Abstract

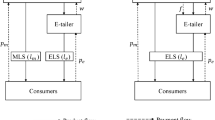

When customers purchase products via cross-border e-commerce, they care about both the product quality and the logistics service quality. Actually, retailers are selling “product + logistics” to customers, although their contracted logistics service provider (LSP) might not be preferred by customers. In practice, it is observed that a retailer selling high-quality products tends to contract with multiple LSPs to ensure higher customer volumes and the overall high quality of “product + logistics”. However, interestingly, we find that the LSP’s profits might be negatively affected by serving two competing retailers, and preferences of the LSP and the retailer selling high-quality products through logistical cooperation result in two “prisoner’s dilemma” regions. We also identify the size of the system’s profit pie and the allocation rules among the competing LSPs and retailers. We show that it is possible to observe competing retailers’ co-delivery, which benefits both the LSP and the retailer selling high-quality products.

Similar content being viewed by others

Notes

Source: http://www.iimedia.cn/60608.html (in Chinese).

Source: https://gs.amazon.cn/japan/seller-stories/shanshui.html (in Chinese).

Technically, this assumption requires Δ ∈ (0, 3 m, 3θm). That is, \(\bar{\Delta } \in 3m - 3\theta m\).

References

Adner, R., Chen, J. Q., & Zhu, F. (2016). Frenemies in platform markets: The case of Apple’s iPad vs. Amazon’s kindle. Harvard Business School Technology and Operations Mgt. Unit Working Paper No. 15-087.

Agatz, N., Fleischmann, M., & Nunen, J. (2008). E-fulfillment and multi-channel distribution—A review. European Journal of Operational Research,187, 339–356.

Barsh, J., Crawford, B., & Grosso, C. (2000). How e-tailing can rise from the ashes. McKinsey Quarterly,3, 98–109.

Cao, J., So, K. C., & Yin, S. Y. (2016). Impact of an “online-to-store” channel on demand allocation, pricing and profitability. European Journal of Operational,248, 234–245.

Chakravarti, D., Krish, R., Paul, P., & Srivastava, J. (2002). Partitioned presentation of multi-component bundle prices: Evaluation, choice and underlying processing effects. Journal of Consumer Psychology,12(3), 215–230.

Chen, B., & Chen, J. (2017). When to introduce an online channel, and offer money back guarantees and personalized pricing? European Journal of Operational Research,257(2), 614–624.

Cho, J., Ozment, J., & Sink, H. (2008). Logistics capability, logistics outsourcing and firm performance in an e-commerce market. International Journal of Physical Distribution and Logistics Management,38(5), 336–359.

Dahana, W. D., Shin, S. J., & Katsumata, S. (2018). Influence of individual characteristics on whether and how much customers engage in showrooming behavior. Electronic Commerce Research,18(4), 665–692.

Delfmann, W., Albers, S., & Gehring, M. (2002). The impact of electronic commerce on logistics service providers. International Journal of Physical Distribution and Logistics Management,32(3), 203–222.

Geng, S., Li, W., & Qu, X. (2017). Design for the pricing strategy of return-freight insurance based on online product reviews. Electronic Commerce Research and Applications,25, 16–28.

Greenleaf, E., Johnson, E. J., Morwitz, V., & Shalev, E. (2009). The price does not include additional taxes, fees, and surcharges: A review of research on partitioned pricing. Journal of Consumer Psychology,26(1), 105–124.

Gujo, O., & Schwind, M. (2007). Bid formation in a combinatorial auction for logistics services. Berlin: Springer.

Huang, G. Q., & Xu, S. X. (2013). Truthful multi-unit transportation procurement auctions for logistics e-marketplaces. Transportation Research Part B: Methodological,47, 127–148.

Jin, M., & Wu, S. D. (2006). Supplier coalitions in on-line reverse auctions: Validity requirements and profit distribution scheme. International Journal of Production Economics,100(2), 183–194.

Lai, G., Liu, H., & Xiao, W. (2018). “Fulfilled by amazon”: A strategic perspective of competition at the E-commerce platform. Working paper. Available at SSRN 3270958.

Lantz, B., & Hjort, K. (2013). Real e-customer behavioral responses to free delivery and free returns. Electronic Commerce Research,13(2), 183–198.

Lim, G. G., Kang, J. Y., Lee, J. K., & Lee, D. C. (2011). Rule-based personalized comparison shopping including delivery cost. Electronic Commerce Research and Applications,10, 637–649.

Michalak, T., Tyrowicz, J., McBurney, P., & Wooldridge, M. (2009). Exogenous coalition formation in the e-marketplace based on geographical proximity. Electronic Commerce Research and Applications,8, 203–223.

Özener, O. Ö., & Ergun, Ö. (2008). Allocating costs in a collaborative transportation procurement network. Transportation Science,42(2), 146–165.

Özener, O. Ö., Ergun, Ö., & Savelsbergh, M. (2011). Lane-exchange mechanisms for truckload carrier collaboration. Transportation Science,45(1), 1–17.

Peng, L., Liao, Q., Wang, X., & He, X. (2016). Factors affecting female user information adoption: an empirical investigation on fashion shopping guide websites. Electronic Commerce Research,16(2), 145–169.

Ramanathan, R. (2010). The moderating roles of risk and efficiency on the relationship between logistics performance and customer loyalty in e-commerce. Transportation Research Part E: Logistics and Transportation Review,46, 950–962.

Shang, W. X., & Liu, L. M. (2011). Promised delivery time and capacity games in time-based competition. Management Science,57(3), 599–610.

Song, B., & Li, M. Z. F. (2018). Dynamic pricing with service unbundling. Production and Operations Management, 27(3), 1334–1354.

Song, J. Z., Yin, Y. H., & Huang, Y. F. (2017). A coordination mechanism for optimizing the contingent-free shipping threshold in online retailing. Electronic Commerce Research and Applications,26, 73–80.

Song, J., & Regan, A. C. (2003). An auction based collaborative carrier network. University of California Transportation Center Working Papers 43.

Song, Y., Maher, T. E., Nicholson, J. D., & Gurney, N. P. (2000). Strategic alliances in logistics outsourcing. Asia Pacific Journal of Marketing and Logistics,12(4), 3–21.

Stank, T., & Daugherty, P. (1997). The impact of operating environment on the formation of cooperative logistics relationships. Transportation Research Part E: Logistics and Transportation Review,33(1), 53–65.

Wang, Y., & Sang, D. (2005). Multi-agent framework for third party logistics in e-commerce. Expert Systems with Applications,29(2), 431–436.

Wang, F., Zhuo, X., Niu, B., & He, J. (2017). Who canvasses for cargos? Incentive analysis and channel structure in a shipping supply chain. Transportation Research Part B: Methodological,97, 78–101.

Xiao, B., & Benbasat, I. (2011). Product-related deception in e-commerce: A theoretical perspective. MIS Quality,35(1), 169–195.

Xing, Y., Grant, D. B., Mckinnon, A. C., & Fernie, J. (2011). The interface between retailers and logistics service providers in the online market. European Journal of Marketing,45(3), 334–357.

Xu, J., Feng, Y., & He, W. (2017). Procurement auctions with ex post cooperation between capacity constrained bidders. European Journal of Operational Research,260, 1164–1174.

Yao, Y. L., & Zhang, J. (2012). Pricing for shipping services of online retailers: Analytical and empirical approaches. Decision Support Systems,53, 368–380.

Zhang, Z., Nan, G., & Li, M. (2016). Duopoly pricing strategy for information products with premium service: Free product or bundling. Journal of Management Information Systems,33(1), 260–295.

Acknowledgements

The authors are grateful to the editors and reviewers for their helpful comments. The first author’s work was supported by NSFC Excellent Young Scientists Fund (No. 71822202), NSFC (No. 71571194), Chang Jiang Scholars Program (Niu Baozhuang 2017), GDUPS (Niu Baozhuang 2017). Carman Lee is supported by ITF Project (No. K-45-35-ZM25). The corresponding author Lei Chen’s work was supported by the Joint Supervision Scheme with the Chinese Mainland, Taiwan, and Macao Universities from HKPolyU and RGC of Hong Kong (No. G-SB0T).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Lemma 1

-

(a)

Comparing the logistics fees and product prices in the two models, we have \(t_{A}^{D} - t_{A}^{B} = \frac{m\theta }{1 + r} - \frac{5m - \Delta }{{5\left( {1 + r} \right)}} = \frac{{\Delta + 5m\left( {\theta - 1} \right)}}{{5\left( {1 + r} \right)}}\). Note that \(0 < \Delta < 3m\left( {1 - \theta } \right)\), \(t_{A}^{D} - t_{A}^{B} < \frac{{2m\left( {\theta - 1} \right)}}{{5\left( {1 + r} \right)}} < 0\)

$$\begin{aligned} t_{B}^{D} - t_{B}^{B} & = \frac{m\theta }{1 + r} - \frac{5m + \Delta }{{5\left( {1 + r} \right)}} = \frac{{ - \Delta + 5m\left( {\theta - 1} \right)}}{{5\left( {1 + r} \right)}} < 0 \\ p_{A}^{D} - p_{A}^{B} & = \frac{{3m\left( {1 - \theta } \right) - \Delta }}{{3\left( {1 + r} \right)}} - \frac{5m - \Delta }{{5\left( {1 + r} \right)}} = \frac{ - 2\Delta - 15m\theta }{{15\left( {1 + r} \right)}} < 0 \\ p_{B}^{D} - p_{B}^{B} & = \frac{{3m\left( {1 - \theta } \right) + \Delta }}{{3\left( {1 + r} \right)}} - \frac{5m + \Delta }{{5\left( {1 + r} \right)}} = \frac{2\Delta - 15m\theta }{{15\left( {1 + r} \right)}}. \\ \end{aligned}$$Calculating \(2\Delta - 15m\theta = 0\), we have \(\Delta_{1} = \frac{15m\theta }{2}\). Then we show that, \(p_{B}^{D} > p_{B}^{B}\) if \(\Delta > \Delta_{1} ;\, p_{B}^{D} < p_{B}^{B}\) otherwise.

-

(b)

Comparing the demand of four participants in the two models, we have the demand of RA,\(q_{AA}^{D} - q_{AA}^{B} = \left( {\frac{1}{2} - \frac{\Delta }{{6m\left( {1 - \theta } \right)}}} \right) - \left( {\frac{1}{2} - \frac{\Delta }{10m}} \right) = \frac{{\Delta \left( {3\theta + 2} \right)}}{{30m\left( {\theta - 1} \right)}} < 0\) the demand of RB,\(q_{BA}^{D} + q_{BB}^{D} - q_{BB}^{B} = \left( {\frac{\Delta }{{6m\left( {1 - \theta } \right)}} + \frac{1}{2}} \right) - \left( {\frac{1}{2} + \frac{\Delta }{10m}} \right) = - \frac{{\Delta \left( {3\theta + 2} \right)}}{{30m\left( {\theta - 1} \right)}} > 0\) the demand of LA, \(q_{BA}^{D} + q_{AA}^{D} - q_{AA}^{B} = \left( {\frac{\Delta }{{6m\left( {1 - \theta } \right)}} + \frac{1}{2} - \frac{\Delta }{{6m\left( {1 - \theta } \right)}}} \right) - \left( {\frac{1}{2} - \frac{\Delta }{10m}} \right) = \frac{\Delta }{10m} > 0\) the demand of LB,\(q_{BB}^{D} - q_{BB}^{B} = \frac{1}{2} - \left( {\frac{1}{2} + \frac{\Delta }{10m}} \right) = - \frac{\Delta }{10m} < 0\)

-

(c)

Conducting a sensitivity analysis of price difference with respect to θ and Δ, we have

$$\begin{aligned} \frac{{\partial \left( {p_{A}^{D} - p_{A}^{B} } \right)}}{\partial \theta } & = - \frac{m}{1 + r} < 0,\quad \frac{{\partial \left( {p_{A}^{D} - p_{A}^{B} } \right)}}{\partial \Delta } = - \frac{2}{{15\left( {1 + r} \right)}} < 0 \\ \frac{{\partial \left( {p_{B}^{D} - p_{B}^{B} } \right)}}{\partial \theta } & = - \frac{m}{1 + r} < 0,\quad \frac{{\partial \left( {p_{B}^{D} - p_{B}^{B} } \right)}}{\partial \Delta } = \frac{2}{{15\left( {1 + r} \right)}} > 0 \\ \frac{{\partial \left( {t_{A}^{D} - t_{A}^{B} } \right)}}{\partial \theta } & = \frac{m}{1 + r} > 0,\quad \frac{{\partial \left( {t_{A}^{D} - t_{A}^{B} } \right)}}{\partial \Delta } = \frac{1}{{5\left( {1 + r} \right)}} > 0 \\ \frac{{\partial \left( {t_{B}^{D} - t_{B}^{B} } \right)}}{\partial \theta } & = \frac{m}{1 + r} > 0,\quad \frac{{\partial \left( {t_{B}^{D} - t_{B}^{B} } \right)}}{\partial \Delta } = - \frac{1}{{5\left( {1 + r} \right)}} < 0 \\ \end{aligned}$$

Proof of Lemma 2

In the dual-LSP model, RB makes profits from customer group BA and customer group BB. While in the base model, RB makes profits from customer group BB.

- (a)

Comparing the customer groups’ marginal profit and conducting a sensitivity analysis with respect to Δ, we have

$$\begin{aligned} \left( { p_{B}^{D} + t_{i}^{D} } \right) - \left( {p_{B}^{B} + t_{B}^{B} } \right) & = - \frac{\Delta + 15m}{{15\left( {1 + r} \right)}} < 0 \\ \frac{{\partial \left[ {\left( {p_{B}^{D} + t_{i}^{D} } \right) - \left( {p_{B}^{B} + t_{B}^{B} } \right)} \right]}}{\partial \Delta } & = - \frac{1}{{15\left( {1 + r} \right)}} < 0 \\ \end{aligned}$$ - (b)

Comparing the proportion of RB in the customer groups’ marginal profit, we have

$$\frac{{p_{B}^{D} }}{{p_{B}^{D} + t_{i}^{D} }} - \frac{{p_{B}^{B} }}{{p_{B}^{B} + t_{B}^{B} }} = \frac{1}{2} - \frac{3m\theta }{3m + \Delta }\left\{ {\begin{array}{ll} { > 0,} \hfill & {\quad if \theta \in \left( {0,\frac{1}{2}} \right)\quad and\quad \Delta \in \left( {0,\bar{\Delta }} \right);\,\theta \in \left( {\frac{1}{2},\frac{2}{3}} \right)\quad and\quad \Delta \in \left( {3m\left( { - 1 + 2\theta } \right),\bar{\Delta }} \right)} \hfill \\ { < 0,} \hfill & {\quad otherwise} \hfill \\ \end{array} } \right.$$ - (c)

Conducting a sensitivity analysis of the difference between pB’s proportion with respect to θ and Δ, we have

$$\begin{aligned} \frac{{\partial \left( {\frac{{p_{B}^{D} }}{{p_{B}^{D} + t_{i}^{D} }} - \frac{{p_{B}^{B} }}{{p_{B}^{B} + t_{B}^{B} }}} \right)}}{\partial \theta } & = - \frac{3m}{3m + \Delta } < 0 \\ \frac{{\partial \left( {\frac{{p_{B}^{D} }}{{p_{B}^{D} + t_{i}^{D} }} - \frac{{p_{B}^{B} }}{{p_{B}^{B} + t_{B}^{B} }}} \right)}}{\partial \Delta } & = \frac{3m\theta }{{\left( {3m + \Delta } \right)^{2} }} > 0 \\ \end{aligned}$$

Proof of Proposition 1

We next examine the total profit pie of RB’s customer groups and the conditions under which RB can earn a larger share of the pie.

- (a)

Comparing the total profit pie of RB’s customer groups in the two models, we have

$$\begin{aligned} \left( {\pi_{BA}^{D} + \pi_{BB}^{D} } \right) - \pi_{BB}^{B} & = \left( {\pi_{{R_{B} }}^{D} + \pi_{{L_{B} }}^{D} + t_{A}^{D} q_{BA}^{D} } \right) - \left( {\pi_{{R_{B} }}^{B} + \pi_{{L_{B} }}^{B} } \right) \\ & = \left( {\frac{{\left[ {\Delta + 3m\left( {1 - \theta } \right)} \right]^{2} }}{{18m\left( {1 - \theta } \right)\left( {1 + r} \right)}} + \frac{m\theta }{{2\left( {1 + r} \right)}} + \frac{m\theta }{1 + r}.\frac{\Delta }{{6m\left( {1 - \theta } \right)}}} \right) \\ & \quad - \left( {\frac{{\left( {5m + \Delta } \right)^{2} }}{{50m\left( {1 + r} \right)}} + \frac{{\left( {5m + \Delta } \right)^{2} }}{{50m\left( {1 + r} \right)}}} \right) \\ & = \frac{{225m^{2} \left( { - 1 + \theta } \right) + 15m\Delta \left( { - 2 + 7\theta } \right) + \Delta^{2} \left( {7 + 18\theta } \right)}}{{450m\left( {1 + r} \right)\left( {1 - \theta } \right)}} < 0 \\ \end{aligned}$$for \(0 < \theta < 1 and 0 < \Delta < 3m - 3m\theta\)

- (b)

Comparing the proportion of RB in the total profit pie of RB’s customer groups, we have

$$\frac{{\pi_{{R_{B} }}^{D} }}{{\pi_{BA}^{D} + \pi_{BB}^{D} }} - \frac{{\pi_{{R_{B} }}^{B} }}{{\pi_{BB}^{B} }} = \frac{1}{2} - \frac{3m\theta }{3m + \Delta }\left\{ {\begin{array}{ll} { > 0,} \hfill & {\quad if\,\, \theta \in \left( {0,\frac{1}{2}} \right) \quad and \quad \Delta \in \left( {0,\bar{\Delta }} \right);} \hfill \\ {\theta \in \left( {\frac{1}{2},\frac{2}{3}} \right) \quad and\quad \Delta \in \left( {3m\left( { - 1 + 2\theta } \right),\bar{\Delta }} \right)} \hfill & {} \hfill \\ { < 0,} \hfill & {\quad otherwise} \hfill \\ \end{array} } \right.$$

Proof of Lemma 3

-

(a)

We use \(\frac{{{\text{q}}_{{\text{BA}}}^{{\text{D}}} }}{{{\text{q}}_{{\text{AA}}}^{{\text{D}}} }}\) to characterize the transfer effect in the dual-LSP model. Conducting a sensitivity analysis of the transfer effect with respect to θ and Δ, we have

$$\begin{aligned} \frac{{\partial \left( {\frac{{q_{BA}^{D} }}{{q_{AA}^{D} }}} \right)}}{\partial \theta } & = \frac{{\partial \left( {\frac{\Delta }{{3m\left( {1 - \theta } \right) - \Delta }}} \right)}}{\partial \theta } = \frac{3m\Delta }{{\left[ {3m\left( {1 - \theta } \right) - \Delta } \right]^{2} }} > 0 \\ \frac{{\partial \left( {\frac{{q_{BA}^{D} }}{{q_{AA}^{D} }}} \right)}}{\partial \Delta } & = \frac{{3m\left( {1 - \theta } \right)}}{{\left[ {3m\left( {1 - \theta } \right) - \Delta } \right]^{2} }} > 0 \\ \end{aligned}$$ -

(b)

In the dual-LSP model, LA makes profits from customer group AA and customer group BA. While in the base model, LA makes profits from customer group AA. Comparing the customer groups’ marginal profit and conducting a sensitivity analysis with respect to θ and Δ, we have

$$\begin{aligned} \frac{{\partial \left[ {\left( {p_{A}^{D} + t_{A}^{D} } \right) - \left( {p_{A}^{B} + t_{A}^{B} } \right)} \right]}}{\partial \Delta } & = \frac{{\partial \left[ {\frac{ - 15m + \Delta }{{15\left( {1 + r} \right)}}} \right]}}{\partial \Delta } = \frac{1}{{15\left( {1 + r} \right)}} > 0 \\ \frac{{\partial \left[ {\left( {p_{B}^{D} + t_{A}^{D} } \right) - \left( {p_{A}^{B} + t_{A}^{B} } \right)} \right]}}{\partial \Delta } & = \frac{{\partial \left[ {\frac{ - 15m + 11\Delta }{{15\left( {1 + r} \right)}}} \right]}}{\partial \Delta } = \frac{11}{{15\left( {1 + r} \right)}} > 0 \\ \end{aligned}$$ -

(c)

Conducting a sensitivity analysis of the difference between tA’s proportion with respect to θ and Δ, we have

$$\begin{aligned} \frac{{\partial \left( {\frac{{t_{A}^{D} }}{{p_{A}^{D} + t_{A}^{D} }} - \frac{{t_{A}^{B} }}{{p_{A}^{B} + t_{A}^{B} }}} \right)}}{\partial \theta } & = \frac{{\partial \left( { - \frac{1}{2} + \frac{3m\theta }{3m - \Delta }} \right)}}{\partial \theta } = \frac{3m}{3m - \Delta } > 0 \\ \frac{{\partial \left( {\frac{{t_{A}^{D} }}{{p_{B}^{D} + t_{A}^{D} }} - \frac{{t_{A}^{B} }}{{p_{A}^{B} + t_{A}^{B} }}} \right)}}{\partial \theta } & = \frac{{\partial \left( { - \frac{1}{2} + \frac{3m\theta }{3m + \Delta }} \right)}}{\partial \theta } = \frac{3m}{3m + \Delta } > 0 \\ \frac{{\partial \left( {\frac{{t_{A}^{D} }}{{p_{A}^{D} + t_{A}^{D} }} - \frac{{t_{A}^{B} }}{{p_{A}^{B} + t_{A}^{B} }}} \right)}}{\partial \Delta } & = \frac{{\partial \left( { - \frac{1}{2} + \frac{3m\theta }{3m - \Delta }} \right)}}{\partial \Delta } = \frac{3m\theta }{{\left( {3m - \Delta } \right)^{2} }} > 0 \\ \frac{{\partial \left( {\frac{{t_{A}^{D} }}{{p_{B}^{D} + t_{A}^{D} }} - \frac{{t_{A}^{B} }}{{p_{A}^{B} + t_{A}^{B} }}} \right)}}{\partial \Delta } & = \frac{{\partial \left( { - \frac{1}{2} + \frac{3m\theta }{3m + \Delta }} \right)}}{\partial \Delta } = - \frac{3m\theta }{{\left( {3m + \Delta } \right)^{2} }} < 0 \\ \end{aligned}$$

Proof of Proposition 2

We next examine the total profit pie of LA’s customer groups and the conditions under which LA can earn a larger share of the pie.

- (a)

Comparing the total profit pie of LA’s customer groups in the two models, we have

$$\begin{aligned} \left( {\pi_{AA}^{D} + \pi_{BA}^{D} } \right) - \pi_{AA}^{B} & = \left( {\pi_{{R_{A} }}^{D} + \pi_{{L_{A} }}^{D} + p_{B}^{D} q_{BA}^{D} } \right) - \left( {\pi_{{R_{A} }}^{B} + \pi_{{L_{A} }}^{B} } \right) \\ & = \frac{{ - 225m^{2} \left( { - 1 + \theta } \right) + 105m\Delta \left( { - 1 + \theta } \right) - 2\Delta^{2} \left( {16 + 9\theta } \right)}}{{450m\left( {1 + r} \right)\left( { - 1 + \theta } \right)}} \\ & \quad \left\{ {\begin{array}{l} { > 0, \quad if \theta \in \left( {0,\frac{{ - 49 + 5\sqrt {217} }}{36}} \right)\quad and\quad \Delta \in \left( {\frac{{15m\left[ { - 7\left( {1 - \theta } \right) + \sqrt {\left( {1 - \theta } \right)\left( {177 + 23\theta } \right)} } \right]}}{{4\left( {16 + 9\theta } \right)}},\bar{\Delta }} \right)} \\ { < 0,\quad otherwise} \\ \end{array} } \right. \\ \end{aligned}$$ - (b)

Comparing the proportion of LA in the total profit pie of LA’s customer groups, we have

$$\begin{aligned} \frac{{\pi_{{L_{A} }}^{D} }}{{\pi_{AA}^{D} + \pi_{BA}^{D} }} - \frac{{\pi_{{L_{A} }}^{B} }}{{\pi_{AA}^{B} }} & = \frac{{2\Delta^{2} + 3m\Delta \left( { - 1 + \theta } \right) + 9m^{2} \left( { - 1 + \theta } \right)\left( { - 1 + 2\theta } \right)}}{{2\left( { - 2\Delta^{2} + 9m^{2} \left( { - 1 + \theta } \right) - 3m\Delta \left( { - 1 + \theta } \right)} \right)}} \\ & \quad \left\{ {\begin{array}{l} { > 0, \quad if\quad \theta \in \left( {\frac{7}{15},\frac{1}{2}} \right) \quad and\quad \Delta \in \left( {\frac{{3m\left[ {\left( {1 - \theta } \right) - \sqrt {\left( {1 - \theta } \right)\left( { - 7 + 15\theta } \right)} } \right]}}{4},\quad \frac{{3m\left[ {\left( {1 - \theta } \right) + \sqrt {\left( {1 - \theta } \right)\left( { - 7 + 15\theta } \right)} } \right]}}{4}} \right);} \hfill \\ {\theta \in \left( {\frac{1}{2},\frac{2}{3}} \right) \quad and\quad \Delta \in \left( {0,\frac{{3m\left[ {\left( {1 - \theta } \right) + \sqrt {\left( {1 - \theta } \right)\left( { - 7 + 15\theta } \right)} } \right]}}{4}} \right)} \hfill \\ {\theta \in \left( {\frac{2}{3},1} \right)\quad and\quad \Delta \in \left( {0,\bar{\Delta }} \right)} \hfill \\ { < 0,\quad otherwise} \hfill \\ \end{array} } \right. \\ \end{aligned}$$

Proof of Corollary 1

We next examine the conditions under which RB and LA have incentives to cooperate with each other.

- (a)

Comparing the profits of RB in the two models, we have

$$\begin{aligned} \pi_{{R_{B} }}^{D} - \pi_{{R_{B} }}^{B} & = - \frac{{ - 60m\Delta \left( { - 1 + \theta } \right) + 225m^{2} \left( { - 1 + \theta } \right)\theta + \Delta^{2} \left( {16 + 9\theta } \right)}}{{450m\left( {1 + r} \right)\left( { - 1 + \theta } \right)}} \\ & \quad \left\{ {\begin{array}{ll} > 0, &\quad if \theta \in \left( {0,\frac{{ - 26 + 10\sqrt {10} }}{9}} \right) \quad and\quad \Delta \in \left( {\frac{{15m\left[ { - 2\left( {1 - \theta } \right) + \left( {2 + 3\theta } \right)\sqrt {1 - \theta } } \right]}}{16 + 9\theta },\bar{\Delta }} \right) \\ < 0, &\quad otherwise \\ \end{array} } \right. \\ \end{aligned}$$ - (b)

Comparing the profits of LA in the two models, we have

$$\left\{ {\begin{array}{ll} > 0,&\quad if \theta \in \left( {\frac{4}{9},1} \right)\quad and \quad \Delta \in \left( {5m\left( {1 - \sqrt \theta } \right),\bar{\Delta }} \right) \\ < 0, &\quad otherwise \\ \end{array} } \right.$$

Rights and permissions

About this article

Cite this article

Niu, B., Wang, J., Lee, C.K.M. et al. “Product + logistics” bundling sale and co-delivery in cross-border e-commerce. Electron Commer Res 19, 915–941 (2019). https://doi.org/10.1007/s10660-019-09379-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10660-019-09379-y