Abstract

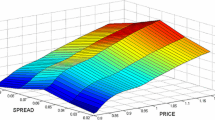

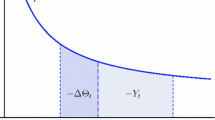

This paper is concerned with liquidation of an illiquid stock. The stock price follows a fluid model which is dictated by the rates of selling and buying over time. The objective is to maximize the expected overall return. The method of constrained viscosity solution is used to characterize the dynamics governing the optimal reward function and the associated boundary conditions. Numerical examples are given to illustrate the results.

Similar content being viewed by others

References

Bertsimas, D., Lo, A.W.: Optimal control of execution. J. Financ. Mark. 1, 1–50 (1998)

Almgren, R., Chriss, N.: Optimal execution of portfolio transactions. J. Risk 3, 5–39 (2000)

Almgren, R.F.: Optimal execution with nonlinear impact functions and trading-enhanced risk. Appl. Math. Finance 10, 1–18 (2003)

Longstaff, F.A.: Optimal portfolio choices and the valuation of illiquid securities. Rev. Financ. Stud. 14, 407–431 (2001)

Subramanian, R.A., Jarrow, R.A.: The liquidity discount. Math. Finance 11, 447–474 (2001)

Schied, A., Schöneborn, T.: Risk aversion and the dynamics of optimal liquidation strategies in illiquid markets. Finance Stoch. 13, 181–204 (2009)

Schied, A., Schöneborn, T.: Optimal basket liquidation with finite time horizon for CARA investors. Working paper

Pemy, M., Zhang, Q., Yin, G.: Liquidation of a large block of stock. J. Bank. Finance 31, 295–1305 (2006)

Øksendal, B.: Stochastic Differential Equations. Springer, New York (1998)

Guo, X., Zhang, Q.: Optimal selling rules in a regime switching model. IEEE Trans. Autom. Control 50, 1450–1455 (2005)

Zhang, Q.: Stock trading: An optimal selling rules. SIAM J. Control Optim. 40, 4–87 (2001)

Zhang, Q., Yin, G., Liu, R.H.: A near-optimal selling rule for a two-time-scale market model. Multiscale Model. Simul. 4, 172–193 (2005)

Yin, G., Liu, R.H., Zhang, Q.: Recursive algorithms for stock liquidation: a stochastic optimization approach. SIAM J. Optim. 13, 240–263 (2002)

Helmes, K.: Computing optimal selling rules for stocks using linear programming. In: Yin, G., Zhang, Q. (eds.) Mathematics of Finance, pp. 87–198. AMS, Providence (2004)

Pemy, M., Zhang, Q.: Optimal stock liquidation in a regime switching model with finite time horizon. J. Math. Anal. Appl. 321, 537–552 (2006)

Soner, H.M.: Optimal control with state space constraints II. SIAM J. Control Optim. 24, 1110–1122 (1986)

Fleming, W.H., Rishel, R.: Deterministic and Stochastic Optimal Control. Springer, New York (1975)

Katsoulakis, M.A.: Viscosity solutions of second order fully nonlinear elliptic equations with state constraints. Indiana Univ. Math. J. 43, 493–519 (1994)

Dai, M., Kwok, Y.K., You, H.: Intensity-based framework and penalty formulation of optimal stopping problems. J. Econ. Dyn. Control, 31, 3860–3880 (2007)

Dai, M., Kwok, Y.K., Zong, J.: Guaranteed minimum withdrawal benefit in variable annuities. Math. Finance 18, 595–611 (2008)

Forsyth, P.A., Vetzal, K.R.: Quadratic convergence of a penalty method for valuing American options. J. Sci. Comput., 23, 2095–2122 (2002)

Fleming, W.H., Zhang, Q.: Risk-sensitive production planning in a stochastic manufacturing system. SIAM J. Control Optim. 36, 1147–1170 (1998)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Bian, B., Dai, M., Jiang, L. et al. Optimal Decision for Selling an Illiquid Stock. J Optim Theory Appl 151, 402–417 (2011). https://doi.org/10.1007/s10957-011-9897-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10957-011-9897-0