Abstract

This paper analyzes an emerging rebate mode where a cashback website not only serves as a promotional device in generating more sales for an online retailer, but also makes decisions on its marketing effort autonomously under certain product availability conditions set by the online retailer. Using a game-theoretic approach, this paper analyzes the optimal decision of both parties in commission-driven rebate mode and marketing-based rebate mode in a market dominated by the online retailer and cashback website respectively. Our main findings are as follows: (1) In the Retailer Stackelberg (RS) game, which rebate mode an online retailer will adopt is related to the marketing cost of the rebate channel and the consumer utility discount (UD) factor. (2) Both rebate modes will help the retailer to expand the market and increase profit because of price differentiation. (3) There is a possible price trap in marketing-based rebate mode. (4) In RS game, the effect of consumer UD factor on the optimal marketing effort is related to the product availability in the rebate channel. (5) In both RS game and Cashback-website Stackelberg (CS) game, the online retailer should strive to become a leader. However, the cashback website prefers the online retailer to be a leader when marketing cost is relatively low in the marketing-based mode. Our results, consistent with several real-world observations, have useful implications for marketers.

Similar content being viewed by others

Notes

References

Ahmadi, R., Iravani, F., & Mamani, H. (2017). Supply chain coordination in the presence of gray markets and strategic consumers. Production & Operations Management, 26, 252

Appati, J. K., Denwar, I. W., Owusu, E., & Tettey Soli, M. A. (2021). Construction of an ensemble scheme for stock price prediction using deep learning techniques. International Journal of Intelligent Information Technologies, 17(2), 72–95

Arcelus, F. J., Gor, R., & Srinivasan, G. (2012). Price, rebate and order quantity decisions in a newsvendor framework with rebate-dependent recapture of lost sales. International Journal of Production Economics, 140(1), 473–482

Arcelus, F. J., Kumar, S., & Srinivasan, G. (2007). Pricing and rebate policies for the newsvendor problem in the presence of a stochastic redemption rate. International Journal of Production Economics, 107(2), 467–482

Arcelus, F. J., Kumar, S., & Srinivasan, G. (2008). Pricing and rebate policies in the two-echelon supply chain with asymmetric information under price-dependent, stochastic demand. International Journal of Production Economics, 113(2), 598–618

Aydin, G., & Porteus, E. L. (2008). Manufacturer-to-retailer versus manufacturer-to-consumer rebates in a supply chain. International, 122, 237–270

Ballestar, M. T., Sainz, J., & Torrent-Sellens, J. (2016). Social networks on cashback websites. Psychology & Marketing, 33(12), 1039–1045

Bawa, K., & Shoemaker, R. W. (1987). The effects of a direct mail coupon on brand choice behavior. Journal of Marketing Research, 24(4), 370–376

Cao, E., & Li, H. (2020). Group buying and consumer referral on a social network. Electronic Commerce Research, 20(1), 21–52

Cao, K., & He, P. (2016). The competition between B2C platform and third-party seller considering sales effort. Kybernetes, 45(7), 1084–1108

Chen, K. Y., Kaya, M., & Özer, Ö. (2008). Dual sales channel management with service competition. Manufacturing & Service Operations Management, 10(4), 654–675

Chen, T., Hou, W. H., & Zhang, X. X. (2019). Decision analysis of product positioning with manufacturer rebate competition. Soft Science, 33(12), 73–79

Chen, X., Li, C. L., Rhee, B. D., & Simchi-Levi, D. (2010). The impact of manufacturer rebates on supply chain profits. Naval Research Logistics, 54(6), 667–680

Chen, Y., Moorthy, S., & Zhang, Z. J. (2005). Research note: Price discrimination after the purchase: rebates as state-dependent discounts. Management Science, 51(7), 1131–1140

Chen, Z., & Peng, J. (2021). Should the assembly system with direct omnichannel introduce integrated management service? A game-theoretical modelling study. Electronic Commerce Research. https://doi.org/10.1007/s10660-020-09450-z

Chiang, W. Y. K., Chhajed, D., & Hess, J. D. (2003). Direct marketing, indirect profits: A strategic analysis of dual-channel supply-chain design. Management Science, 49(1), 1–20

Chiu, C. H., Choi, T. M., & Li, X. (2011). Supply chain coordination with risk sensitive retailer under target sales rebate. Automatica, 47(8), 1617–1625

Duan, Y., Ge, Y., & Feng, Y. (2020). Pricing and personal data collection strategies of online platforms in the face of privacy concerns. Electronic Commerce Research. https://doi.org/10.1007/s10660-020-09439-8

Dhar, S. K., & Raju, J. S. (1998). The effects of cross-ruff coupons on sales and profits. Management Science, 44(11), 1501–1516

Dumrongsiri, A., Fan, M., Jain, A., & Moinzadeh, K. (2008). A supply chain model with direct and retail channels. European Journal of Operational Research, 187(3), 691–718

Gong, Y., Hao, Y., & Xing, G. (2018). Conditions and strategies of physical retailers entering rebate network channel. Industrial Engineering Journal, 21(6), 91–97

Gerstner, E., & Hess, J. D. (1991). A theory of channel price promotions. American Economic Review, 81(4), 872–886

Gilpatric, S. M. (2009). Slippage in rebate programs and present-biased preferences. Marketing Science, 28(2), 229–238

Guo, X., Zheng, X., Ling, L., & Yang, C. (2014). Online coopetition between hotels and online travel agencies: From the perspective of cash back after stay. Tourism Management Perspectives, 12(12), 104–112

Ho, Y. C. (2014). The Impact of Digital Marketing on Firms’ Strategies and Consumers’ Post-purchase Behavior. University of Washington.

Ho, Y. C., Ho, Y. J., & Tan, Y. (2017). Online cashback shopping: Implications for consumers and e-Businesses. Information Systems Research, 28(2), 250–264

Hu, S., Hu, X., & Ye, Q. (2017). Optimal rebate strategies under dynamic pricing. Operations Research, 65(6), 1546–1561

Iravani, F., Dasu, S., & Ahmadi, R. (2016). Beyond price mechanisms: How much can service help manage the competition from Gray Markets? European Journal of Operational Research, 252(3), 789–800

Kurata, H., & Nam, S. H. (2010). After-sales service competition in a supply chain: Optimization of customer satisfaction level or profit or both? International Journal of Production Economics, 127(1), 136–146

Lariviere, M. A. (1999). Supply chain contracting and coordination with stochastic demand. (Vol. 17, pp. 233–268). Springer.

Lu, Q., & Moorthy, S. (2007). Coupons versus rebates. Marketing Science, 26(1), 67–82

Luo, Z., Chen, X., Chen, J., & Wang, X. (2016). Optimal pricing policies for differentiated brands under different supply chain power structures. European Journal of Operational Research, 259(2), 437–451

Mantin, B., Krishnan, H., & Dhar, T. (2015). The strategic role of third-party marketplaces in retailing. Production & Operations Management, 23(11), 1937–1949

Mu, L., Wang, F., & Chen, L. (2020). Research on pricing strategy of E-commerce platform based on strategic consumers. Operations Research and Management, 29(10), 225–232

Mu, L., Wang, F., & Chen, L. (2018). Research on prcing strategy of merchant cooperating with cashback website. Industrial Engineering and Management, 12(6), 155–161

Narasimhan, C. (1988). Competitive promotional strategies. Journal of Business, 61(4), 427–449

Neslin, S. A. (1990). A market response model for coupon promotions. Marketing Science, 9(2), 125–145

Pasternack, B. A. (2007). Using revenue sharing to achieve channel coordination for a newsboy type inventory model. Mathematics in Practice & Theory, 62(7), 117–136

Pasternack, B. A. (2008). Optimal pricing and return policies for perishable commodities. Marketing Science, 27(1), 133–140

Raju, J. S., Dhar, S. K., & Morrison, D. G. (1994). The effect of package coupons on brand choice. Marketing Science, 13(2), 145–164

Su, X., & Zhang, F. (2008). Strategic customer behavior, commitment, and supply chain performance. Social Science Electronic Publishing, 54(10), 1759–1773

Su, X., & Zhang, F. (2009). On the value of commitment and availability guarantees when selling to strategic consumers. Social Science Electronic Publishing, 55(5), 713–726

Taylor, T. A. (2002). Supply chain coordination under channel rebates with sales effort effects. Management Science, 48(8), 992–1007

Vana, P., Lambrecht, A., & Bertini, M. (2015). Cashback is cash forward: Delaying a discount to increase future spending. Social Science Electronic Publishing. https://doi.org/10.2139/ssrn.2588611

Wang, Q., Chay, Y., & Wu, Z. (2011). Streamlining inventory flows with time discounts to improve the profits of a decentralized supply chain. International Journal of Production Economics, 132(2), 230–239

Wong, W. K., Qi, J., & Leung, S. Y. S. (2009). Coordinating supply chains with sales rebate contracts and vendor-managed inventory. International Journal of Production Economics, 120(1), 151–161

Xing, D., & Liu, T. (2012). Sales effort free riding and coordination with price match and channel rebate. European Journal of Operational Research, 219(2), 264–271

Yerpude, S., & Singhal, T. K. (2020). Value enablement of collaborative supply chain environment embedded with the Internet of Things: Empirical evidence from the Automotive Industry in India. International Journal of Intelligent Information Technologies, 16(3), 19–51

Yu, N., Wang, S., & Wang, H. (2020). Optimal pricing and rebate strategies in a supply chain considering consumer behavior. Systems Engineering, 38(4), 87–94

Yu, N., Li, J. B., & Liu, Z. X. (2016). Optimization of pricing and rebate strategies and coordination for e-commence product. Journal of Management Sciences in China, 19(11), 18–32

Zhang, J. (2016). The benefits of consumer rebates: A strategy for gray market deterrence. European Journal of Operational Research, 251(2), 509–521

Zhou, J., & Kasikitvorakul, C. (2013). Cashback websites: An empirical study of factors influencing customer loyalty. Företagsekonomi.

Zhou, Y. W., Cao, B., Tang, Q., & Zhou, W. (2017). Pricing and rebate strategies for an e-shop with a cashback website. European Journal of Operational Research, 262(1), 108–122

Zhang, Z. L., Popkowski, L. P., Qu, R. L., & Joseph, K. (2019). A joint optimal model of pricing, rebate value, and redemption hassle. Decision Sciences, 50(5), 1060–1092. https://doi.org/10.1111/deci.12365

Acknowledgements

This work was financially supported by Natural Science Foundation of China (NSFC) under Grant Number 71871133.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

1.1 Proof of the equilibrium of the benchmark case (Retailer Without Cashback Channel)

The retailer’s profit function is given by: \(\pi_{RN} (p_{N} ) = (p_{N} - c)\left( {1 - p} \right)\). Obviously, the second order condition holds. From the first order condition, we can yield \(p_{N}^{*} = \frac{1 + c}{2}\). By substituting the maximum point into the demand function and profit function, we then have \(D_{N}^{*} = \frac{1 - c}{2}\),\(\pi_{N}^{*} { = }\frac{{\left( {1 - c} \right)^{2} }}{4}\).

1.2 Proof of the equilibrium of the Retailer Stackelberg (RS) Game

1.2.1 Commission-driven Mode in RS Game

For any given retail price \(p\) and commission rate \(\alpha\),the objective the cashback website is to determine the rebate rate given to customers to maximize its profit, which is given by \(\pi_{CF} (\beta ) = p(\alpha - \beta )(\frac{\beta p}{{1 - \theta }} - \frac{{\left( {1 - \beta } \right)p}}{\theta })\). The second order derivative of \(\pi_{CF}\) with respect to (w.r.t)\(\beta\) is \(\frac{{\partial^{2} \pi_{CF} }}{{\partial \beta^{2} }}{ = } - \frac{{2p^{2} }}{{\theta \left( {1 - \theta } \right)}}\). It is easy to see that \(\frac{{\partial^{2} \pi_{CF} }}{{\partial \beta^{2} }} < 0\) and \(\pi_{CF}\) is a concave function of \(\beta\) given \(p\) and \(\alpha\). Hence, solving the first order condition of \(\pi_{CF}\) w.r.t \(\beta\), we can yield \(\beta^{*} { = }\frac{1 + \alpha - \theta }{2}\).

Then, substituting this \(\beta\) into the profit function of the retailer, we can express the function as \(\pi_{RL} \left( {p,\alpha } \right) = \left( {p - c} \right)\left( {1 - \frac{{\left( {1 + \alpha - \theta } \right)p}}{{2\left( {1 - \theta } \right)}}} \right) + \frac{{\left( {1 - \alpha } \right)\left( {\alpha + \theta - 1} \right)p^{2} }}{{2\theta \left( {1 - \theta } \right)}}\). By solving the first order condition of \(\pi_{RL} \left( {p,\alpha } \right)\) w.r.t \(p\) and \(\alpha\), the following results can be yield:\(p_{dL}^{*} = \frac{1 + c}{2}\),\(\alpha_{RS}^{*} = 1 - \frac{\theta }{1 + c}\). Then, we use the bordered Hessian matrix to prove whether \(\pi_{RL} \left( {p,\alpha } \right)\) is jointly quasi-concave in \(\left( {p_{dL}^{*} ,\alpha_{RS}^{*} } \right)\). The bordered Hessian matrix of \(\pi_{RL} \left( {p,\alpha } \right)\) in \(\left( {p_{dL}^{*} ,\alpha_{RS}^{*} } \right)\) is as follows: \(H_{1} = \left( {\begin{array}{*{20}c} {\frac{{2\left( {1 + c} \right)^{2} - \left( {2 + c\left( {4 + c} \right)} \right)\theta }}{{\left( {1 + c} \right)^{2} \left( { - 1 + \theta } \right)}}} & {\frac{c}{{2\left( { - 1 + \theta } \right)}}} \\ {\frac{c}{{2\left( { - 1 + \theta } \right)}}} & {\frac{{\left( {1 + c} \right)^{2} }}{{4\left( { - 1 + \theta } \right)\theta }}} \\ \end{array} } \right)\). If the determinant of the matrix \(\left| {H_{1} } \right|\) is greater than zero and the first order principal minor of the Hessian matrix \(H_{1} \left[ {1,1} \right]\) is less than zero,\(\pi_{RL} \left( {p,\alpha } \right)\) is quasi-concave. From \(H_{1}\), it is easy to get \(\left| {H_{1} } \right| = \frac{{\left( {1 + c} \right)^{2} }}{{2\left( {1 - \theta } \right)\theta }}\), \(H_{1} \left[ {1,1} \right] = - \frac{{2\left( {1 + 2c} \right)\left( {1 - \theta } \right) + c^{2} \left( {2 - \theta } \right)}}{{\left( {1 + c} \right)^{2} \left( {1 - \theta } \right)}}\). It is obvious that the two conditions (\(\left| {H_{1} } \right| > 0\), \(H_{1} \left[ {1,1} \right] < 0\)) for the negative determination of \(H_{1}\) are satisfied. Thus,\(\pi_{RL} \left( {p,\alpha } \right)\) is jointly concave in \(\left( {p,\alpha } \right)\).

Finally, substituting \(p_{dL}^{*}\) and \(\alpha_{RS}^{*}\) into \(\beta^{*}\), demand functions and profit functions, the equilibrium of commission-driven mode in the RS Game obtained (See Table 2).

1.2.2 Marketing-based Mode in RS Game

In marketing-based mode, the profit functions of the retailer and the cashback platform are as follows respectively:

According to the backward induction method, we calculate the optimal rebate strategy \(\delta^{*}\) and marketing effort strategy \(s^{*}\) of the cashback platform first for any given price p and marketing expense l. By solving the first order condition of \(\pi_{CF^{\prime}} \left( {\delta ,l} \right)\) w.r.t \(\delta\) and \(s\), the following results can be yield:\(\delta^{*} = \frac{{l\left( {\gamma^{2} - \eta \theta \left( {1 - \lambda \theta } \right)} \right) - p\eta \left( {1 - \theta } \right)\theta \left( {1 - \lambda \theta } \right)}}{{l\left( {\gamma^{2} - 2\eta \theta \left( {1 - \lambda \theta } \right)} \right)}}\), \(s^{*} = \frac{{\gamma \left( {\left( {1 - \theta } \right)p - l} \right)}}{{\gamma^{2} - 2\eta \theta \left( {1 - \lambda \theta } \right)}}\). Similarly, we use the bordered Hessian matrix to prove whether \(\pi_{CF^{\prime}} \left( {\delta ,s} \right)\) is jointly quasi-concave in \(\left( {\delta^{*} ,s^{*} } \right)\). The bordered Hessian matrix of \(\pi_{CF^{\prime}} \left( {\delta ,s} \right)\) in \(\left( {\delta^{*} ,s^{*} } \right)\) is as follows: \(H_{2} = \left( {\begin{array}{*{20}c} { - \frac{{2l^{2} }}{{\left( {1 - \lambda \theta } \right)}}} & { - \frac{\gamma l}{{\theta \left( {1 - \lambda \theta } \right)}}} \\ { - \frac{\gamma l}{{\theta \left( {1 - \lambda \theta } \right)}}} & { - \eta } \\ \end{array} } \right)\). Obviously, the first order principal minor of the Hessian matrix \(H_{2} \left[ {1,1} \right]\) is less than zero. If the determinant of the matrix \(\left| {H_{2} } \right|{ = - }\frac{{l^{2} \left( {\gamma^{2} - 2\eta \theta \left( {1 - \lambda \theta } \right)} \right)}}{{\theta^{2} \left( {1 - \lambda \theta } \right)^{2} }}\) is greater than zero,\(\pi_{CF^{\prime}} \left( {\delta ,l} \right)\) is jointly quasi-concave in \(\left( {\delta^{*} ,s^{*} } \right)\). Thus, we derive the condition \(\gamma^{2} - 2\eta \theta \left( {1 - \lambda \theta } \right) < 0\).

Then, after substituting \(\delta^{*}\) and \(s^{*}\) into demand functions and the retailer’s profit function respectively, the retailer’s profit function is

From the first order condition of \(\pi_{RL^{\prime}} \left( {p,l} \right)\) w.r.t \(p\) and \(l\), we have \(\begin{gathered} p_{dL^{\prime}}^{*} = \frac{{2\left( {1 + c} \right)\gamma^{2} + \eta \theta \left( { - 4 + 4\lambda \theta + c\left( { - 4 + \lambda \theta \left( {3 + \lambda } \right)} \right)} \right)}}{{4\gamma^{2} + \eta \theta \left( { - 8 + \theta \left( {1 + \lambda \left( {6 + \lambda } \right)} \right)} \right)}}, \hfill \\ l_{RS}^{*} = \frac{{\left( {1 + c} \right)\left( { - 2 + \theta } \right)\left( { - \gamma^{2} + 2\eta \theta } \right) + \theta \left( {\left( { - 1 + c} \right)\gamma^{2} + \eta \theta \left( {6 + c - \left( {2 + c} \right)\theta } \right)} \right)\lambda + \eta \theta^{2} \left( {c + \left( { - 2 + c} \right)\theta } \right)\lambda^{2} }}{{4\gamma^{2} + \eta \theta \left( { - 8 + \theta \left( {1 + \lambda \left( {6 + \lambda } \right)} \right)} \right)}}. \hfill \\ \end{gathered}\).

Similarly, we use the bordered Hessian matrix to prove whether \(\pi_{RL^{\prime}} \left( {p,l} \right)\) is jointly quasi-concave in \(\left( {p_{dL^{\prime}}^{*} ,l_{RS}^{*} } \right)\). The bordered Hessian matrix of \(\pi_{RL^{\prime}} \left( {p,l} \right)\) in \(\left( {p_{dL^{\prime}}^{*} ,l_{RS}^{*} } \right)\) is as follows: \(H_{3} = \left( {\begin{array}{*{20}c} { - \frac{{2\left( {\gamma^{2} - \eta \left( {1 + \theta } \right)\left( {1 - \lambda \theta } \right)} \right)}}{{\gamma^{2} - 2\eta \theta \left( {1 - \lambda \theta } \right)}}} & {\frac{{\eta \left( {\theta + \lambda \theta - 2} \right)}}{{\gamma^{2} - 2\eta \theta \left( {1 - \lambda \theta } \right)}}} \\ {\frac{{\eta \left( {\theta + \lambda \theta - 2} \right)}}{{\gamma^{2} - 2\eta \theta \left( {1 - \lambda \theta } \right)}}} & {\frac{2\eta }{{\gamma^{2} - 2\eta \theta \left( {1 - \lambda \theta } \right)}}} \\ \end{array} } \right)\). If the two conditions: \(H_{3} \left[ {1,1} \right]{ = } - \frac{{2\left( {\gamma^{2} - \eta \left( {1 + \theta } \right)\left( {1 - \lambda \theta } \right)} \right)}}{{\gamma^{2} - 2\eta \theta \left( {1 - \lambda \theta } \right)}} < 0\) and \(\left| {H_{3} } \right|{ = - }\frac{{\eta \left( {4\gamma^{2} + \eta \theta \left( { - 8 + \theta \left( {1 + \lambda \left( {6 + \lambda } \right)} \right)} \right)} \right)}}{{\left( {\gamma^{2} - 2\eta \theta \left( {1 - \lambda \theta } \right)} \right)^{2} }} > 0\) satisfy, then \(\pi_{RL^{\prime}} \left( {p,l} \right)\) is jointly quasi-concave in \(\left( {p_{dL^{\prime}}^{*} ,l_{RS}^{*} } \right)\). Thus, the premise condition that the equilibrium exists is \(4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right) < 0\). By reducing the two conditions (\(\gamma^{2} - 2\eta \theta \left( {1 - \lambda \theta } \right) < 0\) and \(4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right) < 0\)), the final condition that the optimal equilibrium of marketing-based rebate mode in RS Game exists is \(4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right) < 0\).

Finally, bringing \(p_{dL}^{*}\) and \(\alpha_{RS}^{*}\) back to \(\delta^{*}\),\(s^{*}\), demand functions and profit functions, the equilibrium of marketing-based mode in the RS Game obtained (See Table 2).

1.3 Proof of the equilibrium of the CW Stackelberg (CS) game

1.3.1 Commission-driven Mode in CS Game

For any given commission \(\alpha p\), the objective of the online retailer is to determine the product price p and rebate rate \(\beta\) to maximize its profit. Like, Zhou et al. [53], we denote the commission to the cashback website (\(\alpha p\)) as l for convenience. Thus, the profit function of the online retailer is given by \(\pi_{RF} \left( {p,\beta } \right) = \left( {p - c} \right)\left( {1 - \frac{\beta p}{{1 - \theta }}} \right) + \frac{{p\left( {l - p\left( {1 - \beta } \right)} \right)\left( {1 - \beta - \theta } \right)}}{{\theta \left( {1 - \theta } \right)}}\). By solving the first order condition of \(\pi_{RF} \left( {p,\beta } \right)\) w.r.t \(p\) and \(\beta\), the following results can be yield:\(p_{dF}^{*} = \frac{1 + c}{2}\),\(\beta_{CS}^{*} = \frac{1 + c - l - \theta }{{1 + c}}\). Then, we use the bordered Hessian matrix to prove whether \(\pi_{RF} \left( {p,\beta } \right)\) is jointly quasi-concave in \(\left( {p_{dF}^{*} ,\beta_{CS}^{*} } \right)\). The bordered Hessian matrix of \(\pi_{RF} \left( {p,\beta } \right)\) in \(\left( {p_{dF}^{*} ,\beta_{CS}^{*} } \right)\) is as follows: \(H_{4} = \left( {\begin{array}{*{20}c} {\frac{{2\left( {\left( {1 + c} \right)^{2} \theta + \left( {l + \theta } \right)\left( {l - \left( {1 + 2c} \right)\theta } \right)} \right)}}{{\left( {1 + c} \right)^{2} \left( { - 1 + \theta } \right)\theta }}} & {\frac{l - c\theta }{{\theta \left( {1 - \theta } \right)}}} \\ {\frac{l - c\theta }{{\theta \left( {1 - \theta } \right)}}} & {\frac{{\left( {1 + c} \right)^{2} }}{{2\left( { - 1 + \theta } \right)\theta }}} \\ \end{array} } \right)\). If the determinant of the matrix \(\left| {H_{4} } \right|\) is greater than zero and the first order principal minor of the Hessian matrix \(H_{4} \left[ {1,1} \right]\) is less than zero, \(\pi_{RF} \left( {p,\beta } \right)\) is quasi-concave. From \(H_{4}\), it is easy to get \(\left| {H_{4} } \right| = \frac{{\left( {1 + c} \right)^{2} }}{{\left( {1 - \theta } \right)\theta }}\), \(H_{4} \left[ {1,1} \right] = \frac{{2\left( {\left( {1 + c} \right)^{2} \theta { + }\left( {1 + \theta } \right)\left( {l - \left( {1 + 2c} \right)\theta } \right)} \right)}}{{\left( {1 + c} \right)^{2} \left( {1 - \theta } \right)\theta }}\). It is obvious that the two conditions (\(\left| {H_{4} } \right| > 0\), \(H_{4} \left[ {1,1} \right] < 0\)) for the negative determination of \(H_{4}\) are satisfied. Thus, \(\pi_{RF} \left( {p,\beta } \right)\) is jointly concave in \(\left( {p_{dF}^{*} ,\beta_{CS}^{*} } \right)\).

Then, after substituting \(p_{dF}^{*}\) and \(\beta_{CS}^{*}\) into demand functions and the cashback website’s profit function respectively, the profit function of the cashback website is \(\pi_{CL} \left( l \right) = \frac{{l\left( {l - c\theta } \right)}}{{2\left( { - 1 + \theta } \right)\theta }}\). The second order derivative of \(\pi_{CL}\) w.r.t \(l\) is \(\frac{{\partial^{2} \pi_{CL} }}{{\partial l^{2} }}{ = } - \frac{1}{{\theta \left( {1 - \theta } \right)}}\). It is easy to see that \(\frac{{\partial^{2} \pi_{CL} }}{{\partial l^{2} }} < 0\) and \(\pi_{CL}\) is a concave function of \(l\) given \(p\) and \(\beta\). Hence, solving the first order condition of \(\pi_{CL}\) w.r.t \(l\), we can yield \(l^{*} { = }\frac{c\theta }{2}\).

Finally, bringing this \(l^{*}\) into \(\alpha_{RS}^{*}\) back to \(p_{dF}^{*}\),\(\beta_{CS}^{*}\), demand functions and profit functions, the equilibrium in commission driven mode in the CS Game obtained (See Table 3).

1.3.2 Marketing-based Mode in CS Game

First, the cashback site chooses the marketing effort \(s\) conditional on the price p and rebate rate \(\beta\) to maximize its profit, that is \(\pi_{CL^{\prime}} (s) = \frac{{l\left( {s\gamma + p\left( {\beta + \theta - 1} \right)} \right)}}{{\theta \left( {1 - \lambda \theta } \right)}} - \frac{{s^{2} \eta }}{2}\).The second order derivative of \(\pi_{CL^{\prime}}\) w.r.t \(s\) is \(\frac{{\partial^{2} \pi_{CL^{\prime}} }}{{\partial s^{2} }}{ = } - \eta\). It is obvious that \(\frac{{\partial^{2} \pi_{CL^{\prime}} }}{{\partial s^{2} }} < 0\) and \(\pi_{CL^{\prime}}\) is a concave function of \(s\) given \(p\) and \(\beta\). Hence, solving the first order condition of \(\pi_{CL^{\prime}}\) w.r.t \(s\), we can yield \(s^{*} { = }\frac{l\gamma }{{\eta \theta - \eta \theta^{2} \lambda }}\).

Second, bring this \(s^{*}\) into the retailer’s profit function, we can get \(\pi_{RF^{\prime}} \left( {p,\beta } \right) = \frac{1}{{\eta \theta^{2} \left( {1 - \theta \lambda } \right)^{2} }}\left( \begin{gathered} \left( {p\left( {1 - \beta } \right) - l} \right)\left( {l\gamma^{2} - p\eta \theta \left( {1 - \beta - \theta } \right)\left( {1 - \theta \lambda } \right)} \right) \hfill \\ + \left( {c - p} \right)\theta \left( {l\gamma^{2} \lambda - \eta \theta \left( {1 - \theta \lambda } \right)\left( {1 - p + p\left( {1 - \beta } \right)\lambda - \theta \lambda } \right)} \right) \hfill \\ \end{gathered} \right)\). By solving the first order condition of \(\pi_{RF^{\prime}} \left( {p,\beta } \right)\) w.r.t \(p\) and \(\beta\), one pair of \(p^{*}\) and \(\beta^{*}\) can be yield. As above, we use the bordered Hessian matrix to prove whether \(\pi_{RF^{\prime}} \left( {p^{*} ,\beta^{*} } \right)\) is jointly quasi-concave in \(\left( {p_{{}}^{*} ,\beta_{{}}^{*} } \right)\).

Then, bring the above \(s^{*}\),\(p^{*}\) and \(\beta^{*}\) into the cashback website’s profit function to yield the optimal unit marketing expense l, that is \(\pi_{CL^{\prime}} (l) = - \frac{{l\left( {2\eta \theta \left( {1 + c - \left( {1 - c} \right)\lambda } \right)\left( {1 - \lambda \theta } \right)^{2} + l\left( {\gamma^{2} \left( {1 - \lambda } \right)^{2} - 4\eta \left( {1 - \lambda \theta } \right)^{2} } \right)} \right)}}{{2\eta \theta \left( {1 - \theta \lambda } \right)^{2} \left( { - 4 + \theta \left( {1 + \lambda } \right)^{2} } \right)}}\). From the first order derivation of \(\pi_{CL^{\prime}}\) w.r.t \(l\), the final \(l^{*} = \frac{{\eta \theta \left( {1 + c - \left( {1 - c} \right)\lambda } \right)\left( {1 - \theta \lambda } \right)^{2} }}{{ - \gamma^{2} \left( {1 - \lambda } \right)^{2} + 4\eta \left( {1 - \theta \lambda } \right)^{2} }}\) yields. Meanwhile, the second order derivation of \(\pi_{CL^{\prime}}\) w.r.t \(l\) must less than zero, that is the condition \(\gamma^{2} \left( {1 - \lambda } \right)^{2} < 4\eta \left( {1 - \theta \lambda } \right)^{2}\) must be hold.

Finally, substituting the above \(l^{*}\) into \(s^{*}\),\(p^{*}\) and \(\beta^{*}\), demand functions and the retailer’s profit function respectively, the equilibrium in markeing-based mode in the CS Game obtained (See Table 4).

Proof of Proposition 1

Under the equilibrium of commission driven mode in RS Game (See Table 2), it is obvious that \(p_{dL}^{*} = p_{N}^{*} = {{(c + 1)} \mathord{\left/ {\vphantom {{(c + 1)} 2}} \right. \kern-\nulldelimiterspace} 2}\). From the optimal sales price of the rebate channel \(p_{rF}^{*} = \frac{{\left( {2 + c} \right)\theta }}{4}\), we can easily derive that \(\frac{{\partial p_{rF}^{*} }}{\partial \theta } = \frac{2 + c}{4} > 0\). Therefore, Corollary 1 holds. From the equilibrium of commission driven mode in RS Game, it is straightforward to show that \(D_{dL}^{*} = \frac{{2\left( {1 - \theta } \right) - c\left( {2 - \theta } \right)}}{{4\left( {1 - \theta } \right)}},D_{rF}^{*} = \frac{c}{{4\left( {1 - \theta } \right)}},\pi_{CF}^{*} = \frac{{c^{2} \theta }}{{16\left( {1 - \theta } \right)}}\), \(\pi_{RL}^{*} = \frac{1}{8}\left( {c\left( {\frac{c}{1 - \theta } + c - 4} \right) + 2} \right)\). Thus,\(D_{dL}^{*} + D_{rF}^{*} = \frac{2 - c}{4}\),\(\pi_{RL}^{*} - \pi_{N}^{*} = \frac{{c^{2} \theta }}{{8\left( {1 - \theta } \right)}}\),\(\frac{{\partial \pi_{RL}^{*} }}{\partial \theta } = \frac{{c^{2} }}{{8\left( {1 - \theta } \right)^{2} }}\),\(\frac{{\partial \pi_{CF}^{*} }}{\partial \theta } = \frac{{c^{2} }}{{16\left( {1 - \theta } \right)^{2} }}\). Clearly,\(D_{dL}^{*} + D_{rF}^{*} > D_{N}^{*}\),\(\pi_{RL}^{*} > \pi_{N}^{*}\),\(\frac{{\partial \pi_{RL}^{*} }}{\partial \theta } > 0\) and \(\frac{{\partial \pi_{CF}^{*} }}{\partial \theta } > 0\). Both Corollaries 2 and 3 hold.

Proof of Proposition 2

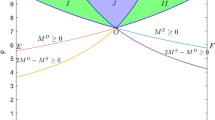

By comparing \(\pi_{RL}^{*}\) and \(\pi_{RL^{\prime}}^{*}\) under the condition that the optimal equilibrium of marketing-based rebate mode in RS Game exists (\(4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right) < 0\)), we can draw the following conclusions:

When \(\pi_{RL}^{*} > \pi_{RL^{\prime}}^{*}\) and \(4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right) < 0\), the two conditions that.

\(\eta > \frac{{4c^{2} \gamma^{2} }}{{\theta \left( {\lambda - 1} \right)\left( {c^{2} \left( {\theta \left( {\lambda - 1} \right) - 2\left( {\lambda + 3} \right)} \right) - 4c\left( {\theta - 1} \right)\left( {\lambda + 1} \right) + 2\left( {\theta - 1} \right)\left( {\lambda - 1} \right)} \right)}}\) and \(\frac{{2\left( {c - 1} \right)\left( {c\left( {\lambda + 3} \right) - \lambda + 1} \right)}}{{\left( {c - 4} \right)c\lambda - c\left( {c + 4} \right) + 2\left( {\lambda - 1} \right)}} < \theta < 1\) should be satisfied;

When \(\pi_{RL}^{*} > \pi_{RL^{\prime}}^{*}\) and \(4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right) < 0\), we can derive the following two conditions: (1) \(- \frac{{4\gamma^{2} }}{{\theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)}} < \eta < \frac{{4c^{2} \gamma^{2} }}{{\theta \left( {\lambda - 1} \right)\left( {c^{2} \left( {\theta \left( {\lambda - 1} \right) - 2\left( {\lambda + 3} \right)} \right) - 4c\left( {\theta - 1} \right)\left( {\lambda + 1} \right) + 2\left( {\theta - 1} \right)\left( {\lambda - 1} \right)} \right)}}\) and \(\frac{{2\left( {c - 1} \right)\left( {c\left( {\lambda + 3} \right) - \lambda + 1} \right)}}{{\left( {c - 4} \right)c\lambda - c\left( {c + 4} \right) + 2\left( {\lambda - 1} \right)}} < \theta < 1\); (2) \(\eta > - \frac{{4\gamma^{2} }}{{\theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)}}\) and \(0 < \theta \le \frac{{2\left( {c - 1} \right)\left( {c\left( {\lambda + 3} \right) - \lambda + 1} \right)}}{{\left( {c - 4} \right)c\lambda - c\left( {c + 4} \right) + 2\left( {\lambda - 1} \right)}}.\)

Through the above comparative analysis, we can get Proposition 2.

Proof of Proposition 3

From the equilibrium of marketing-based mode in RS Game, it is straightforward to show that \(p_{{dL^{\prime}}}^{*} = \frac{{2\left( {c + 1} \right)\gamma^{2} + \eta \theta \left( {c\left( {\theta \lambda \left( {\lambda + 3} \right) - 4} \right) + 4\theta \lambda - 4} \right)}}{{4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)}}\) and \(p_{rF^{\prime}}^{*} { = }\frac{{\eta \theta \left( {c\left( {4 - 2\theta \lambda } \right) + 3\theta \lambda + \theta - 4} \right) - 2\left( {c - 1} \right)\gamma^{2} }}{{4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)}}\). Since the relationship between them satisfies \(p_{rF^{\prime}}^{*} = p_{dL^{\prime}}^{*} (1 - \beta )\), it is obvious that \(p_{dL^{\prime}}^{*} > p_{rF^{\prime}}^{*}\). By comparing \(p_{rF^{\prime}}^{*}\) and \(p_{N}^{*}\) under the condition that the optimal equilibrium of marketing-based rebate mode in RS Game exists (\(4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right) < 0\)), we can conclude that the conditions for the existence of price traps are:\(- \frac{{4\gamma^{2} }}{{\theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)}} < \eta < \frac{{2\gamma^{2} \left( {\left( {1 + c} \right)\left( {2 - \theta } \right) - \left( {1 - c} \right)\lambda \theta } \right)}}{{\theta \left( {8 + 2\lambda \theta^{2} \left( {3 + \lambda } \right) - \theta \left( {1 + \lambda } \right)\left( {7 + \lambda } \right) + c\left( {8 + 4\lambda \theta^{2} - \theta \left( {7 + \lambda \left( {4 + \lambda } \right)} \right)} \right)} \right)}}\). Thus, Proposition 3 holds.

From the equilibrium of marketing-based mode in RS Game, it is straightforward to show that \(s_{RS}^{*} = - \frac{{\gamma \theta \left( {\left( {c - 1} \right)\lambda + c + 1} \right)}}{{4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)}}\), \(\pi_{CF^{\prime}}^{*} = - \frac{{\eta \theta^{2} \left( {\left( {c - 1} \right)\lambda + c + 1} \right)^{2} \left( {\gamma^{2} + 2\eta \theta \left( {\theta \lambda - 1} \right)} \right)}}{{2\left( {4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)} \right)^{2} }}\) and \(\pi_{RL^{\prime}}^{*} = \frac{{\left( {c - 1} \right)^{2} \gamma^{2} + \eta \theta \left( {\left( {c - 2} \right)\left( {c - 1} \right)\theta \lambda - c\left( {2c + \theta - 4} \right) - 2} \right)}}{{4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)}}\). Therefore, \(\frac{{\partial s_{RS}^{*} }}{\partial \gamma } = - \frac{{\theta \left( {\left( {1 + \lambda } \right)c + 1 - \lambda } \right)\left( {\left( {4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)} \right) - 8\gamma^{2} } \right)}}{{\left( {4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)} \right)^{2} }}\), \(\frac{{\partial \prod_{CF^{\prime}}^{*} }}{\partial \gamma } = - \frac{{\gamma \eta \theta^{2} \left( {1 - \lambda + c\left( {1 + \lambda } \right)} \right)^{2} \left( { - 4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda - 10} \right) + 1} \right) + 8} \right)} \right)}}{{\left( {4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)} \right)^{3} }}\) and \(\frac{{\partial \prod_{RL^{\prime}}^{*} }}{\partial \gamma } = \frac{{2\gamma \eta \theta^{2} \left( {1 - \lambda + c\left( {1 + \lambda } \right)} \right)^{2} }}{{\left( {4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)} \right)^{2} }}\).

Since the equilibrium of marketing-based mode in RS Game exists only if \(4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right) < 0\). Given the necessary equilibrium conditions, it is clear that \(\frac{{\partial s_{RS}^{*} }}{\partial \gamma } = - \frac{{\theta \left( {\left( {1 + \lambda } \right)c + 1 - \lambda } \right)\left( {\left( {4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)} \right)} \right)}}{{\left( {4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)} \right)^{2} }} + \frac{{8\gamma^{2} \theta \left( {\left( {1 + \lambda } \right)c + 1 - \lambda } \right)}}{{\left( {4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)} \right)^{2} }} > 0\),\(\frac{{\partial \pi_{CF^{\prime}}^{*} }}{\partial \gamma } = - \frac{{\gamma \eta \theta^{2} \left( {1 + c - \left( {1 - c} \right)\lambda } \right)^{2} \left( {2\eta \theta^{2} \left( {1 - \lambda } \right)^{2} - \left( {4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)} \right)} \right)}}{{\left( {4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)} \right)^{3} }} > 0\) and \(\frac{{\partial \pi_{RL^{\prime}}^{*} }}{\partial \gamma } = \frac{{2\gamma \eta \theta^{2} \left( {1 + c - \left( {1 - c} \right)\lambda } \right)^{2} }}{{\left( {4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)} \right)^{2} }} > 0\). Therefore, Corollary 4 holds.

From the equilibrium of marketing-based mode in RS Game, it is straightforward to show that \(\frac{{\partial s_{RS}^{*} }}{\partial \theta } = \frac{{\gamma \left( {\left( {1 + \lambda } \right)c + 1 - \lambda } \right)\left( { - 4\gamma^{2} + \eta \theta^{2} \left( {\lambda \left( {\lambda + 6} \right) + 1} \right)} \right)}}{{\left( {4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)} \right)^{2} }}\). Therefore, to determine the relationship between \(s_{RS}^{*}\) and \(\theta\) is to determine the positive or negative of \(- 4\gamma^{2} + \eta \theta^{2} \left( {\lambda \left( {\lambda + 6} \right) + 1} \right)\) under the necessary equilibrium condition holds (\(4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right) < 0\)). Consequently, when \(- 4\gamma^{2} + \eta \theta^{2} \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) > 0\) and \(4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right) < 0\), \(s_{RS}^{*}\) increases with \(\theta\); when \(- 4\gamma^{2} + \eta \theta^{2} \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) < 0\) and \(4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right) < 0\),\(s_{RS}^{*}\) decreases with \(\theta\). By analyzing these conditions, we get Corollary 5.

Proof of Proposition 4

From the equilibriums of commission driven mode in RS Game and in CS game, it is obvious that \(p_{dF}^{*} = p_{dL}^{*} = p_{N}^{*} = \frac{1 + c}{2}\), \(p_{rL}^{*} = p_{rF}^{*} = \frac{{\left( {c + 2} \right)\theta }}{4}\).

Proof of Proposition 5

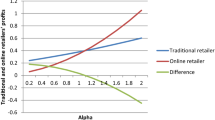

From the equilibriums of commission driven mode in RS Game and in CS game, we can get \(\pi_{CF}^{*} = \frac{{c^{2} \theta }}{{16\left( {1 - \theta } \right)}}\),\(\pi_{RL}^{*} = \frac{1}{8}\left( {c\left( {\frac{c}{1 - \theta } + c - 4} \right) + 2} \right)\),\(\pi_{RF}^{*} = \frac{1}{16}\left( {c\left( {c\left( {\frac{1}{1 - \theta } + 3} \right) - 8} \right) + 4} \right)\) and \(\pi_{CL}^{*} = \frac{{c^{2} \theta }}{8 - 8\theta }\). Thus,\(\pi_{RL}^{*} - \pi_{RF}^{*} = \frac{{c^{2} \theta }}{{16\left( {1 - \theta } \right)}} > 0\), \(\frac{{\pi_{CL}^{*} }}{{\pi_{CF}^{*} }} = 2 > 1\). Proposition 5 holds.

Proof of Proposition 6

From the equilibriums of marketing-based mode in RS Game and in CS game, we can get.

\(\pi_{CF^{\prime}}^{*} = - \frac{{\eta \theta^{2} \left( {\left( {c - 1} \right)\lambda + c + 1} \right)^{2} \left( {\gamma^{2} + 2\eta \theta \left( {\theta \lambda - 1} \right)} \right)}}{{2\left( {4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)} \right)^{2} }}\), \(\pi_{RL^{\prime}}^{*} = \frac{{\left( {c - 1} \right)^{2} \gamma^{2} + \eta \theta \left( {\left( {c - 2} \right)\left( {c - 1} \right)\theta \lambda - c\left( {2c + \theta - 4} \right) - 2} \right)}}{{4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)}}\), \(\pi_{CL^{\prime}}^{*} = \frac{{\eta \theta \left( {\left( {c - 1} \right)\lambda + c + 1} \right)^{2} \left( {\theta \lambda - 1} \right)^{2} }}{{2\left( {\theta \left( {\lambda + 1} \right)^{2} - 4} \right)\left( {\gamma^{2} \left( {\lambda - 1} \right)^{2} - 4\eta \left( {\theta \lambda - 1} \right)^{2} } \right)}}\) and \(\begin{gathered} \pi_{RF^{\prime}}^{*} = \frac{{\theta \left( {\left( {c - 1} \right)\lambda + c + 1} \right)^{2} \left( {\theta \lambda - 1} \right)\left( {\gamma^{2} + \eta \theta \left( {\theta \lambda - 1} \right)} \right)}}{{(4\eta \left( {\theta \lambda - 1} \right)^{2} - \gamma^{2} \left( {\lambda - 1} \right)^{2} )\theta \left( {\theta \left( {\lambda + 1} \right)^{2} - 4} \right)}} - \frac{{\left( {\left( {c - 1} \right)\lambda + c + 1} \right)^{2} \left( {\theta \lambda - 1} \right)^{2} \left( {\gamma^{2} + \eta \theta \left( {\theta \lambda - 1} \right)} \right)^{2} }}{{\left( {\gamma^{2} \left( {\lambda - 1} \right)^{2} - 4\eta \left( {\theta \lambda - 1} \right)^{2} } \right)^{2} \theta \left( {\theta \left( {\lambda + 1} \right)^{2} - 4} \right)}} \hfill \\ - \frac{{\theta \left( {\left( {c - 1} \right)\theta \lambda + c\left( {c + \theta - 2} \right) + 1} \right)}}{{\theta \left( {\theta \left( {\lambda + 1} \right)^{2} - 4} \right)}} \hfill \\ \end{gathered}\). If we make \(\pi_{RL^{\prime}}^{*} - \pi_{RF^{\prime}}^{*} > 0\), we get the following condition:\(\left( {\gamma^{2} - \eta \theta \left( {1 - \lambda \theta } \right)} \right)^{2} \left( {\gamma^{2} \left( {1 - \lambda } \right)^{2} - 4\eta \left( {1 - \lambda \theta } \right)^{2} } \right)^{2} \left( {4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)} \right) < 0\). Obviously, when the preconditions of the equilibrium solution are satisfied (\(4\gamma^{2} + \eta \theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right) < 0\)), the condition is also true. Thus,\(\pi_{RL^{\prime}}^{*} > \pi_{RF^{\prime}}^{*}\). Similarly, we use the same method to obtain the following conditions when \(\pi_{CL^{\prime}}^{*} > \pi_{CF^{\prime}}^{*}\): \(- \frac{{4\gamma^{2} }}{{\theta \left( {\theta \left( {\lambda \left( {\lambda + 6} \right) + 1} \right) - 8} \right)}} < \eta < - \frac{{\gamma^{2} }}{{\theta^{2} \lambda - \theta }}\).

Rights and permissions

About this article

Cite this article

Mu, L., Tang, X., Sugumaran, V. et al. Optimal rebate strategy for an online retailer with a cashback platform: commission-driven or marketing-based?. Electron Commer Res 23, 475–510 (2023). https://doi.org/10.1007/s10660-021-09485-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10660-021-09485-w