Abstract

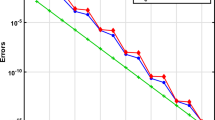

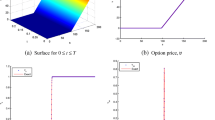

We develop a Legendre quadrilateral spectral element approximation for the Black-Scholes equation to price European options with one underlying asset and stochastic volatility. A weak formulation of the equations imposes the boundary conditions naturally along the boundaries where the equation becomes singular, and in particular, we use an energy method to derive boundary conditions at outer boundaries for which the problem is well-posed on a finite domain. Using Heston’s analytical solution as a benchmark, we show that the spectral element approximation along with the proposed boundary conditions gives exponential convergence in the solution and the Greeks to the level of time and boundary errors in a domain of financial interest.

Similar content being viewed by others

References

Achdou, Y., Pironneau, O.: Computational Methods for Option Pricing. SIAM, Philadelphia (2005)

Andersen, L.B.G., Piterbarg, V.V.: Moment explosions in stochastic volatility models. Finance Stoch. 11(1), 29–50 (2007)

Canuto, C., Hussaini, M.Y., Quarteroni, A., Zang, T.A.: Spectral Methods: Evolution to Complex Geometries and Applications to Fluid Dynamics. Springer, Berlin (2007)

Chan, K.C., Karolyi, G.A., Longstaff, F.A., Sanders, A.B.: An empirical comparison of alternative models of the short-term interest rate. J. Finance 47(3), 1209–1227 (1992)

Clarke, N., Parrott, K.: Multigrid for American option pricing with stochastic volatility. Appl. Math. Financ. 6(3), 177–195 (1999)

Cox, J., Ingersoll Jr., J., Ross, S.: A theory of the term structure of interest rates. Econometrica 53(2), 385–407 (1985)

Gordon, W.J., Hall, C.A.: Construction of curvilinear co-ordinate systems and their applications to mesh generation. Int. J. Numer. Methods Eng. 7, 461–477 (1973)

Heston, S.L.: A closed-form solution for option with stochastic volatility with applications to bond and currency options. Rev. Financ. Stud. 6(2), 327–343 (1993)

Hilber, N., Matache, A., Schwab, C.: Sparse wavelet methods for option pricing under stochastic volatility. J. Comput. Financ. 8(4), 1–42 (2005)

Hull, J., White, A.: The pricing of options on assets with stochastic volatilities. J. Finance 42(2), 281–300 (1987)

Hull, J.C.: Options, Futures, and Other Derivatives, 4th edn. Oxford University Press, London (2000)

Ikonen, S., Toivanen, J.: Efficient numerical methods for pricing American options under stochastic volatility. Numer. Methods Partial Differ. Equ. 24(1), 104–126 (2008)

Jackwerth, J.C., Rubinstein, M.: Recovering probability distributions from option prices. J. Finance 51, 1611–1631 (1996)

Johnson, H., Shanno, D.: Option pricing when the variance is changing. J. Financ. Quant. Anal. 22(2), 143–151 (1987)

macBeth, J.D., Merville, L.J.: An empirical examination of the Black-Scholes call option pricing model. J. Finance 34, 1173–1186 (1979)

Patera, A.T.: A spectral element method for fluid dynamics—Laminar flow in a channel expansion. J. Comput. Phys. 54(3), 468–488 (1984)

Ronquist, E.M., Patera, A.T.: A Lagrange spectral element method for the Stefan problem. Int. J. Numer. Methods Eng. 24(12), 2273–2299 (1987)

Saad, Y.: Iterative Methods for Sparse Linear Systems, 2nd edn. SIAM, Philadelphia (2003)

Scott, L.O.: Option pricing when the variance changes randomly: Theory, estimation, and an application. J. Financ. Quant. Anal. 22(4), 419–438 (1987)

Stein, E.M., Stein, J.C.: Stock price distributions with stochastic volatility: An analytic approach. Rev. Financ. Stud. 4(4), 727–752 (1991)

Vasicek, O.: An equilibrium characterisation of the term structure. J. Financ. Econ. 5, 177–188 (1977)

Van Der Vorst, H.A.: Bi-CGSTAB: A fast and smoothly converging variant of Bi-CG for the solution of nonsymmetric linear systems. SIAM J. Sci. Statist. Comput. 13(2), 631–644 (1992)

Wiggens, J.B.: Option values under stochastic volatility: Theory and empirical estimates. J. Financ. Econ. 19, 351–372 (1987)

Zhu, W., Kopriva, D.A.: A spectral element method to price European options. I. Single asset with and without jump diffusion. J. Sci. Comput. 39(2), 222–243 (2009)

Zhu, W., Kopriva, D.A.: A spectral element approximation to price European options. II. The Black-Scholes model with two underlying assets. J. Sci. Comput. 39(3), 323–339 (2009)

Zvan, R., Forsyth, P., Vetzal, K.: A penalty method for American options with stochastic volatility. J. Comput. Appl. Math. 91, 199–218 (1998)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Zhu, W., Kopriva, D.A. A Spectral Element Approximation to Price European Options with One Asset and Stochastic Volatility. J Sci Comput 42, 426–446 (2010). https://doi.org/10.1007/s10915-009-9333-x

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10915-009-9333-x