Abstract

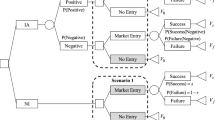

The aim of this paper is to develop a multi-period economic model to interpret how the people become overconfident by a biased learning that people tend to attribute the success to their abilities and failures to other factors. The authors suppose that the informed trader does not know the distribution of the precision of his private signal and updates his belief on the distribution of the precision of his knowledge by Bayer’s rule. The informed trader can eventually recognize the value of the precision of his knowledge after an enough long time biased learning, but the value is overestimated which leads him to be overconfident. Furthermore, based on the definition on the luckier trader who succeeds the same times but has the larger variance of the knowledge, the authors find that the luckier the informed trader is, the more overconfident he will be; the smaller the biased learning factor is, the more overconfident the informed trader is. The authors also obtain a linear equilibrium which can explain some anomalies in financial markets, such as the high observed trading volume and excess volatility.

Similar content being viewed by others

References

Harrison M and Kreps D, Speculative investor behavior in a stock market with heterogeneous expectations, Quarterly Journal of Economics, 1978, 92: 323–336.

Kyle A S, Continuous auctions and insider trading, Economerica, 1985, 53: 1315–1336.

Kyle A S and Wang A, Speculation duopoly with agreement to disgree: Can overconfidence survive the market test?, Journal of Finance, 1997, 52: 2073–2090.

Odean T, Volume, volatility, price and profit when all traders are above average, The Journal of Finance, 1998, 53: 1887–1934.

Daniel K, Hirshleifer D, and Subrahmanyam A, Investor psychology and security market underand overreaction, Journal of Finance, 1998, 53: 1839–1885.

Gervais S and Odean T, Learing to be overconfident, The Review of Financial Studies, 2001, 14: 1–27.

Kyle A S and Lin T, Continuous speculation with overconfident competitors, Unpublished working paper, Duke University, 2001.

Lin T, Under- and over-reaction form relative and aggregate overconfidence, Working paper, Duke University, 2003.

Scheinkman J and Xiong W, Overconfidence and speculative bubbles, The Journal of Political Economics, 2003, 111(6): 1183–1219.

Benabou R and Tirole J, Self-confidence and personal motivation, The Quarterly Journal of Economics, 2002, 117(3): 871–915.

Steen E V, Overconfidence by bayesian-rational agents, Management Science, 2011, 57: 884–896.

Libby R and Rennekamp K, Self-Serving attribution bias, overconfidence, and the issuance of management forecasts, Journal of Accounting Research, 2012, 50: 197–231.

Han B and Hirshleifer D, Investor overconfidence and the forward premium puzzle, Review of Economic Studies, 2011, 78: 523–558.

McCarthy S, Oliver B, and Song S, Corporate social responsibility and CEO confidence, Journal of Banking and Finance, 2017, 75: 280–291.

Malmendier U and Taylor T, On the verges of overconfidence, Journal of Economic Perspectives, 2015, 29: 3–8.

Shefrin H, Beyond Greed and Fear: Understanding Behavioral Finance and the Psychology of Investing, Oxford University Press, New York, 2000.

Statman M, Thorley S, and Vorkink K, Investor overconfidence and trading volume, The Review of Financial Studies, 2006, 19(4): 1531–1565.

Daniel K and Hirshleifer D, Overconfident investors, predictable returns, and excessive trading, Journal of Economic Perspectives, 2015, 29: 61–87.

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported by the National Natural Science Foundation of China under Grant Nos. 71303265 and 71573289, and the Innovative Research Group Project of National Natural Science Foundation of China under Grant No. 71721001.

This paper was recommended for publication by Editor WANG Shouyang.

Rights and permissions

About this article

Cite this article

Ni, X., Wu, C. & Zhao, H. Biased Learning Creates Overconfidence. J Syst Sci Complex 31, 1603–1617 (2018). https://doi.org/10.1007/s11424-018-7254-1

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-018-7254-1