Abstract

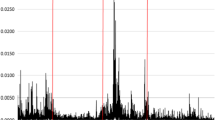

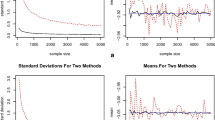

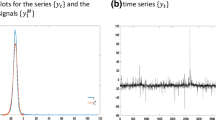

This paper studies the confusion between the long memory and regime switching in the second moment via the stochastic volatility (SV) methodology. An illustrative proposition is firstly presented with simulation evidence to demonstrate that spurious long memory can be caused by a Markov regime-switching SV (MRS-SV) process, when a long memory SV (LMSV) model is employed. To address this, an MRS-LMSV model is developed using a simulation-based optimization method, namely the Markov-Chain Monte Carlo algorithm. Via systematically constructed simulation studies, the proposed model can effectively distinguish between LMSV and MRS-SV processes with consistent estimators of the long-memory parameter. An empirical study of the S&P 500 daily returns is then conducted which demonstrates the superiority of the MRS-LMSV model over LMSV and MRS-SV counterparties. It is verified that significant long memory only exists in the high-volatility state. Important financial implications can be made to improve the risk management operations in practice.

Similar content being viewed by others

References

Ang, A., & Timmermann, A. (2011). Regime changes and financial markets. Technical report, National Bureau of Economic Research.

Ardia, D. (2009). Bayesian estimation of a Markov-switching threshold asymmetric GARCH model with student-t innovations. The Econometrics Journal, 12(1), 105–126.

Baillie, R. T., Bollerslev, T., & Mikkelsen, H. O. (1996). Fractionally integrated generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 74(1), 3–30.

Bali, T. G., & Theodossiou, P. (2007). A conditional-SGT-VaR approach with alternative GARCH models. Annals of Operations Research, 151(1), 241–267.

Bollerslev, T. (1986). Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 31(3), 307–327.

Bollerslev, T. (1987). A conditional heteroskedastic time series model for speculative prices and rates of return. Review of Economics and Statistics, 69(3), 542–547.

Breidt, F. J., Crato, N., & De Lima, P. (1998). The detection and estimation of long memory in stochastic volatility. Journal of Econometrics, 83(1–2), 325–348.

Brockwell, A. (2007). Likelihood-based analysis of a class of generalized long-memory time series models. Journal of Time Series Analysis, 28(3), 386–407.

Carstensen, K., Heinrich, M., Reif, M., & Wolters, M. H. (2020). Predicting ordinary and severe recessions with a three-state Markov-switching dynamic factor model: An application to the German business cycle. International Journal of Forecasting, 36, 829–850.

Carvalho, C. M., & Lopes, H. F. (2007). Simulation-based sequential analysis of Markov switching stochastic volatility models. Computational Statistics & Data Analysis, 51(9), 4526–4542.

Chib, S., Nardari, F., & Shephard, N. (2002). Markov chain Monte Carlo methods for stochastic volatility models. Journal of Econometrics, 108(2), 281–316.

Davidson, J. (2004). Moment and memory properties of linear conditional heteroscedasticity models, and a new model. Journal of Business & Economic Statistics, 22(1), 16–29.

Deo, R. S., & Hurvich, C. M. (2001). On the log periodogram regression estimator of the memory parameter in long memory stochastic volatility models. Econometric Theory, 17(4), 686–710.

Diebold, F. X., & Inoue, A. (2001). Long memory and regime switching. Journal of Econometrics, 105(1), 131–159.

Diebold, F. X., & Mariano, R. S. (2002). Comparing predictive accuracy. Journal of Business & Economic Statistics, 20(1), 134–144.

Engle, R. F. (1982). Autoregressive conditional heteroskedasticity with estimates of variance of United Kingdom inflation. Economerica, 50(4), 987–1007.

Feng, L., & Shi, Y. (2017a). Fractionally integrated GARCH model with tempered stable distribution: A simulation study. Journal of Applied Statistics, 44(16), 2837–2857.

Feng, L., & Shi, Y. (2017b). A simulation study on the distributions of disturbances in the GARCH model. Cogent Economics & Finance, 5(1), 1355503.

Franses, P., & van Dijk, D. (1996). Forecasting stock volatility using (non-linear) GARCH models. Journal of Forecasting, 15, 229–235.

French, K. R., Schwert, G., & Stambaugh, R. F. (1987). Expected stock returns and volatility. Journal of Financial Economics, 19(1), 3–29.

Garman, M. B., & Klass, M. (1980). On the estimation of security price volatilities from. The Journal of Business, 53(1), 67–78.

Gerencsér, L., & Orlovits, Z. (2012). Real time estimation of stochastic volatility processes. Annals of Operations Research, 200(1), 223–246.

Gray, S. F. (1996). Modeling the conditional distribution of interest rates as a regime-switching process. Journal of Financial Economics, 42(1), 27–62.

Guidolin, M., & Timmermann, A. (2006). An econometric model of nonlinear dynamics in the joint distribution of stock and bond returns. Journal of Applied Econometrics, 21(1), 1–22.

Haas, M. (2009). Value-at-risk via mixture distributions reconsidered. Applied Mathematics and Computation, 215(6), 2103–2119.

Haas, M., Mittnik, S., & Paolella, M. S. (2004). A new approach to Markov-switching GARCH models. Journal of Financial Econometrics, 2(4), 493–530.

Haldrup, N., & Nielsen, M. Ø. (2006). A regime switching long memory model for electricity prices. Journal of Econometrics, 135(1), 349–376.

Hamilton, J. D. (1989). A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica, 57(2), 357–384.

Harvey, A., Ruiz, E., & Shephard, N. (1994). Multivariate stochastic variance models. The Review of Economic Studies, 61(2), 247–264.

Harvey, A. C., & Shephard, N. (1996). Estimation of an asymmetric stochastic volatility model for asset returns. Journal of Business & Economic Statistics, 14(4), 429–434.

Henneke, J. S., Rachev, S. T., Fabozzi, F. J., & Nikolov, M. (2011). MCMC-based estimation of Markov switching ARMA-GARCH models. Applied Economics, 43(3), 259–271.

Hillebrand, E. (2005). Neglecting parameter changes in GARCH models. Journal of Econometrics, 129(1–2), 121–138.

Ho, K. Y., & Shi, Y. (2020). Discussions on the spurious hyperbolic memory in the conditional variance and a new model. Journal of Empirical Finance, 55, 83–103.

Ho, K. Y., Shi, Y., & Zhang, Z. (2016). It takes two to tango: A regime-switching analysis of the correlation dynamics between the mainland Chinese and Hong Kong stock markets. Scottish Journal of Political Economy, 63(1), 41–65.

Jacquier, E., Polson, N. G., & Rossi, P. E. (2002). Bayesian analysis of stochastic volatility models. Journal of Business & Economic Statistics, 20(1), 69–87.

Jawadi, F., Louhichi, W., Cheffou, A. I., & Ameur, H. B. (2018). Modeling time-varying beta in a sustainable stock market with a three-regime threshold GARCH model. Annals of Operations Research, 281, 275–295.

Klaassen, F. (2002). Improving GARCH volatility forecasts with regime-switching GARCH. Empirical Economics, 27(2), 363–394.

Krämer, W. (2008). Long memory with Markov-switching GARCH. Economics Letters, 99(2), 390–392.

Lamoureux, C. G., & Lastrapes, W. D. (1990). Heteroskedasticity in stock return data: volume versus GARCH effects. Journal of Finance, 45(1), 221–229.

Lu, X. F., Lai, K. K., & Liang, L. (2014). Portfolio value-at-risk estimation in energy futures markets with time-varying copula-GARCH model. Annals of Operations Research, 219(1), 333–357.

Marcucci, J. (2005). Forecasting stock market volatility with regime-switching GARCH models. Studies in Nonlinear Dynamics & Econometrics,. https://doi.org/10.2202/1558-3708.1145.

Martens, M., De Pooter, M., Van Dijk, D. (2004). Modeling and forecasting S&P 500 volatility: Long memory, structural breaks and nonlinearity, tinbergen Institute Discussion Paper.

Melino, A., & Turnbull, S. M. (1990). Pricing foreign currency options with stochastic volatility. Journal of Econometrics, 45(1–2), 239–265.

Mikosch, T., & Starica, C. (2004). Changes of structure in financial time series and the GARCH model. REVSTAT, 2(1), 41–73.

Moore, T., & Wang, P. (2007). Volatility in stock returns for new EU member states: Markov regime switching model. International Review of Financial Analysis, 16(3), 282–292.

Peng, C. K., Buldyrev, S. V., Havlin, S., Simons, M., Stanley, H. E., & Goldberger, A. L. (1994). Mosaic organization of DNA nucleotides. Physical Review E, 49(2), 1685.

Perron, P., & Qu, Z. (2010). Long-memory and level shifts in the volatility of stock market return indices. Journal of Business & Economic Statistics, 28(2), 275–290.

Ross, G. J., et al. (2015). Parametric and nonparametric sequential change detection in r: The CPM package. Journal of Statistical Software, 66(3), 1–20.

Shi, Y., & Feng, L. (2016). A discussion on the innovation distribution of the Markov regime-switching GARCH model. Economic Modelling, 53, 278–288.

Shi, Y., & Ho, K. Y. (2015). Long memory and regime switching: A simulation study on the Markov regime-switching ARFIMA model. Journal of Banking & Finance, 61, S189–S204.

Smith, D. R. (2002). Markov-switching and stochastic volatility diffusion models of short-term interest rates. Journal of Business & Economic Statistics, 20(2), 183–197.

Tsay, W. J., & Härdle, W. K. (2009). A generalized ARFIMA process with Markov-switching fractional differencing parameter. Journal of Statistical Computation and Simulation, 79(5), 731–745.

Vo, M. T. (2009). Regime-switching stochastic volatility: Evidence from the crude oil market. Energy Economics, 31(5), 779–788.

Zheng, K., Li, Y., & Xu, W. (2019). Regime switching model estimation: Spectral clustering hidden Markov model. Annals of Operations Research,. https://doi.org/10.1007/s10479-019-03140-2.

Acknowledgements

The authors would also like to thank the Macquarie University for the research support. We particularly thank the Guest Editor (Hasan Hüseyin Turan) and two anonymous referees for providing valuable and insightful comments on earlier drafts. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Shi, Y. Long memory and regime switching in the stochastic volatility modelling. Ann Oper Res 320, 999–1020 (2023). https://doi.org/10.1007/s10479-020-03841-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-020-03841-z