Abstract

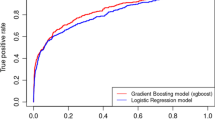

Peer-to-peer (P2P) lending has emerged as an alternative method of financing. Keeping pace with this development, many P2P lending studies have provided approaches to select investment portfolios for individual lenders. However, none of these approaches consider how long it takes for an individual loan to be fully funded so as to reduce the opportunity cost incurred due to delayed investment. In this paper, we propose a goal programming framework to develop an optimal P2P lending portfolio that considers not only the expected returns but also this opportunity cost for individual investors. First, for each loan proposal, a logistic regression model is used to predict the loan default probability while a Weibull regression is used to determine the opportunity cost incurred due to the time taken to obtain the loan. Next, goal programming is applied to construct a portfolio that minimizes the slack from the desired return on investment as well as the surplus from the preset opportunity cost due to a prolonged bidding period. The proposed approach is then applied to Prosper platform data and is expected to help investors’ portfolio decisions in the P2P lending market.

taken from loan application to loan execution (unit: day)

Similar content being viewed by others

References

Belleflamme, P., Lambert, T., & Schwienbacher, A. (2013). Individual crowdfunding practices. Venture Capital, 15(4), 313–333.

Ceyhan, S., Shi, X., & Leskovec, J. (2011). Dynamics of bidding in a P2P lending service: effects of herding and predicting loan success. In Proceedings of the 20th international conference on world Wide web (WWW '11) (pp. 547–556).

Conlin, M. (1999). Peer group micro-lending programs in Canada and the United States. Journal of Development Economics, 60(1), 249–269.

Deng, X., & Pan, X. (2018). The research and comparison of multi-objective portfolio based on intuitionistic fuzzy optimization. Computers & Industrial Engineering, 124, 411–421.

Galak, J., Small, D., & Stephen, A. T. (2011). Microfinance decision making: A field study of prosocial lending. Journal of Marketing Research, 48, S130–S137.

Gavurova, B., Dujcak, M., Kovac, V., & Kotásková, A. (2018). Determinants of successful loan application at peer-to-peer lending market. Economics & Sociology, 11(1), 85–99.

Gomez, R., & Santor, E. (2003). Do peer group members outperform individual borrowers? A test of peer group lending using Canadian micro-credit data. Working Paper 2003-33, Bank of Canada, Ottawa, ON.

Guo, Y., Zhou, W., Luo, C., Liu, C., & Xiong, H. (2016). Instance-based credit risk assessment for investment decisions in P2P lending. European Journal of Operational Research, 249(2), 417–426.

He, H., Zhang, W., & Zhang, S. (2018). A novel ensemble method for credit scoring: Adaption of different imbalance ratios. Expert Systems with Applications, 98(15), 105–117.

Hulme, M. K., & Wright, C. (2006). Internet based social lending: Past, present and future, Working Paper, Social Futures Observatory, UK.

Iyer, R., Khwaja, A., Luttmer, E., & Shue, K. (2009). Screening in new credit markets: can individual lenders infer borrower creditworthiness in peer-to-peer lending? NBER Working Paper No. 15242, NBER, Cambridge, MA.

Jat, D. S., & Xoagub, A. J. (2016). Fuzzy logic-based expert system for assessment of bank loan applications in Namibia. In International congress on information and communication technology (pp. 645–652). Thai Nguyen, Vietnam.

Jaya, Y. B. J., & Tamilselvi, J. J. (2018). Fuzzy multi-criteria random seed and cutoff point approach for credit risk assessment. Journal of Theoretical and Applied Information Technology, 96(4), 1150–1163.

Jiang, C., Wang, Z., Wang, R., & Ding, Y. (2018). Loan default prediction by combining soft information extracted from descriptive text in online peer-to-peer lending. Annals of Operations Research, 266(1–2), 511–529.

Kim, D. (2020). The importance of detailed patterns of herding behaviour in a P2P lending market. Applied Economics Letters, 27(2), 127–130.

Klafft, M. (2008). Peer to peer lending: Auctioning microcredits over the internet. In The international conference on information systems, technology and management. IMT, Dubai.

Larrimore, L., Jiang, L., Larrimore, J., Markowitz, D., & Gorski, S. (2011). Peer to peer lending: The relationship between language features, trustworthiness, and persuasion success. Journal of Applied Communication Research, 39(1), 19–37.

Lejeune, M. A., & Shen, S. (2016). Multi-objective probabilistically constrained programs with variable risk: Models for multi-portfolio financial optimization. European Journal of Operational Research, 252(2), 522–539.

Liao, L., Li, M. R., & Wang, Z. W. (2014). The intelligent investor: Not-fully-marketized interest rate and risk identify: Evidence from P2P lending. Economic Research Journal, 7, 125–137.

Lin, M., Prabhala, N. R., & Viswanathan, S. (2013). Judging borrowers by the company they keep: Friendship networks and information asymmetry in online peer-to-peer lending. Management Science, 59(1), 17–35.

Lu, C., & Zhang, L. (2018). Research on risk factors identification of P2P lending platforms. American Journal of Industrial and Business Management, 8(05), 1344.

Ma, L., Zhao, X., Zhou, Z., & Liu, Y. (2018). A new aspect on P2P online lending default prediction using meta-level phone usage data in China. Decision Support Systems, 111, 60–71.

Mencía, J. (2012). Assessing the risk-return trade-off in loan portfolios. Journal of Banking & Finance, 36(6), 1665–1677.

Metawa, N., Hassan, M. K., & Elhoseny, M. (2017). Genetic algorithm based model for optimizing bank lending decisions. Expert Systems with Applications, 80, 75–82.

Mi, J. J., Hu, T., & Deer, L. (2018). User data can tell defaulters in P2P lending. Annals of Data Science, 5(1), 59–67.

Mollick, E. (2014). The dynamics of crowdfunding: An exploratory study. Journal of Business Venturing, 29(1), 1–16.

Mukerjee, A., Biswas, R., Deb, K., & Mathur, A. P. (2002). Multi–objective evolutionary algorithms for the risk-return trade–off in bank loan management. International Transactions in Operational Research, 9(5), 583–597.

Palmer, S., & Raftery, J. (1999). Opportunity cost. BMJ, 318(7197), 1551–1552.

Qiu, J., Lin, Z., & Luo, B. (2012). Effects of borrower-defined conditions in the online peer-to-peer lending market. E-life: Web-enabled convergence of commerce, work, and social life. Lecture Notes in Business Information Processing, 108, 167–179.

Serrano-Cinca, C., & Gutiérrez-Nieto, B. (2016). The use of profit scoring as an alternative to credit scoring systems in peer-to-peer (P2P) lending. Decision Support Systems, 89, 113–122.

Sonenshein, S., Herzenstein, M., & Dholakia, U. M. (2011). How accounts shape lending decisions through fostering perceived trustworthiness. Organizational Behavior and Human Decision Processes, 115(1), 69–84.

Uddin, M. J., Vizzari, G., Bandini, S., & Imam, M. O. (2018). A case-based reasoning approach to rate microcredit borrower risk in online Kiva P2P lending model. Data Technologies and Applications, 52(1), 58–83.

Xia, Y., Yang, X., & Zhang, Y. (2018). A rejection inference technique based on contrastive pessimistic likelihood estimation for P2P lending. Electronic Commerce Research and Applications, 30, 111–124.

Zeng, X., Liu, L., Leung, S., Du, J., Wang, X., & Li, T. (2017). A decision support model for investment on P2P lending platform. PloS One, 12(9), e0184242.

Zhang, Y., Li, H., Hai, M., Li, J., & Li, A. (2017). Determinants of loan funded successful in online P2P Lending. Procedia Computer Science, 122, 896–901.

Zhao, H., Liu, Q., Wang, G., Ge, Y., & Chen, E. (2016). Portfolio selections in P2P lending: A multi-objective perspective. In: 22nd ACM SIGKDD international conference on knowledge discovery and data mining (pp. 2075–2084). San Francisco, California, USA.

Zhao, H., Wu, L., Liu, Q., Ge, Y., & Chen, E. (2014). Investment recommendation in P2P lending: A portfolio perspective with risk management. In IEEE international conference on data mining (pp. 1109–1114). Shenzhen, China.

Zopounidis, C., Doumpos, M., & Kosmidou, K. (2018). Preface: Analytical models for financial modeling and risk management. Annals of Operations Research, 266(1–2), 1–4.

Acknowledgements

This work was supported by the National Research Foundation of Korea (NRF) grant funded by the Korea government (MSIT) (2020R1A2C2005026).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Park, K.T., Yang, H. & Sohn, S.Y. Recommendation of investment portfolio for peer-to-peer lending with additional consideration of bidding period. Ann Oper Res 315, 1083–1105 (2022). https://doi.org/10.1007/s10479-021-04300-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04300-z