Abstract

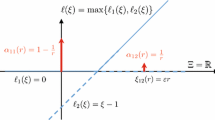

We propose a new credibility portfolio selection model, in which a measure of loss aversion is introduced as an objective function, joint to the expected value of the returns and the below-mean absolute semi-deviation as a risk measure. The uncertainty of the future returns is directly approximated using the historical returns on the portfolios, so the uncertain return on a given portfolio is modeled as an LR-power fuzzy variable. Quantifying the uncertainty by means of a credibility distribution allows us to measure the investors’ loss aversion as the credibility of achieving a non-positive return, which is better perceived by investors than other measures of risk. Furthermore, we analyze the relationships between the three objective functions, showing that the risk measure and the loss aversion function are practically uncorrelated. Thus, the information provided by these criteria do not overlap each other. In order to generate several non-dominated portfolios taking into account the investor’s preferences and that the problem is non-linear and non-convex, we apply up to three preference-based EMO algorithms. These algorithms allow to approximate a part of the Pareto optimal front called region of interest. We analyze three investor profiles taking into account their loss-adverse attitudes: conservative, cautious and aggressive. A computational study is performed with data of the Spanish stock market, showing the important role played by the loss aversion function to generate a diversified set of non-dominated portfolios fitting the expectations of each investor.

Similar content being viewed by others

Notes

Although IBEX35 has 35 assets, there were two assets which were not included in the index through all the time window considered.

jMetal is an open source object-oriented Java-based framework for multi-objective optimization using meta-heuristic algorithms. It can be downloaded at http://jmetal.sourceforge.net/.

In our computational tests, \({\mathbf {r}}\) has been set as follows. If the reference point used \({\mathbf {q}}\) is achievable, then \({\mathbf {r}} = {\mathbf {q}}\). Providing that \({\mathbf {q}}\) is unachievable, \({\mathbf {r}}\) is obtained using the worst objective function values achieved by all the solutions found in the region of interest by the algorithms in all runs.

References

Anagnostopoulos, K.P., Mamanis, G.: A portfolio optimization model with three objectives and discrete variables. Comput. Oper. Res. 37(7), 1285–1297 (2010)

Bermudez, J.D., Segura, J.V., Vercher, E.: A multi-objective genetic algorithm for cardinality constrained fuzzy portfolio selection. Fuzzy Sets Syst. 188, 16–26 (2012)

Branke, J.: Consideration of partial user preferences in evolutionary multiobjective optimization. In: Branke, J., Deb, K., Miettinen, K., Slowinski, R. (eds.) Multiobjective Optimization, Interactive and Evolutionary Approaches. Lecture Notes in Computer Science, vol. 5252, pp. 157–178. Springer, Berlin (2008)

Branke, J., Deb, K., Miettinen, K., Slowinski, R.: Multiobjective Optimization. Interactive and Evolutionary Approaches. Lecture Notes in Computer Science, vol. 5252. Springer, Berlin (2008)

Chang, T.J., Yang, S.C., Chang, K.J.: Portfolio optimization problems in different risk measures using genetic algorithm. Expert Syst. Appl. 36(7), 10529–10537 (2009)

Coello, C.A.C., Lamont, G.B., Veldhuizen, D.A.V.: Evolutionary Algorithms for Solving Multi-Objective Problems, 2nd edn. Springer, New York (2007)

Deb, K.: Multi-objective Optimization using Evolutionary Algorithms. Wiley, Chichester (2001)

Deb, K., Miettinen, K.: Nadir point estimation using evolutionary approaches: better accuracy and computational speed through focused search. In: Ehrgott, M., Naujoks, B., Stewart, T.J., Wallenius, J. (eds.) Multiple Criteria Decision Making for Sustainable Energy and Transportation Systems, pp. 339–354. Springer, Berlin (2010)

Deb, K., Miettinen, K., Chaudhuri, S.: Towards an estimation of nadir objective vector using a hybrid of evolutionary and local search approaches. IEEE Trans. Evol. Comput. 14(6), 821–841 (2010)

Deb, K., Pratap, A., Agarwal, S., Meyarivan, T.: A fast and elitist multiobjective genetic algorithm: NSGA-II. IEEE Trans. Evol. Comput. 6(2), 182–197 (2002)

Dubois, D., Prade, H.: Fundamentals of Fuzzy Sets. The Handbooks of Fuzzy Sets, vol. 7. Springer, New York (2000)

Durillo, J.J., Nebro, A.J.: jMetal: a Java framework for multi-objective optimization. Adv. Eng. Softw. 42, 760–771 (2011)

Ehrgott, M., Klamroth, K., Schwehm, C.: An MCDM approach to portfolio optimization. Eur. J. Oper. Res. 155(3), 752–770 (2004)

Fonseca, C.M., Fleming, P.J.: Genetic algorithms for multiobjective optimization: formulation, discussion and generalization. In: International Conference on Genetic Algorithms, pp. 416–423. Morgan Kaufmann Publishers Inc. (1993)

Huang, X.: Mean-semivariance models for fuzzy portfolio selection. J. Comput. Appl. Math. 217(1), 1–8 (2008)

Jalota, H., Thakur, M., Mittal, G.: Modelling and constructing membership function for uncertain portfolio parameters: a credibilistic framework. Expert Syst. Appl. 71, 40–56 (2017)

Jaszkiewicz, A., Branke, J.: Interactive multiobjective evolutionary algorithms. In: Branke, J., Deb, K., Miettinen, K., Slowinski, R. (eds.) Multiobjective Optimization, Interactive and Evolutionary Approaches. Lecture Notes in Computer Science, vol. 5252, pp. 179–193. Springer, Berlin (2008)

Li, X., Qin, Z., Kar, S.: Mean-variance-skewness model for portfolio selection with fuzzy returns. Eur. J. Oper. Res. 202(1), 239–247 (2010)

Liu, B.: A survey of credibility theory. Fuzzy Optim. Decis. Making 5, 387–408 (2006)

Liu, B., Liu, Y.K.: Expected value of fuzzy variable and fuzzy expected value models. IEEE Trans. Fuzzy Syst. 10(4), 445–450 (2002)

Markowitz, H.M.: Portfolio selection. J. Finance 7(1), 77–91 (1952)

Metaxiotis, K., Liagkouras, K.: Multiobjective evolutionary algorithms for portfolio management: a comprehensive literature review. Expert Syst. Appl. 39(14), 11685–11698 (2012)

Miettinen, K.: Nonlinear Multiobjective Optimization. Kluwer Academic Publishers, Boston (1999)

Molina, J., Santana, L.V., Hernandez-Diaz, A.G., Coello, C.A.C., Caballero, R.: g-dominance: reference point based dominance for multiobjective metaheuristics. Eur. J. Oper. Res. 197(2), 685–692 (2009)

Moral-Escudero, R., Ruiz-Torrubiano, R., Suarez, A.: Selection of optimal investment portfolios with cardinality constraints. In: IEEE Congress on Evolutionary Computation, pp. 2382–2388 (2006)

Ormos, M., Timotity, D.: Generalized asset pricing: expected downside risk-based equilibrium modeling. Econ. Model. 52, 967–980 (2016)

Rockafellar, R.T., Uryasev, S.: Conditional value-at-risk for general loss distributions. J. Bank. Finance 26(7), 1443–1471 (2002)

Rodriguez, R., Luque, M., Gonzalez, M.: Portfolio selection in the Spanish stock market by interactive multiobjective programming. TOP 19(1), 213–231 (2011)

Ruiz, A.B., Saborido, R., Bermudez, J.D., Luque, M., Vercher, E.: Preference-based evolutionary multi-objective optimization for solving fuzzy portfolio selection problems. Revista Electronica de Comunicaciones y Trabajos de ASEPUMA. Rect@ 18, 1–15 (2017)

Ruiz, A.B., Saborido, R., Luque, M.: A preference-based evolutionary algorithm for multiobjective optimization: the weighting achievement scalarizing function genetic algorithm. J. Global Optim. 62(1), 101–129 (2015)

Saborido, R., Ruiz, A.B., Bermudez, J.D., Vercher, E., Luque, M.: Evolutionary multi-objective optimization algorithms for fuzzy portfolio selection. Appl. Soft Comput. 39, 48–63 (2016)

Steuer, R.E., Qi, Y., Hirschberger, M.: Suitable-portfolio investors, nondominated frontier sensitivity, and the effect of multiple objectives on standard portfolio selection. Ann. Oper. Res. 152, 297–317 (2007)

Vercher, E., Bermudez, J.D.: Fuzzy portfolio selection models: a numerical study. In: Doumpos, M., Zopounidis, C., Pardalos, P.M. (eds.) Financial Decision Making Using Computational Intelligence. Springer Optimization and Its Applications, vol. 70, pp. 253–280. Springer, Boston (2012)

Vercher, E., Bermudez, J.D.: A possibilistic mean-downside risk-skewness model for efficient portfolio selection. IEEE Trans. Fuzzy Syst. 21(3), 585–595 (2013)

Vercher, E., Bermudez, J.D.: Portfolio optimization using a credibility mean-absolute semi-deviation model. Expert Syst. Appl. 42, 7121–7131 (2015)

Vercher, E., Bermudez, J.D.: Measuring uncertainty in the portfolio selection problem. Studies in systems, decision and control. In: Gil, E., Gil, E., Gil, J., Gil, M.A. (eds.) The Mathematics of the Uncertainty, vol. 142, pp. 765–775. Springer, Cham (2018)

Vercher, E., Bermudez, J.D., Segura, J.V.: Fuzzy portfolio optimization under downside risk measures. Fuzzy Sets Syst. 158, 769–782 (2007)

Wang, S., Xia, Y.: Portfolio Selection and Asset Pricing. Lecture Notes in Economics and Mathematical Systems, vol. 514. Springer, Berlin (2002)

Zadeh, L.A.: Fuzzy sets as a basis for a theory of possibility. Fuzzy Sets Syst. 1, 3–28 (1978)

Zitzler, E., Thiele, L.: Multiobjective evolutionary algorithms: a comparative case study and the Strength Pareto Approach. IEEE Trans. Evol. Comput. 3(4), 257–271 (1999)

Zopounidis, C., Doumpos, M.: Multicriteria decision systems for financial problems. TOP 21(2), 241–261 (2013)

Acknowledgements

Ana B. Ruiz is recipient of a Post-Doctoral fellowship of “Captación de Talento para la Investigación” at Universidad de Málaga (Spain). Rubén Saborido is a Post-Doctoral fellow at Concordia University (Canada).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This work has been supported by the Spanish Ministry of Economy and Competitiveness (Projects ECO2017-88883-R and MTM2017-83850-P), co-financed by FEDER funds.

Rights and permissions

About this article

Cite this article

Ruiz, A.B., Saborido, R., Bermúdez, J.D. et al. Preference-based evolutionary multi-objective optimization for portfolio selection: a new credibilistic model under investor preferences. J Glob Optim 76, 295–315 (2020). https://doi.org/10.1007/s10898-019-00782-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10898-019-00782-1