Abstract

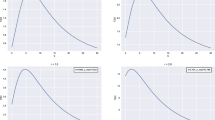

This paper considers the dividend problems in the perturbed compound Poisson risk model. Assume that dividends can only be paid at the observation time when the surplus exceeds the barrier level and the excess is paid as dividend. In this paper, integro-differential equations for the expected discounted dividends until ruin and the Laplace transform of ruin time are firstly derived. When the claim is exponentially distributed, explicit expressions for the expected discounted dividends until ruin and the Laplace transform of ruin time are also obtained. Finally, the optimal dividend barrier which maximizes the expected discounted dividends until ruin is given.

Similar content being viewed by others

References

De Finetti B, Su unimpostazione alternativa dell teoria collectiva del rischio, Transaction of the 15th International Congress of Actuaries, New York, 1957.

Avanzi B, Strategies for dividend distribution: A review, North American Actuarial Journal, 2009, 13(2): 217–251.

Albrecher H and Thonhauser S, Optimality results for dividend problems in insurance, RACSAM Revista de la Real Academia de Ciencias; Serie A, Matematicas, 2009, 103(2): 295–320.

Albrecher H, Cheung E C K, and Thonhauser S, Randomized observation periods for the compound Poisson risk model: Dividends, Astin Bull, 2009, 41(2): 645–672.

Albrecher H, Gerber H U, and Shiu E S W, The optimal dividend barrier in the Gamma-Omega model, European Actuarial Journal, 2011, 1(1): 43–55.

Liu X and Chen Z L, Dividend problems in the dual model with diffusion and exponentially distributed observation time, Statistics and Probability Letters, 2014, 87(1): 175–183.

Wang C L and Liu X, Dividend problems in the diffusion model with interest and exponentially distributed observation time, Journal of Applied Mathematics, 2014, doi:10.1155/2014/814835.

Kyprianou E, Introductory Lectures on Fluctuations of Lévy Processes with Applications, Springer-Verlag, New York, 2006.

Zhang Z M, On a perturbed Sparre Andersen risk model with threshold dividend strategy and dependence, Journal of Computational and Applied Mathematics, 2014, 255(1): 248–269.

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported by the National Natural Science Foundation of China under Grant No. 11371321; the Key Research Base for Humanities and Social Sciences of Zhejiang Provincial High Education Talents (Statistics of Zhejiang Gongshang University).

This paper was recommended for publication by Editor ZOU Guohua.

Rights and permissions

About this article

Cite this article

Liu, X., Chen, Z. & Ming, R. The optimal dividend barrier in the perturbed compound Poisson risk model with randomized observation time. J Syst Sci Complex 28, 451–470 (2015). https://doi.org/10.1007/s11424-015-3156-7

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-015-3156-7