Abstract

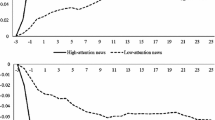

It has become a popular research topic how data on Internet queries are used to make reliable predictions about changes in the marketplace. In this study we analyze the relationship between the online search volume of IPO or initial public offering stocks and their post-IPO stock returns. We obtain the online search data sets of the NAVER, one of the largest online search services in Korea, and the information on IPO stocks and their post-IPO stock returns at the Korea Exchange. We investigate the daily online search volume data of 87 companies that went public in the year of 2016. After analyzing the relations of the abnormal returns and online search volumes using the event study methods, we find that the lower the amount of online search for stocks before IPO, the higher the stock returns after IPO both in short and long-term. One standard deviation increase in search volume decreases one-day return by 3 basis points, two-day return by 6 basis points, and 4-day return by 10 basis points. These economically significant results become stronger if we control for benchmark returns, firm size, and book-to-market ratio. This finding suggests that IPO stocks with low investors’ attention based on the Internet search volume may be undervalued.

Similar content being viewed by others

References

Agarwal, A., Leung, A. C. M., Konana, P., & Kumar, A. (2017). Cosearch attention and stock return predictability in supply chains. Information Systems Research, 28(2), 265–288.

Aissia, D. B. (2014). IPO first-day returns: Skewness preference, investor sentiment and uncertainty underlying factors. Review of Financial Economics, 23(3), 148–154.

Bajo, E., Chemmanur, T. J., Simonyan, K., & Tehranian, H. (2016). Underwriter networks, investor attention, and initial public offerings. Journal of Financial Economics, 122(2), 376–408.

Ban, J. I., & Cheon, Y. H. (2019). Factors affecting IPO stock investment performance of individual investors. The Korean Journal of Financial Managment, 36(3), 169–203.

Barber, B., & Odean, T. (2007). All that glitters: The effect of attention and news on the buying behavior of individual and institutional investors. The Review of Financial Studies, 21(2), 785–818.

Barberis, N., Shleifer, A., & Wurgler, J. (2005). Co-movement. Journal of Financial Economics, 75(2), 283–317.

Baron, D. P. (1982). A model of the demand for investment banking advising and distribution services for new issues. The Journal of Finance, 37, 955–976.

Beatty, R. P., & Ritter, J. R. (1986). Investment banking, reputation, and the underpricing of initial public offerings. Journal of Financial Economics, 15(1–2), 213–232.

Benveniste, L. M., & Spindt, P. A. (1989). How investment bankers determine the offer price and allocation of new issues. Journal of Financial Economics, 24(2), 343–361.

Brav, A., & Gompers, P. A. (1997). Myth or reality? The long-run underperformance of initial public offerings: Evidence from venture and nonventure capital-backed companies. The Journal of Finance, 52(5), 1791–1821.

Brown, S., & Warner, J. (1985). Using daily stock returns: The case of event studies. Journal of Financial Economics, 14(1), 3–31.

Carter, R., & Manaster, S. (1990). Initial public offerings and underwriter reputation. The Journal of Finance, 45(4), 1045–1067.

Chemmanur, T. J., & He, J. (2011). IPO waves, product market competition, and the going public decision: Theory and evidence. Journal of Financial Economics, 101(2), 382–412.

Chemmanur, T. J., Hu, G., & Huang, J. (2010). The role of institutional investors in initial public offerings. Review of Financial Studies, 23(12), 4496–4540.

Chemmanur, T. J., & Yan, A. (2019). Advertising, attention, and stock returns. Quarterly Journal of Finance, 9(3), 1950009.

Chen, K., Luo, P., Liu, L., & Zhang, W. (2018). News, search and stock co-movement: investigating information diffusion in the financial market. Electronic Commerce Research and Applications, 28, 159–171.

Choi, H., & Varian, H. (2012). Predicting the present with Google Trends. Economic Record, 88(s1), 2–9.

Choie, K. S. (2016). Factors of IPO underpricing. International Journal of Economics and Finance, 8(2), 107–114.

Clarke, J., Khurshed, A., Pande, A., & Singh, A. K. (2016). Sentiment traders & IPO initial returns: The Indian evidence. Journal of Corporate Finance, 37, 24–37.

Cook, D. O., Kieschnick, R., & Van Ness, R. A. (2006). On the marketing of IPOs. Journal of Financial Economics, 82, 35–61.

Cornelli, F., Goldreich, D., & Ljungqvist, A. (2006). Investor sentiment and pre-IPO markets. The Journal of Finance, 61(3), 1187–1216.

Da, Z., Engelberg, J., & Gao, P. (2011). In search of attention. The Journal of Finance, 66(5), 1461–1499.

DellaVigna, S., & Pollet, J. M. (2009). Investor inattention and Friday earnings announcements. The Journal of Finance, 64(2), 709–749.

Demers, E., & Lewellen, K. (2003). The marketing role of IPOs: evidence from internet stocks. Journal of Financial Economics, 68(3), 413–437.

Dharan, B. G., & Ikenberry, D. L. (1995). The long-run negative drift of post-listing stock returns. The Journal of Finance, 50(5), 1547–1574.

Dorn, D. (2009). Does sentiment drive the retail demand for IPOs? Journal of Financial and Quantitative Analysis, 44(1), 85–108.

Drake, M. S., Jennings, J., Roulstone, D. T., & Thornock, J. R. (2016). The co-movement of investor attention. Management Science, 63(9), 2847–2867.

Ettredge, M., Gerdes, J., & Karuga, G. (2005). Using web-based search data to predict macroeconomic statistics. Communications of the ACM, 48(11), 87–92.

Fama, E. F. (1970). Efficient capital markets: A review of theory and empirical work. The Journal of Finance, 25(2), 383–417.

Fama, E. F., & French, K. R. (1992). The cross-section of expected stock returns. The Journal of Finance, 47(2), 427–465.

Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of financial economics, 33(1), 3–56.

Gao, S., Meng, Q., & Chan, K. C. (2016). IPO pricing: Do institutional and retail investor sentiments differ? Economics Letters, 148, 115–117.

Gervais, S., Kaniel, R., & Mingelgrin, D. H. (2001). The high-volume return premium. The Journal of Finance, 56(3), 877–919.

Ginsberg, J., Mohebbi, M. H., Patel, R. S., Brammer, L., Smolinski, M. S., & Brilliant, L. (2009). Detecting influenza epidemics using search engine query data. Nature, 457(7232), 1012.

Grullon, G., Kanatas, G., & Weston, J. P. (2004). Advertising, breadth of ownership, and liquidity. The Review of Financial Studies, 17(2), 439–461.

Hanley, K. W. (1993). The underpricing of initial public offerings and the partial adjustment phenomenon. Journal of Financial Economics, 34, 231–250.

Hirshleifer, D., Lim, S. S., & Teoh, S. H. (2011). Limited investor attention and stock market misreactions to accounting information. Review of Asset Pricing Studies, 1(1), 35–73.

Hong, H., Torous, W., & Valkanov, R. (2007). Do industries lead stock markets? Journal of Financial Economics, 83(2), 367–396.

Hou, K. (2007). Industry information diffusion and the lead-lag effect in stock returns. The Review of Financial Studies, 20(4), 1113–1138.

Ibbotson, R. G., & Jaffe, J. F. (1975). “Hot issue” markets. The journal of finance, 30(4), 1027–1042.

Kang, S. K., Kang, H. C., Kim, J., & Kim, N. (2015). Insiders’ Pre-IPO Ownership, Underpricing, and Share-Selling Behavior: Evidence from Korean IPOs. Emerging Markets Finance and Trade, 51(3), 66–84.

Kaustia, M., & Knüpfer, S. (2008). Do investors overweight personal experience? Evidence from IPO subscriptions. The Journal of Finance, 63(6), 2679–2702.

Kim, S., & Jun, S. G. (2017). Dark side of venture capital investment in IPOs. Korean Journal of Financial Studies, 46(3), 559–589.

Leung, A. C. M., Agarwal, A., Konana, P., & Kumar, A. (2016). Network analysis of search dynamics: The case of stock habitats”. Management Science, 63(8), 2667–2687.

Liew, J. K. S., & Wang, G. Z. (2016). Twitter sentiment and IPO performance: A cross-sectional examination. The Journal of Portfolio Management, 42(4), 129–135.

Ljungqvist, A., Nanda, V., & Singh, R. (2006). Hot markets, investor sentiment, and IPO pricing. The Journal of Business, 79(4), 1667–1702.

Lou, D. (2014). Attracting investor attention through advertising. The Review of Financial Studies, 27(6), 1797–1829.

Loughran, T., & McDonald, B. (2013). IPO first-day returns, offer price revisions, volatility, and form S-1 language. Journal of Financial Economics, 109(2), 307–326.

Loughran, T., & Ritter, J. (1995). The new issues puzzle. The Journal of Finance, 50, 23–51.

Loughran, T., & Ritter, J. R. (2002). Why don’t issuers get upset about leaving money on the table in IPOs? The Review of Financial Studies, 15(2), 413–444.

Lowry, M., & Schwert, G. W. (2002). IPO market cycles: Bubbles or sequential learning? The Journal of Finance, 57(3), 1171–1200.

Lowry, M. (2003). Why does IPO volume fluctuate so much? Journal of Financial economics, 67(1), 3–40.

Lowry, M., Officer, M. S., & Schwert, G. W. (2010). The variability of IPO initial returns. The Journal of Finance, 65(2), 425–465.

Luo, X., Zhang, J., & Duan, W. (2013). Social media and firm equity value. Information Systems Research, 24(1), 146–163.

Malkiel, B. G., & Fama, E. F. (1970). Efficient capital markets: A review of theory and empirical work. The journal of Finance, 25(2), 383–417.

Mendelson, H., & Pillai, R. R. (1998). Clockspeed and informational response: Evidence from the information technology industry. Information Systems Research, 9(4), 415–433.

Menzly, L., & Ozbas, O. (2010). Market segmentation and cross-predictability of returns. The Journal of Finance, 65(4), 1555–1580.

Neupane, S., Paudyal, K., & Thapa, C. (2014). Firm quality or market sentiment: What matters more for IPO investors? Journal of banking & Finance, 44, 207–218.

Park, J., & Kim, J. (2019). Public information and IPO Stock performance. The Korean Journal of Financial Management, 36(2), 1–30.

Pástor, Ľ., & Veronesi, P. (2010). Rational IPO waves. The Journal of Finance, 60(4), 1713–1757.

Peng, L., & Xiong, W. (2006). Investor attention, overconfidence and category learning. Journal of Financial Economics, 80(3), 563–602.

Ritter, J. R. (1984). The" hot issue" market of 1980. Journal of Business, 57(2), 215–240.

Ritter, J. R., & Welch, I. (2002). A review of IPO activity, pricing, and allocations. The journal of Finance, 57(4), 1795–1828.

Rock, K. (1986). Why new issues are underpriced. Journal of Financial Economics, 15, 187–212.

Simon, H. A. (1971). Designing organizations for an information-Rich World in Martin Greenberger, computers, communication, and the public interest. Baltimore: The Johns Hopkins Press.

Spatt, C., & Srivastava, S. (1991). Preplay communication, participation restrictions, and efficiency in initial public offerings. Review of Financial Studies, 4(4), 709–726.

Welch, I. (1989). Seasoned offerings, imitation costs, and the underpricing of initial public offerings. The Journal of Finance, 44(2), 421–449.

Wu, L., & Brynjolfsson, E. (2009). The future of prediction: how Google searches foreshadow housing prices and quantities. In ICIS 2009 Proceedings

Yuan, Y. (2015). Market-wide attention, trading, and stock returns. Journal of Financial Economics, 116(3), 548–564.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Appendix

Rights and permissions

About this article

Cite this article

Kang, HG., Bae, K., Shin, J.A. et al. Will data on internet queries predict the performance in the marketplace: an empirical study on online searches and IPO stock returns. Electron Commer Res 21, 101–124 (2021). https://doi.org/10.1007/s10660-020-09417-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10660-020-09417-0