Abstract

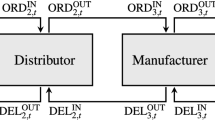

We consider an optimization problem for a dual-channel supply chain with one manufacturer and one retailer under stochastic demand. The manufacturer and retailer play a Stackelberg game. The manufacturer, acting as the leader, decides the total inventory capacity, wholesale price and selling price in the direct channel. The retailer, acting as the follower, decides the order quantity and retail price in the traditional channel. By solving the optimization problem, we find that given the selling price in the direct channel and wholesale price, the retailer’s decisions on order quantity is similar to that for the newsvendor problem. Meanwhile, the manufacturer’s decision on the inventory allocated to the direct channel also has the similar structure. Besides, we show that in our analysis framework, the retail price in the traditional channel, wholesale price and total inventory capacity can be presented in closed-forms. Finally, we numerically study the effects of the demand uncertainties and price sensitivities on the optimal solutions and performance. It is interesting to show that the retailer’s expected profit may be unexpectedly increased when the demand variability in the traditional channel increases, due to the competition between two channels.

Similar content being viewed by others

References

Alptekinoglu, A., & Tang, C. S. (2005). A model for analyzing multi-channel distribution systems. European Journal of Operational Research, 163(3), 802–824.

Boyaci, T. (2005). Competitive stocking and coordination in a multiple-channel distribution system. IIE Transactions, 37(5), 407–427.

Cattani, K., Gilland, W., Heese, H. S., & Swaminathan, J. (2006). Boiling frogs: Pricing strategies for a manufacturer adding a direct channel that competes with the traditional channel. Production and Operations Management, 15(1), 40–56.

Chiang, W. Y. K. (2010). Product availability in competitive and cooperative dual-channel distribution with stock-out based substitution. European Journal of Operational Research, 200(1), 111–126.

Chiang, W. Y. K., Chhajed, D., & Hess, J. D. (2003). Direct marketing, indirect profits: A strategic analysis of dual-channel supply-chain design. Management Science, 49(1), 1–20.

Chiang, W. Y. K., & Monahan, G. E. (2005). Managing inventories in a two-echelon dual-channel supply chain. European Journal of Operational Research, 162(2), 325–341.

Ding, Q., Dong, C., & Pan, Z. (2016). A hierarchical pricing decision process on a dual-channel problem with one manufacturer and one retailer. International Journal of Production Economics, 175, 197–212.

Dumrongsiri, A., Fan, M., Jain, A., & Moinzadeh, K. (2008). A supply chain model with direct and retail channels. European Journal of Operational Research, 187(3), 691–718.

Ernst, R. L. (1970). A linear inventory model of a monopolistic firm. Ph.D. Dissertation, Department of Economics, University of California, Berkeley, CA.

Geng, Q., & Mallik, S. (2007). Inventory competition and allocation in a multi-channel distribution system. European Journal of Operational Research, 182(2), 704–729.

Horn, R. A., & Johnson, C. R. (2012). Matrix analysis. Cambridge: Cambridge University Press.

Hsieh, C. C., Chang, Y. L., & Wu, C. H. (2014). Competitive pricing and ordering decisions in a multiple-channel supply chain. International Journal of Production Economics, 154(4), 156–165.

Hua, G., Wang, S., & Cheng, T. C. E. (2010). Price and lead time decisions in dual-channel supply chains. European Journal of Operational Research, 205, 113–126.

Huang, S., Yang, C., & Zhang, X. (2012). Pricing and production decisions in dual-channel supply chains with demand disruptions. Computers and Industrial Engineering, 62(1), 70–83.

Huang, W., & Swaminathan, J. M. (2009). Introduction of a second channel: Implications for pricing and profits. European Journal of Operational Research, 194(1), 258–279.

Kurata, H., Yao, D. Q., & Liu, J. J. (2007). Pricing policies under direct vs. indirect channel competition and national vs. store brand competition. European Journal of Operational Research, 180(1), 262–281.

Li, B., Hou, P. W., Chen, P., & Li, Q. H. (2016). Pricing strategy and coordination in a dual channel supply chain with a risk-averse retailer. International Journal of Production Economics, 178, 154–168.

Li, Q., Li, B., Chen, P., & Hou, P. (2017). Dual-channel supply chain decisions under asymmetric information with a risk-averse retailer. Annals of Operations Research, 257(1–2), 423–447.

Lu, Q., & Liu, N. (2015). Effects of e-commerce channel entry in a two-echelon supply chain: A comparative analysis of single-and dual-channel distribution systems. International Journal of Production Economics, 165, 100–111.

Liu, B., Zhang, R., & Xiao, M. (2010). Joint decision on production and pricing for online dual channel supply chain system. Applied Mathematical Modelling, 34(12), 4208–4218.

Maglaras, C., & Meissner, J. (2006). Dynamic pricing strategies for multiproduct revenue management problems. Manufacturing and Service Operations Management, 8(2), 136–148.

Mills, E. S. (1959). Uncertainty and price theory. The Quarterly Journal of Economics, 73(1), 116–130.

Niu, R. H., Zhao, X., Castillo, I., & Joro, T. (2012). Pricing and inventory strategies for a two-stage dual-channel supply chain. Asia-Pacific Journal of Operational Research, 29(01), 1240004-1–1240004-38.

Park, S. Y., & Keh, H. T. (2003). Modelling hybrid distribution channels: A game-theoretic analysis. Journal of Retailing and Consumer Services, 10(3), 155–167.

Petruzzi, N. C., & Dada, M. (1999). Pricing and the newsvendor problem: A review with extensions. Operations Research, 47(2), 183–194.

Ryan, J. K., Sun, D., & Zhao, X. (2013). Coordinating a supply chain with a manufacturer-owned online channel: A dual channel model under price competition. IEEE Transactions on Engineering Management, 60(2), 247–259.

Takahashi, K., Aoi, T., Hirotani, D., & Morikawa, K. (2011). Inventory control in a two-echelon dual-channel supply chain with setup of production and delivery. International Journal of Production Economics, 133(1), 403–415.

Thowsen, G. T. (1975). A dynamic, nonstationary inventory problem for a price/quantity setting firm. Naval Research Logistics (NRL), 22(3), 461–476.

Tsay, A. A., & Agrawal, N. (2004). Channel conflict and coordination in the e-commerce age. Production and Operations Management, 13(1), 93–110.

Viswanathan, S. (2005). Competing across technology-differentiated channels: The impact of network externalities and switching costs. Management Science, 51(3), 483–496.

Whitin, T. M. (1955). Inventory control and price theory. Management Science, 2(1), 61–68.

Yao, D. Q., & Liu, J. J. (2005). Competitive pricing of mixed retail and e-tail distribution channels. Omega, 33(3), 235–247.

Yao, D. Q., Yue, X., Mukhopadhyay, S. K., & Wang, Z. (2009). Strategic inventory deployment for retail and e-tail stores. Omega, 37(3), 646–658.

Yue, X., & Liu, J. (2006). Demand forecast sharing in a dual-channel supply chain. European Journal of Operational Research, 174(1), 646–667.

Acknowledgements

The authors thank the editors and two anonymous reviewers for their constructive comments. This research was supported in part by the National Science Foundation of China (No. 71771100 and No. 71601187).

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Proof of Lemma 2

Proof

From Lemma 1, we have

then

indicating that \({{q}_{1}}\left( {{z}_{1}} \right) \) is increasing in \({{z}_{1}}\). \(\square \)

1.2 Proof of Proposition 1

Proof

From the chain rule and Lemma 1, we have:

To obtain the values of \(z_1\) that satisfy this first-order optimality condition, let \(R_1(z_1)\equiv d{\mathbb {E}}[{\varPi }_r(z_1, p_1(z_1))]/dz_1\) and consider that

where \(r_1(\cdot )\equiv f_1(\cdot )/[1-F_1(\cdot )]\) denotes the hazard rate. Also,

Thus, we can obtain,

Since we have \(2r_1(z_1)^2+{dr_1(z_1)}/{dz_1}>0\), then it follows that \(R_1(z_1)\) is monotone or unimodal, implying that \(d{\mathbb {E}}[{\varPi }_r(z_1, p_1(z_1))]/dz_1=0\) has at most two roots. Further, \({{R}_{1}}\left( {{B}_{1}} \right) =-w<0\). Therefore, if \({{R}_{1}}\left( {{z}_{1}} \right) \) has only one root, it indicates a change of sign for \({{R}_{1}}\left( {{z}_{1}} \right) \) from positive to negative, and thus it corresponds to a local maximum of \({\mathbb {E}}\left[ {{{\varPi }}_{r}}\left( {{z}_{1}},{{p}_{1}}\left( {{z}_{1}} \right) \right) \right] \) ; if it has two roots, the larger of the two corresponds to a local maximum and the smaller of the two corresponds to a local minimum of \({\mathbb {E}}\left[ {{{\varPi }}_{r}}\left( {{z}_{1}},{{p}_{1}}\left( {{z}_{1}} \right) \right) \right] \). In either case, \({\mathbb {E}}\left[ {{{\varPi }}_{r}}\left( {{z}_{1}},{{p}_{1}}\left( {{z}_{1}} \right) \right) \right] \) has only one local maximum, identified either as the unique value of \({{z}_{1}}\) that satisfies \({{R}_{1}}\left( {{z}_{1}} \right) =d{\mathbb {E}}\left[ {{{\varPi }}_{r}}\left( {{z}_{1}},{{p}_{1}}\left( {{z}_{1}} \right) \right) \right] /d{{z}_{1}}\ =0\) or as the larger of two values of \({{z}_{1}}\) that satisfies \({{R}_{1}}\left( {{z}_{1}} \right) =0\). And since \({\mathbb {E}}\left[ {{{\varPi }}_{r}}\left( {{z}_{1}},{{p}_{1}}\left( {{z}_{1}} \right) \right) \right] \) is unimodal if \({{R}_{1}}\left( {{z}_{1}} \right) \) has only one root, a sufficient condition for unimodality of \({\mathbb {E}}\left[ {{{\varPi }}_{r}}\left( {{z}_{1}},{{p}_{1}}\left( {{z}_{1}} \right) \right) \right] \) is \({{R}_{1}}\left( {{A}_{1}} \right) >0\) or, equivalently, \(2{{b}_{11}}{{R}_{1}}\left( {{A}_{1}} \right) >0\), where

\(\square \)

1.3 Proof of Corollary 1

Proof

Note from Lemma 2 that \(q_1(z_1)\) increases in \(z_1\). So the boundary of \(q_1\) could be mapped to \(z_1\), such that \(N=y_1(p_1(z_1), p_2)+z_1\) is satisfied. As shown in Proposition 1, if \({{a}_{1}}-\left( {{b}_{11}}w-{{b}_{12}}{{p}_{2}} \right) +{{A}_{1}}>0\), then \({\mathbb {E}}[{\varPi }_r(z_1, p_1(z_1))]\) is unimodal in \(z_1\). So given \(q_1(z_1)\ge N\), we have \(z_1^*=\bar{z_1}\). If \({{a}_{1}}-\left( {{b}_{11}}w-{{b}_{12}}{{p}_{2}} \right) +{{A}_{1}}\le 0\), there are two \(z_1\) satisfy the first-order condition. So we need to compare the values of \({\mathbb {E}}[{\varPi }_r(A_1, p_1(A_1))]\) and \({\mathbb {E}}[{\varPi }_r({\bar{z}}_1, p_1({\bar{z}}_1))]\). If \({\mathbb {E}}[{\varPi }_r(A_1, p_1(A_1))]<{\mathbb {E}}[{\varPi }_r({\bar{z}}_1, p_1({\bar{z}}_1))]\), then \(z_1^*={\bar{z}}_1\), otherwise, \(z_1^*=A_1\). \(\square \)

1.4 Proof of Lemma 3

Proof

We first define retailer’s global optimal solutions as \(z_1^*\left( N,{{p}_{2}},w \right) \), \(q_1^*\left( N,{{p}_{2}},w \right) \) and \(p_1^*\left( N,{{p}_{2}},w \right) \), for given \(\left( N,{{p}_{2}},w \right) \). Besides, similar to the definition of \({{\hat{z}}}_1\), we let \({{\hat{p}}}_1=p_1(p_2,w)\) and \({{\hat{q}}}_1=q_1(p_2,w)\).

There may exist two cases when the manufacturer sets the optimal N. The first case is \(N\ge q_1(p_2,w)\), where the optimal responses of retailer’s decisions are characterized in Proposition 1. The corresponding values are \({\hat{z}}_1\), \({\hat{q}}_1\) and \({\hat{p}}_1\). The second case is \(N<q_1(p_2,w)\), where the optimal responses are given in Corollary 1. The corresponding values are \(z_1^*\left( N,{{p}_{2}},w \right) \), \(q_1^*\left( N,{{p}_{2}},w \right) \) and \(p_1^*\left( N,{{p}_{2}},w \right) \). Next we show that it would not be the optimal solution such that \(N<q_1(p_2,w)\), when the manufacturer sets N.

We assume that there exists a total inventory capacity \(N=n\), i.e., \(0\le n<{\hat{q}}_1\). From Corollary 1, we know that the corresponding optimal responses are \(z_1^*\left( n,{{p}_{2}},w \right) \), \(q_1^*\left( n,{{p}_{2}},w \right) \) and \(p_1^*\left( n,{{p}_{2}},w \right) \). It is easy to check that \(z_1^*(n,p_2,w)<{\hat{z}}_1\). Besides, from Lemmas 1 and 2, we know that both \({{p}_{1}}\left( {{z}_{1}} \right) \) and \({{q}_{1}}\left( {{z}_{1}} \right) \) are increasing in \({{z}_{1}}\). Then we have \(p_1^*(n,p_2,w)<{\hat{p}}_1\) and \(q_1^*(n,p_2,w)\le n<{\hat{q}}_1\). The manufacturer’s expected profit is

Now we consider another feasible solution \(N=n+\frac{w\left[ {\hat{q}}_1-q_1^*(n,p_2,w) \right] }{c}\). It is easy to verify that \(n+\frac{w\left[ {\hat{q}}_1-q_1^*(n,p_2,w) \right] }{c}\ge n+ {\hat{q}}_1-q_1^*(n,p_2,w)\ge {\hat{q}}_1> n\). Here, the first inequality follows from \(w\ge c\), the second inequality follows from \(q_1^*(n,p_2,w)\le n\), and the last inequality follows from \(n<{\hat{q}}_1\). Given the optimal responses \({\hat{q}}_1\) and \({\hat{p}}_1\), the manufacturer’s expected profit function is

Then we have

The inequality follows from \({\mathbb {E}}[D_2\left( {\hat{p}}_1,{{p}_{2}},\epsilon _2 \right) ]\ge {\mathbb {E}}[{{D}_{2}}\left( p_1^*(n,p_2,w),{{p}_{2}},\epsilon _2 \right) ]\) because \({\hat{p}}_1> p_1^*(n,p_2,w)\), and \(n+\frac{w\left[ {\hat{q}}_1-q_1^*(n,p_2,w) \right] }{c}-{\hat{q}}_1\ge n-q_1^*(n,p_2,w)\). It implies that the case \(N=n<{\hat{q}}_1\) would not be optimal.

Thus, we can conclude that given the price in the direct channel \(p_2\) and wholesale price w, the manufacturer will only set the total inventory capacity N in the region \(R_N=\{N: N\ge q_1(p_2,w)\}\). \(\square \)

1.5 Proof of Corollary 2

Proof

From Proposition 1, we know that the retailer’s profit function satisfies the first-order condition, i.e. \(\frac{\partial {\mathbb {E}}[{\varPi }_r(z_1,p_1)]}{\partial z_1}=0\). Thus we can obtain:

By rearranging the above equation, we can obtain

Without loss of generality, we assume that \(\mu _1=0\). According to (5), we can obtain that \(w=[1-F_1(z_1)]p_1\). Plugging it back to Lemma 1, we can obtain

\(\square \)

1.6 Proof of Proposition 3

Proof

To show that the optimization problems \({{{\text {P}}}_{m}}\) and \({{{\text {P}}}_{new}}\) are equivalent, we first show the corresponding regions of their feasible solutions are equivalent, and then we show that the optimal solutions for problem \({{{\text {P}}}_{new}}\) are also optimal for problem \({{{\text {P}}}_{m}}\).

Let \({{{\varOmega }}_{{\text {m}}}}\) be feasible solution region of problem \({{{\text {P}}}_{m}}\), then we have \({{{\varOmega }}_{{\text {m}}}}=\left\{ \left( {{p}_{2}},w \right) :{{p}_{2}}\ge c,w\ge c \right\} \). Let \({{\varOmega }}_{{\text {new}}}\) define the feasible solution region of problem \({{{\text {P}}}_{new}}\), then we have \({{{\varOmega }}_{{\text {new}}}}=\big \{ \left( {{p}_{2}},{{z}_{1}} \right) :{{p}_{2}}\ge c,{{A}_{1}}\le {{z}_{1}}\le {{B}_{1}},p_2\ge g_1(z_1),p_2\ge g_2(z_1)\big \}\), where \(g_1(z_1)=\frac{cb_{11}[1+F_1(z_1)]-[a_1+\mu _1-{\varTheta }_1(z_1)][1-F_1(z_1)]}{b_{12}[1-F_1(z_1)]}\) and \(g_2(z_1)=\frac{[1-F_1(z_1)][1+F_1(z_1)]-2[a_1+\mu _1-{\varTheta }_1(z_1)]r_1(z_1)}{2b_{12}r_1(z_1)}\), and their corresponding constraints directly follow from (17) and (18), respectively. Define \({\varOmega }=\Big \{\left( {{p}_{2}},w\right) :w = \frac{[a_1+\mu _1+b_{12}p_2-{\varTheta }_1(z_1)][1-F_1(z_1)]}{b_{11}[1+F_1(z_1)]},\left( {{p}_{2}},{{z}_{1}}\right) \in {{{\varOmega }}_{{\text {new}}}}\Big \}\). Then, we have \({{{\varOmega }}_{{\text {m}}}}={\varOmega }\), implying that the corresponding regions of the feasible solutions for the two optimization problems are equivalent,

Next we prove the results that the optimal solutions for problem \({{{\text {P}}}_{new}}\) are also optimal for problem \({{{\text {P}}}_{m}}\). Let \(\left( p_{2}^{*},{{w}^{*}} \right) \) be an optimal policy of problem \({{\text {P}}_{m}}\), and \(\left( {{{\hat{p}}}_{2}},{{{\hat{z}}}_{1}} \right) \) be an optimal policy of problem \({{\text {P}}_{new}}\). Because \(\left( p_{2}^{*},{{z}_{1}}\left( p_{2}^{*},{{w}^{*}} \right) \right) \) is a feasible policy for \({{\text {P}}_{new}}\), where \(z_1\left( p_2^*,w^*\right) \) can be obtained from (12) and (13), then we have \({\mathbb {E}}\left[ {{{\varPi }}_{new}}\left( {{{\hat{p}}}_{2}},{{{\hat{z}}}_{1}} \right) \right] \ge {\mathbb {E}}\left[ {{{\varPi }}_{new}}\left( p_{2}^{*},{{z}_{1}}\left( p_{2}^{*},{{w}^{*}} \right) \right) \right] \).

Besides, by definition we have \({\mathbb {E}}[{\varPi }_{new}(p_2,z_1)]={\mathbb {E}}[{\varPi }_m(z_2(p_2,w(p_2,z_1)),p_2,w(p_2,z_1))]\) and \(w(p_2,z_1(p_2,w))=w\), then we have

On the other hand, \(\left( {{{\hat{p}}}_{2}},w\left( {{{\hat{p}}}_{2}},{{{\hat{z}}}_{1}} \right) \right) \) is a feasible policy for \({{\text {P}}_{m}}\), where \(w\left( {{{\hat{p}}}_{2}},{{{\hat{z}}}_{1}} \right) \) can be obtained from (14), then we have

Combining inequalities (19) and (20), we obtain that

Thus, the optimal solutions for problem \({{{\text {P}}}_{new}}\) are also optimal for the problem \({{{\text {P}}}_{m}}\). \(\square \)

1.7 Proof of Lemma 4

Proof

Taking the first derivative of the expected profit with respect to \(p_2\) , we have,

where \(y_2=a_2-b_{22}p_2+b_{21}p_1\), \(y_1=a_1-b_{11}p_1+b_{12}p_2\), and \(z_2 = F_2^{-1}\left( \frac{p_2-c}{p_2}\right) \).

Further,

Here, we define \(p_2^0={{\mathbb {N}}}/{\mathbb {M}}\) as the optimal risk-less price in the direct channel, it is easy to check that when \(p_2>p_2^0\), \(\partial {\mathbb {E}}[{\varPi }_{new}(p_2,z_1)]/\partial p_2<0\), then the optimal price in the direct channel \(p_2^*\) is always less than or equal to \(p_2^0\). \(\square \)

1.8 Proof of Proposition 4

Proof

Define \(R_2(p_2)=\frac{\partial {\mathbb {E}}[{\varPi }_{new}(p_2,z_1)]}{\partial p_2}\), we can obtain,

Define \(r_2(\cdot )=\frac{f_2(\cdot )}{1-F_2(\cdot )}\), we can obtain,

Since we have \(2{{r}_{2}}{{({{z}_{2}})}^{2}}+d{{r}_{2}}({{z}_{2}})/d{{z}_{2}}>0\), then it follows that \({{R}_{2}}({{p}_{2}})\) is monotone or unimodal, implying that \({\partial {\mathbb {E}}[{\varPi }_{new}(p_2,z_1)]}/{\partial {{p}_{2}}=0}\;\) has at most two roots. Further, \({{R}_{2}}\left( p_{2}^{0} \right) <0\). Therefore, if \({{R}_{2}}({{p}_{2}})\) has only one root, it indicates a change of sign for \({{R}_{2}}({{p}_{2}})\) from positive to negative, and thus it corresponds to a local maximum of \({\mathbb {E}}[{\varPi }_{new}(p_2,z_1)]\); if it has two roots, the larger of the two corresponds to a local maximum and the smaller of the two corresponds to a local minimum of \({\mathbb {E}}[{\varPi }_{new}(p_2,z_1)]\). In either case, \({\mathbb {E}}[{\varPi }_{new}(p_2,z_1)]\) has only one local maximum, identified either as the unique value of \({{p}_{2}}\) that satisfies \({{R}_{2}}({{p}_{2}})={\partial {\mathbb {E}}[{\varPi }_{new}(p_2,z_1)]}/{\partial {{p}_{2}}}\;=0\) or as the larger of two values of \({{p}_{2}}\) that satisfies \({{R}_{2}}({{p}_{2}})=0\). And since \({\mathbb {E}}[{\varPi }_{new}(p_2,z_1)]\) is unimodal if \({{R}_{2}}({{p}_{2}})\) has only one root, a sufficient condition for unimodality of \({\mathbb {E}}[{\varPi }_{new}(p_2,z_1)]\) is \({{R}_{2}}(c)={\partial {\mathbb {E}}[{\varPi }_{new}(p_2,z_1)]}/{\partial {{p}_{2}}}|_{p_2=c}>0\). \(\square \)

Rights and permissions

About this article

Cite this article

Huang, G., Ding, Q., Dong, C. et al. Joint optimization of pricing and inventory control for dual-channel problem under stochastic demand. Ann Oper Res 298, 307–337 (2021). https://doi.org/10.1007/s10479-018-2863-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-018-2863-6