Abstract

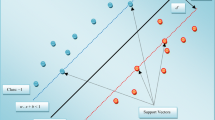

The probability of default (PD) is the key element in the New Basel Capital Accord and the most essential factor to financial institutions’ risk management. To obtain good PD estimation, practitioners and academics have put forward numerous default prediction models. However, how to use multiple models to enhance overall performance on default prediction remains untouched. In this paper, a parametric and non-parametric combination model is proposed. Firstly, binary logistic regression model (BLRM), support vector machine (SVM), and decision tree (DT) are used respectively to establish models with relatively stable and high performance. Secondly, in order to make further improvement to the overall performance, a combination model using the method of multiple discriminant analysis (MDA) is constructed. In this way, the coverage rate of the combination model is greatly improved, and the risk of miscarriage is effectively reduced. Lastly, the results of the combination model are analyzed by using the K-means clustering, and the clustering distribution is consistent with a normal distribution. The results show that the combination model based on parametric and non-parametric can effectively enhance the overall performance on default prediction.

Similar content being viewed by others

References

Altman E, Financial ratio’s, discriminant analysis and the prediction of corporate bankruptcy, Journal of Finance, 1968, 23(4): 589–609.

Altman E, Haldeman G, and Narayanan P, ZETA analysis: A new model to identify the bankruptcy risk of corporations, Journal of Banking and Finance, 1977, 1(1): 29–54.

Horrigan J O, The determinants of long term credit standing with financial ratios empirical research in accounting selected studies, Journal of Accounting Research, 1966, 41(2): 235–272.

West R, An alternative approach to predicting corporate bond ratings, Journal of Accounting Research, 1970, (1): 118–127.

Ohlson J A, Financial ratios and the probabilistic prediction of bankruptcy, Accounting Research, 1980, 18(1): 109–131.

Maddala G S, Limited-Dependent and Quantitative Variables in Econometrics, Cambridge University Press, 1986, 23–27.

Odom M D and Sharda R, A neural network model for bankruptcy prediction, Proceedings of the IEEE International Joint Conference on Neural Networks, 1990, (2): 163–168.

Lee Y C, Application of support vector machine to corporate credit rating prediction, Expert with applicatins, 2007, 33(1): 67–74.

Makowski P, Credit scoring branches out: Decision tree-recent technology, Credit World, 1985, 74(2): 30–37.

Carter C and Catlett J, Assessing credit card applications using machine learning, IEEE Computer Society, 1987, 2(3): 71–79.

Boyle M, Crook J N, and Hamilton R, Methods for Credit Scoring Applied to Slowpayers, University of Edinburgh Department of Business Studies, 1989.

Tae K S, Namsik C, and Gunhee L, Dynamics of modeling in data mining: Interpretive approach to bankruptcy predicion, Journal of Management Information Systems, 1999, 16(1): 63–85.

Lundy M, Cluster Analysis in Credit Scoring Credit Scoring and Credit Control, OxfordUniversity Press, New York, 1993, 78–90.

Tam K Y and Kiang M, Managerial applications of neural networks: The case of bank failure predictions, Journal Management Science, 1992, 38(7): 927–947.

Doumpos M, Kosmidou K, and Baourakis G, Credit risk assessment using a multi-criteria hierarchical discrimination approach a comparative analysis, European Journal of Operational Research, 2002, 138(2): 392–441.

Altman E, Marco G, and Varetto F, Corporate distress diagnosis: Comparisons using linear discriminant anaanaly and neura1 netwoks, Journal of Bakning and Finance, 1994, 18(3): 505–529.

Frydman H, Altman E, and Kao D, Introducing recursive partitioning for financial classification: The case of financial distress, Journal of Finance, 1985, 40(1): 269–291.

Martinelli E, Carvlho A D, Rezende S, and Matias A, Rules extractions from banks’ bankrupt data using connectionist and symbolic learning algorithms, Proceedings of the Computational Finance Conference, New York, 1999, 635–637.

Yeh H C Yang M L, and Lee L C, An empirical study of credit scoring model for credit card//Innovative Computing, Information and Control, ICICIC’07, Second International Conference on Innovative Computing, Kumamoto, 2007, 216.

Pan L, Li J, and Yang X G, An estimation method for default probability based on sample matching and an application, Science & Technology for Development, 2011, 11: 48–52.

Barakat N and Bradley A P, rule extraction from support vector machines: A review, Neurocomputing, 2010, 74(1): 178–190.

Shin K S, Lee T S, and Kim H J, An application of support vector machines in bankruptcy prediction model, Expert Systems with Applications, 2005, 28(1): 127–135.

Lin S T, Lin C J, and Weng R C, A note on Platt’s probabilistic outputs for support vector machines mach learn, 2007, 68(3): 267–276.

Dzeroski S, Cestnik B, and Petrovski I, Using the m-estimate in rule induction, Journal of Computing and Information Technology, 1993, 1(1): 37–46.

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported by the National Natural Science Foundation of China Key Project under Grant No. 70933003, the National Natural Science Foundation of China under Grant Nos. 70871109 and 71203247.

This paper was recommended for publication by Editor WANG Shouyang.

Rights and permissions

About this article

Cite this article

Li, J., Pan, L., Chen, M. et al. Parametric and non-parametric combination model to enhance overall performance on default prediction. J Syst Sci Complex 27, 950–969 (2014). https://doi.org/10.1007/s11424-014-3273-8

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-014-3273-8