Abstract

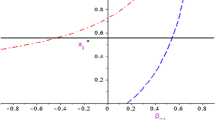

A two-period ultimatum bargaining game is developed in which parties experience an envy-type externality coming from the surplus captured by their counterparts. Our assumptions on envy levels and outside opportunities allow us to characterize a richer set of bargaining outcomes than that identified by the prior literature, which includes a novel agreement equilibrium which we label Type I agreement. As this novel agreement solution is delivered by a negotiation resembling a one-shot ultimatum game, only characteristics of the second-moving player shape the sources of bargaining power. This property contrasts with that of Type II agreement—an agreement solution previously reported by related literature—in which characteristics of both players influence negotiating strengths. Numerical simulations are performed to illustrate the interplay between envy, impatience rates and outside opportunities as well as the degree of inequity generated by each agreement type.

Similar content being viewed by others

Notes

This analysis excludes bargaining advantages coming from the parties’ order of moves in the game.

This is thus an alternative explanation of why the Kirchsteiger’s model is able to arrive at only one of the two agreement types we here characterize.

Note, however, that under the same parameter values, our Type I agreement is unable to recover the Kirchsteiger’s equilibrium since its equilibrium partition is such that

$$\begin{aligned} \pi -\overline{x_{1}}=\frac{\theta _{B}\pi }{1+\theta _{B}}. \end{aligned}$$In the terminology of [17], the (strictly) converse of inequality (11) would be a sufficient condition for an essential bargaining problem, i.e., the existence of a nonempty set of payoff pairs from potential agreements such that both parties are better off than they would be if a disagreement takes place.

This assumption is adopted for simplicity. It should be clear that a symmetric environment of this class does not ‘neutralize’ any source of bargaining power between players in any of the two agreement types. This is because parties have different order of moves, and consequently, they exploit different negotiating advantages (see the discussion presented in Sect. 4.2). Notice, nevertheless, that assuming a common \(\theta \) will allow us to explore through numerical simulations which envy-based advantage eventually dominates in Type II agreement, either that of the first-responder (player B), or that of the last-responder (player A).

Since \(\delta <1\), it is easily confirmed that \(u(\theta ,\delta )>u(\theta ).\)

This result is consistent with Corollary 2.

This property is only present in Type I agreement.

That is, since \(\delta _{i}\in (0,1)\) it is true that

$$\begin{aligned} U_{A}(1+\theta _{B})\frac{\delta _{A}-\delta _{B}}{1-\delta _{B}}\le U_{A}(1+\theta _{B})+U_{B}(1+\theta _{A})\le \pi (1-\theta _{A}\theta _{B}), \end{aligned}$$where the last inequality is in fact condition (1).

References

Berg, J., Dickhaut, J., McCabe, K.: Trust, reciprocity, and social history. Games Econ. Behav. 10(1), 122–142 (1995)

Chowdhury, P.R.: Externalities and bargaining disagreement. Econ. Lett. 61, 61–65 (1998)

Crawford, V.: A theory of disagreement in bargaining. Econometrica 50(3), 607–637 (1982)

Falk, A., Fischbacher, U.: A theory of reciprocity. Games Econ. Behav. 54(2), 293–315 (2006)

Fehr, E., Schmidt, K.: A theory of fairness, competition, and cooperation. Q. J. Econ. 114(3), 817–868 (1999)

Fischbacher, U., Hertwig, R., Bruhin, A.: How to model heterogeneity in costly punishment: insights from responders’ response times. J. Behav. Decis. Making 26(5), 462–476 (2013)

Güth, W., Kocher, M.: More than thirty years of ultimatum bargaining experiments: motives, variations, and a survey of the recent literature. J. Econ. Behav. Organ. 108, 396–409 (2014)

Jehiel, P., Moldovanu, B.: Negative externalities may cause delay in negotiation. Econometrica 63(6), 1321–1335 (1995)

Jehiel, P., Moldovanu, B.: Cyclical delay in bargaining with externalities. Rev. Econ. Stud. 62(4), 619–637 (1995)

Kagel, J., Wolfe, K.: Tests of fairness models based on equity considerations in a three-person ultimatum game. Exp. Econ. 4(3), 203–219 (2001)

Kahneman, D., Knetsch, J., Thaler, R.: Fairness and the assumptions of economics. J. Bus. 59(4), 285–300 (1986)

Kirchsteiger, G.: The role of envy in ultimatum games. J. Econ. Behav. Organ. 25(3), 373–389 (1994)

Laengle, S., Loyola, G.: The ultimatum game with externalities. Econ. Comput. Econ. Cybern. Stud. Res. 49(4), 279–287 (2015)

Laengle, S., Loyola, G.: Bargaining and negative externalities. Optim. Lett. 6, 421–430 (2012)

Muthoo, A.: A Bargaining model based on the commitment tactic. J. Econ. Theory 69, 134–152 (1996)

Muthoo, A.: Bargaining Theory with Applications. Cambridge University Press, Cambridge (1999)

Myerson, R.: Game Theory: Analysis of Conflict. Harvard University Press, Cambridge (1991)

Nowak, M., Page, K., Sigmund, K.: Fairness versus reason in the ultimatum game. Science 289(5485), 1773–1775 (2000)

Pfister, H.-R., Böhm, G.: Responder feelings in a three-player three-option ultimatum game: affective determinants of rejection behavior. Games 3(1), 1–29 (2012)

Pillutla, M., Murnighan, J.: Unfairness, anger, and spite: emotional rejections of ultimatum offers. Organ. Behav. Human. Decis. Process. 68(3), 208–224 (1996)

Sanfey, A., Rilling, J., Aronson, J., Nystrom, L., Cohen, J.: The neural basis of economic decision-making in the ultimatum game. Science 300(5626), 1755–1758 (2003)

Schelling, T.C.: The Strategy of Conflict. Harvard University Press, Cambridge (1960)

van ’t Wout, M., Kahn, R., Sanfey, A., Aleman, A.: Affective state and decision-making in the ultimatum game. Exp. Brain Res. 169(4), 564–568 (2006)

Xie, W., Li, Y., Wang, Y., Li, K.: Responders’ dissatisfaction may provoke fair offer. J. Econ. Interact. Coord. 7(2), 197–207 (2012)

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Proposition 1

By the backward induction principle, we proceed as follows: Period \(t=2\) At this stage player, A accepts player B’s counteroffer if

and rejects it otherwise. In turn, player B chooses \(x_{2}\) such that

This problem is equivalent to the following program:

The interval of \(x_{2}\) defined by constraint (17) turns out to be empty because when (1) is not satisfied, it follows that

Hence, a negotiation breakdown would take place at \(t=2\). The optimal strategy for player B is therefore:

for some \(\varepsilon _{B}>0\).

Period \(t=1\) At this stage, player B accepts player A’s offer if

and rejects it otherwise. In turn, player A chooses \(x_{1}^{*}\) such that

If we make the substitution \(x_{1}=\overline{x_{1}}\), the previous problem implies that player A finally chooses \(x_{1}^{*}=\overline{x_{1}}\) if

Note that condition (18) holds if it is true that

which is in fact condition (2) identified in the main text. Thus, the optimal strategy of player A is described by

for some \(\varepsilon _{A}>0\). \(\square \)

Proof of Corollary 1

(i) Since condition (1) is not satisfied and condition (2) is, it follows from Proposition 1 that the equilibrium path is such that at \(t=1\), player A offers \(x_{1}^{*}= \overline{x_{1}}\) and player B accepts it. (ii) Since conditions (1) and (2) are not satisfied, it follows from Proposition 1 that the equilibrium path is such that:

-

At \(t=1\), player A offers \(x_{1}^{*}=\overline{x_{1}}+\varepsilon _{A}\) and player B rejects it.

-

At \(t=2\), player B counteroffers

$$\begin{aligned} x_{2}^{*}=\frac{U_{A}+\theta _{A}\pi }{1+\theta _{A}}-\varepsilon _{B}, \end{aligned}$$

and player A rejects it. \(\square \)

Proof of Corollary 2

If \(\Theta >1\) then \(\pi (1-\theta _{A}\theta _{B})\) is negative. Thus, since \(\delta _{A}>0\), \(U_{A}\ge 0\) and \(\theta _{B}\ge 0\) for all \(i=A,B\), it is the case that

which is a sufficient condition for both conditions (1) and (2) not to hold. Applying Corollary 1, Part (ii), the statement is finally demonstrated. \(\square \)

Proof of Proposition 2

By backward induction, we proceed as follows:Period \(t=2\)

We follow a similar line of reasoning to that used in proof of Proposition 1. Thus, whereas the optimal decision rule for player A remains the same, player B solves the program described by Eqs. (16) and (17). Note, however, that now the interval for \(x_{2}\) defined by constraint (17) is nonempty, which follows from assuming that condition (1) is satisfied.

Thus, the optimal strategy for player B is given by

Period \(t=1\)

At this stage, player B accepts player A’s offer if

and rejects it otherwise. Player A chooses \(x_{1}^{*}\) such that

If we make substitution \(x_{1}=\overline{\overline{x_{1}}}\), the above program implies that player A finally chooses \(x_{1}^{*}=\overline{ \overline{x_{1}}}\) as long as

which after substituting \(x_{2}^{*}\) is equivalent to

Note, however, that condition (20) holds if

Since condition (1) suffices for the above inequality to hold, checking that it is always satisfied is straightforward.Footnote 10 Hence, the optimal strategy of player A becomes

which completes the proof. \(\square \)

Proof of Corollary 3

Since condition (1) holds, the equilibrium path according to Proposition 2 is such that at \(t=1\), player A offers \(x_{1}^{*}=\overline{\overline{x_{1}}}\) and player B accepts it. \(\square \)

Rights and permissions

About this article

Cite this article

Loyola, G. Alternative equilibria in two-period ultimatum bargaining with envy. Optim Lett 11, 855–874 (2017). https://doi.org/10.1007/s11590-016-1061-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11590-016-1061-1