Abstract

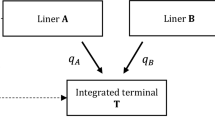

Facing with increasing competition, many ports are taking innovative approaches to improve productivity and profits. Among a variety of methods, introducing external terminal operators (ETOs) while the port acts as a landlord to collect “rents” from those operators for conducting terminal activities inside the port is regarded as an effective way and is commonly observed in practices. This paper analyzes the decisions of two competing ports about whether to introduce their respective ETOs using a three-stage non-cooperative game model when there already exists a port’s self-operation terminal operator (STO). At the first stage, the two ports simultaneously decide whether to introduce an ETO. If a port decided to introduce an ETO, at the second stage, it will further decide the unit fee to charge from the ETO. At the third stage, the two ports and the introduced ETO(s) simultaneously decide their respective profit-maximizing output levels. The findings indicate the equilibrium is both ports will introduce their respective ETOs, but when the ports and ETOs are substitutable in the sense of having the same level of productivity, the equilibrium solution is only one port should introduce an ETO. And simulation results show that even if one of ETOs is inefficient this still hold true.

Similar content being viewed by others

References

Fung K F, Competition between the ports of Hong Kong and Singapore: A structural vector error correction model to forecast the demand for container handling services, Maritime Policy and Management, 2001, 28(1): 3–22.

Song D P, Andrew Li D L, and Hossein S, Modeling port competition from a transport chain perspective, Transportation Research Part E, 2016, 87: 75–96.

Cullinane K, Ya H T, and Teng F W, Port competition between Shanghai and Ningbo, Maritime Policy and Management, 2005, 32(4): 331–346.

Saeed N and Larsen O I, An application of cooperative game among container terminals of one port, European Journal of Operational Research, 2010, 203(2): 392–403.

Barnard B, Europe’s ports brace for intra-terminal rivalries and overcapacity, Journal of Commerce, 2014.

Baird A J, Privatization tends at the world’s top 100 container ports, Maritime Policy and Management, 2002, 29(3): 271–284.

Tongzon J L and Heng W, Port privatization, efficiency and competitiveness: Some empirical evidence from container ports (terminals), Transportation Research Part A, 2005, 39(5): 405–424.

Panayides P M and Song D W, Port integration in global supply chains: Measures and implications for maritime logistics, International Journal of Logistics Research and Applications, 2009, 12(2): 133–145.

Talley W K and Ng M W, Maritime transport chain choice by carriers, ports and shippers, International Journal of Production Economics, 2013, 142(2): 311–316.

Brooks M R and Cullinane K, Governance models defined, Research in Transportation Economics, 2006, 17(1): 405–435.

van Reeven P, The effect of competition on economic rents in seaports, Journal of Transport Economics and Policy, 2010, 44(1): 79–92.

Cullinane K and Wang Y, A capacity-based measure of container port accessibility, International Journal of Logistics Research and Applications, 2009, 12(2): 103–117.

De Langen P W and Pallis A A, Analysis of the benefits of intra-port competition, International Journal of Transport Economics, 2006, 33(1): 69–85.

Yip T L, Liu J J, Fu X, et al., Modeling the effects of competition on seaport terminal awarding, Transport Policy, 2014, 35: 341–349.

Anderson C M, Park Y A, Chang Y T, et al., A game-theoretic analysis of competition among container port hubs: The case of Busan and Shanghai, Maritime Policy and Management, 2008, 35(1): 5–26.

Bae M J, Chew E K, Lee L H, et al., Container transshipment and port competition, Maritime Policy and Management, 2013, 40(5): 479–494.

Song D W, Regional container port competition and co-operation: The case of Hong Kong and South China, Journal of Transport Geography, 2002, 10(2): 99–110.

De Borger B, Proost S, and Van Dender K, Private port pricing and public investment in port and hinterland capacity, Journal of Transport Economics and Policy, 2008, 42: 527–561.

Li J B and Oh Y S, A research on competition and cooperation between Shanghai port and Ningbo-Zhoushan port, Asian Journal of Shipping and Logistics, 2010, 26(1): 67–91.

Luo M, Liu L, and Gao F, Post-entry container port capacity expansion, Transportation Research Part B, 2012, 46: 120–138.

Liu Q, Wilson W, and Luo M, The impact of Panama Canal expansion on the container-shipping market: A cooperative game theory approach, Maritime Policy and Management, 2016, 43(2): 209–221.

Guo L B, Li J, and Xing W, Port co-opetition research in bulk and container businesses, Journal of Transportation Systems Engineering and Information Technology, 2017, 17(2): 189–196 (in Chinese).

Liu Q and Lim S H, Toxic air pollution and container port efficiency in the US, Maritime Economics and Logistics, 2017, 19(1): 94–105.

Xing W, Liu Q, and Chen G, Pricing strategies for port competition and cooperation, Maritime Policy and Management, 2018, 45(2): 1–18.

Heaver T, Meersman H, and van De Voorde E, Co-operation and competition in international container transport: Strategies for ports, Maritime Policy and Management, 2001, 28(3): 293–305.

Notteboom T E, Container shipping and ports: An overview, Review of Network Economics, 2004, 3(2): 86–106.

Yip T L, Sun X Y, and Liu J J, Group and individual heterogeneity in a stochastic frontier model: Container terminal operators, European Journal of Operational Research, 2011, 213(3): 517–525.

Kaselimi E, Notteboom T, and De Borger B, A game theoretical approach to competition between multi-user terminals: The impact of dedicated terminals, Maritime Policy and Management, 2011, 38(4): 395–414.

Álvarez-SanJaime Ó, Cantos-Sánchez P, Moner-Colonques R, et al., Competition and horizontal integration in maritime freight transport, Transportation Research Part E, 2013, 51(710): 67–81.

Fu X, Lijesen M, and Oum T H, An analysis of airport pricing and regulation in the presence of competition between full service airlines and low cost carriers, Journal of Transport Economics and Policy, 2006, 40(3): 425–447.

Oum T H and Fu X, Air transport security user charge pricing: An investigation of flat perpassenger charge vs. ad valorem user charge schemes, Transportation Research Part E, 2007, 43(3): 283–293.

Chen H and Liu S, Optimal concession contracts for landlord ports to maximize traffic volumes, Maritime Policy and Management, 2015, 42(1): 11–25.

Hu W and Li J B, Disposing the leftovers under the consignment contract with revenue sharing: Retailer vs supplier, Journal of Systems Science and Complexity, 2012, 25(2): 262–274.

Zhang R and Liu X A, stackelberg differential games solution to a problem of optimal intertemporal investment and tax rate design, Journal of Systems Science and Complexity, 2004, 17(2): 253–261.

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported by the National Natural Science Foundation of China under Grant Nos. 71571010, 71471101, 71771138, Great Wall Scholar Training Program Beijing Municipality CIT&TCD20180305, and Natural Science Foundation of Shandong Province under Grant No. ZR2015GZ008.

This paper was recommended for publication by Editor WANG Shouyang.

Rights and permissions

About this article

Cite this article

Guo, L., Li, J., Liu, Q. et al. Introducing an External Terminal Operator or Not? The Decision of Ports in a Duopoly Market. J Syst Sci Complex 33, 146–166 (2020). https://doi.org/10.1007/s11424-019-8126-z

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-019-8126-z