Abstract

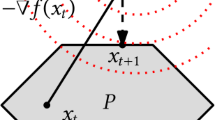

The quickly moving market data in the finance industry requires a frequent parameter identification of the corresponding financial market models. In this paper we apply a special sequential quadratic programming algorithm to the calibration of typical equity market models. As it turns out, the projection of the iterates onto the feasible set can be efficiently computed by solving a semidefinite programming problem. Combining this approach with a Gauss-Newton framework leads to an efficient algorithm which allows to calibrate e.g. Heston’s stochastic volatility model in less than a half second on a usual 3 GHz desktop PC. Furthermore we present an appropriate regularization technique that stabilizes and significantly speeds up computations if the model parameters are chosen to be time-dependent.

Similar content being viewed by others

References

Achdou, Y., Pironneau, O.: Computational Methods for Option Pricing. SIAM, Philadelphia (2005)

Albrecher, H., Mayer, P., Schoutens, W., Tistaert, J.: The little Heston trap. In: Wilmott Magazine, pp. 83–92 (2007)

Andersen, L., Brotherton-Ratcliffe, R.: The equity option volatility smile: an implicit finite-difference approach. J. Comput. Finance 1(2), 5–32 (1997/98)

Black, F., Scholes, M.: The pricing of options and corporate liabilities. J. Political Econ. 81, 637–659 (1973)

Boyd, S., El Ghaoui, L., Feron, E., Balakrishnan, V.: In: Linear Matrix Inequalities in System and Control Theory. SIAM Studies in Applied Mathematics, vol. 15. SIAM, Philadelphia (1994)

Carr, P., Madan, D.: Option valuation using the fast Fourier transform. J. Comput. Finance 3, 463–520 (1999)

Conn, A.R., Gould, N.I.M., Toint, P.L.: Trust-Region Methods. MPS-SIAM Series on Optimization. SIAM, Philadelphia (2000)

Fujisawa, K., Kojima, M., Nakata, K., Yamashita, M.: SDPA (SemiDefinite Programming Algorithm) User’s manual—version 6.2.0. Research Report B-308, Dept. Math. and Comp. Sciences, Tokyo Institute of Technology, December 1995

Goldfarb, D., Idnani, A.: A numerically stable method for solving strictly convex quadratic programs. Math. Program. 27, 1–33 (1983)

Hedar, A., Fukushima, M.: Hybrid simulated annealing and direct search method for nonlinear unconstrained global optimization. Optim. Methods Softw. 17, 891–912 (2002)

Herskovits, J.N., Carvalho, L.A.V.: A successive quadratic programming based feasible directions algorithm. In: Bensoussan, A., Lions, J.L. (eds.) Proceedings of the Seventh International Conference on Analysis and Optimization of Systems, Antibes. Lecture Notes in Control and Inform. Sci., vol. 83, pp. 93–101. Springer, Berlin (1986)

Heston, S.L.: A closed-form solution for options with stochastic volatility with applications to bond and currency options. Rev. Financ. Stud. 6(2), 327–343 (1993)

Higham, N.: Computing a nearest symmetric positive semidefinite matrix. Linear Algebra Appl. 103, 103–118 (1988)

Karatzas, I., Shreve, S.E.: Methods of Mathematical Finance. Springer, Berlin (1998)

Kilin, F.: Accelerating the calibration of stochastic volatility models. Technical Report, available at MPRA: http://mpra.ub.unimuenchen.de/2975 (2007)

Lawrence, C.T., Tits, A.L.: A computationally efficient feasible sequential quadratic programming algorithm. SIAM J. Optim. 11(4), 1092–1118 (2000)

Mayer, P., Kindermann, S., Albrecher, H., Engl, H.: Identification of the local speed function in a Levy model for option pricing. J. Integral Equ. Appl. 20(2), 161–200 (2008)

Mikhailov, S., Noegel, U.: Heston’s stochastic volatility model: implementation, calibration and some extensions. In: Wilmott Magazine, July 2003

Robinson, S.M.: Stability theory for systems of inequalities, Part II: Differentiable nonlinear systems. SIAM J. Numer. Anal. 13, 497–513 (1976)

Turinici, G.: Calibration of local volatility using the local and implied instantaneous variance. J. Comput. Finance 13(2) (2009)

Wächter, A., Biegler, L.T.: On the implementation of a primal-dual interior point filter line search algorithm for large-scale nonlinear programming. Math. Program. 106(1), 25–57 (2006)

Weber, T.: Efficient calibration of Libor market models: alternative strategies and implementation issues. Presentation at the Frankfurt MathFinance Workshop, 14/15 April 2005

Wright, S.J., Tenny, M.J.: A feasible trust-region sequential quadratic programming algorithm. SIAM J. Optim. 14(4), 1074–1105 (2004)

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported by the Forschungsfonds 2005, University of Trier, Germany.

Rights and permissions

About this article

Cite this article

Gerlich, F., Giese, A.M., Maruhn, J.H. et al. Parameter identification in financial market models with a feasible point SQP algorithm. Comput Optim Appl 51, 1137–1161 (2012). https://doi.org/10.1007/s10589-010-9369-8

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10589-010-9369-8