Abstract

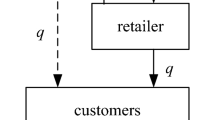

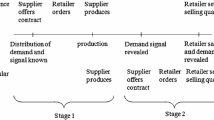

In the online retail market, how to work with upstream suppliers is a key issue for downstream online retailers (e-retailers). Online retailers can choose between functioning either as the “two-sided platforms” (e.g., Taobao.com or eBay.com) allowing suppliers to sell directly to customers by paying a revenue-sharing fee, or as the “resellers” (e.g., Wal-mart.com or JingDong.com) that purchase products from suppliers, and then resell them to customers. Given the rapid growth of e-commerce over past few years, this choice, which is the focus of this article, has become an important practice-based decision. We develop a game-theoretic model for a cross-sales supply chain in which two suppliers deal with two common online retailers. As Stackelberg leaders, online retailers can operate either as a two-sided platform (serving both suppliers and customers) or as a reseller (ordering from suppliers and selling competing products on its own platform). Each supplier adopts either an exclusive-sales strategy, selling products through an exclusive e-retailer, or a cross-sales strategy, selling products through two e-retailers. We analyze the optimal decisions for both e-retailers and suppliers in competing supply chains and describe the system equilibrium for the online marketplace.

Similar content being viewed by others

Notes

References

Ai, X. Z., Chen, J., & Ma, J. H. (2012). Contracting with demand uncertainty under supply chain competition. Annals of Operations Research, 201(1), 17–38.

Abhishek, V., Jerath, K., & Zhang, Z. A. (2016). Agency selling or reselling? Channel structures in electronic retailing. Management Science, 62(8), 2259–2280.

Cai, G. S., Dai, Y., & Zhao, S. X. (2012). Exclusive channels and revenue sharing in a complementary goods market. Management Science, 31(1), 172–187.

Chen, L., Nan, G., & Li, M. (2018). Wholesale pricing or agency pricing on online retail platforms: The effects of customer loyalty. International Journal of Electronic Commerce, 22(4), 576–608.

Coughlan, A. T. (1985). Competition and cooperation in marketing channel choice: Theory and application. Marketing Science, 4(1), 110–129.

Feng, Q., & Lu, L. X. (2013). Supply chain contracting under competition: Bilateral bargaining vs. Stackelberg. Production and Operations Management, 22(3), 661–675.

Gupta, S., & Loulou, R. (1998). Process innovation, product differentiation, and channel structure: Strategic incentives in a duopoly. Marketing Science, 17(3), 301–316.

Gupta, S. (2008). Research note—Channel structure with knowledge spillovers. Marketing Science, 27(2), 247–267.

Ha, A. Y., & Tong, S. (2008). Contracting and information sharing under supply chain competition. Management Science, 54(4), 701–715.

Ha, A. Y., & Tong, S. (2011). Sharing demand information in competing supply chains with production diseconomies. Management Science, 57(3), 566–581.

Ha, A. Y., Tian, Q., & Tong, S. (2017). Information sharing in competing supply chains with production cost reduction. Manufacturing & Service Operations Management, 19(2), 246–262.

Hagiu, A., & Wright, J. (2015). Marketplace or reseller? Management Science, 61(1), 184–203.

Hao, L., Guo, H., & Easley, R. A. (2017). A mobile platform’s in-app advertising contract under agency pricing for app sales. Production and Operations Management, 26(2), 189–202.

Ingene, C. A., & Parry, M. E. (2007). Bilateral monopoly, identical competitors/distributors, and game theoretic analyses of distribution channels. Journal of Academy of Marketing Sciences, 35(4), 586–602.

Jiang, B., Jerath, K., & Srinivasan, K. (2011). Firm Strategies in the “Mid-Tail” of platform based retailing. Marketing Science, 30(5), 757–775.

Jin, Y., Hu, Q., Kim, S. W., & Zhou, S. X. (2018). Supplier development and integration in competitive supply chains. Production and Operations management. https://doi.org/10.1111/poms.12984.

Kwark, Y., Chen, J., & Raghunathan, S. (2017). Platform or wholesale? A strategic tool for online retailers to benefit from third-party information. MIS Quarterly, 41(3), 763–785.

Lee, H. C. B., Cruz, J. M., & Shankar, R. (2018). Corporate social responsibility (CSR) issues in supply chain competition: Should greenwashing be regulated? Decision Science. https://doi.org/10.1111/deci.1230.

Li, B. X., Zhou, Y. W., Li, J. Z., & Zhou, S. P. (2013). Contract choice game of supply chain competition at both manufacturer and retailer levels. International Journal of Production Economics, 143(1), 188–197.

Li, X., Chen, J., & Ai, X. (2019). Contract design in a cross-sales supply chain with demand information asymmetry. European Journal of Operational Research, 275(3), 939–956.

Lin, Y. T., & Parlakturk, A. K. (2014). Vertical integration under competition: Forward, backward, or integration? Production and Operations management, 23(1), 19–35.

McGuire, T., & Staelin, R. (1983). An industry equilibrium analysis of downstream vertical integration. Marketing Science, 2(2), 161–191.

Moorthy, K. S. (1988). Strategic decentralization in channels. Marketing Science, 7(3), 335–355.

Tian, L., Vakharia, A. J., Tan, Y., & Xu, Y. (2018). Marketplace, reseller, or hybrid: Strategic analysis of an emerging e-commerce model. Production and Operations Management, 27(8), 1595–1610.

Trivedi, M. (1998). Distribution channels: An extension of exclusive e-retailer ship. Management Science, 44(7), 896–909.

Shen, Y., Willems, S. P., & Dai, Y. (2018). Channel selection and contracting in the presence of a retail platform. Production and Operations Management. https://doi.org/10.1111/poms.12977.

Wu, C. Q., & Mallik, S. (2010). Cross-sales in supply chains: An equilibrium analysis. International Journal of Production Economics, 126(2), 158–167.

Wu, X. L., & Zhou, Y. (2017). The optimal reverse channel choice under supply chain competition. European Journal of Operational Research, 259(1), 63–66.

Zhu, W., & He, Y. J. (2017). Green product design in supply chains under competition. European Journal of Operational Research, 258(1), 165–180.

Zhang, J., Cao, Q., & He, X. (2019). Contract and product quality in platform selling. European Journal of Operational Research, 272(3), 928–944.

Acknowledgements

The authors gratefully acknowledge financial support from the National Natural Science Foundation of China (Grants Nos. 71372140, 71531003 and 71432003), the Humanities and Social Science Planning Youth Fund of the Ministry of Education of China (Grants Nos. 16YJC630057)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Proof of demand function for Eq. (2)

First, use the first order conditions (FOCs) of the the utility function of the consumer Eq. (1):

we can find the optimal values of \(q_{ij}\):

Then, solving Eqs. (11)–(14), we can get:

Simplifying (15), we can get:

Proof of Lemma 1–3

First, we insert the (inverse) demand Eq. (2) into the retailers’ profit functions (4). That gives us the following updated retailers’ profit functions:

Then use the first order conditions (FOCs) of the profit functions (16) to find the optimal values of \(p_{ij}\), and it can easily be proven that the FOCs guarantee optimality.

Second, inserting Eq. (17) into the suppliers’ profit functions (3) and using the first order conditions (FOCs), we can find the optimal values of \(w_{ij}\):

It can easily be proven that the FOCs guarantee optimality.

Third, inserting Eq. (5) into Eq. (17), we can derive the optimal values of \(p_{ij}\):

The Proof of Lemma 1 is completed.□

The Proof of Lemmas 2 and 3 is similar to the Proof of Lemma 3.

Proof of Proposition 1

Then, we can derive that \(p_{11}^{EDD} > p_{11}^{EDP} > p_{11}^{EPD} (p_{22}^{EDP} ) > p_{11}^{EPP}\).

The proof of Proposition 1 is completed.□

Proof of Proposition 2

(i) \(S_{i}^{EDD} /S_{i}^{EPP} { = }\frac{(1 - r)(1 - b)}{{(1 + b)(2 - b)^{2} }}/\frac{2(1 - b)}{{(1 + b)(4 - 3b)^{2} }} = \frac{{(1 - r)(4 - 3b)^{2} }}{{2(2 - b)^{2} }}\), and we can get

-

if \(r = r_{1} = (8 - 16b + 7b^{2} )/(3b - 4)^{2}\), then \(S_{i}^{EDD} { = }S_{i}^{EPP}\);

-

if \(r > r_{1} = (8 - 16b + 7b^{2} )/(3b - 4)^{2}\), then \(S_{i}^{EDD} > S_{i}^{EPP}\);

-

if \(r < r_{1} = (8 - 16b + 7b^{2} )/(3b - 4)^{2}\), then \(S_{i}^{EDD} > S_{i}^{EPP}\)

-

\(R_{i}^{EDD} /R_{i}^{EPP} { = }\frac{r(1 - b)}{{(1 + b)(2 - b)^{2} }}/\frac{(1 - b)}{{(1 + b)(4 - 3b)^{2} }} = \frac{{r(4 - 3b)^{2} }}{{(2 - b)^{2} }}\), and we can get

-

if \(r = r_{2} = (2 - b)^{2} /(4 - 3b)^{2}\), then \(R_{j}^{EDD} { = }R_{j}^{EPP}\);

-

if \(r < r_{2} = (2 - b)^{2} /(4 - 3b)^{2}\), then \(R_{j}^{EDD} > R_{j}^{EPP}\);

-

if \(r > r_{2} = (2 - b)^{2} /(4 - 3b)^{2}\), then \(R_{j}^{EDD} < R_{j}^{EPP}\).

Therefore, \(S_{i}^{EDD} \le S_{i}^{EPP} , \quad R_{j}^{EDD} \le R_{j}^{EPP} , \quad for \, i,j = \{ 1,2\} ; \, if \, r_{2} (b) \le r \le r_{1} (b).\)

Similarly, we can derive

(ii) \(S_{1}^{EDD} \le S_{1}^{EPD} , \quad R_{1}^{EDD} \le R_{1}^{EPD} , \quad if\, r_{4} (b) \le r \le r_{3} (b).\)

(iii) \(S_{2}^{EPD} \le S_{2}^{EPP} ,\quad R_{2}^{EPD} \le R_{2}^{EPP} ,\quad if\, r_{6} (b) \le r \le r_{5} (b).\)

The Proof of Proposition 2 is completed.□

Proof of Corollary 1

And by the expression of \(r_{1} ,r_{2} ,r_{3} ,r_{4} ,r_{5} ,r_{6}\), we can attain

-

If \(0 < b < 0.4226\), then \(r_{1} (b) > r_{2} (b)\); otherwise, \(r_{1} (b) \le r_{2} (b)\).

-

If \(0 < b < 0.7506\), then \(r_{3} (b) > r_{4} (b)\); otherwise, \(r_{3} (b) \le r_{4} (b)\).

-

If \(0 < b < 0.9194\), then \(r_{5} (b) > r_{6} (b)\); otherwise, \(r_{5} (b) \le r_{6} (b)\).

-

If \(0 < b < 0.5021\), then \(r_{1} (b) > r_{4} (b)\); otherwise, \(r_{1} (b) \le r_{4} (b)\).

-

If \(0 < b < 0.5144\), then \(r_{1} (b) > r_{6} (b)\); otherwise, \(r_{1} (b) \le r_{6} (b)\).

-

If \(0 < b < 0.6074\), then \(r_{3} (b) > r_{2} (b)\); otherwise, \(r_{3} (b) \le r_{2} (b)\).

-

If \(0 < b < 0.7899\), then \(r_{3} (b) > r_{6} (b)\); otherwise, \(r_{3} (b) \le r_{6} (b)\).

-

If \(0 < b < 0.6518\), then \(r_{5} (b) > r_{2} (b)\); otherwise, \(r_{5} (b) \le r_{2} (b)\).

-

If \(0 < b < 0.8312\), then \(r_{5} (b) > r_{4} (b)\); otherwise, \(r_{5} (b) \le r_{4} (b)\).

Therefore, if \(b \in (0,0.4026)\), then \(r_{6} (b) \le r_{4} (b) \le r_{2} (b) \le r_{1} (b) \le r_{3} (b) \le r_{5} (b)\). Based on the above results, we can derive the first Corollary 1.

The Proof of Corollary 1 is completed.□

Proof of Theorem 1

From Corollary 1, we can derive that:

-

(1)

If \(b \in (0,0.4226 )\), then \(S_{i}^{EDD} < S_{i}^{EPP}\), \(S_{2}^{EDD} < S_{2}^{EDP}\), and \(S_{1}^{EDP} < S_{1}^{EPP}\); \(R_{1}^{EDD} < R_{1}^{EPP}\), \(R_{1}^{EDD} < R_{1}^{EDP}\), and \(R_{1}^{EDP} < R_{1}^{EPP}\); \(R_{2}^{EDD} < R_{2}^{EPP}\), \(R_{2}^{EDD} < R_{2}^{EDP}\), and \(R_{2}^{EDP} < R_{2}^{EPP}\).

-

(2)

If \(b \in (0,0.9194 )\), then \(S_{i}^{EDD} > S_{i}^{EPP}\), \(S_{2}^{EDD} > S_{2}^{EDP}\), and \(S_{1}^{EDP} > S_{1}^{EPP}\); \(R_{1}^{EDD} > R_{1}^{EPP}\), \(R_{1}^{EDD} > R_{1}^{EDP}\), and \(R_{1}^{EDP} > R_{1}^{EPP}\); \(R_{2}^{EDD} > R_{2}^{EPP}\), \(R_{2}^{EDD} > R_{2}^{EDP}\), and \(R_{2}^{EDP} > R_{2}^{EPP}\).

Therefore, we can derive that

-

(i)

for any given \(b \in (0,0.2037)\), there exist \(r_{1}^{{}}\) and \(r_{2}^{{}}\) such that a platform selling format is the unique Nash equilibrium for all supply chain members, as long as \(r_{2}^{{}} < r < r_{1}^{{}}\).

-

(ii)

for any given \(b \in (0.9194,1)\), there exists \(r_{5}^{{}}\) and \(r_{6}^{{}}\) such that a reselling format is the unique Nash equilibrium for all supply chain members, as long as \(r_{5}^{{}} < r < r_{6}^{{}}\).

The Proof of Theorem 1 is completed.□

Proof of Lemmas 4–7

For the case CDD, take the first derivative of Eq. (8) w.r.t. \(p_{11}^{{}}\) and \(p_{12}^{{}}\):

The Hessian matrix is:

Inserting Eqs. (18) and (19) into the suppliers’ profit functions (7) and using the first order conditions (FOCs), we can get the optimal values of \(w_{ij}^{CDD}\),which is shown as Eq. (10). Putting Eq. (10) into Eqs. (18) and (19), and then solving them, we can attain the optimal values of \(p_{ij}^{CDD}\) shown as Eq. (9).

The Hessian matrix is following as:

The Proof of Lemma 4 is completed.□

The Proof of Lemma 5–7 is similar to the Proof of Lemma 4.

Proof of Proposition 3

From \(p_{11}^{CDD}\) and \(p_{11}^{CDD}\)’s expression, we can get

-

If \(0 < b < (\sqrt {20 - 4r + r^{2} } + r)/(10 - 2r)\), and then \(\frac{{p_{11}^{CDD} }}{{p_{11}^{CDP} }} = \frac{3(1 - b)}{2(2 - b)}/\frac{{4 + (11 + r)b - 2b^{2} - (r + 13)b^{3} }}{{2(2 + 8b + (1 - r + 6)b^{2} - (1 + r)b^{3} )}} > 1\);

-

if \((\sqrt {20 - 4r + r^{2} } + r)/(10 - 2r) \le b < 1\), and then \(\frac{{p_{11}^{CDD} }}{{p_{11}^{CDP} }} = \frac{3(1 - b)}{2(2 - b)}/\frac{{4 + (11 + r)b - 2b^{2} - (r + 13)b^{3} }}{{2(2 + 8b + (1 - r + 6)b^{2} - (1 + r)b^{3} )}} \le 1\);

In addition,

Then, we can derive Proposition 3.

The proof of Proposition 3 is completed.□

Proof of Proposition 4

Let r7 be the threshold of \(G_{1}^{CPP} = G_{1}^{C(DP)(DP)}\), yielding,

Let r8 be the threshold of \(G_{1}^{CDD} = G_{1}^{C(DP)(DP)}\), yielding,

where

The rectangular area \(\{ (b,r )\left| {(0 < b < 1,0 < r < 1)} \right.\}\) is divided into four regions (IV, V, VI and VII) by three curves: \(G_{1}^{CDD} (b,r) = G_{1}^{CPP} (b,r)\), \(G_{1}^{CDD} (b,r) = G_{1}^{C(DP)(DP)} (b,r)\) and \(G_{1}^{CPP} (b,r) = G_{1}^{C(DP)(DP)} (b,r)\). then, we can get,

-

If \((b,r) \in IV\), and then \(G_{1}^{CDD} (b,r) < G_{1}^{C(DP)(DP)} (b,r) < G_{1}^{CPP} (b,r)\);

-

If \((b,r) \in V\), and then \(G_{1}^{CDD} (b,r) < G_{1}^{CPP} (b,r) < G_{1}^{C(DP)(DP)} (b,r)\);

-

If \((b,r) \in VI\), and then \(G_{1}^{CPP} (b,r) < G_{1}^{CDD} (b,r) < G_{1}^{C(DP)(DP)} (b,r)\);

-

If \((b,r) \in VII\), and then \(G_{1}^{CPP} (b,r) < G_{1}^{C(DP)(DP)} (b,r) < G_{1}^{CDD} (b,r)\).

Therefore, we can derive Proposition 4.

The proof of Proposition 4 is completed.□

Proof of Proposition 5

Then, we can get that when \(0 < b < 0.2679\), there exists \(G_{1}^{CDD} < G_{1}^{CPP}\).

The proof of Proposition 5 is completed.□

Proof of Proposition 6

Let r9 be the threshold of \(G_{1}^{CPD} = G_{1}^{CDD}\), yielding,

In addition,

-

when \(0 < b < 0. 7 6 2 4\), there exists \(0 > r_{ 9} (b)\);

-

when \(0. 7 6 2 4< b < 0. 9 5 7 4\), there exists \(1 > r > r_{ 9} (b)\).

Therefore, when one e-retailer in the cross-sales supply chain is using a traditional reselling format, if (i) \(0 < b < 0. 7 6 2 4\), or (ii) \(0. 7 6 2 4< b < 0. 9 5 7 4\) and \(1 > r > r_{ 9} (b)\), the other e-retailer is incentivized to move from a traditional reselling format to a platform selling format,

The proof of Proposition 6 is completed.□

Proof of Proposition 7

Then, when one e-retailer in the cross-sales supply chain is using a platform selling format, the other e-retailer is incentivized to move from a traditional reselling format to a platform selling format, as \(G_{1}^{CDP} < G_{1}^{CPP}\).

The proof of Proposition 7 is completed.□

Proof of Theorem 2

The rectangular area \(\{ (b,r )\left| {(0 < b < 1,0 < r < 1)} \right.\}\) is divided into four regions (I, II and III) by two curves: \(G_{1}^{CDD} (b,r) = G_{1}^{CPP} (b,r)\), \(G_{1}^{CDD} (b,r) = G_{1}^{CDP} (b,r)\) and \(G_{1}^{CPP} (b,r) = G_{1}^{CDP} (b,r)\).

Then, we can get if \((b,r) \in I\) (i.e. \(0 < b < 0.2679\)), then \(G_{1}^{CDD} (b,r) < G_{1}^{CDP} (b,r) < G_{1}^{CPP} (b,r);\)

-

If \((b,r) \in II\), (i.e. \(02679 < b < 0. 7 6 2 4\), or \(0. 7 6 2 4< b < 0. 9 5 7 4\) and \(1 > r > r_{ 9} (b)\)),

-

then \(G_{1}^{CDD} (b,r) < G_{1}^{CPP} (b,r) < G_{1}^{CDP} (b,r)\);

-

If \((b,r) \in III\),(i.e. \(0. 9 5 7 4< b < 1\), or \(0. 7 6 2 4< b < 0. 9 5 7 4\) and \(0 < r < r_{ 9} (b)\)),

-

then \(G_{1}^{CDD} (b,r) < G_{1}^{C(DP)(DP)} (b,r),G_{1}^{CPP} (b,r) < G_{1}^{C(DP)(DP)} (b,r)\).

In the other words, under a cross-sales supply chain, b can be found such that platform selling is the unique Nash equilibrium for all groups as \(0 < b < 0.2679\).

The proof of Theorem 2 is completed.□

Rights and permissions

About this article

Cite this article

Li, X., Ai, X. A choice of selling format in the online marketplace with cross-sales supply chain: Platform selling or traditional reselling?. Electron Commer Res 21, 393–422 (2021). https://doi.org/10.1007/s10660-019-09370-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10660-019-09370-7