Abstract

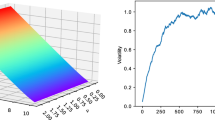

In this paper we introduce a novel pricing methodology for a broad class of models for which the characteristic function of the log-asset price can be efficiently computed. The method is based on a new quantization procedure, crucially exploiting for the first time the Fourier transform of the asset process, which fully characterizes the distribution of the log-asset. As opposed to previous quantizations based on Euler (or more sophisticated) discretization schemes, our method reveals to be fast and accurate, to the point that it is possible to calibrate the models on real data. Moreover, our approach allows to price options in multi factor stochastic volatility models including jumps. As a motivating example, we calibrate a Tempered Stable model on market data. This represents the first application of quantization to a pure jump process.

Similar content being viewed by others

Notes

The quantization problem in infinite dimension, namely when \(\mathbb R^d\) is replaced by a separable Hilbert space or, more generally, by a separable Banach space \((E, \vert \cdot \vert _E)\) (think of E as, e.g., the functional spaces \(L^2_{\mathbb R}([0,T], \lambda )\) or \(\mathcal C([0,T], \mathbb R)\), with \(\lambda \) denoting the Lebesgue measure on \((\mathbb R, \mathcal B(\mathbb R)))\) is known as functional quantization (see e.g. Pagès and Luschgy (2002) for the quantization of stochastic processes viewed as \(L^2([0,1], \lambda )\)-valued random vectors and Pagès and Printems (2005) for an application to finance).

For ease of notation, hereafter we drop N in the notation \(\varGamma ^N\) as we consider a fixed number of points in the grid.

We also mention the optimal quantization website: http://www.quantize.maths-fi.com, where one can download the optimized quadratic quantization grids of the d-dimensional Gaussian distributions \(\mathcal N(0; I_d)\), for \(N = 1\) up to \(10^4\) and for \(d = 1, \dots , 10\). Moreover, at the same link one can also find functional quantization grids of the standard Brownian motion over the interval [0; 1], of the Brownian bridge, as well as a detailed procedure to compute grids for the (normalized) Ornstein-Uhlenbeck process and its bridge.

The function \(\bar{\beta }(x,a,b)\) can be written as

$$\begin{aligned} \bar{\beta }(x,a,b)&= \beta (a,b) - \beta (x,a,b) = \int _{0}^{1} t^{a-1} (1-t)^{b-1} dt - \int _{0}^{x} t^{a-1} (1-t)^{b-1} dt, \end{aligned}$$where \(\beta (a,b)\) (resp. \(\beta (x,a,b)\)) is the complete (resp. incomplete) Euler beta function, see e.g. Abramowitz and Stegun (1970). Therefore, \(\bar{\beta }(x,a,b)\) can be denoted as complementary incomplete Euler beta function. The complete Euler beta function is defined only when \(\mathrm {Re}(a)> 0 , \mathrm {Re}(b)>0\), because otherwise the integral would diverge. Nevertheless, its definition can be extended, by regularization, to negative values of \(\mathrm {Re}(a)\) and \(\mathrm {Re}(b)\), see Ozcag et al. (2008) for a comprehensive study of these special functions. From an implementation perspective, softwares like e.g. Wolfram System already include a regularized version of the Beta and incomplete Beta functions defined for most arguments, by taking into account singular cases.

An important exception is the case when the density is log-concave, for which the Fourier quantization algorithm allows to determine quantizers that are also optimal, see Remark 1.

For sake of brevity we omit the calibration for the other models, for which results are available upon request.

Of course, also the initial variance \(V_0\) should be considered as a parameter to be estimated/calibrated, as it is unobservable.

Tempered stable distributions form a six parameter family of infinitely divisible distributions. They include several well-known subclasses like variance gamma distributions of Madan and Milne (1991), bilateral gamma distributions of Kuchler and Tappe (2008) and the CGMY distributions of Carr et al. (2002).

As usual, Call (resp. Put) prices are provided when the strike is less (resp. greater) than 100.

We did not perform any optimization in the code. On top of that, we guess that the computational time can be even reduced by migrating to other languages like e.g. \(C{\texttt {++}}\).

The calibration can be easily performed for each of the six models presented, we skip the results (available upon request) for the other models for the sake of brevity. The choice of the dataset is also arbitrary: we tested several dates by getting similar results.

References

Abramowitz, M., & Stegun, I. A. (1970). Handbook of mathematical functions (1st ed.). New York: Dover Publications.

Albrecher, H., Mayer, P., Schoutens, W., & Tistaert, J. (2007). The little Heston trap. Wilmott Magazine, 83–92.

Andersen, L. B. G., & Piterbarg, V. V. (2007). Moment explosions in stochastic volatility models. Finance and Stochastics, 11(1), 29–50.

Bates, D. S. (1996). Jumps and stochastic volatility: Exchange rate processes implicit in Deutsche mark options. The Review of Financial Studies, 9(1), 69–107.

Bianchi, M. L. (2009). Tempered stable models in finance: Theory and applications. PhD thesis, University of Bergamo.

Bonnans, J. F., Cen, Z., & Christel, T. (2012). Energy contracts mangement by stochastic programming techniques. Annals of Operations Research, 200(1), 199–222.

Bormetti, G., Callegaro, G., Livieri, G., & Pallavicini, A. (2017). A backward Monte Carlo approach to exotic option pricing. European Journal of Applied Mathematics, 29(1), 146–187.

Boyarchenko, S., & Levendorskiĭ, S. (2014). Efficient variations of the Fourier transform in applications to option pricing. Journal of Computational Finance, 18(2), 57–90.

Brigham, E. O. (1988). The fast Fourier transform and its applications. Signal processing series. Englewood Cliffs, NJ: Prentice Hall.

Callegaro, G., Fiorin, L., & Grasselli, M. (2015). Quantized calibration in local volatility. Risk Magazine, 28(4), 62–67.

Callegaro, G., Fiorin, L., & Grasselli, M. (2016). Pricing via recursive quantization in stochastic volatility models. Quantitative Finance, 17(6), 855–872.

Cambanis, S., & Gerr, N. (1983). A simple class of asymptotically optimal quantizers. IEEE Transactions on Information Theory, 29(5), 664–676.

Carr, P., Geman, H., Madan, D., & Yor, M. (2002). The fine structure of asset returns: An empirical investigation. The Journal of Business, 75(2), 305–332.

Carr, P., & Madan, D. B. (1999). Option valuation using the fast Fourier transform. Journal of Computational Finance, 2, 61–73.

Chesney, M., & Scott, L. (1989). Pricing European currency options: A comparison of the modified Black–Scholes model and a random variance model. Journal of Financial and Quantitative Analysis, 24(3), 267–284.

Christoffersen, P., Heston, S., & Jacobs, K. (2009). The shape and term structure of the index option smirk: Why multifactor stochastic volatility models work so well. Management Science, 55(12), 1914–1932.

Cont, R., Bouchaud, J.-P., & Potters, M. (1997). Scaling in financial data: Stable laws and beyond. In B. Dubrulle, F. Graner, & D. Sornette (Eds.), Scale invariance and beyond. Berlin: Springer.

Cont, R., & Tankov, P. (2004). Financial modelling with jump processes. Boca Raton: Chapman and Hall/CRC.

Cui, Y., del Baño Rollin, S., & Germano, G. (2017). Full and fast calibration of the Heston stochastic volatility model. European Journal of Operational Research, 263(2), 625–638.

Da Fonseca, J., Gnoatto, A., & Grasselli, M. (2015). Analytic pricing of volatility-equity options within Wishart-based stochastic volatility models. Operations Research Letters, 43(6), 601–607.

Da Fonseca, J., & Grasselli, M. (2011). Riding on the smiles. Quantitative Finance, 11, 1609–1632.

Duffie, D., Pan, J., & Singleton, K. (2000). Transform analysis and asset pricing for affine jump-diffusion. Econometrica, 68(6), 1343–1376.

Eberlein, E., Glau, K., & Papapantoleon, A. (2010). Analysis of Fourier transform valuation formulas and applications. Applied Mathematical Finance, 17(3), 211–240.

Fang, F., & Oosterlee, C. W. (2009). A novel pricing method for european options based on Fourier-cosine series expansions. SIAM Journal on Scientific Computing, 31(2), 826–848.

Fiorin, L., Pagès, G., & Sagna, A. (2018). Product Markovian quantization of a diffusion process with applications to finance. Methodology and Computing in Applied Probability (to appear).

Graf, S., & Luschgy, H. (2000). Foundations of quantization for probability distributions. New York: Springer.

Grasselli, M. (2017). The 4/2 stochastic volatility model. Mathematical Finance, 27(4), 1013–1034.

Gray, R., & Neuhoff, D. L. (1998). Quantization. IEEE Transactions on Information Theory, 44(6), 2325–2383.

Gulisashvili, A., & Stein, E. M. (2010). Asymptotic behavior of the stock price distribution density and implied volatility in stochastic volatility models. Applied Mathematics and Optimization, 61(3), 287–315.

Heston, S. (1997). A simple new formula for options with stochastic volatility. Technical report, Washington University of St. Louis.

Heston, S. L. (1993). A closed-form solution for options with stochastic volatility with applications to bond and currency options. Review of Financial Studies, 6(2), 327–343.

Hull, J., & White, A. (1987). The pricing of options on assets with stochastic volatilities. The Journal of Finance, 42(2), 281–300.

Jacobs, K., & Li, X. (2008). Modeling the dynamics of credit spreads with stochastic volatility. Management Science, 54(6), 1176–1188.

Keller-Ressel, M. (2011). Moment explosions and long-term behavior of affine stochastic volatility models. Mathematical Finance, 21(1), 73–98.

Koponen, I. (1995). Analytic approach to the problem of convergence of truncated Lévy flights towards the Gaussian stochastic process. Physics Review E, 52(1), 1197–1199.

Kuchler, U., & Tappe, S. (2008). Bilateral gamma distributions and processes in financial mathematics. Stochastic Processes and their Applications, 118(2), 261–283.

Levendorskiĭ, S. (2016). Pitfalls of the Fourier transform method in affine models, and remedies. Applied Mathematical Finance, 23(2), 81–134.

Madan, D. B., Carr, P. P., & Chang, E. C. (1998). The variance gamma process and option pricing. European Finance Review, 2(1), 79–105.

Madan, D. B., & Milne, F. (1991). Option pricing with V. G. martingale components. Mathematical Finance, 1(4), 39–55.

McWalter, T., Rudd, R., Kienitz, J., & Platen, E. (2018). Recursive marginal quantization of higher-order schemes. Quantitative Finance, 18(4), 693–706.

Ozcag, E., Ege, I., & Gurcay, H. (2008). An extension of the incomplete beta function for negative integers. Journal of Mathematical Analysis and Applications, 338(2), 984–992.

Pagès, G. (2015). Introduction to vector quantization and its applications for numerics. ESAIM: Proceedings and Surveys, 48, 29–79.

Pagès, G., & Luschgy, H. (2002). Functional quantization of stochastic processes. Journal of Functional Analysis, 196(2), 486–531.

Pagès, G., & Printems, J. (2005). Functional quantization for numerics with an application to option pricing. Monte Carlo Methods and Applications, 11(4), 407–446.

Pagès, G., & Sagna, A. (2015). Recursive marginal quantization of the Euler scheme of a diffusion process. Applied Mathematical Finance, 22(5), 463–498.

Pierce, J. (1970). Asymptotic quantizing error for unbounded random variables. IEEE Transactions on Information Theory, 16(1), 81–83.

Platen, E. (1997). A non-linear stochastic volatility model. Financial Mathematics Research Report No. FMRR 005-97. Center for Financial Mathematics, Australian National University, Canberra.

Shephard, N. G. (1991). From characteristic function to distribution function: A simple framework for the theory. Econometric Theory, 7(4), 519–529.

Stein, E. M., & Stein, J. C. (1991). Stock price distributions with stochastic volatility: An analytic approach. Review of Financial Studies, 4(4), 727–752.

Thangavel, K., & Ashok Kumar, D. (2006). Optimization of code book in vector quantization. Annals of Operations Research, 143(1), 317–325.

Acknowledgements

We are grateful to Alexander Antonov, Mark Joshi, Daniele Marazzina, Gilles Pagès, Andrea Pallavicini, Abass Sagna, Antonino Zanette and the participants to the Quantitative Methods in Finance congress (Sydney, December 2016), SIAM Conference on Financial Mathematics and Engineering (Austin, November 2016) for useful discussions.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix

A Proof of Theorem 2.5

Proof

Let us fix the index j and rewrite the distortion function in Eq. (10) by emphasizing in the summation the four components depending on the variable \(x_{j}\):

We then derive with respect to \(x_{j}\), recalling the definition of the density f in (8):

where we used the Eq. (8). Now we study separately the two last integrals. For the first one we use the change of variable \(t = z/x_{j}\) to get

where the function \(\bar{\beta }\) is defined in (12), while for the second integral we use \(1/t=z/x_j\) and we find

Summing up the two expressions we get

which gives the result.\(\square \)

B Proof of Theorem 2.6

Proof

First of all, notice that we can rewrite \(\frac{\partial D_p(\varGamma )}{\partial x_{i}}\) as seen in the proof of Theorem 1:

We now compute the upper and lower diagonal components. Noting that \(x_{j+1}\) and \(x_{j-1}\) appear only in the endpoints of the interval of integration, we easily have that

and

Let us now consider the main diagonal:

Note that the integrals in the last expression are similar to the ones encountered in the proof of Theorem 1 when replacing the exponent \(p-2\) with \(p-1\), so the same computations lead to the result.\(\square \)

C Proof of Theorem 2.11

Proof

The proof adapts to our context the arguments of Graf and Luschgy (2000) and Cambanis and Gerr (1983) and will be developed in several steps.

Step 0. As a preliminary step, we observe that from

and the fact that \(S_T\) has finite \(p-th\) moment, it follows that \(\alpha > p+1\). Similarly, the polynomial behavior at 0

and \(\mathbb {E}\left[ S_T^{p} \right] < + \infty \) implies that \(\gamma > -(1 + p)\). These conditions together guarantee that \( || f ||_{\frac{1}{p+1}} <+ \infty \).

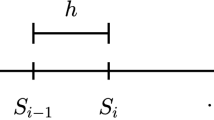

Step 1 Now we develop the expression of the distortion function in the Voronoï partition as follows:

Let \(\xi _{1}=\underset{z \in \left[ x_{1}, \frac{ x_{1} + x_{2}}{2} \right] }{{\text {argmax}}} f(z)\), \(\xi _{i}=\underset{z \in C_{i}}{{\text {argmax}}} f(z)\), for \(i=2, \dots , N-1\), and \(\xi _{N}=\underset{z \in \left[ \frac{x_{N-1} + x_{N}}{2}, x_{N} \right] }{{\text {argmax}}} f(z)\), then

Step 2 Let us define a quantization grid \((\bar{x}_{1}, \dots , \bar{x}_{N})\) such that

This definition is well posed from Step 0. We have that, for \(i=1, \dots , N-1\)

and, using the mean value theorem (notice that f is continuous), we obtain that for \(i = 1, \dots , N-1\) there exists \(\zeta _{i} \in \left[ \bar{x}_{i} , \bar{x}_{i+1} \right] \) such that

where the denominator is always bounded away from zero.

Step 3 In this step we provide a bound for the quantization error. We define

so that

We now use the quantization grid \((\bar{x}_{1}, \dots , \bar{x}_{N})\) defined in Step 2. Let us define, in a similar way as in Step 1, \(\bar{\xi }_{1}=\underset{z \in \left[ \bar{x}_{1}, \frac{ \bar{x}_{1} + \bar{x}_{2}}{2} \right] }{{\text {argmax}}} f(z)\), \(\bar{\xi }_{i}=\underset{z \in \left[ \frac{\bar{x}_{i-1} + \bar{x}_{i}}{2}, \frac{\bar{x}_{i} + \bar{x}_{i+1}}{2} \right] }{{\text {argmax}}} f(z)\), for \(i=2, \dots , N-1\), and \(\bar{\xi }_{N}=\underset{z \in \left[ \frac{\bar{x}_{N-1} + \bar{x}_{N}}{2}, x_{N} \right] }{{\text {argmax}}} f(z)\), then:

By definition of the quantization error \(e_{p,N}(S_T,\varGamma )\), we have that

In the next step we study the asymptotic behavior of \(e_{p,N}\) when \(N \rightarrow + \infty \).

Step 4 Note that when \(N \rightarrow + \infty \), \(\bar{x}_{1} \rightarrow 0\) and \(\bar{x}_{N} \rightarrow +\infty \), so that

Now we show that the integrals \(\displaystyle \int _{\bar{x}_{N}}^{+ \infty } (z - \bar{x}_{N})^{p} f(z) dz\) and \(\displaystyle \int _{\bar{x}_{N}}^{+ \infty } (z - \bar{x}_{N})^{p} f(z) dz\) are of order \(\displaystyle o\left( \frac{1}{N^p} \right) \). For the first one we recall that, from Step 2,

so that

therefore we are reduced to the study of

From Step 0 we have that \(f(z) \sim z^{- \alpha }\) when \(z \rightarrow +\infty \) for \(\alpha >p+1\), then

Let us focus on the numerator:

where the Beta function is well defined here as both \(\alpha - 1 - p\) and \(p+1 \) are positive. In conclusion we get

that is \(\displaystyle \int _{\bar{x}_{N}}^{+ \infty } (z - \bar{x}_{N})^{p} f(z) dz\) is \(\displaystyle o\left( \frac{1}{N^p} \right) \). The second integral \(\displaystyle \int _{\bar{x}_{N}}^{+ \infty } (z - \bar{x}_{N})^{p} f(z) dz\) can be handled similarly using the fact that f(z) behaves as \(z^{\gamma }\) at 0 with \(\gamma > - 1\).

Step 5 Using the results in Step 4, we have that, when \(N \rightarrow + \infty \),

and the theorem is proved.\(\square \)

Rights and permissions

About this article

Cite this article

Callegaro, G., Fiorin, L. & Grasselli, M. Quantization meets Fourier: a new technology for pricing options. Ann Oper Res 282, 59–86 (2019). https://doi.org/10.1007/s10479-018-3048-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-018-3048-z