VaR and AVaR of skewed t distribution. Journal of Applied Functional Analysis, 3, 189–209.

Dowd, K. (2005). Measuring market risk. New York: Wiley.

Iaquinta, G., Lamantia, F., Massabó, I., & Ortobelli, S. (2009). Moment based approaches to value the risk of contingent claim portfolios. Annals of Operations Research, 165, 97–121.

Mansini, R., Ogryczak, W., & Grazia Speranza, M. (2007). Conditional value at risk and related linear programming models for portfolio optimization. Annals of Operations Research, 152, 227–256.

Markowitz, H. M. (1952). Portfolio selection. The Journal of Finance, 7(1), 77–91.

Rachev, S. T., & Mittnik, S. (2000). Stable Paretian models in finance. Chichester: Wiley.

Rachev, S., Stoyanov, S., Biglova, A., & Fabozzi, F. (2005). An empirical examination of daily stock return distributions for U.S. stocks. In D. Baier, R. Decker, & L. Schmidt-Thieme (Eds.), Springer series in studies in classification, data analysis, and knowledge organization. Data analysis and decision support (pp. 269–281). Berlin: Springer.

Samorodnitsky, G., & Taqqu, M.S. (1994). Stable non-Gaussian random processes. New York/London: Chapman & Hall.

Stoyanov, S., Samorodnitsky, G., Rachev, S., & Ortobelli, S. (2006). Computing the portfolio conditional value-at-risk in the α-stable case. Probability and Mathematical Statistics, 26, 1–22.

Stoyanov, S., Rachev, S., & Fabozzi, F. (2010). Stochastic models for risk estimation in volatile markets: a survey. Annals of Operations Research, 176, 293–309.

Zangari, P. (1996). A VaR methodology for portfolios that include options. RiskMetrics Monitor, First Quarter, 4–12.

Zolotarev, V. M. (1986). Translation of mathematical monographs: Vol. 65. One-dimensional stable distributions. Providence: Am. Math. Soc.

Author information

Authors and Affiliations

Corresponding author

Additional information

Rachev gratefully acknowledges research support by grants from the Deutschen Forschungsgemeinschaft and the Deutscher Akademischer Austausch Dienst.

Rights and permissions

About this article

Cite this article

Stoyanov, S.V., Rachev, S.T. & Fabozzi, F.J. Sensitivity of portfolio VaR and CVaR to portfolio return characteristics. Ann Oper Res 205, 169–187 (2013). https://doi.org/10.1007/s10479-012-1142-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-012-1142-1