Abstract

Imbalanced classification on bankruptcy prediction is considered as one of the most important topics in financial institutions. In this context, various statistical and artificial intelligence methods have been proposed. Recently, deep learning algorithms are experiencing a resurgence of interest, and are widely used to build a prediction and classification models. To this end, we propose a novel deep learning-based approach called BSM-SAES. This approach combines Borderline Synthetic Minority oversampling technique (BSM) and Stacked AutoEncoder (SAE) based on the Softmax classifier. The aim is to develop an accurate and reliable bankruptcy prediction model which includes the features extraction process. To assess the classification performance of our proposed model, k- nearest neighbor, decision tree, support vector machine, and artificial neural network, C5.0 that are machine learning methods, are applied. We evaluate our proposed approach on the Polish imbalanced datasets. The obtained results confirm the efficiency of our proposed model compared to other machine learning models regarding predicting and classifying the financial status of a firm.

Similar content being viewed by others

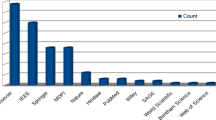

References

P. Addo, D. Guegan, B. Hassani, P. Addo, D. Guegan, B. Hassani, C. Risk (2018) Credit Risk analysis using machine and deep learning models HAL id : Halshs-01719983 Centre d ’ Economie de la Sorbonne documents de travail du

Ahn, A., & Kim, K. J. (2011). Corporate credit rating using multiclass classification models with order information. International Journal of Economics and Management Engineering, 5(12), 1800–1811.

Akkoç, S. (2012). An empirical comparison of conventional techniques, neural networks and the three stage hybrid adaptive Neuro fuzzy inference system (ANFIS) model for credit scoring analysis: The case of Turkish credit card data. European Journal of Operational Research, 222(1), 168–178.

T. Aliaj, A. Anagnostopoulos, S. Piersanti (2018) Firms Default Prediction with Machine Learning.

J. Almotiri, K. Elleithy, A. Elleithy (2017) Comparison of autoencoder and principal component analysis followed by neural network for e-learning using hand-written recognition. In systems, applications and technology conference (LISAT). IEEE long island (pp. 1–5). IEEE.

Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. Journal of Finance, 23, 589–609. https://doi.org/10.2307/2329297.

Ashoori, S., & Mohammadi, S. (2011). Procedia computer compare failure prediction models based on feature selection technique : Empirical case from Iran. Procedia Comput. Sci., 3, 568–573. https://doi.org/10.1016/j.procs.2010.12.094.

Barboza, F., Kimura, H., & Altman, E. (2017). Machine learning models and bankruptcy prediction. Expert Systems with Applications, 83, 405–417. https://doi.org/10.1016/j.eswa.2017.04.006.

W.H. Beaver. Financial Ratio as Predictors of Failure, Empirical Research in Accounting: Selected Studies 1966 (1966) Journal of Accounting Research Supplement to vol. 4 : https://doi.org/10.2307/2490171, 71-111.

A. Bordes, S. Chopra, and J. Weston (2014) Question answering with subgraph embeddings, Conference on Empirical Methods in Natural Language Processing (EMNLP): 615–620.

L. Bottou Large-scale machine learning with stochastic gradient descent, Proc. COMPSTAT 2010 - 19th Int. Conf. Comput. Stat. Keynote, Invit. Contrib. Pap. (2010) 177–186. https://doi.org/10.1007/978-3-7908-2604-3-16.

A. Bouallégue, S. Hassairi, R. Ejbali, M. Zaied (2016) Learning Deep Wavelet Networks for Recognition System of Arabic Words. International Joint Conference SOCO’16-CISIS’16- ICEUTE’16: 498–507.

K. Broelemann, G. Kasneci (2018) A Gradient-Based Split Criterion for Highly Accurate and Transparent Model Trees. http://arxiv.org/abs/1809.09703.

Callejón, A. M., Casado, A. M., Fernández, M. A., & Peláez, J. I. (2013). A system of insolvency prediction for industrial companies using a financial alternative model with neural networks. International Journal Computational Intelligence Systems, 6, 29–37. https://doi.org/10.1080/18756891.2013.754167.

Chaudhuri, A., & Ghosh, S. K. (2018). Bankruptcy Prediction through Soft Computing based Deep Learning Technique. https://doi.org/10.1007/978-981-10-6683-2.

Chawla, K. W. P., Bowyer, N. V., Hall, K. W., & L.O. (2002). SMOTE: Synthetic Minority Over-Sampling Technique. Journal of Artificial Intelligence Research, 16, 321–357.

Chen, M. Y. (2011). Predicting corporate financial distress based on integration of decision tree classification and logistic regression. Expert Systems with Applications, 38(9), 11261–11272. https://doi.org/10.1016/j.eswa.2011.02.173.

R. Collobert, J. Weston, A unified architecture for natural language processing, Proc, International Conference on Machine Learning.-ICML ‘08. (2008) 160–167. doi:https://doi.org/10.1145/1390156.1390177.

Collobert, R., Weston, J., Bottou, L., Karlen, M., Kavukcuoglu, K., & Kuksa, P. (2011). Natural language processing (almost) from scratch. Journal of Machine Learning Research, 12, 2493–2537.

R. L. Constand, R. Yazdipour (2011) Firm failure prediction models: a critique and a review of recent developments, in: Advances in Entrepreneurial Finance. Springer-Verlag New York: 185–204. doi: https://doi.org/10.1007/978-1-4419-7527-0.

T. Cormen, C. Leiserson, R. Rivest, Introduction to algorithms (1990). MIT Press

Cortes, C., & Vapnik, V. (1995). Support-vector networks. Machine Learning, 20, 273–297.

Dahl, G. E., Yu, D., Deng, L., & Acero, A. (2012). Context-dependent pre-trained deep neural networks for large-vocabulary speech recognition. IEEE Trans. Audio, Speech Lang. Process, 20, 30–42. https://doi.org/10.1109/TASL.2011.2134090.

T. Daniel, Discovering knowledge in data: An introduction to data mining, second edition. IEE computer society (2014).

De Andrés, J., Landajo, M., & Lorca, P. (2012). Bankruptcy prediction models based on multinorm analysis: An alternative to accounting ratios. Knowledge-Based Systems, 30, 67–77. https://doi.org/10.1016/j.knosys.2011.11.005.

Dey, D. (2017). Growing Importance of Machine Learning in Compliance and Regulatory Reporting. European Journal of Multidisciplinary studies, 6, 255–258. https://doi.org/10.26417/ejms.v6i2.p255-258.

Dudani, S. A. (1976). The distance-weighted k-nearest-neighbor rule. IEEE Transactions on Systems, Man, and Cybernetics, 6(4), 325–327. https://doi.org/10.1109/TSMC.19765408784.

Ejbali, R., & Zaied, M. (2018). A dyadic multi-resolution deep convolutional neural wavelet network for image classification. Multimedia Tools and Applications, 77(5), 6149–6163. https://doi.org/10.1007/s11042-017-4523-2.

Erdogan, B. E. (2013). Prediction of bankruptcy using support vector machines: An application to bank bankruptcy. Journal of Statistical Computation and Simulation, 83, 1543–1555. https://doi.org/10.1080/00949655.2012.666550.

S. Ertekin (2013) Adaptive Oversampling for Imbalanced Data Classification. Information Sciences and Systems. doi:https://doi.org/10.1007/978-3-319-01604-7.

S. Fan, G. Liu, Z. Chen (2018) Anomaly detection methods for bankruptcy prediction, 2017 4th International Conference on Systems and Informatics, ICSAI 2017. 1456–1460. doi:https://doi.org/10.1109/ICSAI.2017.8248515.

V. Garcı, J.S. Sa, A.I. Marque (2013) On the suitability of resampling techniques for the class imbalance problem in credit scoring, 1060–1070. doi:https://doi.org/10.1057/jors.2012.120.

A. Gepp, K. Kumar (2015) Predicting Financial Distress: A Comparison of Survival Analysis and Decision Tree Techniques, Eleventh International Multi-Conference on Information Processing-2015 (IMCIP-2015) 396–404. doi:https://doi.org/10.1016/j.procs.2015.06.046.

A. Gepp, K. Kumar, S. Bhattacharya (2010) Business failure prediction using decision trees, journal of forecasting, 536–555 doi: https://doi.org/10.1002/for.1153.

Ghaddar, B., & Naoum-sawaya, J. (2017). PT us CR. Eur. J. Oper. Res. https://doi.org/10.1016/j.ejor.2017.08.040.

Han, H., Wang, W. Y., & Mao, B. H. (2005). Borderline-SMOTE: A new over-sampling method in imbalanced data sets learning. ICIC, 878–887.

Hinton, G., Deng, L., Yu, D., Dahl, G., Mohamed, A., Jaitly, N., Vanhoucke, V., Nguyen, P., Sainath, T., & Kingsbury, B. (2012). Deep neural networks for acoustic modeling in speech recognition. IEEE Signal Processing Magazine, 29, 82–97. https://doi.org/10.1109/MSP.2012.2205597.

Jack, L. B., & Nandi, A. K. (2002). Fault detection using support vector machines and artificial neural networks. Augmented by Genetic Algorithms, 16, 373–390. https://doi.org/10.1006/mssp.2001.1454.

Jang, M., Seo, S., & Kang, P. (2018) Recurrent neural network-based semantic variational autoencoder for sequence-to-sequence learning. http://arxiv.org/abs/1802.03238.

Jardin, P. D. (2010). Predicting bankruptcy using neural networks and other classification methods: The influence of variable selection techniques on model accuracy. Neurocomputing, 73, 2047–2060. https://doi.org/10.1016/j.neucom.2009.11.034.

Jaynes, E. T. (1957). Information theory and statistical mechanics. The Physical Review, 106/4, 620–630.

S. Jean, K. Cho, R. Memisevic, Y. Bengio (2014) On using very large target vocabulary for neural machine translation, 000. http://arxiv.org/abs/1412.2007.

Johnson, J. M., & Khoshgoftaar, T. M. (2019). Survey on deep learning with class imbalance. J. Big Data, 6. https://doi.org/10.1186/s40537-019-0192-5.

Karels, G. V., & Prakash, A. J. (1987). Multivariate normality and forecasting of business bankruptcy. J. Bus. Financ. Account, 14, 573–593. https://doi.org/10.1111/j.1468-5957.1987.tb00113.x.

Kasgari, A. A., Divsalar, M., Javid, M. R., & Ebrahimian, S. J. (2012). Prediction of bankruptcy Iranian corporations through artificial neural network and Probit-based analyses. Neural Computing and Applications, 23(3–4), 927–936. https://doi.org/10.1007/s00521-012-1017-z.

Kasun, L. L. C., Zhou, H., Huang, G. B., & Vong, C. M. (2013). Representational learning with extreme learning machine for big data. IEEE Intelligent Systems, 28(6), 31–34.

A. Krizhevsky, I. Sutskever, G.E. Hinton (2012) ImageNet Classification with Deep Convolutional Neural Networks, Advances in Neural Information Processing Systems 1–9. https://doi.org/10.1016/j.protcy.2014.09.007.

Z. Lanbouri, S. Achchab (2015) A hybrid Deep belief network approach for Financial distress prediction, 2015 10th International Conference on Intelligent Systems Theories Application1–6. doi:https://doi.org/10.1109/SITA.2015.7358416.

F. Last, G. Douzas, F. Bacao (2018) Oversampling for imbalanced learning based on K-means and SMOTE information sciences 465.

T. Le, M.Y. Lee, J.R. Park, S.W. Baik (2018) Oversampling techniques for bankruptcy prediction: Novel features from a transaction dataset, Symmetry (Basel). 10. doi:https://doi.org/10.3390/sym10040079.

Lee, L. H., Wan, C. H., Rajkumar, R., & Isa, D. (2012). An enhanced support vector machine classification framework by using Euclidean distance function for text document categorization. Applied Intelligence, 37(1), 80–99. https://doi.org/10.1007/s10489-011-0314-z.

Lee, J., Jang, D., & Park, S. (2017). Deep learning-based corporate performance prediction model considering technical capability. Sustain., 9, 1–12. https://doi.org/10.3390/su9060899.

V. López, A. Fernández, S. García, V. Palade, F. Herrera (2013) An insight into classification with imbalanced data : Empirical results and current trends on using data intrinsic characteristics. doi:https://doi.org/10.1016/j.ins.2013.07.007

Lu, H., & Li, Y. (2017). Brain Intelligence : Go beyond Artificial Intelligence. https://doi.org/10.1007/s11036-017-0932-8.

H. Lu, Y. Li, S. Mu, D. Wang, H. Kim, S. Serikawa (2017) Motor anomaly detection for unmanned aerial vehicles using reinforcement learning, 4662. doi:https://doi.org/10.1109/JIOT.2017.2737479.

Mai, F., Tian, S., Lee, C., & Ma, L. (2019). Deep learning models for bankruptcy prediction using textual disclosures. European Journal of Operational Research, 274, 743–758. https://doi.org/10.1016/j.ejor.2018.10.024.

Mbarki, N. E. H., Ejbali, R., & Zaied, M. (2017). Recognition of human activities in smart homes using stacked autoencoders. Tenth Int. Conf. Adv. Comput. Interact. ACHI, 2017, 176–180.

McKee, T. E., & Lensberg, T. (2002). Genetic programming and rough sets: A hybrid approach to bankruptcy classification. European Journal of Operational Research, 138, 436–451. https://doi.org/10.1016/S0377-2217(01)00130-8.

Min, J. H., & Jeong, C. (2009). A binary classification method for bankruptcy prediction. Expert Systems with Applications, 36, 5256–5263. https://doi.org/10.1016/j.eswa.2008.06.073.

M.R. Minar, J. Naher (2018) Recent Advances in Deep Learning: An Overview, 2006 1–31. doi:https://doi.org/10.13140/RG.2.2.24831.10403.

K. Murphy, Machine learning: A probabilistic perspective (2012). MIT Press.

Najafabadi, M. M., Villanustre, F., Khoshgoftaar, T. M., Seliya, N., Wald, R., & Muharemagic, E. (2015). Deep learning applications and challenges in big data analytics. Journal of Big Data., 2, 1–21. https://doi.org/10.1186/s40537-014-0007-7.

Nekooeimehr, I., & Lai-Yuen, S. K. (2016). Adaptive semi-unsupervised weighted oversampling (A- SUWO) for imbalanced datasets. Expert Systems with Applications, 46, 405–416. https://doi.org/10.1016/j.eswa.2015.10.031.

Nguyen, H. G. (2005). Using Neutral Network in Predicting Corporate Failure. Journal of Social Sciences (15493652), 1(4), 199–202.

R. Nilsson, M. Pe, J. Bjorkegren, J. Tegnér (2006) Evaluating feature selection for SVMs in high dimensions. European Conference on Machine Learning.

S. H. Syed Nor, S. Ismail, B.W. Yap, Personal bankruptcy prediction using decision tree model, (2020). doi:https://doi.org/10.1108/JEFAS-08-2018-0076.

Ocal, N., Ercan, M. K., & Kadıoğlu, E. (2015). Predicting financial failure using decision tree algorithms: An empirical test on the manufacturing industry at Borsa Istanbul. International Journal of Economics and Finance, 7(7). https://doi.org/10.5539/ijef.v7n7p189.

Ohlson, J. A. (1980). Financial ratios and the probabilistic prediction of bankruptcy. Journal of Accounting Research, 18, 109. https://doi.org/10.2307/2490395.

B. B. Ribeiro, and N. Lopes (2011) Deep belief networks for financial prediction, International Conference on Neural Information Processing; Springer: Berlin/Heidelberg, Germany : 766–773.

Ripley, B. D. (2008). Pattern recognition and neural networks. Technometrics, 39(2), 403.

Rumelhart, D. E., Hinton, G. E., & Williams, R. J. (1986). Learning internal representations by error propagation (no. ICS-8506). California Univ San Diego La Jolla Inst For Cognitive Science, 1, 318–362.

S. Said, O. Jemai, S. Hassairi, R. Ejbali, M. Zaied, C. Ben Amar (2016) Deep wavelet network for image classification, IEEE International Conference on Systems, Man, and Cybernetics, SMC - Conference Proceedings: 922–927.

Sanchis, A., Segovia, M. J., Gil, J. A., Heras, A., & Vilar, J. L. (2007). Rough sets and the role of the monetary policy in financial stability (macroeconomic problem) and the prediction of insolvency in insurance sector (microeconomic problem). European Journal of Operational Research, 181, 1554–1573. https://doi.org/10.1016/j.ejor.2006.01.045.

Santoso, N., & Wibowo, W. (2018). Financial Distress Prediction using Linear Discriminant Analysis and Support Vector Machine. International Conference on Science (ICOS). https://doi.org/10.1088/1742-6596/979/1/012089.

Serikawa, S., & Lu, H. (2014). Underwater image dehazing using joint trilateral filter q. Computers and Electrical Engineering, 40, 41–50. https://doi.org/10.1016/j.compeleceng.2013.10.016.

Sharma, H., & Kumar, S. (2016). A Survey on Decision Tree Algorithms of Classification in Data Mining. Int. J. Sci. Res., 5, 2094–2097. https://doi.org/10.21275/v5i4.nov162954.

Shin, K. S., & Lee, Y.-J. (2002). A genetic algorithm application in bankruptcy prediction modeling. Expert Systems with Applications, 23, 321–328. https://doi.org/10.1016/S0957-4174(02)00051-9.

A. Shrivastava, K. Kumar (2018) Business Distress Prediction Using Bayesian Logistic Model for Indian Firms. doi:https://doi.org/10.3390/risks6040113.

Skryjomski, P., & Krawczyk, B. (2017). Influence of minority class instance types on SMOTE imbalanced data oversampling. Proc. Mach. Learn. Res., 74, 7–21 http://proceedings.mlr.press/v74/skryjomski17a/skryjomski17a.pdf.

S. Smiti, M. Soui, I. Gasmi (2018) A comparative study of rule based classification algorithms for credit Risk assessment. The 31st IBIMA, International Business Information Management Conference.

S. Smiti, M. Soui, R. Ejbali, G Khaled (2019) Comparing Approaches for Combining Data sampling and Stacked Autoencoder to address Bankruptcy Prediction. the 34th IBIMA, International Business Information Management Conference.

Sønderby, C. K., Raiko, T., Maaløe, L., Sønderby, S. K., & Winther, O. (2016). Ladder variational autoencoders. Advances in Neural Information Processing Systems, 3738–3746.

V.S. Spelmen, R. Porkodi (2018) A review on handling imbalanced data, 2018 Int Conf. Curr. Trends Towar. Converging Technol. 1–11.

M. A. Sprengers (2005) Bankruptcy prediction using classification and regression trees.

S. Srinivas, R. K. Sarvadevabhatla, K. R. Mopuri, N. Prabhu, S. S. S Kruthiventi, R.V. Babu, (2016) A Taxonomy of Deep Convolutional Neural Nets for Computer Vision, Frontiers in Robotics and AI. doi: https://doi.org/10.3389/frobt.2015.00036.

I. Sutskever, O. Vinyals, Q. V Le (2014a) Sequence to sequence learning with neural networks, Advances in Neural Information Processing Systems. 3104–3112. doi:https://doi.org/10.1007/s10107-014-0839-0.

I. Sutskever, O. Vinyals, Q. V Le (2014b), Sequence to sequence learning with neural networks, Adv. Neural Information Processing Systems 3104–3112. doi:https://doi.org/10.1007/s10107-014-0839-0.

Toribio, P., Alejo, R., Valdovinos, R. M., & Pacheco Sanchez, J. H. (2012). Using Gabriel graphs in borderline-SMOTE to deal with severe two-class imbalance problems on neural networks. Artificial Intelligence Research and Development. https://doi.org/10.3233/978-1-61499-139-7-29.

T. Van Gestel, B. Baesens, J. Suykens, M. Espinoza, D.-E. Baestaens, J. Vanthienen, De Moor B., Bankruptcy prediction with least squares support vector machine classifiers, 2003 IEEE international conference computer intelligence financial engineering 2003. Proceedings (n.d.) 1–8. doi:https://doi.org/10.1109/CIFER.2003.1196234.

Veganzones, D., & Séverin, E. (2018). An investigation of bankruptcy prediction in imbalanced datasets. Decision Support Systems, 112, 111–124. https://doi.org/10.1016/j.dss.2018.06.011.].

M. Verleysen, D. François, G. Simon, V. Wertz, On the effects of dimensionality on data analysis with, (2003) 105–112.

Wang, N. (2017). Bankruptcy prediction using machine learning. J. Math. Financ., 07, 908–918. https://doi.org/10.4236/jmf.2017.74049.

Wang, G., Ma, J., & Yang, S. (2014). An improved boosting based on feature selection for corporate bankruptcy prediction. Expert Systems with Applications, 41, 2353–2361. https://doi.org/10.1016/j.eswa.2013.09.033.

Wang, K. J., Adrian, A. M., Chen, K. H., & Wang, K. M. (2015). A hybrid classifier combining borderline- SMOTE with AIRS algorithm for estimating brain metastasis from lung cancer: A case study in Taiwan. Computer Methods and Programs in Biomedicine, 119, 63–76. https://doi.org/10.1016/j.cmpb.2015.03.003.

H. Wang, B. Raj, E. P Xing. On the Origin of Deep Learning (2017), abs/1702.07800, Access Date: 29.08.2018 Web.

Xie, C., Luo, C., & Yu, X. (2011). Financial distress prediction based on SVM and MDA methods: The case of Chinese listed companies. Quality and Quantity, 45, 671–686. https://doi.org/10.1007/s11135-010-9376-y.

Yeh, C. C., Chi, D. J., & Lin, Y. R. (2014a). Going-concern prediction using hybrid random forests and rough set approach. Information Sciences, 254, 98–110. https://doi.org/10.1016/j.ins.2013.07.011.

S. Yeh, C. Wang, M.-F. Tsai (2014b) Corporate default prediction via deep learning, Intermational Inst. Forecast. http://forecasters.org/wp/wp-content/uploads/gravity_forms/7-2a51b93047891f1ec3608bdbd77ca58d/2014/07/Yeh_Shu-Hao_ISF2014.pdf.

Yu, L., Yang, Z., & Tang, L. (2015). A novel multistage deep belief network based extreme learning machine ensemble learning paradigm for credit risk assessment. Flexible Services and Manufacturing, 28, 576–592. https://doi.org/10.1007/s10696-015-9226-2.

R. Yusof, K.A. Kasmiran, A. Mustapha, U. Tun, H. Onn (2017) Techniques for handling imbalanced datasets when producing classifier models. Journal of Theoretical and Applied Information Technology.

Zhang, Q., Wang, J., Lu, A., Wang, S., & Ma, J. (2018). An improved SMO algorithm for financial credit Risk assessment–evidence from China’s banking. Neurocomputing, 272, 314–325. https://doi.org/10.1016/j.neucom.2017.07.002.

L. Zhang, B. Tan, T. Liu, X. Sun (2019) Classification study for the imbalanced data based on Biased-SVM and the modified over-sampling algorithm Classification study for the imbalanced data based on Biased-SVM and the modified over-sampling algorithm, . doi:https://doi.org/10.1088/1742-6596/1237/2/022052.

Zhou, L. (2013). Performance of corporate bankruptcy prediction models on imbalanced dataset: The effect of sampling methods. Knowledge-Based Syst., 41, 16–25. https://doi.org/10.1016/j.knosys.2012.12.007.

Zhou, L., Lai, K. K., & Yen, J. (2012). Empirical models based on features ranking techniques for corporate financial distress prediction. Comput. Math. with Appl., 64, 2484–2496. https://doi.org/10.1016/j.camwa.2012.06.003.

Zieba, M., Tomczak, S. K., & Tomczak, J. K. (2016). Ensemble boosted trees with synthetic features generation in application to bankruptcy prediction. Expert Systems with Applications, 58, 93–101. https://doi.org/10.1016/j.eswa.2016.04.001.

Zmijewski, M. E. (1984). Methodological issues related to the estimation of financial distress prediction models. Journal of Accounting Research, 22, 59–82 http://www.jstor.org/stable/2490859.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Smiti, S., Soui, M. Bankruptcy Prediction Using Deep Learning Approach Based on Borderline SMOTE. Inf Syst Front 22, 1067–1083 (2020). https://doi.org/10.1007/s10796-020-10031-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10796-020-10031-6