Abstract

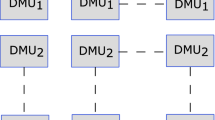

We construct and estimate a dynamic network Luenberger productivity indicator for Japanese banks during fiscal years 2006–2012. The network aspect to the model recognizes that banks produce deposits in the first stage of production using inputs such as labor, physical capital, and equity capital and then in the second stage use those deposits to generate a portfolio of loans and securities investments. Because of asymmetric information between borrower and lender and uncertainty about the future state of the economy the second stage of production also generates an undesirable by-product: some loans become nonperforming. The dynamic aspect to the model recognizes that nonperforming loans generated in one period will typically constrain production in a subsequent period. Moreover, bank managers have discretion over when to transform deposits into the portfolio of loans and investments so that when faced with a high risk lending environment managers can choose to save some deposits as excess reserves for use in a subsequent period when they anticipate a more favorable lending environment.

Similar content being viewed by others

Notes

The static Malmquist index ignores dynamic variables such as carryovers in its construction.

The static directional distance function takes the form \(\overrightarrow{D}(x,y,b;g_{x} ,g_{y},g_{b} )=\max \{\alpha :\;(x-\alpha g_{x},y+\alpha g_{y} ,b-\alpha g_{b} )\in T\}\).

On July 1, 2013, Mizuho Bank and Mizuho Corporate Bank merged and began operating as Mizuho Bank. Hence, both banks still existed as different entities at the end of our sample period.

References

Afsharian, K. M., & Ahn, H. (2015). The overall Malmquist index: A new approach for measuring productivity changes over time. Annals of Operations Research, 226(1), 1–27.

Akther, S., Fukuyama, H., & Weber, W. L. (2013). Estimating two-stage network slacks-based inefficiency: An application to Bangladesh banking. OMEGA, 41(1), 88–96.

Avkiran, N. K. (2009). Removing the impact of environment with units-invariant efficient frontier analysis: An illustrative case study with intertemporal panel data. OMEGA, 37, 535–544.

Avkiran, N. K. (2013). Bank efficiency measurement and network DEA: A discussion of key issues and illustration of recent developments in the field. In F. Pasiouras (Ed.), Efficiency and productivity growth: Modelling in the financial services industry (Chapter 8). London: Wiley.

Azad, A. S. M. S., Yasushi, S., Fang, V., & Ahsan, A. (2014). Impact of policy changes on the efficiency and returns-to-scale of Japanese financial institutions: An evaluation. Research in International Business and Finance, 32, 159–171.

Balla, E., Rose, M. J., & Romero, J. (2012). Loan loss reserve accounting and bank behavior. Economic Brief The Federal Reserve Bank of Richmond, EB12-03, 1–4.

Berg, S. A., Førsund, F. R., & Jansen, E. S. (1992). Malmquist indices of productivity growth during the deregulation of Norwegian banking, 1980–89. The Scandinavian Journal of Economics, 94(suppl), 211–228.

Berger, A. N., & Humphrey, D. (1997). Efficiency of financial institutions: International survey and directions for future research. European Journal of Operational Research, 98(2), 175–212.

Briec, W., & Kerstens, K. (2004). A Luenberger–Hicks–Moorsteen productivity indicator: Its relation to the Hicks–Moorsteen productivity index and the Luenberger productivity indicator. Economic Theory, 23, 925–939.

Castelli, L., & Pesenti, R. (2014). Network, shared flow, and multi-level DEA models: A critical review. In W. D. Cook & J. Zhu (Eds.), Data envelopment analysis: A handbook on the modeling of internal structures and networks (Chapter 15). Berlin: Springer.

Caves, D. W., Christenson, L. R., & Diewert, W. E. (1982). The economic theory of index numbers and the measurement of input, output, and productivity. Econometrica, 50(6), 1393–1414.

Chambers, R. G. (1998). Input and output indicators. In R. Färe, S. Grosskopf, & R. R. Russell (Eds.), Index numbers: Essays in honour of Sten Malmquist. Boston: Kluwer.

Chambers, R. G. (2002). Exact nonradial input, ouput, and productivity measurement. Economic Theory, 20, 751–765.

Chambers, R. G., Chung, Y., & Färe, R. (1996). Benefit and distance functions. Journal of Economic Theory, 70(2), 407–419.

Chambers, R. G., Chung, Y., & Färe, R. (1998). Profit, directional distance functions and Nerlovian efficiency. Journal of Optimization Theory and Applications, 98(2), 351–364.

Chen, Y., Cook, W. D., & Zhu, J. (2010). Deriving the DEA frontier for two-stage processes. European Journal of Operational Research, 202, 138–142.

Chen, Y., & Zhu, J. (2004). Measuring information technology’s indirect impact on firm performance. Information Technology and Management Journal, 5, 9–22.

Cook, W. D., Liang, L., & Zhu, J. (2010). Measuring performance of two-stage network structures by DEA: A review and future perspective. Omega, 38, 423–430.

Elyasiani, E., & Mehdian, S. (1990). Efficiency in the commercial banking industry: A production function approach. Applied Economics, 22, 539–551.

Epure, M., & Lafuente, E. (2014). Monitoring bank performance in the presence of risk. Journal of Productivity Analysis. doi:10.1007/s11123-014-0413-z.

Färe, R., Grosskopf, S., & Margaritis, D. (2011). Malmquist productivity indexes and DEA. In W. W. Cooper, L. Seiford, & J. Zhu (Eds.), Handbook of data envelopment analysis (2nd edn.). New York, NY: Springer.

Färe, R., & Grosskopf, S. (1996). Intertemporal production frontiers: With dynamic DEA. Hingham, MA: Kluwer Academic Publishers.

Färe, R., & Grosskopf, S. (1998). Efficiency and productivity in rich and poor countries. In B. S. Jensen & K. Wong (Eds.), Dynamics, economic growth, and international trade. Ann Arbor, MI: The University of Michigan Press.

Färe, R., & Grosskopf, S. (2000). Network DEA. Socio-Economic Planning Sciences, 34, 35–49.

Färe, R., Grosskopf, S., Lindgren, B., & Roos, P. (1994a). Productivity developments in Swedish hospital: A Malmquist output index approach. In A. Charnes, W. W. Cooper, A. Lewin, & L. Seiford (Eds.), Data envelopment analysis: Theory, methodology and applications. Boston, MA: Kluwer Academic Publishers.

Färe, R., Grosskopf, S., & Lovell, C. A. K. (1994b). Production frontiers. Cambridge, MA: Cambridge University Press.

Fethi, M. D., & Pasiouras, F. (2013). Assessing bank efficiency and performance with operational research and artificial intelligence techniques: A survey. European Journal of Operational Research, 204(2), 189–198.

Fukuyama, H. (1993). Technical and scale efficiency of Japanese commercial banks: A nonparametric approach. Applied Economics, 25(8), 1101–1112.

Fukuyama, H. (1995). Measuring efficiency and productivity growth in Japanese banking: A nonparametric frontier approach. Applied Financial Economics, 5(2), 95–107.

Fukuyama, H. (1996). Returns to scale and efficiency of credit associations in Japan: A nonparametric frontier approach. Japan and the World Economy, 8(3), 129–146.

Fukuyama, H., & Weber, W. L. (2010). A slacks-based inefficiency measure for a two-stage system with bad outputs. Omega, 38(5), 239–410.

Fukuyama, H., & Weber, W. L. (2012). Estimating two-stage network technology inefficiency: An application to cooperative Shinkin banks in Japan. International Journal of Operations Research and Information Systems, 3(2), 1–22.

Fukuyama, H., & Weber, W. L. (2013). A dynamic network DEA model with an application to Japanese cooperative Shinkin banks. In P. Fotios (Ed.), Efficiency and productivity growth: Modelling in the financial services industry, Chapter 9 (pp. 193–213). London: Wiley.

Fukuyama, H., & Weber, W. L. (2014a). Two-stage network DEA with bad outputs. In W. D. Cook & J. Zhu (Eds.), Data envelopment analysis a handbook on the modeling of internal structures and networks, Chapter 19 (pp. 451–474). New York, NY: Springer.

Fukuyama, H., & Weber, W. L. (2015). Measuring Japanese bank performance: A dynamic network DEA approach. Journal of Productivity Analysis. doi:10.1007/s11123-014-0403-1.

Glass, C., McKillop, D. G., Quinn, B., & Wilson, J. (2014). Cooperative bank efficiency in Japan: A parametric distance function analysis. The European Journal of Finance, 20(3), 291–317.

Grigoroudis, E., Tsitsiridi, E., & Zopounidis, C. (2013). Linking customer satisfaction, employee appraisal, and business performance: An evaluation methodology in the banking sector. Annals of Operations Research, 205(1), 5–27.

Harimaya, K. (2004). Measuring the efficiency in Japanese credit cooperatives. Review of Monetary and Financial Studies, 23, 92–111. (in Japanese).

Jonas, M. R., & King, S. K. (2008). Bank efficiency and the effectiveness of monetary policy. Contemporary Economic Policy, 26(4), 579–589.

Kao, C. (2014). Network data envelopment analysis: A review. European Journal of Operational Research, 239, 1–16.

Kao, C., & Hwang, S. N. (2008). Efficiency decomposition in two-stage data envelopment analysis: An application to non-life insurance companies in Taiwan. European Journal of Operational Research, 185(1), 418–429.

Kao, C., & Hwang, S. N. (2014). Multi-period efficiency and Malmquist productivity index in two-stage production systems. European Journal of Operational Research, 232(1), 512–521.

Kuosmanen, T. (2005). Weak disposability in nonparametric production with undesirable outputs. American Journal of Agricultural Economics, 87(4), 1077–1082.

Lewis, L., & Sexton, T. R. (2004). Network DEA: Efficiency analysis of organizations with complex internal structure. Computer and Operations Research, 31(9), 1365–1410.

Malmquist, S. (1953). Index numbers and indifference surfaces. Trabajos de Estadistica, 4, 209–242.

Miyakoshi, T., & Tsukuda, Y. (2004). The causes of the long stagnation in Japan. Applied Financial Economics, 14, 113–120.

Park, K. H., & Weber, W. L. (2006). A note on efficiency and productivity growth in the Korean Banking Industry, 1992–2002. Journal of Banking and Finance, 30(8), 2371–2386.

Pastor, J. T., Asmild, M., & Lovell, C. A. K. (2011). The biennial Malmquist productivity change index. Socio-Economic Planning Sciences, 45(1), 10–15.

Pastor, J. T., & Lovell, C. A. K. (2005). A global Malmquist productivity index. Economics Letters, 88, 266–271.

Rangan, N., Grabowski, R., Aly, H., & Pasurka, C. (1988). The technical efficiency of U.S. banks. Economics Letters, 28(1988), 169–175.

Satake, M., & Tsutsui, Y. (2002). Why is Kyoto where Shinkin banks reign? An analysis based on the efficient structures hypothesis. In T. Yuno (Ed.), Regional finance: A case of Kyoto. Tokyo: Nippon Hyoron Sha. (in Japanese).

Seiford, L. M., & Zhu, J. (1999). Profitability and marketability of the top 55 US commercial banks. Management Science, 45(9), 1270–1288.

Shephard, R. W., & Färe, R. (1980). Dynamic theory of production correspondences. Cambridge, MA: Oelgeschlager, Gunn and Hain Publishers Inc.

Sherman, H. D., & Gold, F. (1985). Bank branch operating efficiency. Journal of Banking and Finance, 9(2), 297–315.

Tone, K., & Tsutsui, M. (2009). Network DEA: A slacks-based measure approach. European Journal of Operational Research, 197, 243–252.

Tone, K., & Tsutsui, M. (2010). Dynamic DEA: A slacks-based measure approach. OMEGA, 38, 145–156.

Wang, C. H., Gopal, R. D., & Zionts, S. (1997). Use of data envelopment analysis in assessing information technology impact on firm performance. Annals of Operations Research, 73, 191–213.

Yashiro, N. (2001). Social implications of demographic change in Japan. Federal Reserve Bank of Boston. Conference Proceedings (Vol. 46, pp. 297–304).

Acknowledgments

An earlier version of this paper, entitled “Modeling Bank Production with Dynamic-Network Data Envelopment Analysis”, was presented at the 12th International Conference of Data Envelopment Analysis (DEA 2014) held at University of Malaya (Kuala Lumpur, Malaysia) in March 15–17, 2014. We are grateful for the helpful and insightful suggestions of three anonymous reviewers. We are also grateful to the Grant-in-Aid for Scientific Research from Culture, Sports, Science and Technology, Grant No. 25282090 (B).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Fukuyama, H., Weber, W.L. Measuring bank performance with a dynamic network Luenberger indicator. Ann Oper Res 250, 85–104 (2017). https://doi.org/10.1007/s10479-015-1922-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-015-1922-5