Abstract

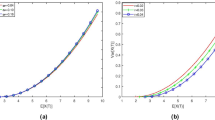

In this paper, we study an optimal reinsurance-investment problem with partial information and common shock dependence under the mean-variance criterion for an insurer. The insurer has two dependent classes of insurance business, which are subject to a common shock. We consider the optimal reinsurance-investment problem under complete information and partial information, respectively. We formulate the complete information problem within a game theoretic framework and seek the equilibrium reinsurance-investment strategy and equilibrium value function by solving an extended Hamilton–Jacobi–Bellman system of equations. For the partial information problem, we first transform it to a completely observable model by virtue of the filtering theory, then derive the equilibrium strategy and equilibrium value function by using the methods similar to those for the complete information problem. In addition, we illustrate the equilibrium reinsurance-investment strategies by numerical examples and discuss the impacts of model parameters on the equilibrium reinsurance-investment strategies for both the complete information and partial information cases.

Similar content being viewed by others

Notes

A pre-committed strategy means that if the decision makers can commit themselves at the initial time, they can choose a strategy that is optimal from the point of view at the initial time, and then constrain themselves to abide by it in the future, although the strategy is no longer optimal for the future time.

References

Asadi, M., Ebrahimi, N., & Soofi, E. S. (2018). Optimal hazard models based on partial information. European Journal of Operational Research, 270(2), 723–733.

Bai, L., Cai, J., & Zhou, M. (2013). Optimal reinsurance policies for an insurer with a bivariate reserve risk process in a dynamic setting. Insurance Mathematics and Economics, 53(3), 664–670.

Bäuerle, N. (2005). Benchmark and mean-variance problems for insurers. Mathematical Methods of Operations Research, 62(1), 159–165.

Ben Abdelaziz, F. (2012). Solution approaches for the multiobjective stochastic programming. European Journal of Operational Research, 216(1), 1–16.

Ben Abdelaziz, F., Aouni, B., & El Fayedh, R. (2007). Multi-objective stochastic programming for portfolio selection. European Journal of Operational Research, 177(3), 1811–1823.

Ben Abdelaziz, F., & Masri, H. (2010). A compromise solution for the multiobjective stochastic linear programming under partial uncertainty. European Journal of Operational Research, 202(1), 55–59.

Ben Abdelaziz, F., Masri, H., & Alaya, H. (2017). A recourse goal programming approach for airport bus routing problem. Annals of Operations Research, 251(1–2), 383–396.

Bi, J., & Cai, J. (2019). Optimal investment-reinsurance strategies with state dependent risk aversion and VaR constraints in correlated markets. Insurance Mathematics and Economics, 85, 1–14.

Bi, J., Jin, H., & Meng, Q. (2018). Behavioral mean-variance portfolio selection. European Journal of Operational Research, 271(2), 644–663.

Bi, J., Liang, Z., & Xu, F. (2016). Optimal mean-variance investment and reinsurance problems for the risk model with common shock dependence. Insurance Mathematics and Economics, 70, 245–258.

Bielecki, T. R., Jin, H., Pliska, S. R., & Zhou, X. Y. (2005). Continuous-time mean-variance portfolio selection with bankruptcy probihition. Mathematical Finance, 15, 213–244.

Björk, T., Davis, M. H. A., & Landén, C. (2010). Optimal investment under partial information. Mathematical Methods of Operations Research, 71, 371–399.

Björk, T., Khapko, M., & Murgoci, A. (2017). On time-inconsistent stochastic control in continuous time. Finance and Stochastics, 21, 331–360.

Björk, T., & Murgoci, A. (2010). A general theory of Markovian time inconsistent stochastic control problems. Working paper. Available at: http://ssrn.com/abstract=1694759.

Björk, T., & Murgoci, A. (2014). A theory of Markovian time-inconsistent stochastic control in discrete time. Finance and Stochastics, 18, 545–592.

Björk, T., Murgoci, A., & Zhou, X. Y. (2014). Mean-variance portfolio optimization with state-dependent risk aversion. Mathematical Finance, 24(1), 1–24.

Brendle, S. (2006). Portfolio selection under incomplete information. Stochastic Processes and their Applications, 116, 701–723.

Browne, S. (1995). Optimal investment policies for a firm with a random risk process: Exponential utility and minimizing the probability of ruin. Mathematics of Operations Research, 20(4), 937–958.

Cong, J. F., & Tan, K. S. (2016). Optimal VaR-based risk management with reinsurance. Annals of Operations Research, 237(1–2), 177–202.

Deng, C., Zeng, X. D., & Zhu, H. M. (2018). Non-zero-sum stochastic differential reinsurance and investment games with default risk. European Journal of Operational Research, 264(3), 1144–1158.

Dimitrova, D. S., Kaishev, V. K., & Zhao, S. Q. (2015). On finite-time ruin probabilities in a generalized dual risk model with dependence. European Journal of Operational Research, 242(1), 134–148.

Feng, B., Zhao, J., & Jiang, Z. (2021). Robust pricing for airlines with partial information. Annals of Operations Research. https://doi.org/10.1007/s10479-020-03926-9

Fouque, J. P., Papanicolaou, A., & Sircar, A. (2015). Filtering and portfolio optimization with stochastic unobserved drift in asset returns. Communications in Mathematical Sciences, 13(4), 935–953.

Gu, A., Viens, F. G., & Yi, B. (2017). Optimal reinsurance and investment strategies for insurers with mispricing and model ambiguity. Insurance Mathematics and Economics, 72, 235–249.

Jang, B., Kim, K. T., & Lee, H. (2021). Optimal reinsurance and portfolio selection: Comparison between partial and complete information models. European Financial Management. https://doi.org/10.1111/eufm.12303

Kacem, I., La Torre, D., & Masri, H. (2021). Preface: Recent advances in multiple objective optimization and goal programming. Annals of Operations Research, 296(1–2), 1–5.

Kim, J. H., Kim, W. C., Kwon, D. G., & Fabozzi, F. J. (2018). Robust equity portfolio performance. Annals of Operations Research, 266(1–2), 293–312.

La Torre, D., & Mendivil, F. (2018). Portfolio optimization under partial uncertainty and incomplete information: A probability multimeasure-based approach. Annals of Operations Research, 267(1–2), 267–279.

Li, Y., & Li, Z. (2013). Optimal time-consistent investment and reinsurance strategies for mean-variance insurers with state dependent risk aversion. Insurance Mathematics and Economics, 53(1), 86–97.

Li, D., & Ng, W. L. (2000). Optimal dynamic portfolio selection: Multiperiod mean-variance formulation. Mathematical Finance, 10(3), 387–406.

Li, Y., Qiao, H., Wang, S., & Zhang, L. (2015). Time-consistent investment strategy under partial information. Insurance Mathematics and Economics, 65, 187–197.

Li, S., & Qiu, Z. (2021). Equilibrium investment-reinsurance strategy with delay and common shock dependence under Heston’s SV model. Optimization. https://doi.org/10.1080/02331934.2021.1935934

Li, D., Shen, Y., & Zeng, Y. (2018). Dynamic derivative-based investment strategy for mean-variance asset-liability management with stochastic volatility. Insurance Mathematics and Economics, 78, 72–86.

Li, Y., Wang, S., Zeng, Y., & Qiao, H. (2017). Equilibrium investment strategy for a DC plan with partial information and mean-variance criterion. IEEE Systems Journal, 11(3), 1492–1504.

Li, X., Zhou, X. Y., & Lim, A. E. B. (2002). Dynamic mean-variance portfolio selection with no-shorting constraints. SIAM Journal on Control and Optimization, 40, 1540–1555.

Liang, Z., & Song, M. (2015). Time-consistent reinsurance and investment strategies for mean-variance insurer under partial information. Insurance Mathematics and Economics, 65, 66–76.

Liang, Z., & Yuen, K. C. (2016). Optimal dynamic reinsurance with dependent risks: Variance premium principle. Scandinavian Actuarial Journal, 2016(1), 18–36.

Liang, Z., Yuen, K. C., & Zhang, C. (2018). Optimal reinsurance and investment in a jump-diffusion financial market with common shock dependence. Journal of Applied Mathematics and Computing, 56, 637–664.

Liptser, R., & Shiryayev, A. (2004). Statistics of Random Processes, I, II. Berlin: Springer.

Liu, J., & Chen, Z. (2018). Time consistent multi-period robust risk measures and portfolio selection models with regime-switching. European Journal of Operational Research, 268(1), 373–385.

Markowitz, H. (1952). Portfolio selection. Journal of Finance, 7(1), 77–91.

Masri, H. (2017). A multiple stochastic goal programming approach for the agent portfolio selection problem. Annals of Operations Research, 251(1–2), 179–192.

Masri, H. (2018). A Shariah-compliant portfolio selection model. Journal of the Operational Research Society, 69(10), 1568–1575.

Peng, X., & Hu, Y. (2013). Optimal proportional reinsurance and investment under partial information. Insurance Mathematics and Economics, 53(2), 416–428.

Promislow, D., & Young, V. (2005). Minimizing the probability of ruin when claims follow Brownian motion with drift. North American Actuarial Journal, 9(3), 110–128.

Schmidli, H. (2002). On minimizing the ruin probability by investment and reinsurance. Annals of Applied Probability, 12(3), 890–907.

Wang, L., Chen, Z., & Yang, P. (2021). Robust equilibrium control-measure policy for a DC pension plan with state-dependent risk aversion under mean-variance criterion. Journal of Industrial and Management Optimization, 17(3), 1203–1233.

Wei, J., & Wang, T. (2017). Time-consistent mean-variance asset-liability management with random coefficients. Insurance Mathematics and Economics, 77, 84–96.

Wu, H., & Zeng, Y. (2015). Equilibrium investment strategy for defined-contribution pension schemes with generalized mean-variance criterion and mortality risk. Insurance Mathematics and Economics, 64, 396–408.

Xu, L., Zhang, L., & Yao, D. (2017). Optimal investment and reinsurance for an insurer under Markov-modulated financial market. Insurance Mathematics and Economics, 74, 7–19.

Yuen, K. C., Guo, J., & Wu, X. (2006). On the first time of ruin in the bivariate compound Poisson model. Insurance Mathematics and Economics, 38, 298–308.

Yuen, K. C., Liang, Z., & Zhou, M. (2015). Optimal proportional reinsurance with common shock dependence. Insurance Mathematics and Economics, 64, 1–13.

Zeng, Y., & Li, Z. (2011). Optimal time-consistent investment and reinsurance policies for mean-variance insurers. Insurance Mathematics and Economics, 49(1), 145–154.

Zeng, Y., Li, D., & Gu, A. (2016). Robust equilibrium reinsurance-investment strategy for a mean-variance insurer in a model with jumps. Insurance Mathematics and Economics, 66, 138–152.

Zhang, C., & Liang, Z. (2017). Portfolio optimization for jump-diffusion risky assets with common shock dependence and state dependent risk aversion. Optimal Control Applications and Methods, 38(2), 229–246.

Zhou, X. Y., & Li, D. (2000). Continuous-time mean-variance portfolio selection: A stochastic LQ framework. Applied Mathematics and Optimization, 42, 19–33.

Zhou, Z., Ren, T., Xiao, H., & Liu, W. (2019). Time-consistent investment and reinsurance strategies for insurers under multi-period mean-variance formulation with generalized correlated returns. Journal of Management Science and Engineering, 4(2), 142–157.

Acknowledgements

The authors thank the anonymous reviewer and the Editor for the insightful comments and suggestions that improved the presentation of the paper. Junna Bi is supported by National Natural Science Foundation of China (Nos. 11871220, 11871219, 12071224) and 111 Project (No. B14019). Jun Cai acknowledges the financial support from the Natural Sciences and Engineering Research Council of Canada (No. RGPIN-2016-03975). Yan Zeng is supported by National Natural Science Foundation of China (Nos. 71991474, 71771220, 71571195, 71721001).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: The proof of Theorem 2

Before giving the proof of Theorem 2, we first provide Proposition 1 and Lemma 1 as follows.

Proposition 1

The extended HJB system of Eq. (3.4) can be simplified as follows

Proof

According to the model assumptions, after a straightforward but tedious calculation, we find that the extended HJB system of Eq. (3.4) has the simplified form (7.1–7.2). We omit the detailed calculation. \(\square \)

Lemma 1

For two-dimensional function \(f(x,y)={\tilde{a}}x^{2}+{\tilde{b}}y^{2}+{\tilde{c}}x+{\tilde{d}}y+{\tilde{e}}xy\), if \({\tilde{a}}>0\) and \(4{\tilde{a}}{\tilde{b}}-{\tilde{e}}^{2}>0\), f(x, y) attains its minimum value \(f(x^{*},y^{*})=-\frac{{\tilde{b}}{\tilde{c}}^{2}+{\tilde{a}}{\tilde{d}}^{2}-{\tilde{c}}{\tilde{d}}{\tilde{e}}}{4{\tilde{a}}{\tilde{b}}-{\tilde{e}}^{2}}\) at \((x^{*},y^{*})=\left( \frac{{\tilde{e}}{\tilde{d}}-2{\tilde{b}}{\tilde{c}}}{4{\tilde{a}}{\tilde{b}}-{\tilde{e}}^{2}}, \frac{{\tilde{e}}{\tilde{c}}-2{\tilde{a}}{\tilde{d}}}{4{\tilde{a}}{\tilde{b}}-{\tilde{e}}^{2}}\right) .\)

Proof

The lemma follows the standard solutions for an extreme value problem of a two-dimensional function. The detailed arguments are omitted. \(\square \)

The proof of Theorem 2

Since the wealth process has the linear structure, and in accordance with the forms of the boundary conditions, we conjecture that

Then, we have

and

Substituting the above expressions into (7.1) and (7.2), we have

and

Rearrange (7.3), we have

where

From (7.5), we have

Next we look for the equilibrium reinsurance strategy and the corresponding equilibrium value function. We firstly give the detailed discussion for Case 2.

For Case 2, using Lemma 1, we obtain the equilibrium reinsurance strategy

and

with \({\tilde{A}}_{2}\) given by (3.9).

Then we look for the equilibrium value function. Inserting \(u^{*}\), \(q_{1}^{*}\) and \(q_{2}^{*}\) into (7.5) yields

By separating variables, we obtain the following ordinary differential equations

Then we have \(A(t)=e^{r(T-t)}.\) Substituting the expression of \(u^{*}\), \(q_{1}^{*}\) and \(q_{2}^{*}\) given by (7.6), (7.7) and (7.8) into (7.4) yields

By separating variables again, we obtain

Then, we have \(a(t)=e^{r(T-t)},\) b(t) and c(t) are given by (3.13) and (3.14), respectively, and

Moreover, we can obtain the expressions of B(t), C(t) and \(D_{2}(t)\) as (3.16)–(3.18). Note that in Case 2, we use \(D_{2}(t)\) to denote D(t). Recall that in Case 2, \(m_{1}>0,~m_{2}>0\), so the equivalent reinsurance strategy \(q_{1}^{*},~q_{2}^{*}\) we have obtained in (7.7) and (7.8) satisfy the nonnegative constraint for the reinsurance strategy. The results in Case 1 and Case 3 can be derived similarly. This completes the proof. \(\square \)

Appendix B: The proof of Theorem 2

Proposition 2

The extended HJB system of Eq. (3.4) with \({\varPi }_{c}\), \(V_{c}\) and \(g_{c}\) replaced by \({\varPi }\), V and g, respectively, can be simplified as follows

Proof

The proof of this proposition is similar to that of Proposition 1 and thus is omitted. \(\square \)

Rights and permissions

About this article

Cite this article

Bi, J., Cai, J. & Zeng, Y. Equilibrium reinsurance-investment strategies with partial information and common shock dependence. Ann Oper Res 307, 1–24 (2021). https://doi.org/10.1007/s10479-021-04317-4

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04317-4

Keywords

- Equilibrium reinsurance-investment strategy

- Common shock

- Partial information

- Extended HJB system of equations