Abstract

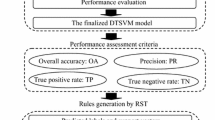

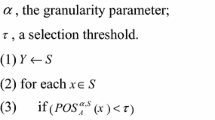

In this study, a novel hybrid intelligent mining system integrating rough sets theory and support vector machines is developed to extract efficiently association rules from original information table for credit risk evaluation and analysis. In the proposed hybrid intelligent system, support vector machines are used as a tool to extract typical features and filter its noise, which are different from the previous studies where rough sets were only used as a preprocessor for support vector machines. Such an approach could reduce the information table and generate the final knowledge from the reduced information table by rough sets. Therefore, the proposed hybrid intelligent system overcomes the dificulty of extracting rules from a trained support vector machine classifier and possesses the robustness which is lacking for rough-set-based approaches. In addition, the effectiveness of the proposed hybrid intelligent system is illustrated with two real-world credit datasets.

Similar content being viewed by others

References

E. I. Altman, Financial ratios, discriminant analysis and the prediction of corporate bankruptcy, Journal of Finance, 1968, 23(3): 589–609.

J. C. Wiginton, A note on the comparison of logit and discriminant models of consumer credit behaviour, Journal of Financial Quantitative Analysis, 1980, 15(3): 757–770.

C. V. Zavgren, Assessing the vulnerability to failure of American industrial firms: A logistic analysis, Journal of Business Finance and Accounting, 1985, 12(1): 19–45.

B. J. Grablowsky and W. K. Talley, Probit and discriminant functions for classifying credit applicants: A comparison, Journal of Economic and Business, 1981, 33(3): 254–261.

F. Glover, Improved linear programming models for discriminant analysis, Decision Science, 1990, 21(4): 771–785.

O. L. Mangasarian, Linear and nonlinear separation of patterns by linear programming, Operations Research, 1965, 13(3): 444–452.

W. E. Henley and D. J. Hand, A k-nearest-neighbour classifier for assessing consumer credit risk, Statistician, 1996, 45(1): 77–95.

P. Makowski, Credit scoring branches out, Credit World, 1985, 75(1): 30–37.

R. Smalz and M. Conrad, Combining evolution with credit apportionment: A new learning algorithm for neural nets, Neural Networks, 1994, 7(2): 341–351.

K. K. Lai, L. Yu, S. Y. Wang, and L. G. Zhou, Credit risk analysis using a reliability-based neural network ensemble model, Lecture Notes in Computer Science, 2006, 4132: 682–690.

R. Malhotra and D. K. Malhotra, Evaluating consumer loans using neural networks, Omega, 2003, 31(1): 83–96.

L. Yu, S. Y. Wang, and K. K. Lai, Credit risk assessment with a multistage neural network ensemble learning approach, Expert Systems with Applications, 2008, 34(2): 1434–1444.

M. C. Chen and S. H. Huang, Credit scoring and rejected instances reassigning through evolutionary computation techniques, Expert Systems with Applications, 2003, 24(4): 433–441.

F. Varetto, Genetic algorithms applications in the analysis of insolvency risk, Journal of Banking and Finance, 1998, 22(10): 1421–1439.

T. Van Gestel, B. Baesens, J. Garcia, and P. Van Dijcke, A support vector machine approach to credit scoring, Bank en Financiewezen, 2003, 2(1): 73–82.

Z. Huang, H. C. Chen, C. J. Hsu, W. H. Chen, and S. S. Wu, Credit rating analysis with support vector machines and neural networks: A market comparative study, Decision Support Systems, 2004, 37(4): 543–558.

K. K. Lai, L. Yu, S. Y. Wang, and L. G. Zhou, Credit risk evaluation with least square support vector machine, Lecture Notes in Computer Science, 2006, 4062: 490–495.

L. Yu, S. Y. Wang, K. K. Lai, and L. G. Zhou, Bio-Inspired Credit Risk Analysis–Computational Intelligence with Support Vector Machines, Springer-Verlag, Berlin, 2008.

A. I. Dimitras, R. Slowinski, R. Susmaga, and C. Zopounidis, Business failure prediction using rough sets, European Journal of Operational Research, 1999, 114(2): 263–280.

M. J. Beynon and M. J. Peel, Variable precision rough set theory and data discretisation: An application to corporate failure prediction, Omega, 2001, 29(6): 561–576.

T. S. Lee, C. C. Chiu, C. J. Lu, and I. F. Chen, Credit scoring using the hybrid neural discriminant technique, Expert Systems with Applications, 2002, 23(3): 245–254.

S. Piramuthu, Financial credit-risk evaluation with neural and neurofuzzy systems, European Journal of Operational Research, 1999, 112(2): 310–321.

R. Malhotra and D. K. Malhotra, Differentiating between good credits and bad credits using neurofuzzy systems, European Journal of Operational Research, 2002, 136(1): 190–211.

B. S. Ahn, S. S. Cho, and C. Y. Kim, The integrated methodology of rough set theory and artificial neural network for business failure prediction, Expert Systems with Applications, 2000, 18(1): 65–74.

Y. Q. Wang, S. Y. Wang, and K. K. Lai, A new fuzzy support vector machine to evaluate credit risk, IEEE Transactions on Fuzzy Systems, 2005, 13(6): 820–831.

L. C. Thomas, A survey of credit and behavioral scoring: forecasting financial risk of lending to consumers, International Journal of Forecasting, 2002, 16(2): 149–172.

L. C. Thomas, R. W. Oliver, and D. J. Hand, A survey of the issues in consumer credit modelling research, Journal of the Operational Research Society, 2005, 56(9): 1006–1015.

M. Yahia, R. Mahmod, N. Sulaiman, and F. Ahmad, Rough neural expert systems, Expert Systems with Applications, 2000, 18(2): 87–99.

H. P. Nguyen, L. L. Phong, P. Santiprabhob, and B. De Baets, Approach to generation rules for expert systems using rough set theory, in Proceedings of the Joint 9th IFSA World Congress and 20th NAFIPS International Conference (ed. by M. H. Smith, W. A. Gruver, and William, H. L. O’Higgins), Vancouver, Canada, 2001, 877–882.

Z. Pawlak, Rough sets, International Journal of Computing and Information Science, 1982, 11(5): 341–356.

J. Bazan, A. Skowron, and P. Synak, Dynamic reducts as a tool for extracting laws from decisions tables, in Proceedings of the 8th International Symposium on Methodologies for Intelligent Systems (ed. by G. Goos, J. Hartmanis, and J. van Leeuwen), Springer-Verlag, Berlin, 1994, 346–355.

R. Li and Z. Wang, Mining classification rules using rough sets and neural networks, European Journal of Operational Research, 2004, 157(2): 439–448.

V. N. Vapnik, The Nature of Statistical Learning Theory, Springer-Verlag, New York, 1995.

G. Fung, S. Sandilya, and R. B. Rao, Rule extraction from linear support vector machines via mathematical programming, in Rule Extraction from Support Vector Machines (ed. by D. Joachim), Springer, Berlin, 2008, 83–107.

Y. Li and T. Fang, Study of forecasting algorithm for support vector machines based on rough sets, Journal of Data Acquisition & Processing, 2003, 18(2): 199–203.

Z. Pawlak, Rough classification, International Journal of Man-Machine Studies, 1984, 20(5): 469–483.

Z. Pawlak, Rough sets, in Rough Sets and Data Mining (ed. by T. Y. Lin and N. Cercone), Kluwer, Dordrecht, 1997, 3–8.

Z. Pawlak, Rough Sets: Theoretical Aspects of Reasoning about Data, Kluwer, Dordrecht, 1991.

R. R. Hashemi, F. R. Jelovsek, and M. Razzaghi, Developmental toxicity risk assessment: A rough set approach, International Journal of Methods of Information in Medicine, 1993, 32(1): 47–54.

M. Dash and H. Liu, Feature selection for classification, Intelligent Data Analysis, 1997, 1(3): 131–156.

R. W. Swiniarski and A. Skowron, Rough set methods in feature selection and recognition, Pattern Recognition Letters, 2003, 24(6): 833–849.

N. Zhong, J. Dong, and S. Ohsuga, Using rough sets with heuristics for feature selection, Journal of Intelligent Information Systems, 2001, 16(2): 199–214.

M. Beynon, Reducts within the variable precision rough sets model: A further investigation, European Journal of Operational Research, 2001, 134(3): 592–605.

R. Slowinski, C. Zopoundis, and A. I. Dimitras, Prediction of company acquisition in Greece by means of the rough set approach, European Journal of Operational Research, 1997, 100(1): 1–15.

M. Last, A. Kandel, and O. Maimon, Information-theoretic algorithm for feature selection, Pattern Recognition Letters, 2001, 22(6–7): 799–811.

I. Guyon, J. Weston, and S. Barnhill, Gene selection for cancer classification using support vector machines, Machine Learning, 2002, 46(1–3): 389–422.

J. Brank, M. Grobelnik, N. Milic-Frayling, and D. Mladenic, Feature selection using support vector machines, in Proceeding of the 3th International Conference on Data Mining Methods and Databases for Engineering, Finance and Other Fields, Bologna, Italy, 2002, 25–27.

R. Felix and T. Ushio, Rule induction from inconsistent and incomplete data using rough sets, in IEEE International Conference on Systems, Man, and Cybernetics, Tokyo, 1999, 5: 154–158.

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was partially supported by the National Natural Science Foundation of China under Grant Nos. 70221001, 70701035, the Knowledge Innovation Program of the Chinese Academy of Sciences under Grant Nos. 3547600, 3046540, 3047540, the Key Research Institute of Philosophies and Social Sciences in Hunan Universities, and the National Natural Science Foundation of China/Research Grants Council (RGC) of Hong Kong Joint Research Scheme under Grant No. N_CityU110/07.

Rights and permissions

About this article

Cite this article

YU, L., WANG, S., WEN, F. et al. Designing a Hybrid Intelligent Mining System for Credit Risk Evaluation. J Syst Sci Complex 21, 527–539 (2008). https://doi.org/10.1007/s11424-008-9133-7

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-008-9133-7