Abstract

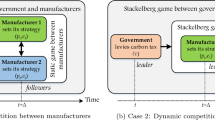

In this paper, we present a study on a government using subsidy policy to motivate firms’ adoption of green emissions-reducing technology when consumers are environmentally discerning. We consider two profit-maximizing firms selling two products in a price and pollution sensitive market. The products differ only in their manufacturing costs, selling prices and the amount of pollutant emissions per unit of product. The objective of each firm is to determine the selling prices of the products, taking into account the impact of green technology on costs and customer demands. Two cases are considered: (1) the government has limited budget and can choose only one firm at most to provide subsidy; (2) the government has sufficient budget and can choose both firms to provide subsidy. We discuss which firm should be selected in each case and in which situation the firm has incentive to invest in the green technology. We also show that the green technology level, environmental improvement coefficient and unit cost increase coefficient play important roles in the government subsidy strategy.

Similar content being viewed by others

References

Acaravci, A., & Ozturk, I. (2010). On the relationship between energy consumption, CO\(_{2}\) emissions and economic growth in Europe. Energy, 35(12), 5412–5420.

Albino, V., Balice, A., & Dangelico, R. M. (2009). Environmental strategies and green product development: an overview on sustainability-driven companies. Business Strategy and the Environment, 18(2), 83–96.

Ang, J. B. (2007). CO\(_{2}\) emissions, energy consumption, and output in France. Energy Policy, 35(10), 4772–4778.

Apergis, N., & Payne, J. E. (2009). CO\(_{2}\) emissions, energy usage, and output in central America. Energy Policy, 37(8), 3282–3286.

Arouri, M. E. H., Ben Youssef, A., M’henni, H., & Rault, C. (2012). Energy consumption, economic growth and CO\(_{2}\) emissions in Middle East and North African countries. Energy Policy, 45, 342–349.

Bansal, S. (2008). Choice and design of regulatory instruments in the presence of green consumers. Resource and Energy Economics, 30(3), 345–368.

Chen, C. (2001). Design for the environment: a quality-based model for green product development. Management Science, 47(2), 250–263.

Chen, C., & Zhang, J. (2013). Green product design with engineering tradeoffs under technology efficient frontiers: Analytical results and empirical tests. IEEE Transactions on Engineering Management, 60(2), 340–352.

Drake, D., Kleindorfer, P. R., & Van Wassenhove, L. N. (2010). Technology choice and capacity investment under emissions regulation. Working paper, INSEAD. http://www.insead.edu/facultyresearch/research/doc.cfm?did=46205. Accessed 20 Jan 2016.

Du, S., Ma, F., Fu, Z., Zhu, L., & Zhang, J. (2015). Game-theoretic analysis for an emission-dependent supply chain in a ‘cap-and-trade’ system. Annals of Operations Research, 228(1), 135–149.

Du, S., Zhu, L., Liang, L., & Ma, F. (2013). Emission-dependent supply chain and environment-policy-making in the ‘cap-and-trade’ system. Energy Policy, 57, 61–67.

Fischer, C., Parry, I. W., & Pizer, W. A. (2003). Instrument choice for environmental protection when technological innovation is endogenous. Journal of Environmental Economics and Management, 45(3), 523–545.

Foss, M. M., Gonzales, E., & Noyen, H. (1999). Ford motor company. Corporate incentives and environmental decision making (pp. 35–52). Houston, Tx: Houston Advanced Research Center.

Galinato, G. I., & Yoder, J. K. (2010). An integrated tax-subsidy policy for carbon emission reduction. Resource and Energy Economics, 32(3), 310–326.

Gil-Moltó, M. J., & Varvarigos, D. (2013). Emission taxes and the adoption of cleaner technologies: The case of environmentally conscious consumers. Resource and Energy Economics, 35(4), 486–504.

Goulder, L. H., Hafstead, M. A. C., & Dworsky, M. (2010). Impacts of alternative emissions allowance allocation methods under a federal cap-and-trade program. Journal of Environmental Economics and Management, 60(3), 161–181.

Gong, X., & Zhou, S. X. (2013). Optimal production planning with emissions trading. Operations Research, 61(4), 908–924.

Gray, W. B., & Shadbegian, R. J. (1998). Environmental regulation, investment timing, and technology choice. The Journal of Industrial Economics, 46(2), 235–256.

Hammar, H., & Löfgren, Å. (2010). Explaining adoption of end of pipe solutions and clean technologies–determinants of firms’ investments for reducing emissions to air in four sectors in Sweden. Energy Policy, 38(7), 3644–3651.

He, P., Zhang, W., Xu, H., & Bian, Y. (2014). Production lot-sizing and carbon emissions under cap-and-trade and carbon tax regulations. Journal of Cleaner Production. 103, 241–248.

Jaffe, A. B., Newell, R. G., & Stavins, R. N. (2002). Environmental policy and technological change. Environmental and Resource Economics, 22(1–2), 41–70.

Jiang, Y., & Klabjan, D. (2012). Optimal emissions reduction investment under greenhouse gas emissions regulations. Working paper. Northwestern University.

Krass, D., Nedorezov, T., & Ovchinnikov, A. (2013). Environmental taxes and the choice of green technology. Production and Operations Management, 22(5), 1035–1055.

Kurk, F., & Eagan, P. (2008). The value of adding design-for-the-environment to pollution prevention assistance options. Journal of Cleaner Production, 16(6), 722–726.

Letmathe, P., & Balakrishnan, N. (2005). Environmental considerations on the optimal product mix. European Journal of Operational Research, 167(2), 398–412.

Levi, M. D., & Nault, B. R. (2004). Converting technology to mitigate environmental damage. Management Science, 50(8), 1015–1030.

MacKenzie, I. A., & Ohndorf, M. (2012). Cap-and-trade, taxes, and distributional conflict. Journal of Environmental Economics and Management, 63(1), 51–65.

Mandell, S. (2008). Optimal mix of emissions taxes and cap-and-trade. Journal of Environmental Economics and Management, 56(2), 131–140.

Milliman, S. R., & Prince, R. (1989). Firm incentives to promote technological change in pollution control. Journal of Environmental economics and Management, 17(3), 247–265.

Raz, G., Druehl, C. T., & Blass, V. (2013). Design for the environment: Life-cycle approach using a newsvendor model. Production and Operations Management, 22(4), 940–957.

Sharma, A., & Iyer, G. R. (2012). Resource-constrained product development: Implications for green marketing and green supply chains. Industrial Marketing Management, 41(4), 599–608.

Subramanian, R., Gupta, S., & Talbot, B. (2007). Compliance strategies under permits for emissions. Production and Operations Management, 16(6), 763–779.

Tarui, N., & Polasky, S. (2005). Environmental regulation with technology adoption, learning and strategic behavior. Journal of Environmental Economics and Management, 50(3), 447–467.

Uçak, H., Aslan, A., Yucel, F., & Turgut, A. (2015). A dynamic analysis of CO\(_{2}\) emissions and the GDP relationship: Empirical evidence from high-income OECD countries. Energy Sources, Part B: Economics, Planning and Policy, 10(1), 38–50.

Zhang, X. P., & Cheng, X. M. (2009). Energy consumption, carbon emissions, and economic growth in China. Ecological Economics, 68(10), 2706–2712.

Acknowledgments

All authors have made equal contributions to the work. The authors would like to thank anonymous reviewers for their helpful comments and suggestions which have significantly improved earlier versions of the paper. Financial support from National Natural Science Foundation of China (Grant Nos. 71271195, 71171181 and 71322101) and USTC Foundation for Innovative Research Team (WK2040160008) are acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

Proof of Proposition 5

-

(1)

Under the condition that the government has limited budget and can choose at most one firm to provide subsidy and it chooses \(F_{1}\) to subsidize, the necessary condition of \(F_{1 }\) accepting the subsidy policy and investing in technology is \(F_{1}\)’s profit satisfy: \(\pi _{11} >\pi _{10} \) and \(\pi _{11} >\pi _{12} \), equivalently,

$$\begin{aligned} \frac{1}{9\left( {\Delta e-\delta t} \right) }\left( {\Delta e-\delta t+\Delta c-\gamma t} \right) ^{2}-\xi t^{2}+ts>\frac{1}{9\Delta e}\left( {\Delta e+\Delta c} \right) ^{2} \end{aligned}$$and

$$\begin{aligned} \frac{1}{9\left( {\Delta e-\delta t} \right) }\left( {\Delta e-\delta t+\Delta c-\gamma t} \right) ^{2}-\xi t^{2}+ts>\frac{1}{9\left( {\Delta e+\delta t} \right) }\left( {\Delta e+\delta t+\Delta c+\gamma t} \right) ^{2}. \end{aligned}$$Simplifying these conditions we get

$$\begin{aligned} s>-\frac{2}{9}\left( {\frac{\delta \left( {\delta ^{2}t^{2}-\left( {\Delta e} \right) ^{2}+t^{2}\delta \gamma \left( {2\delta +\gamma } \right) -2\Delta e\gamma \left( {\Delta e+\Delta c} \right) +\delta \left( {\Delta c} \right) ^{2}} \right) }{\delta ^{2}t^{2}-\left( {\Delta e} \right) ^{2}}} \right) +\xi t. \end{aligned}$$ -

(2)

Under the condition that the government has limited budget and can choose at most one firm to provide subsidy and it chooses \(F_{2}\) to subsidize, the necessary condition of \(F_{2 }\) accepting the subsidy policy and investing in technology is \(F_{2}\)’s profit satisfy: \(\pi _{22} >\pi _{20} \) and \(\pi _{22} >\pi _{21} \), equivalently,

$$\begin{aligned} \frac{1}{9\left( {\Delta e+\delta t} \right) }\left( {2\Delta e+2\delta t-\Delta c+\gamma t} \right) ^{2}-\xi t^{2}+ts>\frac{1}{9\Delta e}\left( {2\Delta e-\Delta c} \right) ^{2} \end{aligned}$$and

$$\begin{aligned} \frac{1}{9\left( {\Delta e+\delta t} \right) }\left( {2\Delta e+2\delta t-\Delta c+\gamma t} \right) ^{2}-\xi t^{2}+ts>\frac{1}{9\left( {\Delta e-\delta t} \right) }\left( {2\Delta e-2\delta t-\Delta c+\gamma t} \right) ^{2}. \end{aligned}$$Simplifying these conditions we get \(s>-\frac{2\delta }{9}\left( {4+\frac{\left( {\gamma t-\Delta c} \right) ^{2}}{\delta ^{2}t^{2}-\left( {\Delta e} \right) ^{2}}} \right) +\xi t\).

-

(3)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy and it only chooses \(F_{1}\) to subsidize, the necessary condition of \(F_{1 }\) accepting the subsidy policy and investing in technology is \(F_{1}\)’s profit satisfy: \(\pi _{11} >\pi _{10} \) and \(\pi _{11} >\pi _{12} \), equivalently

$$\begin{aligned} \frac{1}{9\left( {\Delta e-\delta t} \right) }\left( {\Delta e-\delta t+\Delta c-\gamma t} \right) ^{2}-\xi t^{2}+ts>\frac{1}{9\Delta e}\left( {\Delta e+\Delta c} \right) ^{2} \end{aligned}$$and

$$\begin{aligned} \frac{1}{9\left( {\Delta e-\delta t} \right) }\left( {\Delta e-\delta t+\Delta c-\gamma t} \right) ^{2}-\xi t^{2}+ts>\frac{1}{9\left( {\Delta e+\delta t} \right) }\left( {\Delta e+\delta t+\Delta c+\gamma t} \right) ^{2}. \end{aligned}$$Simplifying these conditions we get

$$\begin{aligned} s>-\frac{2}{9}\left( {\frac{\delta \left( {\delta ^{2}t^{2}-\left( {\Delta e} \right) ^{2}+t^{2}\delta \gamma \left( {2\delta +\gamma } \right) -2\Delta e\gamma \left( {\Delta e+\Delta c} \right) +\delta \left( {\Delta c} \right) ^{2}} \right) }{\delta ^{2}t^{2}-\left( {\Delta e} \right) ^{2}}} \right) +\xi t. \end{aligned}$$ -

(4)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy and it chooses both firms to subsidize, the necessary condition of both firms accepting the subsidy policy and investing in technology is the profits of \(F_{1}\) and \(F_{2}\) satisfy: \(\pi _{13} >\max \left\{ {\pi _{10} ,\pi _{12} } \right\} \) and \(\pi _{23} >\max \left\{ {\pi _{20} ,\pi _{21} } \right\} \), equivalently

$$\begin{aligned} \frac{1}{9\Delta e}\left( {\Delta e+\Delta c} \right) ^{2}-\xi t^{2}+ts>\max \left\{ {\frac{1}{9\Delta e}\left( {\Delta e+\Delta c} \right) ^{2}, \frac{1}{9\left( {\Delta e\hbox {+}\delta t} \right) }\left( {\Delta e\hbox {+}\delta t+\Delta c\hbox {+}\gamma t} \right) ^{2}} \right\} \end{aligned}$$and \(\frac{1}{9\Delta e}\left( {2\Delta e-\Delta c} \right) ^{2}-\xi t^{2}+ts>\max \Big \{ \frac{1}{9\Delta e}\left( {2\Delta e-\Delta c} \right) ^{2}, \frac{1}{9\left( {\Delta e-\delta t} \right) }( 2\Delta e-\hbox {2}\delta t-\Delta c\hbox {+}\gamma t )^{2} \Big \}\) Simplifying these conditions we get

$$\begin{aligned} s>\max \left\{ {\begin{array}{l} \frac{1}{9\Delta e\left( {\Delta e+\delta t} \right) }\left( {\left( {\Delta e} \right) ^{2}\delta +2\left( {\Delta e} \right) ^{2}\gamma +\Delta e\delta ^{2}t+2\Delta e\delta t\gamma +2\Delta e\Delta c\gamma +\Delta e\gamma ^{2}t-\left( {\Delta c} \right) ^{2}\delta } \right) +\xi t, \\ \frac{1}{9\Delta e\left( {\Delta e-\delta t} \right) }\left( {-4\left( {\Delta e} \right) ^{2}\delta +4\left( {\Delta e} \right) ^{2}\gamma +4\Delta e\delta ^{2}t-4\Delta e\delta t\gamma -2\Delta e\Delta c\gamma +\Delta e\gamma ^{2}t+\left( {\Delta c} \right) ^{2}\delta } \right) +\xi t \\ \end{array}} \right\} . \end{aligned}$$

Proof of Proposition 6

-

(1)

Under the condition that the government has limited budget and can choose at most one firm to provide subsidy, \(F_{1 }\)is chosen if the total change in pollutant emissions satisfy\(\Delta E_1 >0\) and \(\Delta E_1 >\Delta E_2 \), equivalently, \(\frac{1}{3}t\left( {\delta +\gamma } \right) >0\)and \(\frac{1}{3}t\left( {\delta +\gamma } \right) >\frac{1}{3}t\left( {2\delta -\gamma } \right) \). Simplifying these conditions we get \(\delta <2\gamma \).

-

(2)

Under the condition that the government has limited budget and can choose at most one firm to provide subsidy, \(F_{2 }\)is chosen if the total change in pollutant emissions satisfy \(\Delta E_2 >0\) and \(\Delta E_2 >\Delta E_1 \), equivalently \(\frac{1}{3}t\left( {2\delta -\gamma } \right) >0\) and \(\frac{1}{3}t\left( {2\delta -\gamma } \right) >\frac{1}{3}t\left( {\delta +\gamma } \right) \). Simplifying these conditions we get \(\delta >2\gamma \).

-

(3)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy, only \(F_{1 }\)is chosen if the total change in pollutant emissions satisfy \(\Delta E_1 >0\), \(\Delta E_1 >\Delta E_2 \) and \(\Delta E_1 >\Delta E_3 \), equivalently \(\frac{1}{3}t\left( {\delta +\gamma } \right) >0\), \(\frac{1}{3}t\left( {\delta +\gamma } \right) >\frac{1}{3}t\left( {2\delta -\gamma } \right) \), and \(\frac{1}{3}t\left( {\delta +\gamma } \right) >\delta t\). Simplifying these conditions we get \(\delta <\gamma /2\).

-

(4)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy, both firms are chosen if the total change in pollutant emissions satisfy \(\Delta E_3 >0\), \(\Delta E_3 >\Delta E_1 \), and \(\Delta E_3 >\Delta E_2 \), equivalently \(\delta t>0\), \(\delta t>\frac{1}{3}t\left( {\delta +\gamma } \right) \) and \(\delta t>\frac{1}{3}t\left( {2\delta -\gamma } \right) \). Simplifying these conditions we get \(\delta >\gamma /2\).

Appendix 2

Proof of Proposition 10

-

(1)

Under the condition that the government has limited budget and can choose at most one firm to provide subsidy and it chooses \(F_{2}\) to subsidize, the necessary condition of \(F_{2 }\) accepting the subsidy policy and investing in technology is \(F_{2}\)’s profit satisfy: \(\pi _{22} >\max \left\{ {\pi _{20} ,\pi _{21} } \right\} \), equivalently,

$$\begin{aligned} \frac{1}{9\left( {\Delta e+\delta t} \right) }\left( {2\Delta e+2\delta t-\Delta c-\gamma t} \right) ^{2}-\xi t^{2}+ts> \max \left\{ {\begin{array}{l} \frac{1}{9\Delta e}\left( {2\Delta e-\Delta c} \right) ^{2}, \\ \frac{1}{9\left( {\Delta e-\delta t} \right) }\left( {2\Delta e-2\delta t-\Delta c-\gamma t} \right) ^{2} \\ \end{array}} \right\} . \end{aligned}$$Simplifying these conditions we get

$$\begin{aligned} s>\max \left\{ {\begin{array}{l} \frac{1}{9\Delta e\left( {\Delta e+\delta t} \right) }\left( {\left( {\Delta c} \right) ^{2}\delta -4\left( {\Delta e} \right) ^{2}\delta +4\left( {\Delta e} \right) ^{2}\gamma -4\Delta e\delta ^{2}t+4\Delta e\delta t\gamma -2\Delta e\Delta c\gamma -\Delta e\gamma ^{2}t} \right) +\xi t, \\ \frac{1}{9\left( {\left( {\Delta e} \right) ^{2}-\delta ^{2}t^{2}} \right) }\left( {-4\left( {\Delta e} \right) ^{2}+\left( {\Delta c} \right) ^{2}+\gamma ^{2}t^{2}+2\Delta c\gamma t+4\delta ^{2}t^{2}} \right) +\xi t \\ \end{array}} \right\} . \end{aligned}$$ -

(2)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy and it only chooses \(F_{2}\) to subsidize, the necessary condition of \(F_{2 }\)accepting the subsidy policy and investing in technology is \(F_{2}\)’s profit satisfy: \(\pi _{22} >\max \left\{ {\pi _{20} ,\pi _{21} } \right\} \) and we get

$$\begin{aligned} s>\max \left\{ {\begin{array}{l} \frac{1}{9\Delta e\left( {\Delta e+\delta t} \right) }\left( {\left( {\Delta c} \right) ^{2}\delta -4\left( {\Delta e} \right) ^{2}\delta +4\left( {\Delta e} \right) ^{2}\gamma -4\Delta e\delta ^{2}t+4\Delta e\delta t\gamma -2\Delta e\Delta c\gamma -\Delta e\gamma ^{2}t} \right) +\xi t, \\ \frac{1}{9\left( {\left( {\Delta e} \right) ^{2}-\delta ^{2}t^{2}} \right) }\left( {-4\left( {\Delta e} \right) ^{2}+\left( {\Delta c} \right) ^{2}+\gamma ^{2}t^{2}+2\Delta c\gamma t+4\delta ^{2}t^{2}} \right) +\xi t \\ \end{array}} \right\} \end{aligned}$$ -

(3)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy and it chooses both firms to subsidize, the necessary condition of both firms accepting the subsidy policy and investing in technology is the profits of \(F_{1}\) and \(F_{2}\) satisfy: \(\pi _{13} >\max \left\{ {\pi _{10} ,\pi _{12} } \right\} \) and \(\pi _{23} >\max \left\{ {\pi _{20} ,\pi _{21} } \right\} \), equivalently,

$$\begin{aligned} \frac{1}{9\Delta e}\left( {\Delta e+\Delta c} \right) ^{2}-\xi t^{2}+ts_0 >\max \left\{ {\begin{array}{l} \frac{1}{9\Delta e}\left( {\Delta e+\Delta c} \right) ^{2}, \\ \frac{1}{9\left( {\Delta e+\delta t} \right) }\left( {\Delta e+\delta t+\Delta c-\gamma t} \right) ^{2} \\ \end{array}} \right\} \end{aligned}$$and

$$\begin{aligned} \frac{1}{9\Delta e}\left( {2\Delta e-\Delta c} \right) ^{2}-\xi t^{2}+ts_0 >\max \left\{ {\begin{array}{l} \frac{1}{9\Delta e}\left( {2\Delta e-\Delta c} \right) ^{2}, \\ \frac{1}{9\left( {\Delta e-\delta t} \right) }\left( {2\Delta e-2\delta t-\Delta c-\gamma t} \right) ^{2} \\ \end{array}} \right\} . \end{aligned}$$Simplifying these conditions we get

$$\begin{aligned}s>\max \left\{ {\begin{array}{l} \frac{1}{9\Delta e\left( {\Delta e+\delta t} \right) }\left( {\left( {\Delta e} \right) ^{2}\delta -\left( {\Delta c} \right) ^{2}\delta -2\left( {\Delta e} \right) ^{2}\gamma +\Delta e\delta ^{2}t-2\Delta e\delta t\gamma -2\Delta e\Delta c\gamma +\Delta e\gamma ^{2}t} \right) +\xi t, \\ \frac{1}{9\Delta e\left( {\Delta e-\delta t} \right) }\left( {-4\left( {\Delta e} \right) ^{2}\delta -4\left( {\Delta e} \right) ^{2}\gamma +\left( {\Delta c} \right) ^{2}\delta +\Delta e\gamma ^{2}t+4\Delta e\delta t\gamma +2\Delta e\Delta c\gamma +4\Delta e\delta ^{2}t} \right) +\xi t, \\ \\ \xi t \\ \end{array}} \right\} \end{aligned}$$

Proof of Proposition 11

-

(1)

Because \(\Delta E_2 >\Delta E_1 \), \(F_{1}\) will never be chosen when the government has limited budget and can choose at most one firm to provide subsidy

-

(2)

Under the condition that the government has limited budget and can choose at most one firm to provide subsidy, \(F_{2 }\)will be chosen because \(\Delta E_2 >\Delta E_1 \) and \(\Delta E_2 >0\).

-

(3)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy, only \(F_{2 }\)will be chosen if the total change in pollutant emissions satisfy \(\Delta E_2 >\Delta E_3 \), equivalently, \(\frac{1}{3}t\left( {2\delta +\gamma } \right) >\delta t\). Simplifying these conditions we get \(\delta <\gamma \).

-

(4)

Under the condition that the government has enough budget and can choose at most both firms to provide subsidy, both firms are chosen if the total change in pollutant emission satisfy \(\Delta E_3 >0\) and \(\Delta E_3 >\Delta E_2 \), equivalently \(\delta t>0\) and \(\delta t>\frac{1}{3}t\left( {2\delta +\gamma } \right) \). Simplifying these conditions we get \(\delta >\gamma \).

Rights and permissions

About this article

Cite this article

Bi, G., Jin, M., Ling, L. et al. Environmental subsidy and the choice of green technology in the presence of green consumers. Ann Oper Res 255, 547–568 (2017). https://doi.org/10.1007/s10479-016-2106-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-016-2106-7