Abstract

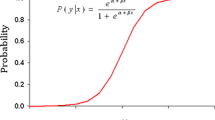

One influence analysis method of top management team and investment efficiency based on analytic hierarchy process and support vector machine model has been proposed to improve the influence analysis accuracy of top management team and investment efficiency under international accounting standard. Firstly, it takes A stock companies in Shanghai and Shenzhen between 2008 and 2011 as research objects and sets up influence model of top management team background feature for the relationship between accounting robustness and investment efficiency; secondly, based on analytic hierarchy process and support vector machine, it makes comprehensive consideration for the index weights of different influencing factors within investment efficiency impact evaluation system, which makes the prediction results more reasonable and realizes the accuracy of investment efficiency affecting evaluation analysis algorithm; lastly, the effectiveness of the proposed method has been verified through simulation experiment.

Similar content being viewed by others

References

Arunkumar, N., Ram Kumar, K., Venkataraman, V.: Automatic detection of epileptic seizures using permutation entropy, Tsallis entropy and Kolmogorov complexity. J. Med. Imaging Health Inf. 6(2), 526–531 (2016)

Stephygraph, L.R., Arunkumar, N.: Brain-actuated wireless mobile robot control through an adaptive human-machine interface. Adv. Intell. Syst. Comput. 397, 537–549 (2016)

Zhao, P.Z., Che, M.C.: (2010) An empirical analysis on impact of foreign direct investment to technical efficiency of service industry in Heilongjiang province. In: IEEE International Conference on Management and Service Science, pp. 1–4

Tangpinyoputtikhun, Y., Thammavinyu, C.: The impact of accounting changes on accounting information efficiency and firm image: an empirical research of Thai-listed firms. J. Acad Bus Econ (2011)

Shen, C.H., Luo, F., Huang, D.: Analysis of earnings management influence on the investment efficiency of listed Chinese companies. J Empir. Financ. 34, 60–78 (2015)

Cheung, Y.L., Jiang, P., Limpaphayom, P., et al.: Does corporate governance matter in China? China Econ. Rev. 19(3), 460–479 (2008)

Ansari, S., Reinecke, J., Spaan, A.: How are practices made to vary? Managing practice adaptation in a multinational corporation. Organ. Stud. 35, 1313–1341 (2014)

Liozu, S.M., Boland, R.J., Hinterhuber, A.: Industrial pricing orientation: the organizational transformation to value-based pricing. Social Science Electronic Publishing, New York (2011)

Krishnan, R., Miller, F., Sedatole, K.L.: Collaborative contracting in inter-firm relationships. Social Science Electronic Publishing, New York (2007)

Min, T., Li, H., Xu, H.: Influencing factor analysis of the investment efficiency of the environmental governance. In: IEEE International Conference on Grey System and Intelligent Services Joint with the 15th WOSC International Congress on Cybernetics and System, pp. 414–418. 2011

Wetering, R.V.D.: Wetenschap als aanjager van groei: Inrichten van de valorisatieketen door focus, samenwerking en financiering (2015)

Tao, M., Li, H., Xu, H.: Influencing factor analysis of the investment efficiency of the environmental governance: a case of Shandong Province in China. Grey Systems 1(3), 414–418 (2011)

Tian, L., Estrin, S.: Retained state shareholding in Chinese PLCs: does government ownership always reduce corporate value? Cepr Discuss. Papers 36(1), 74–89 (2008)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Lina, S. Analysis of factors affecting investment efficiency based on analytic hierarchy process and support vector machine (SVM) model. Cluster Comput 22 (Suppl 2), 4367–4374 (2019). https://doi.org/10.1007/s10586-018-1896-6

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10586-018-1896-6