Abstract

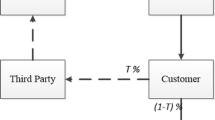

We model a closed-loop supply chain, made up of one manufacturer and one retailer, as a stochastic dynamic game. This paradigm allows us to simultaneously capture the strategic interactions between the agents, the intertemporal nature of the return of past-sold products for remanufacturing, and the uncertainty in the parameter values. We characterize and compare the solutions in two scenarios. In the no-sharing scenario, we assume that the manufacturer alone incurs the cost of the green activities aimed at incentivizing consumers to return previously purchased products at the end of their useful life. In the second scenario, namely, revenue and cost sharing contract, the retailer shares the cost of the green activities and the manufacturer transfers part of its revenues to the retailer. Numerical experiments are discussed.

Similar content being viewed by others

Notes

That is, a game where the transition from one node to another is Nature’s decision and cannot be influenced by the players’ actions.

To be more rigorous, we should write the demand function as \(Q(p(n_{l}^{t}))\), but to simplify the notation, we write it as \(Q(n_{l}^{t})\).

Numerical results for any (feasible) constellation of parameter values can be produced by the authors upon request.

References

Aras, N., Boyaci, T., & Verter, V. (2010). Designing the reverse logistics network. In Ferguson, M., & Souza, G. (Eds.) Closed-Loop Supply Chains: New Developments to Improve the Sustainability of Business Practices, Supply Chain Integration Series, pp. 67–97.

Atasu, A., Guide, V., Jr., & Van Wassenhove, L. (2008). Product reuse economics in closed-loop supply chain research. Production and Operations Management, 17(5), 483–496.

Aust, G., & Buscher, U. (2014). Cooperative advertising models in supply chain management: A review. European Journal of Operational Research, 234(1), 1–14.

Basar, T., & Olsder, G. J. (1998). Dynamic Noncooperative Game Theory. Philadelphia: SIAM.

Cachon, G. P., & Lariviere, M. A. (2005). Supply chain coordination with revenue-sharing contracts: Strengths and limitations. Management Science, 51(1), 30–44.

Dana, J. D., Jr., & Spier, K. E. (2001). Revenue sharing and vertical control in the video rental industry. The Journal of Industrial Economics, 49(3), 223–245.

De Giovanni, P. (2014). Environmental collaboration in a closed-loop supply chain with a reverse revenue sharing contract. Annals of Operations Research, 220(1), 135–157.

De Giovanni, P. (2017). Closed-loop supply chain coordination through incentives with asymmetric information. Annals of Operations Research, 253(1), 133–167.

De Giovanni, P. (2018). A joint maximization incentive in closed-loop supply chains with competing retailers: The case of spent-battery recycling. European Journal of Operational Research, 268(1), 128–147.

De Giovanni, P., & Zaccour, G. (2013). Cost revenue sharing in a closed loop supply chain. In P. Cardaliaguet & R. Cressman (Eds.), Advances in Dynamic Games, volume 12 of Annals of the International Society of Dynamic Games (pp. 395–421). Birkhauser Boston.

De Giovanni, P., & Zaccour, G. (2019). Optimal quality improvements and pricing strategies with active and passive product returns. Omega, 88, 248–262.

De Giovanni, P., & Zaccour, G. (2022). A selective survey of game-theoretic models of closed-loop supply chains. Annals of Operations Research, 1, 77–140.

Ferguson, M. E., & Toktay, L. B. (2006). The effect of competition on recovery strategies. Production and Operations Management, 15(3), 351–368.

Ferrer, G., & Swaminathan, J. M. (2006). Managing new and remanufactured products. Management Science, 52(1), 15–26.

Fleischmann, M., Beullens, P., Bloemhof-Ruwaard, J. M., & Van Wassenhove, L. N. (2001). The impact of product recovery on logistics network design. Production and Operations Management, 10(2), 156–173.

Fleischmann, M., van Nunen, J., & Graeve, B. (2002). Integrating closed-loop supply chains and spare parts management at IBM. (ERS-2002-107-LIS).

Geng, Q., & Mallik, S. (2007). Inventory competition and allocation in a multi-channel distribution system. European Journal of Operational Research, 182(2), 704–729.

Gerchak, Y., & Wang, Y. (2004). Revenue-sharing vs. wholesale-price contracts in assembly systems with random demand. Production and Operations Management, 13(1), 23–33.

Geyer, R., Van Wassenhove, L. N., & Atasu, A. (2007). The economics of remanufacturing under limited component durability and finite product life cycles. Management Science, 53(1), 88–100.

Guide, V., Jr., Souza, G., Van Wassenhove, L., & Blackburn, J. (2006). Time value of commercial product returns. Management Science, 52(8), 1200–1214.

Guide, V. D. R., Jr., & Wassenhove, L. N. V. (2009). The evolution of closed-loop supply chain research. Operations Research, 57(1), 10–18.

Guo, S., Shen, B., Choi, T.-M., & Jung, S. (2017). A review on supply chain contracts in reverse logistics: Supply chain structures and channel leaderships. Journal of Cleaner Production, 144, 387–402.

Haurie, A., Krawczyk, J., & Zaccour, G. (2012). Games and Dynamic Games. World Scientific Publishing Company.

He, Y. (2017). Supply risk sharing in a closed-loop supply chain. International Journal of Production Economics, 183, 39–52.

Heydari, J., Govindan, K., & Jafari, A. (2017). Reverse and closed loop supply chain coordination by considering government role. Transportation Research Part D: Transport and Environment, 52, 379–398.

Jørgensen, S., & Zaccour, G. (2014). A survey of game-theoretic models of cooperative advertising. European Journal of Operational Research, 237(1), 1–14.

Kelle, P., & Silver, E. (1989). Forecasting the returns of reusable containers. Journal of Operations Management, 8(1), 17–35.

Liang, X., Jin, X., & Ni, J. (2014). Forecasting product returns for remanufacturing systems. Journal of Remanufacturing, 4(1), 1–18.

Nerlove, M., & Arrow, K. J. (1962). Optimal advertising policy under dynamic conditions. Economica, 29(114), 129–142.

Savaskan, R. C., Bhattacharya, S., & Wassenhove, LNv. (2004). Closed-loop supply chain models with product remanufacturing. Management Science, 50(2), 239–252.

Savaskan, R. C., & Van Wassenhove, L. N. (2006). Reverse channel design: The case of competing retailers. Management Science, 52(1), 1–14.

Sethi, S. P. (1983). Deterministic and stochastic optimization of a dynamic advertising model. Optimal Control Applications and Methods, 4(2), 179–184.

Shekarian, E. (2020). A review of factors affecting closed-loop supply chain models. Journal of Cleaner Production, 253, 119823.

Taleizadeh, A. A., Moshtagh, M. S., & Moon, I. (2018). Pricing, product quality, and collection optimization in a decentralized closed-loop supply chain with different channel structures: Game theoretical approach. Journal of Cleaner Production, 189, 406–431.

Tirole, J. (1988). The theory of industrial organization (Vol. 1). MIT Press Books.

Toktay, L., Wein, L., & Zenios, S. (2000). Inventory management of remanufacturable products. Management Science, 46(11), 1412–1426.

Tsiliyannis, C. (2020). Prognosis of product take-back for enhanced remanufacturing. Journal of Remanufacturing, 10(1), 15–42.

van der Laan, E., Dekker, R., & Salomon, M. (1996). Product remanufacturing and disposal: A numerical comparison of alternative control strategies. International Journal of Production Economics, 45(1):489–498. Proceedings of the Eighth International Symposium on Inventories.

van der Laan, E., Salomon, M., & Dekker, R. (1999). An investigation of lead-time effects in manufacturing/remanufacturing systems under simple push and pull control strategies. European Journal of Operational Research, 115(1), 195–214.

Xie, J., Zhang, W., Liang, L., Xia, Y., Yin, J., & Yang, G. (2018). The revenue and cost sharing contract of pricing and servicing policies in a dual-channel closed-loop supply chain. Journal of Cleaner Production, 191, 361–383.

Zhang, Q., Tang, W., Zaccour, G., & Zhang, J. (2019). Should a manufacturer give up pricing power in a vertical information-sharing channel? European Journal of Operational Research, 276(3), 910–928.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The second author’s research is supported by the Shandong Province “Double-Hundred Talent Plan” (No. WST2017009). This research was partially conducted during the research stay of the second author at GERAD, HEC Montreal, Canada. The third author’s research is supported by NSERC Canada, Grant RGPIN-2016-04975.

Appendices

Appendix A

1.1 Proof of Lemma 1

Substituting \(\frac{\theta _{i+1}}{\theta _{i}}=\eta \) in (2), we obtain

Consider one-period lag

and multiply the above result by \(\eta \), to get

Compute the difference between (28) and (30) to obtain

or equivalently

1.2 Proof of Lemma 2

Consider the total returns along the path from the root node \(n^{0}\) to the terminal node \(n^{T}\in \mathcal {N}^{T}\), that is, \(\mathcal {P} (n^{T})=(n^{0},n^{1},\ldots ,n^{T})\), where \(n^{t}\in S(a(n^{t-1}))\) for any \(t=1,\ldots ,T\), which are given by

when \(r(\cdot )\) satisfies the dynamics in (28) with initial condition \(r(n^{0})=0\). Substituting r from (28) into (31) and grouping terms, we obtain

The coefficient of \(Q(n^{0})\) can be interpreted as a share of sales at node \(n^{0}\) that is totally returned along the path. It is natural to constrain this share to be no greater than one. As the upper bound of f \(\left( \cdot \right) \) is \(\upsilon _{1}\), we need to satisfy the inequality:

which is equivalent to

If this condition is satisfied, the returns from sales in any further nodes on the path will be smaller than the sales because \(1+\eta +\cdots +\eta ^{T-1}\ge 1+\eta +\cdots +\eta ^{t}\) for any \(0<t<T-1\).

1.3 Proof of Proposition 1

The retailer’s optimization problem is given by

which is independent of the manufacturer’s decision variable G and of the state variable r. Assuming an interior solution, the first-order optimality condition at node \(n_{l}^{t}\) reads

which yields

Clearly, \(p(n_{l}^{t})>0\) and, as \({J}_{R}\left( p\right) \) is concave in \( p(n_{l}^{t})\), we have an interior maximum. We should mention that \( p(n_{l}^{t})\) should be no less than w. Therefore, we need to satisfy condition

for any node \({n_{l}^{t}\in {\mathcal {N}}}^{t},t=0,\ldots ,T\).

Introduce the manufacturer’s pre-Hamiltonian

defined for any node \(n_l^t\in {\mathcal {N}}^{t},t=0,\ldots ,T\), where \( \lambda (S(n_l^t))\) is the vector of costate variables.

For any non-terminal node, we differentiate \(\mathcal {H}_{M}\) with respect to \(G(n_{l}^{t})\), and equating it to zero, we obtain

We introduce the operator

so the strategy \(G(n_{l}^{t})\) can be rewritten in the following way:

At the terminal node \(n_{l}^{T}\in \mathcal {N}^{T}\), the manufacturer’s strategy does not influence the state variable r at any node of period T . As the payoff function of the manufacturer is linear and decreasing in G , then its equilibrium strategy equals zero for any terminal node:

The costate variables are derived using the following system of equations:

where we substitute \(p(n_{l}^{t})\) given by (33).

The transversality condition is \(\lambda \left( \nu \right) =0\) for any node \( \nu \in S(n^{t})\), meaning that returns after period T have no value to the manufacturer.

Substituting (37) in the expression of \(G(n_{l}^{t})\) leads to the results in the Proposition.

1.4 Proof of Proposition 2

We first determine the manufacturer’s optimal control problem to the retailer announcing a retail price \(p(n_{l}^{t})\) and a support rate \( B(n_{l}^{t})\) for any \(n_{l}^{t}\in \mathcal {N}^{t}\), \(t=1,\ldots ,T\). The manufacturer aims to maximize

with \(G(n_{l}^{t})\ge 0\) with respect to returns dynamics

The manufacturer’s Hamiltonian function for any node \(n_{l}^{t}\in \mathcal {N }{\setminus } \mathcal {N}^{T}\) is as follows:

where \(\lambda _{M}\left( \cdot \right) \) is the costate variable appended by the manufacturer to the state dynamics in (38), and operator \(\Phi \) is defined by (34). For any \(n_{T}\in \mathcal {N}^{T}\) function \(\mathcal {H}_{M}\) is defined as:

Maximizing \(\mathcal {H}_{M}\) with respect to \(G(n_{l}^{t})\), we obtain

and for the terminal nodes \(n_{l}^{T}\in \mathcal {N}^{T}\) we have

because function \(\mathcal {H} _{M}(n_{l}^{T},r(n_{l}^{T}),G(n_{l}^{T}),B(n_{l}^{T}))\) is a linear decreasing function of \(G(n_{l}^{T})\).

Notice that under the assumptions of an interior solution and positive demand, \(\Phi (n_{l}^{t},\lambda _{M})\) must satisfy the condition

to have a nonnegative \(G(n_{l}^{t})\). The expression in the left-hand side of the inequality is the expected demand on the stage that follows the current node \(n_{l}^{t}\).

The conditions on \(\lambda _M (n_{l}^{t})\) are given by

This costate variable will play the role of an additional state variable in the retailer’s (leader’s) problem.

Following the proof of Theorem 7.1 in Basar and Olsder (1998, pp. 368–370), we obtain the Stackelberg strategy of the retailer. We have to maximize \( J_{R}\left( G,p,B,r\right) \) in view of the unique optimal response of the follower (manufacturer). Therefore, the retailer is faced with the optimal control problem

subject to state dynamics (38), relations on \(\lambda _{M}\) dynamics given by (41) and (42), and equations (39) and (40).

The Hamiltonian of the optimal control problem of the retailer for any node \( n_l^t\in \mathcal {N}{\setminus }\mathcal {N}^T\) is

where \(Q(n_{l}^{t})=\alpha ^{n_{l}^{t}}-\beta ^{n_{l}^{t}}p(n_{l}^{t})\). And for terminal nodes \(n_l^T\in \mathcal {N}^T\) we have

Theorem 7.1 in Basar and Olsder (1998) (see pp. 368–370) gives the following system of relations:

with the state dynamics (38). Substituting the expressions of \( H_{M}\), \(H_{R}\), \(F^{n_{l}^{t}},\) and \(F^{n_{l}^{T}},\) we obtain the relations given in the theorem. In particular, (43) and (44) imply (14) and (15); (45) and (46) imply (18) and \(\nu (n_{l}^{T})=0\) given in (19); (47) and (48) imply (16) and \(B(n_{l}^{T})=0\) given in (19); (53) and (54) imply (17) and \(G(n_{l}^{T})=0\) given in (19); (49) and (50) imply (23) and (24); (51) and (52) imply (25) and (26) ; (55) and (56) imply (21) and (22).

The solution of this system gives the Stackelberg equilibrium strategies G , B, and p and the equilibrium state trajectory r.

Appendix B

Table 8 presents the expected payoff for each player for different values of the sharing parameter, \(\phi \).

Tables 9, 10 and 11 show how changing parameters \(\zeta \), \( c_{0}\), \(\eta \) affect the expected payoffs to the players. Comparing the numerical results in these tables with those in Table 8 provides more insight into the model. The changed parameters are bold italic in Tables 9, 10 and 11.

We can observe the following:

-

1.

As expected, increasing \(\zeta \) does not change the retailer’s expected payoff in the no-sharing scenario, while it reduces the manufacturer’s expected payoff. This change leads to slightly lower expected payoffs for both players in the RCSC scenario (see Table 9 in comparison with Table 8).

-

2.

Increasing \(c_{0}\) leads to a lower profit for the manufacturer in the no-sharing and RCSC scenarios. Although the retailer is not affected in the no-sharing scenario, it is highly penalized for a higher \(c_{0}\) in the RCSC scenario (see Table 10 in comparison with Table 8).

-

3.

The retailer is not affected by decreasing \(\eta \) in the no-sharing scenario, but the manufacturer’s payoff decreases slightly. Decreasing \(\eta \) leads to a negligible negative impact in both players’ expected payoffs in the RCSC scenario (see Table 11 in comparison with Table 8).

-

4.

The manufacturer is much more sensitive to a higher \(c_{0}\) than to a higher \(\zeta \) and lower \(\eta \). This may be due to the low level of green investments, which implies a low sensitivity to increasing \(\zeta \).

-

5.

In Tables 8, 9, 10, and 11 we show in bold font where RCSC is Pareto improving with respect to the no-sharing scenario.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Kuchesfehani, E.K., Parilina, E.M. & Zaccour, G. Revenue and cost sharing contract in a dynamic closed-loop supply chain with uncertain parameters. Ann Oper Res 322, 851–877 (2023). https://doi.org/10.1007/s10479-022-05055-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-022-05055-x