Abstract

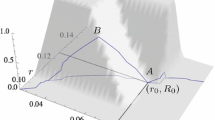

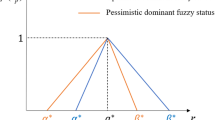

Yang and Iwamura (Appl Math Sci 46:2271–2288, 2008) introduced a new fuzzy measure as a convex linear combination of possibility and necessity measures. This measure generalizes the credibility measure and the real parameter associated to the possibility measure is considered as the decision making’s optimism level. In this paper, we introduce by means of that measure, two new dominances as binary relations on fuzzy variables. The first one generalizes the first order dominance based on credibility measure and introduced recently by Tassak et al. (J Oper Res Soc 68:1491–1502, 2017) and the second one, based on the investor’s optimism level, is more stronger than the other. Moreover, we study some properties of those dominances and characterize them on the particular family of trapezoidal fuzzy numbers. We implement the second dominance in a numerical example to illustrate the impact of the investor’s attitude through the set of best portfolios.

Similar content being viewed by others

Notes

It is worth noting that \(\textit{Supp}(A)\) is a closed subset of X relatively to the usual topology defined on X.

References

Anderson, R. (1978). An elementary core equivalence theorem. Econometrica, 46, 1483–1487.

Asady, B., & Zendehnam, M. (2007). Ranking of fuzzy numbers by minimize distance. Applied Mathematical Modelling, 31, 2589–2598.

Carlsson, C., Fullér, R., & Majlender, P. (2002). A possibilistic approach to selecting portfolios with highest utility score. Fuzzy Sets and Systems, 131, 13–21.

Dzuche, J., Tassak, C. D., Sadefo, J. K., & Fono, L. A. (2017). On the first moments and semi-moments of a fuzzy variable based on a new measure and application for portfolio selection with fuzzy returns. Working paper.

Ezzati, R., Allahviranloo, T., Khezerloo, S., & Khezerloo, M. (2012). An approach for ranking of fuzzy numbers. Experts Systems with Applications, 39, 690–695.

Huang, X. (2008). Mean-semivariance models for fuzzy portfolio selection. Journal of Computational and Applied Mathematics, 217, 1–8.

Li, X., Qin, Z., & Kar, S. (2010). Mean-variance-skewness model for portfolio selection with fuzzy returns. European Journal of Operationnal Research, 202, 239–247.

Liu, B. (2004). Uncertainty theory: An introduction to its axiomatics foundations. Berlin: Springer.

Liu, B., & Liu, Y. K. (2002). Expected value of fuzzy variable and fuzzy expected value models. IEEE Transactions on Fuzzy Systems, 10, 445–450.

Markowitz, H. (1952). Portofolio selection. Journal of Finance, 7, 77–91.

Peng, J., Jiang, Q., & Rao, C. (2007). Fuzzy dominance: A new approach for ranking fuzzy variables via credibility measure. International Journal of Uncertainty, Fuzziness and Knowledge-Based Systems, 15, 29–41.

Ogryczak, W., & Ruszczynski, A. (1999). From stochastic dominance to mean-risk models: Semideviations as risk measures. European Journal of Operational Research, 116, 33–50.

Sadefo, J. K., Tassak, C. D., & Fono, L. A. (2012). Moments and semi-moments for fuzzy portfolio selection. In Insurance: mathematics and economics (vol. 51, pp. 517–530).

Sharpe, W. (1971). A linear programming approximation for the general portfolio analysis problem. Journal of Financial and Quantitative Analysis, 6, 1263–1275.

Stone, B. (1973). A linear programming formulation of the general portfolio selection problem. Journal of Financial and Quantitative Analysis, 8, 621–636.

Tassak, C. D., Sadefo, K. J., Fono, L. A., & Andjiga, N. G. (2017). Characterization of order dominances on fuzzy variables for portfolio selection with fuzzy returns. Journal of the Operational Research Society, 68, 1491–1502.

Wang, X., & Kerre, E. (2001). Reasonable properties for the ordering of fuzzy quantities. Fuzzy Sets and Systems, 118, 375–385.

Yang, L., & Iwamura, K. (2008). Fuzzy chance-constrained programming with linear combination of possibility measure and necessity measure. Applied Mathematical Sciences, 46, 2271–2288.

Zadeh, L. A. (1978). Fuzzy set as a basis of theory of possibility. Fuzzy Sets and Systems, 1, 3–28.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

Proof of Proposition 2

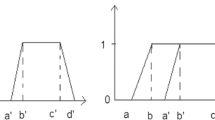

Let be \(\lambda \in [0,1]\), \(\xi _1=(a_1,b_1,c_1,d_1)\) and \(\xi _2=(a_2,b_2,c_2,d_2)\) be two trapezoidal fuzzy variables whose respective distribution functions with respect to \(M_{\lambda }\) are \(\phi _{\lambda }^1\) and \(\phi _{\lambda }^2\).

Let us assume that there exist \( \alpha ,\beta \in [0,1]\) such that

and let us prove that:

-

(1)

First step

Let us prove that \( \left\{ \begin{array}{l} a_1=a_2,\\ b_1=b_2,\\ c_1=c_2,\\ d_1=d_2\\ \end{array} \right. \)

-

(i)

If \(a_1\ne a_2\) (without loss of generality, we assume that \(a_1 < a_2\)).

For x \(\in ]a_1,a_2[\), according to (1) we have: \(\phi _{\alpha }^1(x)\ne 0\) and \(\phi _{\beta }^2(x)=0,\) that contradicts (9).

-

(ii)

If \(b_1\ne b_2\) (without loss of generality, we assume that \(b_2 < b_1\)).

For \(x_1,x_2\in ]b_2,b_1[\) such that \(x_1\ne x_2\) and \(x_1< c_1\), \(x_2< c_2\), according to (1) we have: \(\phi _{\alpha }^1(x_1)=0\) or \(\phi _{\beta }^2(x_2)=0\) or \(\phi _{\alpha }^1(x_1)= \phi _{\beta }^2(x_2)=\beta .\) The first two cases are obvious and we focus only on the third case: \(\phi _{\alpha }^1(x_1)= \phi _{\beta }^2(x_2)=\beta \Longrightarrow \frac{\alpha (x_1-a_1)}{b_1-a_1}=\frac{\alpha (x_2-a_1)}{b_1-a_1}=\beta ,\) according to (1) and (9). We have: \((\frac{\alpha (x_1-a_1)}{b_1-a_1}=\frac{\alpha (x_2-a_1)}{b_1-a_1}=\beta ) \Rightarrow x_1=x_2\), which contradicts \(x_1\ne x_2.\)

-

(iii)

If \(c_1\ne c_2\) (without loss of generality, we assume that \(c_2 < c_1\)).

For \(x_1,x_2\in ]c_2,c_1[\) such that \(x_1\ne x_2\) and \(x_1> b_1\) , \(x_2> b_2\), according to (1) we have: \(\phi _{\alpha }^1(x_1)=1\) or \(\phi _{\beta }^2(x_2)=1\) or \(\phi _{\alpha }^1(x_1)= \phi _{\beta }^2(x_2)=\alpha .\) The first two cases are obvious and we focus only on the third case: \(\phi _{\alpha }^1(x_1)= \phi _{\beta }^2(x_2)=\alpha \Longrightarrow \frac{\beta (d_2-x_1)+ x_1-c_2}{d_2-c_2}=\frac{\beta (d_2-x_2)+ x_2-c_2}{d_2-c_2}= \alpha \) according to (1) and (9). We have: (\(\frac{\beta (d_2-x_1)+ x_1-c_2}{d_2-c_2}=\frac{\beta (d_2-x_2)+ x_2-c_2}{d_2-c_2}= \alpha ) \Longrightarrow x_1=x_2,\) that contradicts \(x_1\ne x_2.\)

-

(iv)

If \(d_1\ne d_2\) (without loss of generality, we assume that \(d_1 < d_2\)).

For \(x\in ]d_1,d_2[\), according to (1) we have: \(\phi _{\alpha }^1(x_1)=1\) and \(\phi _{\beta }^2(x)< 1,\) that contradicts (9).

Finally, we have \(a_1=a_2,b_1=b_2,c_1=c_2,d_1=d_2.\)

-

(i)

-

(2)

Second step

Let us prove that \(\alpha =\beta \).

According to the first step, we have \([b_2,c_2]=[b_1,c_1]\). Moreover, \(x \in [b_1,c_1]\Longrightarrow \phi _{\alpha }^1(x_1)=\alpha \) and \(x \in [b_2,c_2]\Longrightarrow \phi _{\beta }^2(x)=\beta \).

Thus: (\(x \in [b_1,c_1]\Longleftrightarrow x \in [b_2,c_2])\) and \( \phi _{\alpha }^1(x_1) =\phi _{\beta }^2(x),\) that is, \(\alpha =\beta \).

-

(3)

Third step

Let us prove that \(\phi ^1(x)=\phi ^2(x),\forall x \in \mathbb {R}.\)

By the fact that,

\(\phi _{\alpha }^1(x)=\phi _{\beta }^2(x),\forall x \in \mathbb {R}, \alpha =\beta \) and

$$\begin{aligned} \left\{ \begin{array}{l} a_1=a_2,\\ b_1=b_2,\\ c_1=c_2,\\ d_1=d_2 \end{array} \right. \end{aligned}$$we can conclude according to (1) that: \(\phi _{\alpha }^1(x_1)=\phi _{\lambda }^2(x),\forall x \in \mathbb {R},\forall \lambda \in [0,1]\), that means in the particular case where \(\lambda =\frac{1}{2}\) (Liu 2004), \(\phi ^1(x)=\phi ^2(x),\forall x \in \mathbb {R}.\) \(\square \)

Proof of Proposition 3

Proof of Theorem 1

Let be \(\xi _1=(a_1,b_1,c_1,d_1)\) and \(\xi _2=(a_2,b_2,c_2,d_)\) be two trapezoidal fuzzy variables with respective distribution functions \(\phi _{\lambda _1}\) and \(\phi _{\lambda _2}\) where \(\lambda \in [0,1]\). \((\Rightarrow )\) We assume that \(a_1< a_2\) or \(a_1< b_2\) or \(b_1< b_2\) or \(c_1< c_2\) or \(c_1< d_2\) or \(d_1< d_2\) we prove that \(\xi _1 \nsucceq _{d^{\lambda }_1} \xi _2,\) that is, there exists some \(r_0\in \mathbb {R}\) such that \(\phi _{\lambda _1}(x)(r_0)> \phi _{\lambda _2}(x)(r_0).\) We distinguish four cases:

-

First case: \(a_1< a_2\). Let consider \(r\in ]a_1,a_2[;\) we have: \(r> a_1\Rightarrow \phi _{\lambda _1}(r)> \phi _{\lambda _1}(a_1)=0\) and \(r< a_2\Rightarrow \phi _{\lambda _2}(r)=0\), Thus \(\phi _{\lambda _1}(r)>\phi _{\lambda _2}(r)\).

-

Second case: \(b_1< b_2\). Let consider \(r\in ]b_1,b_2[,\) we have: \(\phi _{\lambda _1}(r)>\phi _{\lambda _2}(r)\).

-

Third case: \(c_1< c_2\). Let consider \(r\in ]c_1,c_2[,\) we have: \(\phi _{\lambda _1}(r)>\phi _{\lambda _2}(r)\).

-

Fourth case: \(d_1< d_2\). Let consider \(r\in ]d_1,d_2[,\) we have: \(\phi _{\lambda _1}(r)>\phi _{\lambda _2}(r)\).

Hence, we obtain: \(\xi _1 \nsucceq _{d^{\lambda }_1} \xi _2\).

\((\Leftarrow )\) We assume that \(a_1\ge a_2\),\(b_1 \ge b_2\),\(c_1\ge c_2\) and \(d_1\ge d_2\) and we prove that \(\xi _2\) is dominated by \(\xi _1,\) that is, \(\forall r \in \mathbb {R},\phi _{\lambda _1}(r)\le \phi _{\lambda _2}(r)\).

For that purpose, we have to study eight cases and conclude according to relation (1):

-

First case: if \( r\in ]-\infty , a_2]\), then: \(\phi _{\lambda _2}(r)=\phi _{\lambda _1}(r)=0\) since \(r\le a_2\le a_1\). Thus, \(\phi _{\lambda _1}(r)\le \phi _{\lambda _2}(r)\).

-

Second case: if \( r\in [a_2, a_1]\), then: \(\phi _{\lambda _2}(r)=\frac{r-a_2}{2(b_2-a_2)}\ge 0\) and \(\phi _{\lambda _1}(r)=0\). Thus, \(\phi _{\lambda _1}(r)\le \phi _{\lambda _2}(r)\).

-

Third case: if \( r \in [b_2, a_1]\) (with \(a_1 \ge b_2\),) then we have: either \(\phi _{\lambda _1}(r)=0\) and \(\phi _{\lambda _2}(r)=\frac{1}{2}\) that is \(\phi _{\lambda _1}(r)\le \phi _{\lambda _2}(r)\).

In the same way, if \( r\in [a_1, b_2]\) (with \(a_1 < b_2\),) then we have: \(\phi _{\lambda _1}(r)=\frac{r-a_1}{2(b_1-a_1)}\) and \(\phi _{\lambda _2}(r)=\frac{r-a_2}{2(b_2-a_2)}\).

Let us prove that \(\frac{r-a_1}{(b_1-a_1)}\le \frac{r-a_2}{2(b_2-a_2)}, \forall r\in [a_1, b_2] \).

Let us consider two functions f, g, respectively defined by: \(f(r)=\frac{r-a_1}{(b_1-a_1)}\) and \(g(r)=\frac{r-a_2}{(b_2-a_2)}\).

Let \(r_0 \in ]a_1, b_2[\). \(f(r_0)=g(r_0)\Leftrightarrow r_0=\frac{a_2(b_1-a_1)-a_1(b_2-a_2)}{(b_1-a_1)-(b_2-a_2)}\). \(r_0-a_1=\frac{(b_1-a_1)(a_2-a_1)}{(b_1-a_1)-(b_2-a_2)}\) and \(r_0-b_2=\frac{(b_2-b_1)(b_2-a_2)}{(b_1-a_1)-(b_2-a_2)}\) have the same sign because \(a_1\ge a_2\) and \(b_1\ge b_2\). This contradicts the fact that \(r_0 \in ]a_1, b_2[\). On the other hand, \(f(a_1)\le g(a_1)\), \(f(b_2)\le g(b_2)\), f and g are strictly non-decreasing on \(]a_1, b_2[\) and \(f(r)\ne g(r), \forall r \in ]a_1, b_2[ \), so \(f(r)\le g(r), \forall r \in [a_1, b_2] \), that is \(\frac{r-a_1}{(b_1-a_1)}\le \frac{r-a_2}{2(b_2-a_2)} \).

-

Fourth case: if \( r\in [\max (a_1,b_2), b_1]\), then we have: \(\phi _{\lambda _2}(r)=\frac{1}{2}\) and \(\phi _{\lambda _1}(r)=\frac{r-a_1}{2(b_1-a_1)}\le \frac{1}{2}\). Hence, \(\phi _{\lambda _1}(r)\le \phi _{\lambda _2}(r)\).

-

Fifth case: if \( r\in [b_1, c_2]\), then we have: \( \phi _{\lambda _2}(r)=\phi _{\lambda _1}(r)=\frac{1}{2}\) since \( b_2\le r\le b_1\) and \( c_2\le r\le c_1.\) Hence, \(\phi _{\lambda _1}(r)\le \phi _{\lambda _2}(r)\).

-

Sixth case: if \( r\in [c_2,\min (c_1,d_2)]\), then we have: \(\phi _{\lambda _2}(r)=1-\frac{r-d_2}{2(c_2-d_2)}\ge \frac{1}{2}\) and and \(\phi _{\lambda _1}(r)=\frac{1}{2}\). Hence, \(\phi _{\lambda _1}(r)\le \phi _{\lambda _2}(r)\).

-

Seventh case: if \( r\in [\min (c_1,d_2), d_1]\), then by using a similar proof as presented in the third case, we get \( \phi _{\lambda _1}(r)\le \phi _{\lambda _2}(r)\).

-

Eighth case: \(\forall r\in [d_1, +\infty [, \phi _{\lambda _2}(r)=\phi _{\lambda _1}(r)=1.\) Hence, \(\phi _{\lambda _1}(r)\le \phi _{\lambda _2}(r)\). \(\square \)

Rights and permissions

About this article

Cite this article

Dzuche, J., Tassak, C.D., Sadefo Kamdem, J. et al. On two dominances of fuzzy variables based on a parametrized fuzzy measure and application to portfolio selection with fuzzy return. Ann Oper Res 300, 355–368 (2021). https://doi.org/10.1007/s10479-020-03873-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-020-03873-5