Abstract

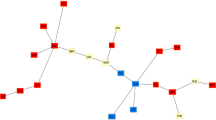

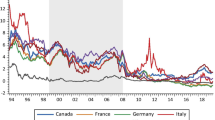

In this paper, we propose a novel concept of correlation-based stable networks to empirically investigate the dynamic integration and network structure of the European Monetary Union (EMU) sovereign bond markets. The obtained results uncover a high degree of market integration between sample markets over the period preceding the recent financial crises, while segmentation is found afterwards. The stable network analysis shows, for its part, the existence of two different network structures before and after the onset of the European debt crisis, where the in-crisis network structure is characterized by two groups of countries with respect to their fiscal performance. In particular, Belgium is the unique vertex connecting the two groups, making it the channel for shock transmission in the event of worsening debt crisis in the EMU.

Similar content being viewed by others

Notes

Abad et al. (2010) examine the sensitivity of Government bond returns to two sources of systemic risk (world and eurozone) and find that the euro markets are more sensitive to EMU risk factors than to world risk factors, an evidence that shows their increased integration over time. Pozzi and Wolswijk (2012) investigate the time-varying integration of euro area government bond markets (Belgium, France, Italy, Germany, and the Netherlands) from an ICAPM with impediments, whereby risk premiums are conditional on a country-specific factor. They mainly document a convergence of the government bond market exposures to the common international risk factor, with no tendency to reverse during the global financial crisis 2007–2009.

The fundamentals contagion refers to the fact that sovereign bond markets are more sensitive to countries’ economic fundamentals during the crisis period than the pre-crisis period, while the geographic herding contagion indicates that sovereign risk increased simultaneously across countries. Beirne and Fratscher (2013) find evidence of the geographic herding contagion for the euro area countries in 2008 and between August and September 2011.

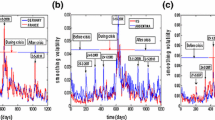

In financial time series, one of the most common stylized facts is the volatility clustering which can be captured by GARCH process. However, GARCH process can not capture the asymmetric effects of the positive and negative shocks on volatility. In addition to that, conditional variance need not be a linear function process of lagged square residuals or lagged absolute residuals which leads us to the Asymmetric Power ARCH models. Finally, we would like to capture the long range dependence on conditional volatility which is a common phenomenon in financial time series, leading us to the fractionally integrated volatility models. To obtain the richest volatility dynamics, we use the FIAPARCH modeling proposed by Tse (1998).

It is clear that every \(p_{1}\)-stable connection is also \(p_{2}\)-stable for any \(p_{2} \le p_{1} \le 1\).

It would be naive to choose a fixed threshold level to determine if a correlation value is strong or not. Several studies in the literature have shown that correlations are time-varying and tend to increase in turbulent times. Therefore, a fixed choice would most likely introduce a bias depending on the global conditions. With our model, the threshold level is determined endogenously and updated everyday. Thus, possible bias arising due to changing global conditions is minimized.

When \(c <0\), c-strong correlation levels become below the average. In order to consider a reasonable strength concept for correlations, minimum c should be taken as 0.

Estimated model parameters can be found in Appendix A.

The size of the circles in the figures do not have any economic interpretation and are chosen for optimal allocation purposes when constructing networks.

Debt is measured as the consolidated general government gross debt at nominal (face) value, outstanding at the end of the year. This debt-to-GDP ratio is defined in the Maastricht Treaty.

Detailed statistics are provided upon requests.

We observe severe capital outflows from emerging markets during this period. Due to these outflows, currencies of Chile, India, Brazil, Turkey, South Africa and Indonesia experienced depreciations ranging between 10 and 26% in 2013. Similarly, several emerging sovereign bond yields shot up and equity markets in some of these countries loss up to 30% of their values.

For example, developed countries worldwide were averaging about 100% debt to GDP ratio while in the emerging countries this ratio was averaging around only about 40% by the end of 2012. Similar considerable differences in other fiscal indicators were also observed.

Although it is not the scope of this paper, further research could seek answer to the rhetorical question of “do we need any other central banks then Fed?”. Naturally, the answer would be “yes” but the idea is to stress on the challenges faced with other central banks when one clearly dominates the others.

The main advantage of this methodology is that it does not impose any condition on the dependency and distribution of the data. For details, see Lavielle (2005).

See Masson (1999) for theoretical support to this argument.

References

Abad, P., Chulia, H., & Gomez-Puig, M. (2010). European government bond market integration. Journal of Banking & Finance, 34, 2851–2860.

Aielli, G. P. (2013). Dynamic conditional correlation: On properties and estimation. Journal of Business & Economic Statistics, 31, 282–299.

Barrios, S., Iversen, P., Lewandowska, M., Setzer, R. (2009). Determinants of intra-euro area government bond spreads during the financial crisis. European Commission Economic Papers 388.

Barro, D., & Basso, A. (2010). Credit contagion in a network of firms with spatial interaction. European Journal of Operational Research, 205, 459–468.

Beber, A., Brandt, M. W., & Kavajecz, K. A. (2009). Flight-to-quality or flight-to-liquidity? Evidence from the Euro-area bond market. Review of Financial Studies, 22, 925–957.

Beirne, J., & Fratscher, M. (2013). The pricing of sovereign risk and contagion during the European sovereign debt crisis. Journal of International Money and Finance, 34, 60–82.

Bernoth, K., von Hagen, J., & Schuknecht, L. (2012). Sovereign risk premiums in the European government bond market. Journal of International Money and Finance, 31, 975–995.

Caccioli, F., Farmer, J. D., Foti, N., & Rockmore, D. (2015). Overlapping portfolios, contagion, and financial stability. Journal of Economic Dynamics and Control, 51, 50–63.

Capponin, A., & Chen, P. C. (2015). Systemic risk mitigation in financial networks. Journal of Economic Dynamics and Control, 58, 152–166.

Christiansen, C. (2014). Integration of European bond markets. Journal of Banking & Finance, 42, 191–198.

Codogno, L., Favero, C., & Missale, A. (2003). Yield spreads on EMU government bonds. Economic Policy, 37, 527–529.

Conrad, C., Karanasos, M., & Zeng, N. (2008). Multivariate fractionally integrated APARCH modeling of stock market volatility: A multi-country study. Discussion Paper Series, University of Heidelberg.

Dewachter, H., Iania, L., Lyrio, M., & de Sola Perea, M. (2015). A macro-financial analysis of the euro area sovereign bond market. Journal of Banking & Finance, 50, 308–325.

Ehrmann, M., Fratzcher, M., Gurkaynak, R., & Swanson, E. T. (2011). Convergence and anchoring of yield curves in the Euro area. Review of Economics and Statistics, 93, 350–364.

Engle, R. F. (2002). Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics, 20, 339–350.

Fatas, A. (2010). The economics of achieving fiscal sustainability. Paper presented at the Academic Consultants Meeting - Board of Governors, Federal Reserve

Gruner, H. P. (2010). Why EMU is not a failure? European Journal of Political Economy, 26, 1–11.

Iara, A., & Wolff, G. B. (2014). Rules and risk in the Euro area. European Journal of Political Economy, 34, 222–236.

Iori, G., De Masi, G., Precup, O., Gabbi, G., & Caldarelli, G. (2008). A network analysis of the Italian overnight money market. Journal of Economic Dynamics and Control, 32, 259–278.

Lavielle, M. (2005). Using penalized contrasts for the change-point problem. Signal Processing, 85, 1501–1510.

Markellos, R. N., Psychoyios, D., & Schneider, F. (2016). Sovereign debt markets in light of the shadow economy. European Journal of Operational Research, 252, 220–231.

Masson, P. (1999). Contagion: Macroeconomic models with multiple equilibria. Journal of International Money and Finance, 18, 587–602.

Minoiu, C., & Reyes, J. A. (2013). A network analysis of global banking: 1978–2010. Journal of Financial Stability, 9, 168–184.

Nagurney, A., & Ke, K. (2006). Financial networks with intermediation: Risk management with variable weights. European Journal of Operational Research, 172, 40–63.

Paltalidis, N., Gounopoulos, D., Kizys, R., & Koutelidakis, Y. (2015). Transmission channels of systemic risk and contagion in the European financial network. Journal of Banking & Finance, 61, 36–52.

Pozzi, L., & Wolswijk, G. (2012). The time-varying integration of euro area government bond markets. European Economic Review, 56, 36–53.

Pragidis, I. C., Aielli, G. P., Chionis, D., & Schizas, P. (2015). Contagion effects during financial crisis: Evidence from the Greek sovereign bonds market. Journal of Financial Stability, 18, 127–138.

Reboredo, J. C., & Ugolini, A. (2015). Systemic risk in european sovereign debt markets: A CoVaR-copula approach. Journal of International Money and Finance, 51, 214–244.

Schuknecht, L., von Hagen, J., & Wolswijk, G. (2009). Government risk premiums in the bond market: EMU and Canada. European Journal of Political Economy, 25, 371–384.

Sibbertsen, P., Wegener, C., & Basse, T. (2014). Testing for a break in the persistence in yield spreads of EMU government bonds. Journal of Banking & Finance, 41, 109–118.

Tola, V., Lillo, F., Gallegati, M., & Mantegna, R. N. (2008). Cluster analysis for portfolio optimization. Journal of Economic Dynamics and Control, 32, 235–258.

Tse, Y. K. (1998). The conditional heteroskedasticity of the yen-dollar exchange rate. Journal of Applied Econometrics, 13, 49–55.

Tumminello, M., Lillo, F., & Mantegna, R. N. (2010). Correlation, hierarchies, and networks in financial markets. Journal of Economic Behavior & Organization, 75, 40–58.

von Hagen, J., Schuknecht, L., & Wolswijk, G. (2011). Government bond risk premiums in the EU revisited: The impact of the finanial crisis. European Journal of Political Economy, 27, 36–43.

Author information

Authors and Affiliations

Corresponding author

Additional information

An earlier version of this paper is available as World Bank Policy Research Paper 7149. The findings, interpretations, and conclusions expressed in this paper are entirely those of the authors. They do not necessarily represent the views of the International Bank for Reconstruction and Development/World Bank and its affiliated organizations, or those of the Executive Directors of the World Bank or the governments they represent.

Appendix A: Parameter estimates

Appendix A: Parameter estimates

The following Table 2 presents the estimated parameters for the model used in this paper.

Rights and permissions

About this article

Cite this article

Sensoy, A., Nguyen, D.K., Rostom, A. et al. Dynamic integration and network structure of the EMU sovereign bond markets. Ann Oper Res 281, 297–314 (2019). https://doi.org/10.1007/s10479-018-2831-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-018-2831-1