Abstract

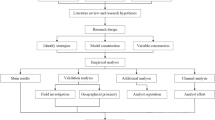

This paper builds an agent-based model to study the impact of analyst competition on analyst optimism. Two strategies (a catering strategy and a pressure strategy) are used to model analysts conflicts of interest between listed corporations and institutional clients. The finding suggests that the relationship between competition and analyst optimism is nonlinear. Low-level competition generates more analyst unbiased forecasts. However, the condition of no competition or high-level competition generates more analyst optimistic forecasts. The empirical test also confirms that analysts issue less biased earnings forecasts under the condition of low-level competition.

Similar content being viewed by others

References

Firth M, Lin C, Liu P, et al., The client is king: Do mutual fund relationships bias analyst recommendations?, Journal of Accounting Research, 2013, 51(1): 165–200.

Malmendier U and Shanthikumar D, Do security analysts speak in two tongues?, The Review of Financial Studies, 2014, 27(5): 1287–1322.

Hong H and Kacperczyk M, Competition and bias, The Quarterly Journal of Economics, 2010, 125(4): 1683–1725.

Bolton P, Freixas X, and Shapiro J, Conflicts of interest, information provision, and competition in the financial services industry, Journal of Financial Economics, 2007, 85(2): 297–330.

Jackson A R, Trade generation, reputation, and sell-side analysts, The Journal of Finance, 2005, 60(2): 673–717.

Mayew W J and Venkatachalam M, The power of voice: Managerial affective states and future firm performance, The Journal of Finance, 2012, 67(1): 1–43.

Matsumoto D, Pronk M, and Roelofsen E, What makes conference calls useful? The information content of managers’ presentations and analysts’ discussion sessions, The Accounting Review, 2011, 86(4): 1383–1414.

Solomon D and Soltes E, What are we meeting for? The consequences of private meetings with investors, The Journal of Law and Economics, 2015, 58(2): 325–355.

Bushee B J, Gerakos J, and Lee L F, Corporate jets and private meetings with investors, Journal of Accounting and Economics, 2018, 65(2–3): 358–379.

Chen S and Matsumoto D A, Favorable versus unfavorable recommendations: The impact on analyst access to management-provided information, Journal of Accounting Research, 2006, 44(4): 657–689.

Mayew W J, Evidence of management discrimination among analysts during earnings conference calls, Journal of Accounting Research, 2008, 46(3): 627–659.

Corwin S A, Larocque S A, and Stegemoller M A, Investment banking relationships and analyst affiliation bias: The impact of the global settlement on sanctioned and non-sanctioned banks, Journal of Financial Economics, 2017, 124(3): 614–631.

Cowen A, Groysberg B, and Healy P, Which types of analyst firms are more optimistic?, Journal of Accounting and Economics, 2006, 41(1–2): 119–146.

Ljungqvist A, Marston F, Starks L T, et al., Conflicts of interest in sell-side research and the moderating role of institutional investors, Journal of Financial Economics, 2007, 85(2): 420–456.

Green T C, Jame R, Markov S, et al., Access to management and the informativeness of analyst research, Journal of Financial Economics, 2014, 114(2): 239–255.

Mullainathan S and Shleifer A, The market for news, American Economic Review, 2005, 95(4): 1031–1053.

Hong H and Kubik J D, Analyzing the analysts: Career concerns and biased earnings forecasts, The Journal of Finance, 2003, 58(1): 313–351.

Pacelli J, Corporate culture and analyst catering, Journal of Accounting and Economics, 2019, 67(1): 120–143.

Kadan O, Madureira L, Wang R, et al., Conflicts of interest and stock recommendations: The effects of the global settlement and related regulations, The Review of Financial Studies, 2008, 22(10): 4189–4217.

Soltes E, Private interaction between firm management and sell-side analysts, Journal of Accounting Research, 2014, 52(1): 245–272.

Fang L and Yasuda A, The effectiveness of reputation as a disciplinary mechanism in sell-side research, The Review of Financial Studies, 2009, 22(9): 3735–3777.

Wu J S and Zang A Y, What determine financial analysts’ career outcomes during mergers?, Journal of Accounting and Economics, 2009, 47(1–2): 59–86.

Merkley K, Michaely R, and Pacelli J, Does the scope of the sell-side analyst industry matter? An examination of bias, accuracy, and information content of analyst reports, The Journal of Finance, 2017, 72(3): 1285–1334.

Todd A, Beling P, Scherer W, et al., Agent-based financial markets: A review of the methodology and domain, IEEE Symposium Series on Computational Intelligence, 2016, 1–5.

Tesfatsion L and Judd K L, Handbook of computational economics: Agent-based computational economics, Elsevier, 2006, 2.

Mizuta T, Izumi K, Yagi I, et al., Regulations’ effectiveness for market turbulence by large erroneous orders using multi agent simulation, 2014 IEEE Conference on Computational Intelligence for Financial Engineering & Economics (CIFEr), 2014, 138–143.

Hayes R, Paddrik M, Todd A, et al., Agent based model of the e—mini future: Application for policy making, Proceedings of the 2012 Winter Simulation Conference (WSC), 2012, 1–12.

Mo S Y K, Paddrik M, and Yang S Y, A study of dark pool trading using an agent-based model, IEEE Conference on Computational Intelligence for Financial Engineering & Economics (CIFEr), 2013, 19–26.

Mizuta T, Matsumoto W, Kosugi S, et al., Do dark pools stabilize markets and reduce market impacts? Investigations using multi-agent simulations, 2014 IEEE Conference on Computational Intelligence for Financial Engineering & Economics (CIFEr), 2014, 71–76.

Wah E and Wellman M P, Latency arbitrage, market fragmentation, and efficiency: A two-market model, Proceedings of the fourteenth ACM Conference on Electronic Commerce, 2013, 855–872.

Cao L and Philip S Y, Behavior Computing: Modeling, Analysis, Mining and Decision, Springer Science & Business Media, 2012.

Feng X, Zhang W, Zhang Y, et al., Information identification in different networks with heterogeneous information sources, Journal of Systems Science and Complexity, 2014, 27(1): 92–116.

Zhang Y, Liu Y, and Feng X, Cheap talk communication with dynamic information searching, Springer Plus, 2016, 5(1): 707–730.

Zhang W, Sun Y, Feng X, et al., Evolutionary minority game with searching behavior, Physica A: Statistical Mechanics and Its Applications, 2015, 436: 694–706.

Lang M H, Lins K V, and Miller D P, ADRs, analysts, and accuracy: Does cross listing in the United States improve a firm’s information environment and increase market value?, Journal of Accounting Research, 2003, 41(2): 317–345.

Wang Z, Xu B, and Zhou H J, Social cycling and conditional responses in the Rock-Paper-Scissors game, Scientific Reports, 2014, 4: 5830–5836.

Gan L, Cen Y, and Bai C, Information Searching Behavior Mining Based on Reinforcement Learning Models, Eds. by Cao L and Yu P, Behavior Computing, Springer, London, 2017.

Börgers T and Sarin R, Naive reinforcement learning with endogenous aspirations, International Economic Review, 2000, 41(4): 921–950.

Fama E F and French K R, Incremental variables and the investment opportunity set, Journal of Financial Economics, 2015, 117(3): 470–488.

Fang L H and Yasuda A, Are stars’ opinions worth more? The relation between analyst reputation and recommendation values, Journal of Financial Services Research, 2014, 46(3): 235–269.

Author information

Authors and Affiliations

Corresponding author

Additional information

This research was supported by the National Natural Science Foundation of China under Grant Nos. 71871157, 71790594 and 71532009, and the Major project of Tianjin Education Commission under Grant No. 2018JWZD47.

This paper was recommended for publication by Editor WANG Shouyang.

Rights and permissions

About this article

Cite this article

Zhang, J., Xiong, X., An, Y. et al. The Impact of Competition on Analysts’ Forecasts: A Simple Agent-Based Model. J Syst Sci Complex 33, 1980–1996 (2020). https://doi.org/10.1007/s11424-020-9006-2

Received:

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11424-020-9006-2