Abstract

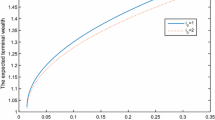

This paper investigates a multi-period mean-variance portfolio selection with regime switching and uncertain exit time. The returns of assets all depend on the states of the stochastic market which are assumed to follow a discrete-time Markov chain. The authors derive the optimal strategy and the efficient frontier of the model in closed-form. Some results in the existing literature are obtained as special cases of our results.

Similar content being viewed by others

References

H. Markowitz, Portfolio selection, Journal of Finance, 1952, 7: 77–91.

D. Li and W. L. Ng, Optimal dynamic portfolio selection: Multiperiod mean-variance formulation, Mathematical Finance, 2000, 10: 387–406.

W. J. Guo and Q. Y. Hu, Multi-period portfolio optimization when exit time is uncertain, Journal of Management Sciences in China, 2005, 8: 14–19.

M. Leippold, F. Trojani, and P. Vanini, A geometric approach to multiperiod mean variance optimization of assets and liabilities, Journal of Economic Dynamics and Control, 2004, 28: 1079–1113.

S. S. Zhu, D. Li, and S. Y. Wang, Risk control over bankruptcy in dynamic portfolio selection: A generalized mean-variance formulation, IEEE Transactions on Automatic Control, 2004, 49: 447–457.

M. C. Steinbach, Markowitz revisited: Mean-variance models in financial portfolio analysis, Society for Industrial and Applied Mathematics, 2001, 43: 31–85.

X. Y. Zhou and G. Yin, Markowitz’s mean-variance portfolio selection with regime switching: A continuous-time model, SIAM Journal on Control and Optimization, 2003, 42: 1466–1482.

G. Yin and X. Y. Zhou, Markowitz’s mean-variance portfolio selection with regime switching: From discrete-time to their continuous-time limits, IEEE Transactions on Automatic Control, 2004, 49: 349–360.

U. Çakmak and S. Özekici, Portfolio optimization in stochastic markets, Mathematical Methods of Operations Research, 2006, 63: 151–168.

U. Çakmak and S. Özekici, Multiperiod portfolio optimization models in stochastic markets using the mean-variance approach, European Journal of Operational Research, 2007, 179: 186–202.

S. Z. Wei and Z. X. Ye, Multi-period optimization portfolio with bankruptcy control in stochastic market, Applied Mathematics and Computation, 2007, 186: 414–425.

P. Chen, H. L. Yang, and G. Yin, Markowitz’s mean-variance asset-liability management with regime switching: A continuous-time model, Insurance: Mathematics and Economics, 2008, 43: 456–465.

O. L. V. Costa and M. V. Araujo, A generalized multi-period mean-variance portfolio optimization with Markov switching parameters, Automatica, 2008, 44: 2487–2497.

L. Martellini and B. Urošević, Static mean-variance analysis with uncertain time horizon, Management Science, 2006, 52(6): 955–964.

L. Yi, Z. F. Li, and D. Li, Multi-period portfolio selection for asset-liability management with uncertain investment horizon, Journal of Industrial and Management Optimization, 2008, 4: 535–552.

M. Yaari, Uncertain lifetime, life insurance and the theory of the consumer, Review of Economic Studies, 1965, 2: 137–150.

N. H. Hakansson, Optimal investment and consumption strategies under risk, an uncertain lifetime, and insurance, International Economic Review, 1969, 10: 427–449.

R. C. Merton, Lifetime portfolio selection under uncertainty: The continuous-time case, The Review of Economics and Statistics, 1969, 51: 247–257.

S. F. Richard, Optimal consumption, portfolio and life insurance rules for an uncertain lived individual in a continuous time model, Journal of Financial Economics, 1975, 2: 187–203.

Author information

Authors and Affiliations

Corresponding author

Additional information

This research is supported by the National Science Foundation for Distinguished Young Scholars under Grant No. 70825002, the National Natural Science Foundation of China under Grant No. 70518001, and the National Basic Research Program of China 973 Program, under Grant No. 2007CB814902.

This paper was recommended for publication by Editor Shouyang WANG.

Rights and permissions

About this article

Cite this article

Wu, H., Li, Z. Multi-period mean-variance portfolio selection with Markov regime switching and uncertain time-horizon. J Syst Sci Complex 24, 140–155 (2011). https://doi.org/10.1007/s11424-011-9184-z

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-011-9184-z